- Home

- »

- Beauty & Personal Care

- »

-

Sun Care Products Market Size, Industry Report, 2030GVR Report cover

![Sun Care Products Market Size, Share & Trends Report]()

Sun Care Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Distribution Channel (Hypermarket & supermarket, Pharmacy & Drug stores, Specialty store, Online, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-705-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sun Care Products Market Summary

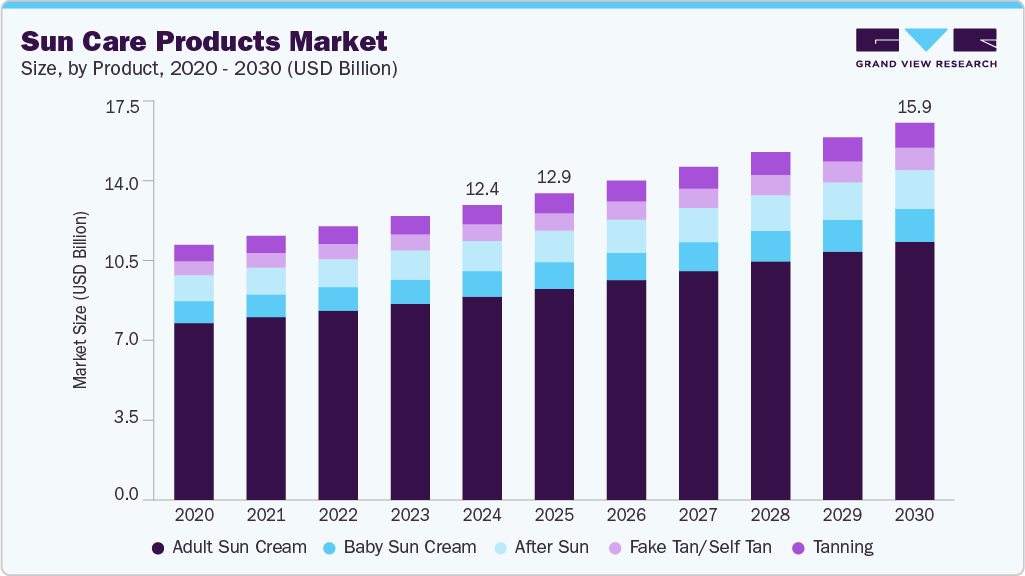

The global sun care products market size was estimated at USD 12.44 billion in 2024 and is projected to reach USD 15.92 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. This market is primarily driven by rising consumer awareness about the harmful effects of UV exposure, the growing incidence of skin cancer, and increasing demand for multifunctional skincare.

Key Market Trends & Insights

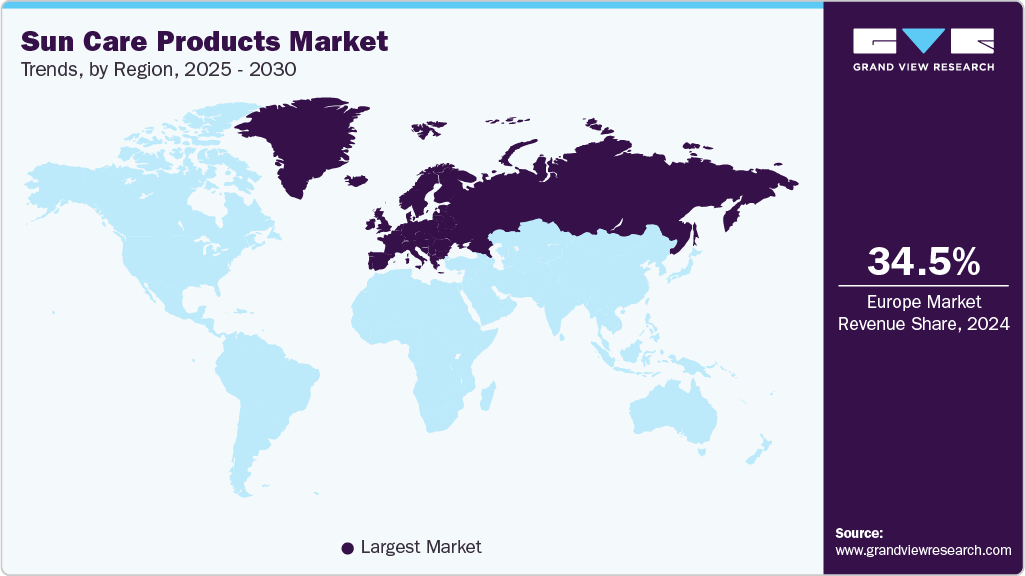

- The European sun care product market held the largest market share of 34.5% in 2024.

- Germany dominated Europe’s sun care products market with the largest revenue share in 2024.

- By product, the adult sun cream segment held the highest market share in 2024.

