- Home

- »

- Clinical Diagnostics

- »

-

Structural Heart Imaging Market Size, Industry Report, 2030GVR Report cover

![Structural Heart Imaging Market Size, Share & Trends Report]()

Structural Heart Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (Echocardiogram, Angiogram), By Procedure (TAVR, SAVR, TMVR, LAAC), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-536-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Structural Heart Imaging Market Trends

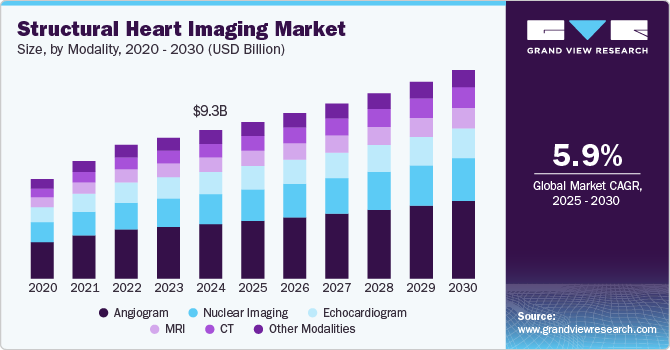

The global structural heart imaging market size was estimated at USD 9.31 billion in 2024 and is expected to grow at a CAGR of 5.92% from 2025 to 2030. The market is experiencing significant growth, driven by several key factors. The increasing prevalence of cardiac diseases is a major contributor; for instance, cardiovascular diseases are a leading cause of mortality worldwide, affecting millions annually.

Technological advancements have led to the development of sophisticated imaging modalities, such as 3D and 4D imaging, enhancing diagnostic accuracy and procedural outcomes. The rising adoption of minimally invasive procedures, like transcatheter aortic valve replacement (TAVR), has further propelled market expansion due to their benefits in reducing patient recovery times and improving safety. Additionally, growing awareness about early disease detection has led to an increase in diagnostic procedures, as early intervention is crucial for effective treatment of heart conditions. The expanding healthcare infrastructure in both developed and emerging economies has improved access to advanced imaging technologies, facilitating market growth.

The increasing prevalence of cardiac diseases worldwide is a key driver of growth in the structural heart imaging market. According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death globally, accounting for an estimated 17.9 million deaths in 2019, representing 32% of all global deaths, with 85% attributed to heart attacks and strokes. Conditions such as valvular heart disease, coronary artery disease, congenital heart defects, and heart failure are becoming more common due to aging populations, sedentary lifestyles, and the rising incidence of obesity and diabetes. Similarly, data from the CDC highlights that heart disease remains the leading cause of death in the U.S., with one person dying every 33 seconds from cardiovascular disease in 2022, amounting to 702,880 deaths or 1 in every 5 fatalities.

Advanced imaging devices, including echocardiograms, CT scans, MRIs, angiograms, and nuclear imaging systems, play a pivotal role in diagnosing and managing these conditions. These technologies provide detailed insights into the heart’s structure and function, enabling clinicians to assess disease severity, plan effective treatments, and guide minimally invasive procedures such as transcatheter valve replacements and defect closures. For example, 3D echocardiography and cardiac MRIs offer precise anatomical and functional data, while CT angiography delivers high-resolution imaging of coronary arteries, enhancing diagnostic accuracy and treatment precision. The growing awareness among patients and healthcare providers about the importance of early diagnosis and advanced imaging solutions has further fueled the adoption of these technologies. Government initiatives and educational campaigns on cardiac health and preventive care are driving demand for diagnostic services. As more individuals prioritize timely medical interventions for cardiac conditions, the market continues to expand.

Advancements in imaging technology are playing an essential role in driving significant growth in the structural heart imaging industry by offering enhanced capabilities that improve diagnostic accuracy, treatment planning, and procedural outcomes. Innovations such as 3D and 4D imaging, higher-resolution detectors, and real-time imaging modalities have transformed how structural heart diseases are diagnosed and managed. For instance, 3D echocardiography provides clinicians with highly detailed visualizations of heart structures, enabling accurate evaluation of conditions like valvular defects and congenital abnormalities.

