Sunflower Oil Market Size & Trends

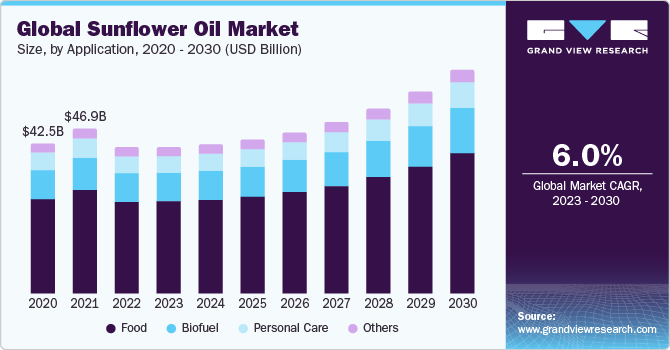

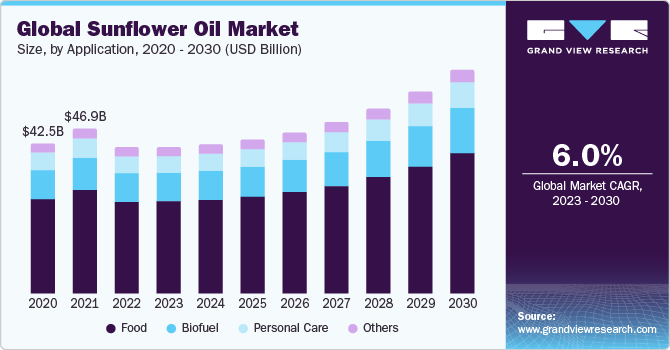

The global sunflower oil market size was valued at USD 41.43 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. One of the major drivers of the sunflower oil market is the increasing awareness and emphasis on health and nutrition. Sunflower oil is rich in polyunsaturated fats, particularly linoleic acid, and vitamin E, making it a healthier alternative to some other cooking oils. With a growing focus on healthy living and dietary choices, consumers are actively seeking oils that offer health benefits. Sunflower oil's perceived health advantages have fueled its demand in the market.

Sunflower oil's versatility in cooking applications is another key factor propelling its market growth. It has a high smoke point, making it suitable for various cooking methods, including frying, baking, and sautéing. The neutral flavor profile of sunflower oil also allows it to be used in a wide range of cuisines, appealing to diverse consumer preferences globally. As the culinary landscape becomes more diverse and consumers experiment with different cuisines, the demand for versatile cooking oils like sunflower oil continues to rise. Moreover, shifts in dietary preferences and lifestyle choices influence the demand for different cooking oils. As more consumers embrace plant-based diets or seek alternatives to traditional oils, the demand for sunflower oil tends to increase.

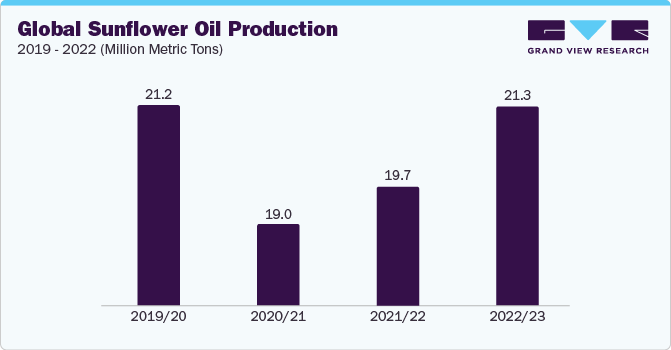

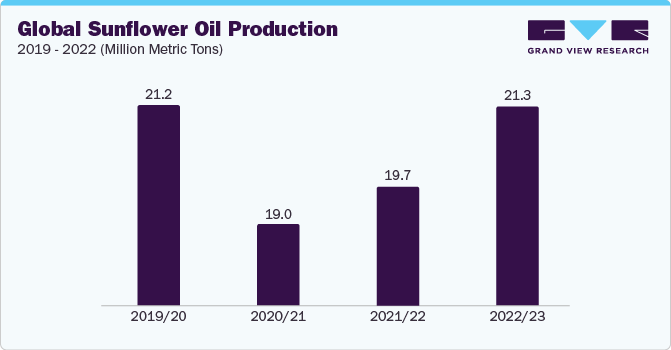

Technological advancements in the extraction and processing of sunflower oil. Modern oil extraction methods, such as cold pressing and solvent extraction, are more efficient and result in higher oil yields. These methods also contribute to maintaining the quality of the oil, meeting consumer expectations for a premium product. The efficiency gains achieved through these extraction techniques translate into increased production capacity for the industry. Furthermore, the expanding use of sunflower oil in various industries, beyond its traditional role as a cooking oil, has led to increased production. Sunflower oil is now a key ingredient in cosmetics, biofuels, and industrial applications. The diversification of uses creates additional demand, prompting producers to scale up their operations to meet the evolving needs of diverse industries.

