- Home

- »

- Advanced Interior Materials

- »

-

Straw Bale Construction Materials Market Size Report 2033GVR Report cover

![Straw Bale Construction Materials Market Size, Share & Trends Report]()

Straw Bale Construction Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Wheat Straw, Rice Straw, Barley / Oat Straw), By End Use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-801-5

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Straw Bale Construction Materials Market Summary

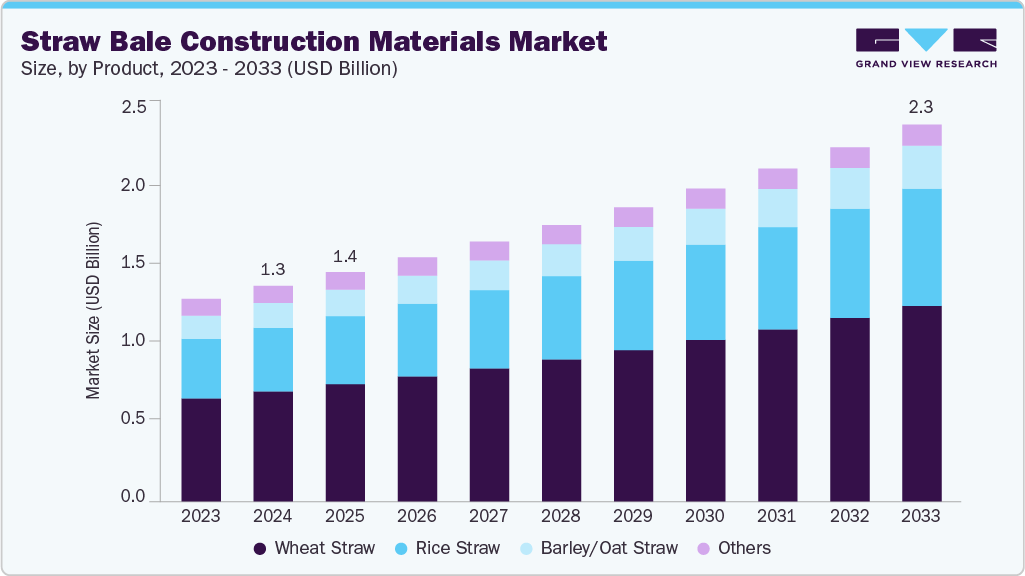

The global straw bale construction materials market size was estimated at USD 1.31 billion in 2024 and is projected to reach USD 2.29 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The demand for straw bale construction materials is increasing due to the growing emphasis on sustainable and energy-efficient building solutions.

Key Market Trends & Insights

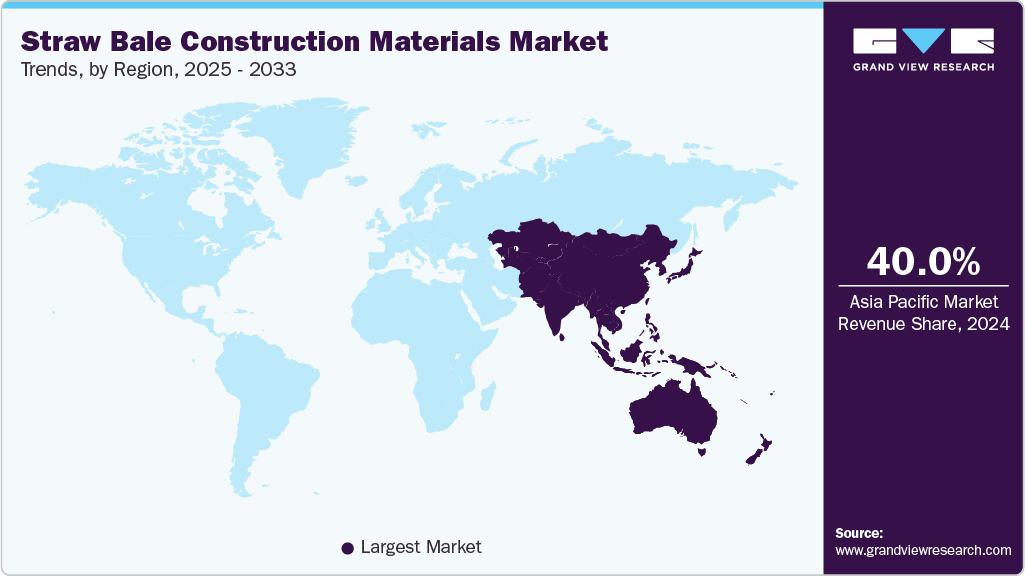

- The Asia Pacific dominated the straw bale construction materials market, accounting for the largest revenue share of 40.0% in 2024.