Similarly, advancements in cardiac MRI offer comprehensive anatomical and functional insights, while CT angiography delivers high-resolution imaging of coronary and structural anomalies, aiding both diagnosis and interventions. In November 2024, Koninklijke Philips N.V. introduced the new Azurion system to specialist interventionalists across cardiology, neurology, vascular, and surgical disciplines in India. Similarly, Siemens Healthineers secured FDA clearance for its AI-enhanced ACUSON Origin cardiovascular ultrasound system in August 2024.

The integration of artificial intelligence (AI) and machine learning into imaging technologies has further elevated their utility. AI-driven tools now assist in identifying subtle abnormalities, optimizing valve sizing for transcatheter procedures, and enhancing surgical planning. Hybrid imaging modalities, such as PET/CT and SPECT/CT, combine functional and anatomical data for a more comprehensive evaluation of cardiac conditions. In November 2024, Shanghai United Imaging Healthcare Co., LTD received Health Canada approval for its uMI Panorama digital PET/CT models, underscoring the progress in hybrid imaging technology.

Advancements in miniaturization and portability have also enabled the development of handheld imaging devices, expanding access to diagnostic tools in outpatient and remote settings. For instance, GE Healthcare introduced enhanced Venue ultrasound systems and the Venue Sprint solution for point-of-care ultrasound (POCUS) in September 2024, further advancing portable imaging. These innovations not only improve workflow efficiency but also reduce procedure times, enhancing patient safety and overall satisfaction. As imaging technologies continue to evolve, they empower clinicians with more advanced devices to address the rising prevalence of cardiac diseases, fueling the market growth, and transforming cardiovascular care.

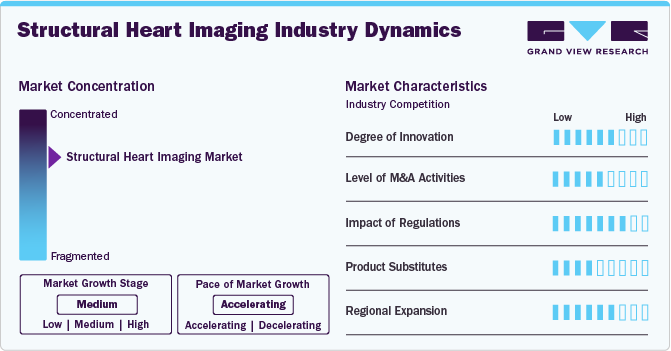

Market Concentration & Characteristics

The structural heart imaging industry is experiencing substantial growth, driven by advancements in imaging technologies, software solutions, and associated diagnostic tools. These innovations are improving the precision, efficiency, and accessibility of imaging systems, enabling healthcare providers to diagnose and treat structural heart conditions more effectively. Furthermore, the increasing prevalence of cardiovascular diseases and structural heart disorders worldwide has significantly boosted the demand for advanced imaging solutions. As healthcare systems adopt cutting-edge structural heart imaging technologies to enhance patient outcomes and optimize procedural workflows, the market is poised for continued expansion.

Companies in the structural heart imaging industry are strategically focusing on product launches to strengthen their industry position and meet the growing demand for advanced imaging solutions. For instance, In August 2024, Siemens Healthineers announced that it has received FDA clearance for the ACUSON Origin, an advanced cardiovascular ultrasound system enhanced with artificial intelligence (AI) capabilities.

The structural heart imaging industry exhibits a high degree of innovation, driven by continuous technological advancements and the need to address complex cardiovascular conditions. In October 2024, GE HealthCare announced the launch of the new Versana Premier, the latest addition to the Versana ultrasound family. This system offers reliable, affordable, and easy-to-use ultrasound technology, designed to provide versatile solutions for a wide range of clinical needs.