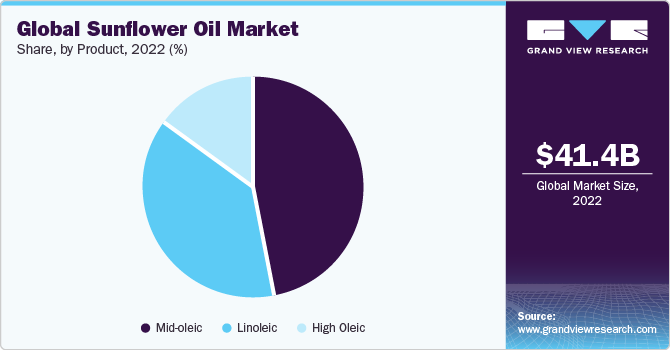

Product Insights

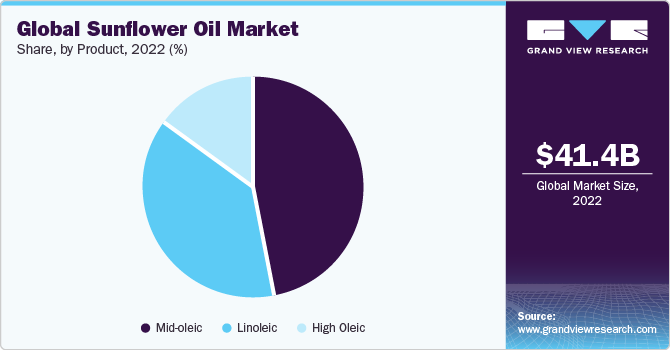

Based on product, the sunflower oil is market is segmented into high oleic, mid-oleic, linoleic. Mid-oleic sunflower oil held the highest share in 2022. Mid-oleic sunflower oil, known for its equilibrium between oleic and linoleic acid content, stands out as a wholesome option, delivering essential fatty acids. Widely recognized as the standard sunflower oil, it has become a prevalent choice globally due to its health advantages at a cost-effective price point, comparable to other seed oils.

With a composition comprising 65% oleic acid, 25% linoleic acid, and approximately 10% saturated fats, mid-oleic sunflower oil offers a balanced nutritional profile. This oil not only provides essential nutrients at an affordable price but has also become the preferred choice for snack manufacturers, particularly those producing items like potato chips and crisps.

Mid-oleic sunflower oil is popularity in the snack industry attributing to its cost-effectiveness and the ability to resist rancidity in storage without the need for hydrogenation. The composition of mid-oleic sunflower oil makes it a stable and economical choice for mass production, meeting the nutritional needs of a broad consumer base while ensuring a longer shelf life for snack products.

Application Insights

On the basis of application, the market is segmented into food, biofuel, personal care, and others. Sunflower oil’s widespread adoption in households and the food industry is primarily attributed to its versatility, neutral taste, and high smoke point. Sunflower oil serves as a go-to cooking oil due to its ability to withstand high temperatures without breaking down or producing harmful compounds. This quality makes it ideal for deep frying, sautéing, and baking, offering a reliable and stable medium for a variety of culinary methods. The neutral flavor of sunflower oil allows it to seamlessly integrate into a diverse range of dishes, preserving the natural taste of ingredients without imparting an overpowering influence. Its popularity in cooking applications is further driven by its affordability, making it an accessible and economical choice for consumers and food manufacturers alike.

Regional Insights

Europe dominated the sunflower oil market in 2022. Health-conscious trends in Europe have significantly influenced the sunflower oil market. The oil's nutritional benefits, including its potential positive impact on heart health, have driven its adoption among health-conscious consumers. Additionally, the rising awareness of the adverse effects of trans fats has led to a shift away from oils that require hydrogenation for stability, further propelling the demand for sunflower oil. The European market's receptivity to healthier cooking options contributes to the continued growth and prominence of sunflower oil in the region. Furthermore, the emphasis on locally sourced and sustainable products aligns with sunflower oil's production within the region, fostering a sense of trust and preference among European consumers.

Competitive Insights

Key players operating in the market are Bunge Limited, Archer-daniels-midland Company, Cargill Incorporated, Kaissa Oil, Avril Group, Optimusagro Trade LLC, Gustav Heess Oleochemische, Erzeugnisse Gmbh, Risoil Sa, Mwc Oil, Borges Agricultural Industries and Industrial Edible Oils Sa, Delta Wilmar, and Spack Bv. The market participants are constantly working towards new product launches, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In February 2023, MK Agrotech, under the Sunpure brand, acquired Riso, a distinguished premium edible oil brand in India. Riso boasts a diverse product range encompassing rice bran oil, groundnut oil, and sunflower oil. The strategic initiative was taken by the company to strengthen Sunpure's market presence in Maharashtra, India.

-

In June 2022, Edible Oils (EOL) announced a USD 29.3 million investment in the Erith site, opening a newly refurbished bottling facility. The investment in the Erith location involved the implementation of new bottling lines for cooking oils including sunflower oil, rapeseed oil, and corn oil, alongside the enhancement of the oil tank farm. This strategic initiative has significantly boosted the overall production capacity of the site by approximately 50%.