- By product, the rice straw segment is expected to grow at the fastest CAGR of 7.0% over the forecast period.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 7.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.31 Billion

- 2033 Projected Market Size: USD 2.29 Billion

- CAGR (2025-2033): 6.4%

- Asia Pacific: Largest market in 2024

Straw bales offer a carbon-negative alternative to traditional concrete and brick, aligning with global net-zero emission objectives. Their superior insulation performance significantly reduces operational energy consumption in residential and commercial structures. Additionally, they provide an effective use for agricultural waste, which would otherwise contribute to pollution through open field burning. Rising construction activity in rural and eco-conscious housing segments has further supported market growth. Government and private builders are also recognizing the cost-effectiveness of using readily available natural resources.The primary drivers of the straw bale construction materials market include the material’s excellent thermal performance, cost efficiency, and environmental sustainability. The use of agricultural by-products such as wheat or rice straw reduces waste and provides a renewable raw material base. Advancements in prefabricated straw panels and modular systems have improved structural integrity and moisture resistance, enhancing commercial viability. Growing adoption of passive housing and energy-efficient architecture further promotes its application. The support from non-governmental and research organizations in training and awareness programs strengthens market credibility. Consumer interest in natural and non-toxic building materials is another key factor influencing demand.

Technological advancements and design innovations are shaping the future of straw bale construction. Prefabricated wall systems and structural straw panels have addressed issues related to consistency, moisture, and fire resistance. Hybrid structures that combine straw with conventional frames are gaining traction for blending modern aesthetics with sustainability. The integration of digital design tools such as BIM enables efficient customization and planning of straw-based projects. Additionally, the development of breathable plasters and advanced sealing techniques enhances the durability of the material. Collaborative value chains that link farmers, manufacturers, and green builders are enhancing supply reliability.

Market Concentration & Characteristics

The straw bale construction materials industry is moderately fragmented, with several small to mid-sized players operating at the regional or local levels. Companies such as ModCell, EcoCocon, and Straw Works have established niche expertise but have limited global presence. The market structure is characterized by a strong self-build and small-scale construction culture, with low capital entry barriers. Prefabrication and modularization are enabling a few firms to expand production capacity and standardize products. Despite growing awareness, the absence of large-scale multinational manufacturers continues to keep the industry decentralized. Partnerships among architects, research institutions, and local producers continue to define market dynamics. As standardization improves, selective consolidation is expected to occur over the forecast period.

Straw bale construction faces competition from several well-established materials, including concrete blocks, timber framing, and structural insulated panels (SIPs). Alternatives such as hempcrete, bamboo composites, and wood fiber insulation also offer sustainable yet more standardized solutions. Conventional materials benefit from strong supply chains, insurance compatibility, and regulatory familiarity, which pose barriers to the adoption of straw bales. Moreover, in regions with limited straw availability or high labour costs, substitutes tend to be more cost-effective. However, rising carbon taxation and the advantages of green certification could improve the competitiveness of straw bales. Continuous improvements in fire safety, pest resistance, and moisture control are reducing the performance gap.

Product Insights

The wheat straw segment held the largest revenue market share of 51.0% in 2024, owing to its wide availability, favorable structural density, and superior insulation characteristics. The widespread cultivation of wheat across Europe, North America, and parts of Asia ensures a consistent and cost-effective supply chain. Its uniform stalk structure provides better compressive strength and stability for bale formation compared to other crop residues. Builders and manufacturers prefer wheat straw for prefabricated panels and load-bearing wall applications due to its workability and resistance to moisture. In addition, extensive field testing and proven performance in cold and temperate climates have reinforced its dominance. As sustainability certifications increasingly value traceable and locally sourced feedstocks, wheat straw remains the preferred material base for bio-based construction.

The rice straw segment is expected to grow at a significant CAGR of 7.0% over the forecast period, driven by expanding rice cultivation and growing environmental concerns regarding residue burning. Regions such as South and East Asia, particularly India and China, are promoting the reuse of rice straw to reduce air pollution and carbon emissions. Advancements in treatment and densification technologies have enhanced the mechanical strength and durability of rice straw bales, making them suitable for structural and insulation purposes. The material’s low thermal conductivity and availability in tropical regions also make it ideal for energy-efficient housing. Increasing government and private initiatives aimed at utilizing agricultural waste for sustainable building materials are accelerating its adoption.