Mergers and acquisitions are gaining momentum in the structural heart imaging market as companies seek to strengthen their technological capabilities and expand their product portfolios. For instance, in July 2024, GE HealthCare announced its agreement to acquire Intelligent Ultrasound Group PLC’s (Intelligent Ultrasound) clinical artificial intelligence (AI) software business for a total consideration of approximately USD 51 million.

Regulatory frameworks are pivotal in shaping the market, influencing product development, clinical trials, and market entry. Regulatory bodies such as the FDA and EMA ensure the safety and efficacy of structural heart imaging systems, especially for high-stakes applications in interventional cardiology. The introduction of the Medical Device Regulation (MDR) in the European Union has further emphasized compliance, encouraging manufacturers to adopt rigorous standards in designing imaging systems tailored for structural heart procedures.

Manufacturers in the structural heart imaging industry are actively launching new solutions to address the growing demand for precise and efficient imaging. In March 2024, GE Healthcare released the Vivid T8 Ultra Edition, an advanced cardiovascular ultrasound system featuring AI-powered tools and 4D imaging capabilities. Designed specifically for structural heart evaluations, this system improves diagnostic accuracy and streamlines complex interventional workflows.

The market is witnessing significant regional expansion as companies aim to enhance accessibility and meet diverse healthcare demands. In June 2024, Siemens Healthineers announced the establishment of a new production facility in Singapore to manufacture its Acuson Sequoia ultrasound systems, optimized for structural heart imaging. This strategic move underscores the company’s commitment to addressing the growing cardiovascular healthcare needs in Asia-Pacific while supporting local healthcare advancements. These initiatives exemplify the market's focus on increasing accessibility to state-of-the-art imaging technologies worldwide.

Modality Insights

The angiogram segment dominated the market in 2024 by capturing a share of 36.75%. The angiogram segment represents the largest and fastest-growing segment, driven by its critical role in diagnosing and guiding treatments for various cardiovascular conditions. The increasing prevalence of coronary artery disease (CAD) and other structural heart disorders has significantly boosted the demand for angiograms, as these procedures provide high-resolution, real-time imaging of blood vessels and heart structures. According to the World Health Organization (WHO), cardiovascular diseases remain the leading cause of death globally, accounting for nearly 17.9 million deaths annually, underscoring the need for advanced diagnostic tools like angiograms. Leading companies are driving innovation in this segment; for instance, in 2024, Siemens Healthineers launched the ARTIS icono angiography system, designed to enhance precision and efficiency during interventional cardiology procedures. Similarly, Philips' Azurion system continues to gain traction for its integrated imaging and workflow optimization capabilities. These advancements, combined with increasing investments in healthcare infrastructure and the growing adoption of minimally invasive procedures, are fueling the expansion of the angiogram segment. With its indispensable role in structural heart imaging, this segment is poised for sustained growth in the coming years.

Computed tomography (CT) is emerging as the fastest-growing segment, driven by its unparalleled ability to deliver detailed, 3D cross-sectional images of the heart and surrounding structures. The growing adoption of advanced CT systems for structural heart evaluations, including pre-procedural planning for interventions like transcatheter aortic valve replacement (TAVR) and mitral valve repair, has significantly contributed to this growth. Innovations from key players are accelerating this trend; for instance, in 2024, Canon Medical Systems unveiled its Aquilion Precision cardiac CT system, which offers ultra-high-resolution imaging for accurate diagnostics and procedural guidance. Additionally, GE Healthcare’s Revolution Apex CT scanner, equipped with AI-enhanced imaging capabilities, has garnered widespread adoption for its efficiency in reducing scan times while maintaining diagnostic accuracy. The increasing prevalence of structural heart diseases and the push for non-invasive diagnostic tools position the CT segment as a cornerstone of modern cardiovascular imaging.

