- Home

- »

- Plastics, Polymers & Resins

- »

-

Styrene Butadiene Rubber Market Size & Share Report, 2030GVR Report cover

![Styrene Butadiene Rubber Market Size, Share & Trends Report]()

Styrene Butadiene Rubber Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (E SBR, S-SBR), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: 978-1-68038-011-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Styrene Butadiene Rubber Market Trends

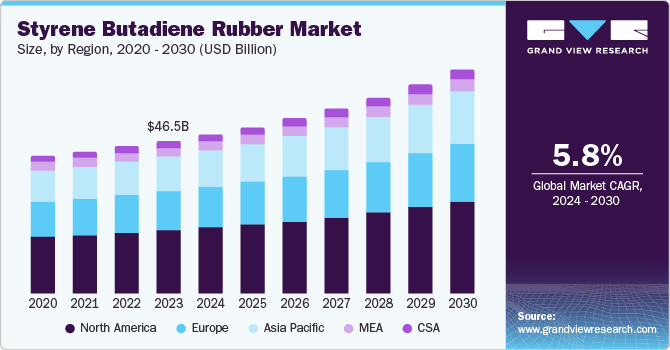

The global styrene butadiene rubber market size was valued at USD 46.46 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. Styrene butadiene rubber (SBR) is used in the automotive industry, particularly in tire manufacturing. As global vehicle production and sales grow, especially in emerging markets, the need for high-performance tires made from SBR rises correspondingly. The material's desirable properties, such as good abrasion resistance and aging stability, make it a suitable choice for tire applications, contributing significantly to its demand.

Another important factor contributing to the increased demand for SBR is its versatility in various industrial applications. Beyond tires, SBR is extensively used to manufacture other products such as conveyor belts, hoses, footwear, and adhesives. The construction industry, which is experiencing significant growth in both residential and commercial sectors, also utilizes SBR for various components, including sealants and waterproofing membranes. This widespread usage across multiple industries highlights SBR's versatility and underpins its growing global demand.

Environmental considerations and regulatory pressures are also significant in driving the demand for SBR. The automotive industry increasingly focuses on producing more fuel-efficient vehicles with lower emissions. SBR's use in low rolling resistance tires contributes to better fuel efficiency and reduced carbon emissions, aligning with global sustainability goals. Additionally, advancements in SBR production technologies, such as the development of solution SBR (SSBR), offer enhanced properties like improved wet grip and lower rolling resistance, making SBR a preferred choice in high-performance tire applications. Moreover, the rising trend of urbanization and industrialization in emerging economies contributes to the increased consumption of SBR. These regions are witnessing a surge in infrastructure projects and consumer goods manufacturing, which require SBR for various applications.

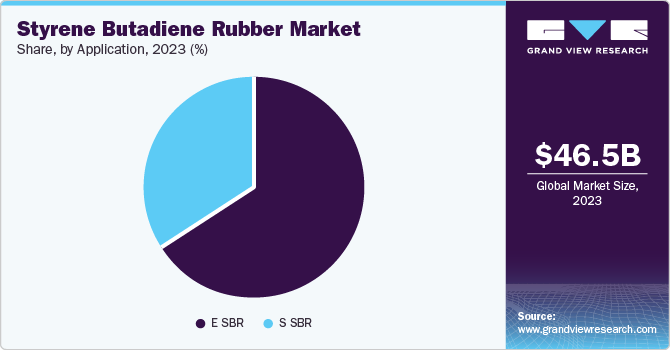

Application Insights

The E SBR segment held the largest market revenue share of 66.2% in 2023. E-SBR offers excellent abrasion resistance, good aging stability, and an affordable production cost, making it suitable for use in a variety of products. One of the primary applications driving this demand is the tire manufacturing industry, where E-SBR is a key component in producing durable and high-performance tires. Additionally, its use in other sectors, such as footwear, adhesives, and industrial rubber products, is expanding due to its balance of durability and cost-effectiveness.

S-SBR is projected to grow at the fastest CAGR of 8.2% over the forecast period. The growing footwear industry fuels the demand for durable and flexible materials, significantly driving the demand for S-SBR. In addition, the rising influence of sustainable and environment-friendly products is increasing the use of S-SBR, attributed to its properties that help improve fuel efficiency and reduce environmental impact. Regulatory compliances and standards for safety precautions, improved performance, and sustainability factors further fuel market growth. In addition, the rising investment in research and development by major companies in the market leads to innovative products and increases the applications of S-SBR in the market.

Regional Insights

North America styrene butadiene rubber market held the largest market revenue share of 41.3% in 2023. The region’s dominance can be attributed to its well-developed automotive industry, ongoing infrastructure expansion, and the rising need for consumer goods drives the increased utilization of styrene butadiene rubber in the region. The demand is also fueled by regional infrastructure projects, which utilize SBR in applications like waterproofing, adhesives, and sealants. Furthermore, the shift towards electric vehicles, which often require specialized tires and components, drives additional demand for high-quality SBR in North America.