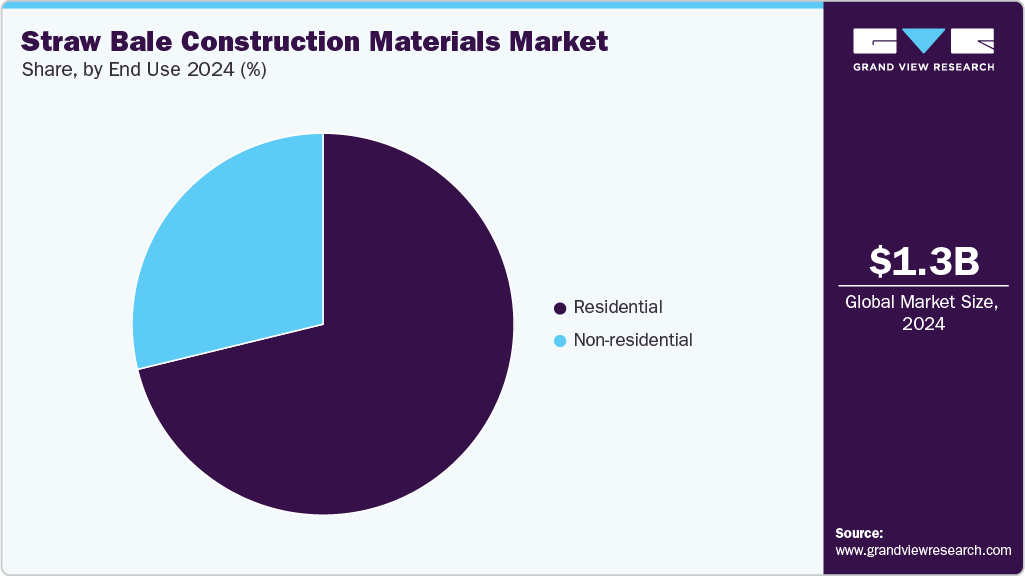

End Use Insights

The residential segment held the largest revenue market share of 71.2% in 2024, due to rising demand for affordable, sustainable, and energy-efficient housing solutions. Straw bale walls offer high thermal insulation and soundproofing, making them suitable for eco-homes, cottages, and small residential buildings. The self-build culture in rural and peri-urban areas has further fueled adoption, as straw bales provide a cost-effective material for homeowners seeking low-carbon construction. Moreover, the growing popularity of green building certifications such as LEED and BREEAM has encouraged residential developers to integrate bio-based materials. Easy availability of straw feedstock and minimal processing requirements reduce overall project costs.

The non-residential segment is expected to grow at a significant CAGR of 7.2% over the forecast period, as architects and developers increasingly explore straw bale construction for commercial, institutional, and community buildings. Schools, offices, and cultural centers are adopting straw bale systems to meet energy efficiency and carbon neutrality goals. Advancements in prefabricated straw panel technology have made the material more suitable for large-scale and modular construction. Several pilot projects across Europe and North America have demonstrated that straw bale buildings can meet stringent fire, moisture, and structural standards required for non-residential use. Besides, corporate sustainability programs and public-sector green procurement policies are promoting the use of bio-based materials.

Regional Insights

The Asia Pacific straw bale construction materials industry dominated the global market, accounting for the largest revenue share of 40.0% in 2024. This dominance is driven by the abundance of agricultural residue and the rising demand for low-cost, sustainable housing. Countries such as India and China have high straw availability and an increasing emphasis on energy-efficient rural construction. Government efforts to reduce stubble burning are also creating opportunities for the utilization of straw. The region’s expanding population and infrastructure investments provide a strong base for adoption. However, the lack of regulatory frameworks and awareness among builders limits immediate scalability. Pilot projects and international collaborations are expected to improve regional feasibility.

China Straw Bale Construction Materials Market Trends

The straw bale construction materials industry in China is gaining attention due to the dual benefits of waste reduction and emission control. National directives to eliminate open-field burning have improved access to raw materials. Research initiatives are underway to evaluate the thermal and structural performance of straw-based walls. However, large-scale commercial adoption remains limited due to strict building codes and urban construction preferences. The focus is shifting toward prefabricated systems that meet modern fire and moisture standards. With government encouragement for green buildings, the segment could gain traction in rural housing and pilot eco-projects.