Procedure Insights

The Transcatheter Aortic Valve Replacement (TAVR) segment dominated by capturing the market share of 22.58% in 2024, driven by its widespread adoption as a minimally invasive alternative to open-heart surgery for treating aortic stenosis. The aging global population and the rising prevalence of aortic valve diseases have significantly fueled the demand for TAVR procedures. According to the American College of Cardiology, over 1.5 million people in the U.S. alone suffer from aortic stenosis, with a large percentage eligible for TAVR. Imaging technologies play a pivotal role in TAVR, from pre-procedural planning to intra-procedural guidance and post-operative assessments, ensuring precise valve placement and optimal patient outcomes. Industry leaders like Edwards Lifesciences and Medtronic are continuously innovating in this space, offering advanced imaging-guided solutions to enhance procedural efficiency. The robust clinical adoption and favorable outcomes associated with TAVR position as the largest segment in the market.

Transcatheter Mitral Valve Repair (TMVR) is emerging as the fastest-growing segment, driven by advancements in imaging technologies and the growing burden of mitral valve diseases such as mitral regurgitation. Unlike TAVR, the TMVR segment is still in its nascent stages, presenting significant growth opportunities as new devices and imaging modalities enter the market. The global prevalence of mitral regurgitation, estimated to affect nearly 2% of the population, has created a high demand for minimally invasive TMVR procedures. Recent advancements, such as 3D echocardiography and CT imaging, have enhanced procedural planning and outcomes by providing precise visualization of the mitral valve anatomy. Companies like Abbott Laboratories, with their MitraClip system, and Boston Scientific, developing the Millipede platform, are at the forefront of innovation in TMVR. These technologies, combined with increasing regulatory approvals and investments in R&D, are propelling the rapid growth of the TMVR segment.

Application Insights

Interventional cardiology is the fastest-growing and largest application segment within the structural heart imaging industry, owing to the rising demand for minimally invasive cardiac procedures. Technologies like fluoroscopy, intravascular ultrasound (IVUS), and 3D echocardiography are essential for guiding interventions such as TAVR, TMVR, and left atrial appendage closure (LAAC). The segment's growth is fueled by advancements in imaging technologies that enable real-time, high-precision visualization during complex interventions, ensuring better patient outcomes. Leading players like Philips and Abbott Laboratories are driving innovation with integrated imaging platforms tailored for interventional cardiology, such as Philips’ Azurion system and Abbott’s Navitor TAVI imaging-guided solution. The growing adoption of these technologies, coupled with increasing procedural volumes, positions interventional cardiology as the dominant force in the structural heart imaging industry.

Diagnostic imaging is a cornerstone application in the market, enabling accurate identification and assessment of structural heart conditions. Advanced imaging modalities such as echocardiography, CT, and MRI are integral to diagnosing conditions like aortic stenosis, mitral regurgitation, and congenital heart defects. These technologies provide detailed visualizations of cardiac anatomy and function, helping clinicians develop precise treatment strategies. The increasing prevalence of structural heart diseases, combined with the need for non-invasive diagnostic techniques, is driving growth in this segment. Companies like Siemens Healthineers and GE Healthcare have developed innovative diagnostic imaging systems equipped with AI-powered tools to improve accuracy and streamline workflows. With the global focus on early detection and management of cardiovascular diseases, diagnostic imaging continues to play a vital role in the market for structural heart imaging.