U.S. Styrene Butadiene Rubber Market Insights

The U.S. market held the largest market revenue share regionally in 2023. The demand is fueled by the U.S. government's focus on infrastructure improvements and the associated growth in the construction sector. SBR is used in various applications like roofing, adhesives, and waterproofing materials. Additionally, the U.S. market has seen a push toward sustainability and the use of eco-friendly materials, driving innovation in SBR formulations to meet these new standards.

Europe Styrene Butadiene Rubber Market Insights

Europe styrene butadiene rubber market is projected to grow with a significant CAGR over the forecast period. The demand for styrene butadiene rubber in the region is increasing due to the rising demand for substitutes for natural rubber. This is attributed to its versatility and cost-effectiveness properties. Styrene butadiene rubber is widely used in adhesives owing to its balance of properties, such as improved adhesion, resilience, and flexibility. It helps in the significant bonding of several substances, resulting in its widespread adoption in diverse applications. These factors are driving the market demand in the region.

Germany market is projected to grow rapidly over the forecast period. The rising demand for styrene butadiene rubber (SBR) is closely tied to the country's robust automotive sector, a cornerstone of its economy. German automakers, including major brands such as Volkswagen, BMW, and Mercedes-Benz, are increasingly utilizing SBR in tire manufacturing due to its cost-effectiveness and superior performance characteristics, such as wear resistance and wet traction.

Asia Pacific Styrene Butadiene Rubber Market Insights

Asia Pacific is projected to grow at the fastest CAGR over the forecast period. The region is experiencing significant growth in infrastructure projects, especially in Southeast Asian nations where SBR is used in various construction applications. The expanding middle class and rising consumer spending in these countries also boost the demand for consumer goods like footwear, which often utilize SBR for its comfortable and durable properties. Moreover, the region benefits from a favorable regulatory environment and increasing investments in SBR production capacities, making Asia-Pacific a key player in the global SBR market.

China market is projected to grow rapidly in the coming years. China's expanding consumer electronics and appliance manufacturing sectors utilize SBR in products like cables, hoses, and gaskets, whose flexibility and insulating properties are crucial. The footwear industry in China also relies heavily on SBR to produce soles, providing the necessary abrasion resistance and elasticity. Furthermore, as China advances its domestic manufacturing capabilities, there's an increased use of SBR in automotive parts, such as belts and gaskets, beyond just tires.

Key Styrene Butadiene Rubber Company Insights

Some of the key companies in the styrene butadiene rubber market include ARLANXEO; ENEOS Corporation; Sumitomo Chemical Asia Pte Ltd; Synthos; Trinseo; Versalis SpA; and others.

-

ARLANXEO offers a diverse range of Solution-Styrene Butadiene Rubbers (S-SBR) under the brand name BUNA. These S-SBR grades are used in various applications, including tire manufacturing, plastics modification, and molded technical parts. BUNA SL provides low-temperature flexibility and abrasion resistance for tires, while BUNA BL is ideal for shoe soles due to its hardness and abrasion resistance.

-

ENEOS Corporation provides polymerization styrene-butadiene rubber (S-SBR). ENEOS Corporation’s provides innovative materials for the automotive industry such as the S-SBR which is a high-performance material primarily used in fuel-efficient tires, offering improved wet grip, rolling resistance, and wear performance.

Key Styrene Butadiene Rubber Companies:

The following are the leading companies in the styrene butadiene rubber market. These companies collectively hold the largest market share and dictate industry trends.

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation6.

- ENEOS Corporation

- Kemipex

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Sumitomo Chemical Asia Pte Ltd

- Synthos

- Trinseo

- Versalis SpA

Recent Developments

-

In May 2023, Sumitomo Corporation, KUMHO Petrochemical Co., announced a collaboration with Idemitsu Kosan Co., Ltd. to develop a sustainable Asian polymers and chemicals market. With this collaboration, KUMHO Petrochemical Co. will produce bio-Solution Styrene Butadiene Rubber for the production of high-performance tires.

Styrene Butadiene Rubber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.41 billion

Revenue forecast in 2030

USD 68.01 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume Kilo Tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Thailand, Indonesia, Malaysia, Australia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

ARLANXEO; Asahi Kasei Corporation; China Petrochemical Corporation.; ENEOS Corporation; Kemipex; KUMHO PETROCHEMICAL; LANXESS; LG Chem; Sumitomo Chemical Asia Pte Ltd; Synthos; Trinseo; Versalis SpA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Styrene Butadiene Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the styrene butadiene rubber market report based on application and region.

-

Application Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

E SBR

-

Tire

-

Footwear

-

Construction

-

Polymer Modification

-

Adhesive

-

Others

-

-

S SBR

-

Tire

-

Footwear

-

Polymer Modification

-

Adhesive and Sealant

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.