- Home

- »

- Consumer F&B

- »

-

Stout Market Size, Share, Global Industry Report, 2020-2027GVR Report cover

![Stout Market Size, Share & Trends Report]()

Stout Market (2020 - 2027) Size, Share & Trends Analysis Report By Distribution Channel (On-trade, Off-trade), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-073-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stout Market Summary

The global stout market size was valued at USD 10.64 billion in 2019 and is expected to reach USD 15.04 billion by 2027, expanding at a compound annual growth rate (CAGR) of 4.4% from 2020 to 2027. The rising demand for premium drinks with rich taste and texture among consumers is fueling the market growth.

Key Market Trends & Insights

- Europe was the largest regional market for stouts, accounting for a share of more than 35.0% in 2019.

- North America is anticipated to be the fastest-growing regional market with a CAGR of 5.0% from 2020 to 2027.

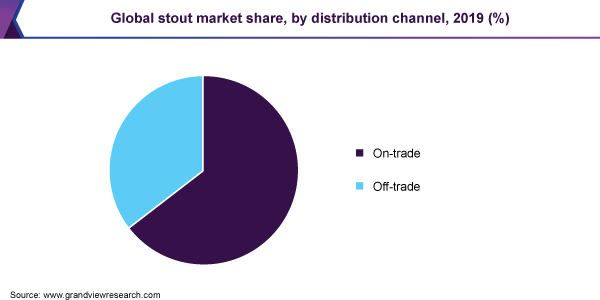

- By distribution channel, on-trade segment accounted for largest share of more than 60.0% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 10.64 Billion

- 2027 Projected Market Size: USD 15.04 Billion

- CAGR (2020-2027): 4.4%

- Europe: Largest market in 2019

- North America: Fastest growing market

Moreover, this fermented black beer is a rich source of antioxidants, vitamins, and iron, which is widely gaining popularity among health-conscious customers. These health properties have offered new growth opportunities for the market. With the growing culture of pubbing, house party, outings, clubbing, and other social gatherings, the demand for stouts is increasing across the globe. According to the American Nightlife Association (ANA), in 2018, the American bar and nightclub industry witnessed decent growth with a 2.1% yearly rate. Simultaneously, the U.S. bar and nightclub industry was valued at USD 26 billion in 2018. This growing market, coupled with increasing popularity among young customers and millennials, opens up new scope for the market.

People are increasingly visiting bars, nightclubs, casinos, and pubs across the U.S., thus expanding the market for premium beers, including stout. For instance, according to the American Nightlife Association (ANA), in 2018, an estimated 20.5 million people went to nightclubs or bars in casinos across the U.S. Moreover, out of the total sales of food and beverages in these bars and lounges, 35.0% of sales were beer and ale. These statistics are anticipated to increase the demand for the product over the forecast period.

Manufacturers are launching new products by collaborating with breweries to cater to the increasing demand across the globe. For instance, in September 2017, Sufferfest Beer Company, a premium subsidiary of Sierra Nevada Brewing Company, launched stout under its functional beer category. This new line of stouts has a hint of coconut water and milk with cocoa beans. These new product launches are opening new opportunities for the market and increasing product visibility among consumers worldwide.

Additionally, awareness regarding various health benefits associated with the product is propelling its demand. Stout is a rich source of natural antioxidants, vitamins, carbohydrates, proteins, coupled with low calories and zero fat or cholesterol. These nutritional properties help maintain cardiovascular health and support in the muscle rebuild.

From the starting of the year 2020, due to the sudden breakdown of the novel coronavirus, almost all the countries around the world have imposed a strict lockdown at the country level to contain this deadly virus in their countries. This market situation has restricted the sales of any kind of alcohol across all the major countries. Due to such a situation, the sales of stout have been decreased across the globe. However, gradually, with the number of vaccines coming, the world market has led to the reopening of tourism and pubbing across the globe, thus opening new opportunities for the global market.