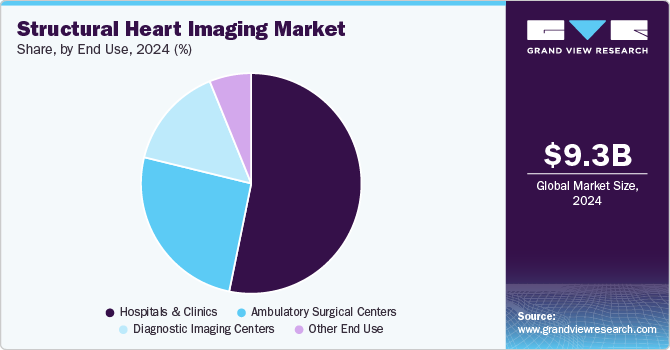

End Use Insights

Hospitals and clinics constitute the largest end use segment by capturing 53.21% in 2024, driven by their role as primary centers for the diagnosis and treatment of cardiovascular conditions. These facilities are equipped with advanced imaging technologies and offer access to specialized expertise, making them the preferred choice for complex structural heart procedures such as TAVR and TMVR. The high patient volume and extensive healthcare infrastructure in hospitals and clinics allow for seamless integration of cutting-edge imaging systems, such as CT, echocardiography, and fluoroscopy. Major healthcare providers are increasingly adopting state-of-the-art imaging solutions to enhance diagnostic precision and procedural outcomes, further cementing the dominance of this segment. For example, collaborations between Siemens Healthineers and leading hospitals have enabled the deployment of innovative imaging platforms tailored for structural heart interventions, reinforcing the segment's leadership in the market.

The Ambulatory Surgical Centers (ASCs) is emerging as the fastest-growing end user segment, fueled by the rising demand for cost-effective, minimally invasive procedures in outpatient settings. ASCs offer significant advantages, including reduced procedure costs, shorter hospital stays, and improved patient convenience, making them an increasingly attractive option for structural heart interventions. Advances in portable and compact imaging systems, such as mobile fluoroscopy units and high-resolution ultrasound devices, have facilitated the adoption of sophisticated imaging technologies in these centers. Companies like GE Healthcare and Philips are developing tailored solutions for ASCs, focusing on affordability and efficiency without compromising imaging quality. The growing shift toward decentralized care and the expansion of ASCs equipped with advanced imaging capabilities are key drivers of this segment's rapid growth.

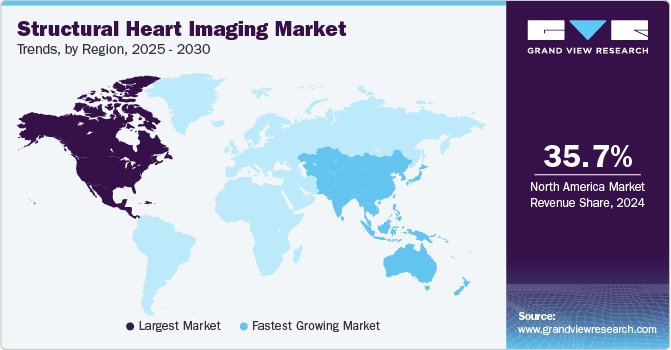

Regional Insights

North America structural heart imaging industry held the largest share accounting for 35.68% in 2024. This leadership is attributed to the region's advanced healthcare infrastructure, the presence of key market players, and the growing adoption of innovative technologies. High investment in research and development has driven the development of AI-driven imaging systems that enhance diagnostic precision and procedural efficiency. The aging population and increasing prevalence of structural heart diseases, such as aortic stenosis and mitral regurgitation, are also key growth drivers. According to the U.S. Census Bureau, the number of Americans aged 65 and older is expected to reach 80 million by 2040, further boosting demand for advanced imaging technologies.

U.S. Structural Heart Imaging Market Trends

The U.S. structural heart imaging market is the largest contributor to the North America market, has maintained its dominance through the rapid adoption of advanced imaging technologies and sustained innovation. In June 2024, Siemens Healthineers received FDA clearance for its Biograph Trinion PET/CT scanner, designed to enhance imaging precision and reduce radiation exposure. The increasing incidence of cardiovascular diseases, which account for nearly 697,000 deaths annually according to the CDC, underscores the importance of structural heart imaging technologies in the U.S. healthcare landscape.