North America Straw Bale Construction Materials Market Trends

The straw bale construction materials industry in North America has gained ground from eco-conscious regions like California and New Mexico. Supportive sustainability policies, progressive building codes, and strong local advocacy groups have encouraged market expansion. Prefabricated straw wall systems are increasingly being used in green-certified projects. However, mainstream adoption remains constrained by insurance challenges and a lack of widespread standardization. Builders are focusing on improving fire testing, pest control, and moisture management to meet modern standards. Growing consumer preference for low-energy and natural homes continues to sustain niche demand across the region.

The U.S. straw bale construction materials industry is driven by environmentally conscious builders and small-scale developers. The availability of straw feedstock from grain-producing states ensures a stable raw material supply. State-level initiatives promoting sustainable housing have also increased visibility for bio-based materials. Despite this, integration into mainstream commercial construction is still limited due to cost and code-related hurdles. Companies are focusing on modular systems and education programs to bridge the knowledge gap. Niche demand from green building enthusiasts and passive house developers continues to support the market’s growth trajectory.

Europe Straw Bale Construction Materials Market Trends

The straw bale construction materials industry in Europe remains one of the most mature markets due to strong policy support for low-carbon building. Countries such as the UK, France, and Germany have well-documented case studies demonstrating performance reliability. European Union directives on carbon neutrality and building efficiency are accelerating adoption. Manufacturers are increasingly offering prefabricated straw wall panels meeting European technical standards. High awareness among architects and sustainability consultants further supports integration into modern projects. However, labour costs and regulatory variation across countries continue to influence adoption rates.

The Germany straw bale construction materials industry has emerged as a leader in natural and bio-based construction materials, including straw bale systems. Research institutions and architectural firms are actively collaborating to standardize design codes and testing. High environmental consciousness and government incentives for energy-efficient construction support the market. Prefabricated straw modules are being used in residential and commercial retrofitting projects. The growing number of certified passive houses and green buildings is expanding the application scope. Despite cost challenges, Germany’s strong policy and innovation environment make it a key contributor to regional growth.

Central & South America Straw Bale Construction Materials Market Trends

The straw bale construction materials industry in Central & South America is gradually developing, driven by the need for affordable housing and climate adaptability. Countries such as Mexico, Chile, and Brazil are exploring straw systems for rural and eco-tourism applications. Availability of agricultural residues and growing environmental awareness create favourable conditions. However, a lack of technical expertise, financing, and standardized testing frameworks restricts growth. NGOs and sustainability organizations are playing a major role in skill development and pilot projects. As infrastructure modernization continues, interest in low-cost, climate-resilient materials is expected to rise.

Middle East & Africa Straw Bale Construction Materials Market Trends

The straw bale construction materials industry in the Middle East & Africa presents emerging opportunities for straw bale materials amid increasing sustainability mandates. Although feedstock availability is uneven, countries such as Egypt and South Africa are exploring bio-based construction for affordable housing. The region’s hot climate enhances demand for thermally efficient wall systems, where straw bales perform well. Government initiatives promoting green building standards can further support market penetration. Challenges include limited awareness, moisture control issues, and the absence of technical codes. With rising urbanization and renewable construction programs, early adoption is likely in niche housing sectors.

Key Straw Bale Construction Materials Company Insights

Some of the key players operating in the market include Blue Mountain Hay, Hay Kingdom Inc.

-

Blue Mountain Hay is a leading supplier of premium-grade straw and hay products catering to agricultural, livestock, and eco-construction applications. The company has expanded its product range to serve the sustainable building materials market, providing high-quality, tightly compressed straw bales ideal for insulation and structural use. Its focus on moisture control, consistent bale density, and eco-friendly harvesting practices aligns with the growing demand for green construction materials.

-

Hay Kingdom Inc. specializes in the production and export of high-quality hay and straw products used in animal feed, landscaping, and eco-friendly building projects. The company is increasingly recognized for supplying clean, durable straw bales suitable for natural construction and insulation applications. Its strong sourcing network and quality assurance standards make it a preferred partner in the straw bale construction materials market.

BRAR AGRO WORKS and Douliere Hay France are some of the emerging market participants in the straw bale construction materials industry.