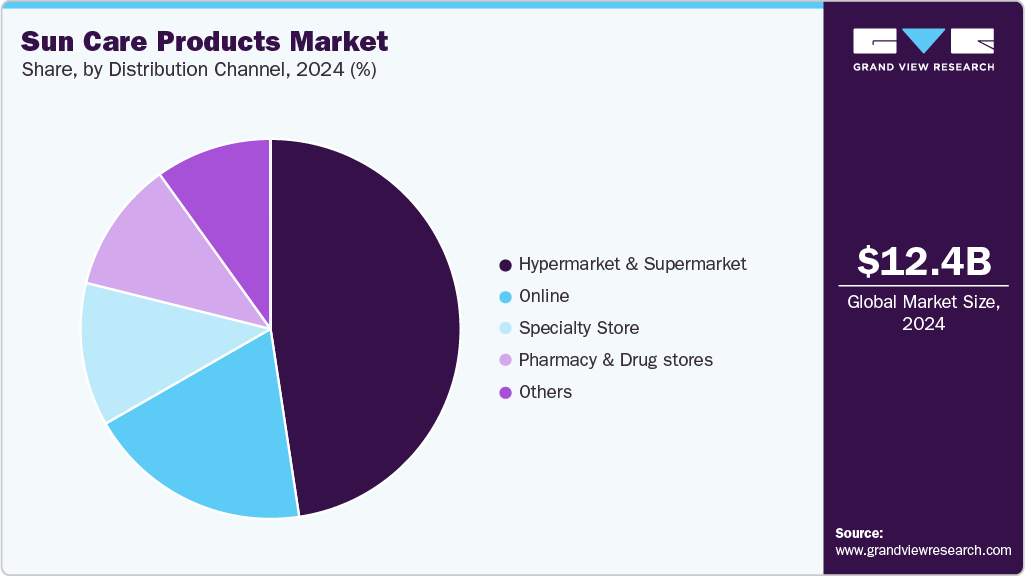

- By distribution channel, the hypermarket & supermarket segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.44 Billion

- 2030 Projected Market Size: USD 15.92 Billion

- CAGR (2025-2030): 4.2%

- Europe: Largest market in 2024

Excessive exposure to ultraviolet (UV) radiation is a major risk factor for skin cancer, contributing to a rising public health concern in the U.S. According to the World Health Organization, UV radiation particularly from the sun can cause DNA damage in skin cells, ultimately leading to both melanoma and non-melanoma skin cancers. The risk is heightened by outdoor occupations, tanning practices, and climate-related changes that increase UV intensity.The expanding sun care products market is largely fueled by the growing occurrence of skin cancer and global sun safety promotions. Data from the U.S. Centers for Disease Control and Prevention (CDC) indicates that skin cancer is the most common cancer in the U.S., with over 6.1 million adults annually treated for basal and squamous cell carcinomas. In response, public health bodies have implemented sun safety initiatives, urging regular sunscreen use and limited UV exposure. Such campaigns have significantly boosted awareness, particularly in high UV regions, leading to consistent, year-round demand for protective sun care solutions among all age groups.

Another key driver is the rising consumer preference for eco-friendly and mineral-based sun care products, supported by growing environmental regulations and public awareness. In 2024, the National Oceanic and Atmospheric Administration (NOAA) reiterated that chemicals like oxybenzone and octinoxate contribute to coral bleaching, prompting more U.S. coastal states to restrict non-mineral sunscreens. This aligns with global trends, as the European Commission has also recommended limits on UV filters harmful to aquatic ecosystems under REACH regulation. Brands are responding with zinc oxide- and titanium dioxide-based formulations that offer broad-spectrum protection while complying with environmental safety standards. The shift toward reef-safe products reflects a broader movement among consumers to prioritize skin health and ecological impact.

Product Insights

The adult sun cream segment dominated the market with 69.0% revenue share in 2024. Adult cream is used to protect the skin from sunburn and premature aging, such as wrinkles, leathery skin. Due to multi-purpose benefits such as protection against the high risk of skin cancer, skin discoloration, and inflammation, these products have become quite popular among adults. Consumers increasingly favor formulations that combine broad-spectrum SPF protection with skincare benefits, such as anti-aging actives and light moisturizers.

The fake tan/safe tan segment is expected to witness a robust CAGR of 4.9% over the forecast period. The increasing trend of everyday alternatives to sunbathing that do not expose skin to harmful ultraviolet (UV) rays is driving the market for sun care products. Sunless tanning products are commonly sold in the form of lotions, creams, and sprays.

The proliferation of natural-looking products, the rise in the number of service providers, and widespread acceptance of the concept of sun care are driving the demand. Consumers prefer sunless tanning as it aids in achieving a healthier appearance throughout the year.

Distribution Channel Insights

The hypermarket & supermarket segment had the largest revenue share in 2024. These stores attract a large number of consumers and are usually located in central parts of the city. Due to various brands' availability, consumers opt for these stores to buy products. With nearly 500 SPF products identified as safe and effective by EWG in 2024, consumers rely on physical retail locations to evaluate ingredient lists and product labeling under outdated but strict FDA regulations. Many of these stores have trained personnel in the cosmetics and beauty aisles to give clients expert help and recommendations. This makes it easy for consumers to choose from a wide range of availability, owing to increased demand for cosmetics and shrinking shelf space.