Europe Structural Heart Imaging Market Trends

Europe remains a significant market for structural heart imaging, driven by its focus on personalized care, well-established healthcare infrastructure, and increasing adoption of innovative technologies. In October 2024, United Imaging launched its cutting-edge uMI Panvivo and Panorama GS systems at the EANM conference, highlighting the region’s commitment to advancing molecular imaging. The European Society of Cardiology reports that cardiovascular diseases account for nearly 45% of all deaths in Europe, emphasizing the growing need for accurate diagnostic tools in the region.

The UK structural heart imaging market is growing rapidly, fueled by innovation and strategic investments. In May 2024, Siemens Healthineers announced a £250 million investment in a new Oxfordshire facility to develop helium-efficient superconducting magnets for MRI scanners, advancing sustainability and operational efficiency. The British Heart Foundation reports that 7.6 million people in the UK live with heart and circulatory diseases, driving the demand for advanced diagnostic imaging.

The structural heart imaging market in France is poised for steady growth, driven by rising chronic disease prevalence and increasing demand for advanced imaging solutions. France's commitment to healthcare innovation is evident in its support for AI-integrated diagnostic tools, which help address the growing burden of cardiovascular conditions, affecting over 17% of the population according to national health statistics.

Germany structural heart imaging market is experiencing significant growth, propelled by advancements in medical technology and collaborations. In October 2024, GE HealthCare partnered with University Medicine Essen to establish a Theranostics Centre of Excellence, combining diagnostics and therapy for precision care. Germany's robust healthcare infrastructure and increasing investments in R&D strengthen its position as a leader in the European market.

Asia Pacific Structural Heart Imaging Market Trends

Asia Pacific structural heart imaging market is expected to witness the fastest growth, with a CAGR of 6.86% from 2024 to 2030, driven by improving healthcare infrastructure and rising awareness of early disease detection. In June 2024, Esaote Group established a manufacturing site in New Delhi to produce advanced ultrasound systems, highlighting the region's growing focus on localized production. The increasing prevalence of cardiovascular diseases and government initiatives to enhance healthcare access further support market growth.

China's structural heart imaging market is expanding rapidly due to significant investments in healthcare infrastructure and the adoption of advanced imaging technologies. Government initiatives, such as the Healthy China 2030 Plan, aim to enhance healthcare services and early disease detection. The country's focus on addressing the rising prevalence of cardiovascular conditions, which affect over 290 million people, is driving demand for cutting-edge diagnostic tools.

The structural heart imaging market in Japan is driven by technological advancements and strategic acquisitions. In December 2024, GE HealthCare acquired the remaining stake in Nihon Medi-Physics, enhancing its capabilities in molecular imaging and theranostics. Japan’s aging population, with 28.7% aged 65 and older, according to World Bank data, underscores the growing demand for precise diagnostic imaging to address age-related structural heart conditions.

Latin America Structural Heart Imaging Market Trends

The structural heart imaging industry in Latin America is expanding, driven by rising healthcare investments and the growing prevalence of chronic diseases. The adoption of advanced imaging technologies, such as AI-powered diagnostic tools, is improving healthcare accessibility across the region. For example, Brazil's Ministry of Health has launched initiatives to increase access to cardiovascular care, fostering the demand for innovative imaging systems.

Middle East & Africa Structural Heart Imaging Market Trends

The Middle East & Africa region is experiencing notable growth in the structural heart imaging industry due to rising healthcare investments and the adoption of advanced technologies. Countries like the UAE and Saudi Arabia are modernizing healthcare systems to address the growing prevalence of chronic diseases. AI and machine learning integration in imaging solutions are enhancing diagnostic precision, further driving market growth in the region.

Key Structural Heart Imaging Company Insights

The leading players in the structural heart imaging industry are implementing strategic initiatives to strengthen their market position and drive growth. These include significant investments in cutting-edge imaging technologies, such as 3D echocardiography, AI-integrated platforms, and real-time imaging systems designed for complex interventions like TAVR and TMVR. Companies are actively engaging in mergers, acquisitions, and collaborations to expand their product offerings and enhance research and development capabilities. Strategic partnerships with hospitals, clinics, and academic institutions are fostering innovation and accelerating the adoption of advanced imaging solutions. Additionally, leading players are focusing on expanding their footprint in high-growth regions, such as Asia Pacific, Latin America, and the Middle East, to tap into the increasing demand for structural heart imaging. Emphasis on regulatory compliance, product quality, and patient-centric innovations continues to play a pivotal role in sustaining their competitive advantage.