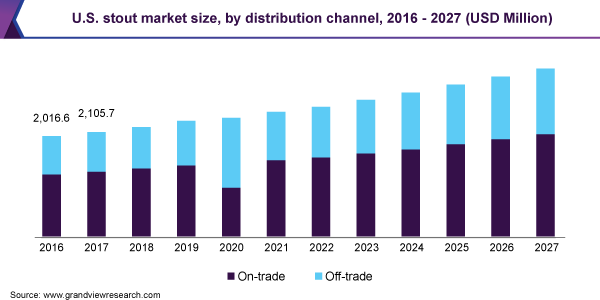

Distribution Channel Insights

On-trade was the largest distribution channel with a share of more than 60.0% in 2019 due to the growing pubbing and partying culture among youngsters worldwide. Young generation customers and the working-class population are propelling the demand for the on-trade sales of premium products, like a stout, across the globe. The prevalence of house parties is also gaining pace in various countries, such as the U.S., France, the U.K., Germany, India, Australia, and China. In addition, the increasing employment, disposable income, and rising living standards across the major economies around the globe are resulting in higher spending on pubs, bars, casinos, and restaurants for premium drinks.

The off-trade sale channel is anticipated to be the fastest-growing segment with a CAGR of 4.7% from 2020 to 2027. Stout is the traditional drink of Europe. With the increasing popularity of various black beer variants worldwide, off-trade sales are gaining traction across the globe. Specialty wine shops and e-commerce portals are increasing product visibility. Due to this pandemic, the online sales channel has witnessed a surge in the sales of alcoholic drinks. Customers were increasingly ordering their drinks through online portals as all the clubs, pubs, and bars were closed due to the pandemic across the globe.

Regional Insights

Europe was the largest regional market for stouts, accounting for a share of more than 35.0% in 2019 as it was traditionally originated and consumed in the U.K. European countries such as the U.K., Italy, Germany, and France are some of the largest stout consuming countries. In the past few years, Germany has witnessed significant growth in the demand for premium black beer, which is opening new growth opportunities for stout.

North America is anticipated to be the fastest-growing regional market with a CAGR of 5.0% from 2020 to 2027 owing to increasing demand for the premium beers with enhanced flavors, textures, and aroma. In addition, the demand for premium beers has increased significantly during this pandemic period. Consumers in the region are increasingly ordering this premium product from the online portals as all the pubs and bars are closed due to strict country-wide lockdown. These consumer trends are anticipated to fuel the demand for the product over the forecast period.

Key Companies & Market Share Insights

The market is slightly consolidated and the demand for stout has witnessed a rise in the past few years owing to its premiumization. Major manufacturers are adopting various strategies, including mergers & acquisitions, collaborations, product launches, and expansion of distribution channels, to capture a major share in the market and expand their customer base across the globe. For instance, in March 2020, Iron Maiden, the most popular and British-based heavy metal band, collaborated with Robinsons Brewery to launch a new line of stouts in the market. The new range of products is launched under the brand name, ‘Fear of the Dark’, containing 4.5% ABV. These new product launches are propelling the product demand among consumers, which is anticipated to boost the market growth over the forecast period. Some prominent companies operating in the global stout market include:

-

Carlsberg Breweries A/S

-

Asahi Group Holdings Ltd.

-

Heineken N.V.

-

Anheuser-Busch InBev SA/NV

-

Kirin Brewery Co. Ltd.

-

Diageo plc

-

Molson Coors Beverage Co.

-

The Boston Beer Co. Inc.

-

Stone Brewing Co.

-

Port Brewing Co.

Stout Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 10.91 billion

Revenue forecast in 2027

USD 15.04 billion

Growth Rate

CAGR of 4.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; Italy; China; Japan; Brazil

Key companies profiled

Carlsberg Breweries A/S; Asahi Group Holdings Ltd.; Heineken N.V.; Anheuser-Busch InBev SA/NV; Kirin Brewery Co. Ltd.; Diageo plc; Molson Coors Beverage Co.; The Boston Beer Co. Inc.; Stone Brewing Co.; Port Brewing Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global stout market report on the basis of distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global stout market size was estimated at USD 10.64 billion in 2019 and is expected to reach USD 10.91 billion in 2020.

b. The global stout market is expected to grow at a compound annual growth rate of 4.4% from 2020 to 2027 to reach USD 15.04 billion by 2027.

b. Europe dominated the stout market with a share of more than 35.0% in 2019 attributed to the strong consumer base in European countries including the U.K., Italy, Germany, and France.

b. Some key players operating in the stout market include Carlsberg Breweries A/S, Asahi Group Holdings Ltd., Heineken N.V., Anheuser-Busch InBev SA/NV, Kirin Brewery Co. Ltd., Diageo plc, Molson Coors Beverage Co., The Boston Beer Co. Inc., Stone Brewing Co., Port Brewing Co.

b. Key factors that are driving the stout market growth include rising demand for premium alcoholic drinks with rich taste and texture among the consumers and new product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.