-

BRAR AGRO WORKS is an agricultural solutions provider focused on straw baling, residue management, and biomass utilization. The company manufactures advanced baling machinery and provides processed wheat and rice straw suitable for bio-construction. Its initiatives in promoting sustainable straw reuse support circular economy goals, making it a key enabler in the straw bale construction materials market across India and other Asian regions.

-

Douliere Hay France is a France-based company engaged in producing, processing, and distributing hay and straw for agricultural and environmental uses. With the rise of eco-friendly construction practices in Europe, the company has extended its product offerings to include high-quality, uniform straw bales for green building applications. Its emphasis on traceability, quality, and environmental compliance positions it as a trusted supplier in the European straw bale materials market.

Key Straw Bale Construction Materials Companies:

The following are the leading companies in the straw bale construction materials market. These companies collectively hold the largest market share and dictate industry trends.

- Swift Straw

- GRASS LAND GOLD AGRI PVT LTD

- BRAR AGRO WORKS.

- Hay Kingdom Inc.

- Al Dahra ACX Inc.

- Gruppo Carli

- Douliere Hay France

- Balco Australia Pty Ltd.

- Blue Mountain Hay

- Barr-Ag Ltd.

Straw Bale Construction Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.40 billion

Revenue forecast in 2033

USD 2.29 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Swift Straw; GRASS LAND GOLD AGRI PVT LTD; BRAR AGRO WORKS; Hay Kingdom Inc.; Al Dahra ACX Inc.; Gruppo Carli; Douliere Hay France; Balco Australia Pty Ltd.; Blue Mountain Hay; Barr-Ag Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Straw Bale Construction Materials Market Report Segmentation

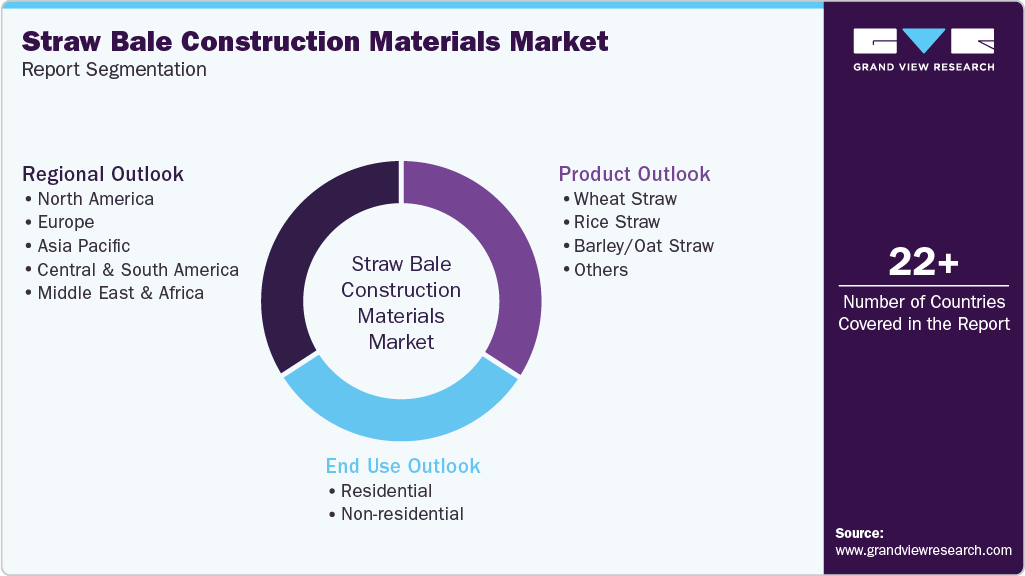

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global straw bale construction materials market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Wheat Straw

-

Rice Straw

-

Barley / Oat Straw

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global straw bale construction materials market size was estimated at USD 1.31 billion in 2024 and is expected to reach USD 1.40 billion in 2025.

b. The global straw bale construction materials market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach USD 2.29 billion by 2033.

b. The wheat straw segment held the highest revenue market share of 51.0% in 2024, owing to its wide availability, favorable structural density, and superior insulation characteristics.

b. Some of the key players operating in the straw bale construction materials market include Swift Straw, GRASS LAND GOLD AGRI PVT LTD, BRAR AGRO WORKS, Hay Kingdom Inc., Al Dahra ACX Inc., Gruppo Carli, Douliere Hay France, Balco Australia Pty Ltd., Barr-Ag Ltd., and Blue Mountain Hay.

b. Rising demand for sustainable, low-carbon, and energy-efficient building solutions is the key factor driving the straw bale construction materials market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.