The online segment is expected to witness a significant CAGR over the forecast period. Rising awareness about ingredient safety, driven by EWG’s annual sunscreen ratings, has pushed consumers to research and buy SPF products online. Limited access to advanced UV filters in U.S. stores has also led buyers to explore international options via e-commerce. Major platforms like Amazon and Walmart expanded SPF-specific filters in 2024, making comparison easier. Social media-driven skincare trends further boost online demand. This channel appeals to health-conscious users seeking transparency and convenience.

The specialty store segment is projected to grow at a CAGR of 4.4% from 2025 to 2030. These stores specialize in a narrow range of offerings and place a premium on customer pleasure. To provide exceptional service, most specialty skin care stores retain a significant depth in terms of the products offered to customers. Specialty stores focus on specific categories and primarily focus on high customer satisfaction. Most specialty stores dealing in the market maintain considerable depth in terms of the offerings to ensure quality service. Several brands prefer to sell these products through specialty stores, as these stores focus on renowned brands and offer more accountability on the overall service.

Regional Insights

The North American sun care products market is growing due to awareness about the harmful effects of prolonged sun exposure on the skin. In May 2025, the Environmental Working Group (EWG) published the 2025 Annual Guide to Sunscreens, which evaluated 2,200 products and identified less than 500 products that effectively protect the user's skin.

U.S. Sun Care Products Market Trends

The sun care products market in the U.S. is anticipated to grow steadily, fueled by increasing awareness of sunscreen safety and regulatory reform. Dermatologists continue to recommend daily use of broad-spectrum SPF 30+, while U.S. retailers and e-commerce platforms have expanded their selection of EWG-verified mineral sunscreens. This convergence of public health campaigns, regulatory pressure, and retail responsiveness positions the U.S. as one of the leading countries in driving demand for safer, more advanced sun care products.

Europe Sun Care Products Market Trends

The European sun care product market held the largest market share of 34.5% in 2024 and is expected to grow rapidly over the forecast period from 2025 to 2030. Increasing awareness about the harmful effects of direct sun exposure and increasing products offering additional benefits, such as dark spot reduction and anti-aging, have further fueled product demand. In Europe, sunscreen products are classified as cosmetics; however, they should meet strict formulation, efficacy testing, and labelling requirements. This ensures the availability of quality and effective products in the region

Germany dominated Europe's sun care products market with the largest revenue share in 2024. This growth is driven by strong public awareness campaigns and increasing cases of UV-related skin conditions.

Asia Pacific Sun Care Products Market Trends

Asia‑Pacific is gaining strong sun care usage momentum, driven by rising skin cancer awareness and UV-related health advisories. The other factor driving the Asia Pacific market growth is the expansion of the chemical industry in India and China, which is expected to ensure continuous raw material access to skin care product manufacturers, and, thus, likely to be a positive factor for the manufacturers in Asia Pacific over the forecast period. The increasing demand from emerging countries such as China and India due to the growth in the number of new product launches and the rising concerns toward harmful effects of UV rays and skin conditions is likely to positively influence the Asia Pacific market.

Key Sun Care Products Company Insights

The market is slightly competitive, with many large and small-scale players. Most companies focus on R&D efforts, mergers, acquisitions, collaborations, and partnerships to achieve greater market share.

Key Sun Care Products Companies:

The following are the leading companies in the sun care products market. These companies collectively hold the largest market share and dictate industry trends.

- Beiersdorf AG

- Groupe Clarins

- Johnson & Johnson

- Coty Inc.

- Shiseido Co. Ltd.

- L'oreal

- The Estee Lauder Companies Inc.

- Burt's Bees

- Bioderma Laboratories

- Unilever

Recent Developments

-

In June 2025, L’Oréal Groupe was named “Europe’s Most Innovative Company” by Fortune, highlighting its breakthrough in sun care with UVMUNE 400, a filter against ultra-long UVA rays-the most significant suncare innovation in 30 years.

-

In June 2025, Beiersdorf Nigeria launched the NIVEA UV Face Sunscreen to boost skin health. The product debuted at a beachfront event in Lagos in the presence of media personalities, skincare lovers, influencers, and health experts.

Sun Care Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.94 billion

Revenue forecast in 2030

USD 15.92 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Beiersdorf AG, Groupe Clarins, Johnson & Johnson, Coty Inc., Shiseido Co. Ltd., L'oreal, The Estee Lauder Companies Inc., Burt's Bees, Bioderma Laboratories, Unilever

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sun Care Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sun care products market report based on product, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult Sun Cream

-

Baby Sun Cream

-

After Sun

-

Fake Tan/Self Tan

-

Tanning

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarkets

-

Pharmacy & Drug Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.