Key Structural Heart Imaging Companies:

The following are the leading companies in the structural heart imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips N.V.

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Shanghai United Imaging Healthcare Co., LTD

- Abbott

- Terumo Corporation

- Samsung Medison Co., Ltd.

- Lepu Medical Technology

Recent Developments

-

In November 2024, Koninklijke Philips N.V. introduced the new Azurion system to specialist interventionalists across cardiology, neurology, vascular, and surgical disciplines in India.

-

In September 2024, GE HealthCare announced the launch of enhanced Venue ultrasound systems along with a new solution, Venue Sprint, setting the pace for point-of-care ultrasound (POCUS).

-

In October 2024, Shanghai United Imaging Healthcare Co., LTD announced a strategic partnership with INVIA, a leading provider of medical imaging software, at the European Association of Nuclear Medicine (EANM) 2024 Congress. This collaboration aims to improve nuclear cardiology solutions by fully integrating INVIA’s Corridor4DM into United Imaging’s AI-powered advanced visualization workspace, uOmnispace.

-

In August 2024, Siemens Healthineers announced that it has received FDA clearance for the ACUSON Origin, an advanced cardiovascular ultrasound system enhanced with artificial intelligence (AI) capabilities.

-

In May 2024, University Hospitals (UH) and Siemens Healthineers have announced a 10-year strategic alliance, building on a 40-year history of clinical and research collaboration. This next phase aims to advance UH’s commitment to enhancing oncology, cardiovascular, and neurovascular care for patients across Ohio.

Structural Heart Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.83 billion

Revenue forecast in 2030

USD 13.12 billion

Growth rate

CAGR of 5.92% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, procedure, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthineers; GE Healthcare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Shanghai United Imaging Healthcare Co., LTD; Abbott; Terumo Corporation; Samsung Medison Co., Ltd.; Lepu Medical Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structural Heart Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global structural heart imaging market report based on modality, procedure, application, end use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Echocardiogram

-

Angiogram

-

CT

-

MRI

-

Nuclear Imaging

-

Other Modalities

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Transcatheter Aortic Valve Replacement (TAVR)

-

Surgical Aortic Valve Replacement (SAVR)

-

Transcatheter Mitral Valve Repair (TMVR)

-

Left Atrial Appendage Closure (LAAC)

-

Tricuspid Valve Replacement and Repair

-

Paravalvular Leak Detection and Repair

-

Annuloplasty

-

Valvuloplasty

-

Other Structural Heart Procedures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Imaging

-

Interventional Cardiology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Diagnostic Imaging Centers

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global structural heart imaging market size was valued estimated at USD 9.31 billion in 2024 and is expected to reach USD 9.83 billion in 2025.

b. The global structural heart imaging market is expected to grow at a compound annual growth rate of 5.92% from 2025 to 2030 to reach USD 13.12 billion by 2030.

b. The angiogram segment dominated the market in 2024, capturing a share of 36.75%. It represents the largest and fastest-growing segment within the structural heart imaging market, driven by its critical role in diagnosing and guiding treatments for various cardiovascular conditions.

b. Some key players operating in the structural heart imaging market include Siemens Healthineers; GE Healthcare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Shanghai United Imaging Healthcare Co., LTD; Abbott; Terumo Corporation; Samsung Medison Co., Ltd.; and Lepu Medical Technology

b. The structural heart imaging market is experiencing significant growth, driven by several key factors. The increasing prevalence of cardiac diseases is a major contributor; for instance, cardiovascular diseases are a leading cause of mortality worldwide, affecting millions annually.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.