- Home

- »

- Food Additives & Nutricosmetics

- »

-

Oleic Acid Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Oleic Acid Market Size, Share & Trends Report]()

Oleic Acid Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Food & Beverages, Pharmaceutical, Soaps & Detergents, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-053-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oleic Acid Market Size & Trends

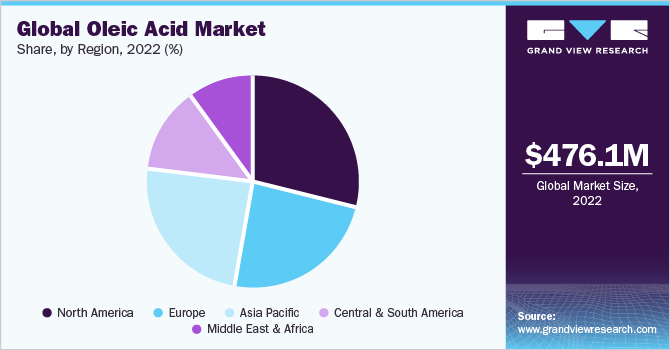

The global oleic acid market size was valued at USD 476.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6 % from 2023 to 2030. The global demand for oleic acid is anticipated to be driven by its increasing inclusion in various skincare products such as moisturizers, anti-aging creams, and sunscreen among others. In addition, the rising usage of oleic acid in other end-use industries like food & beverages, mining, plastics & rubber, textile, as well as lubricants is fueling the market growth. Over the forecast period, development in the industry is anticipated to be driven by rising demand for fatty acids in a variety of personal care and cosmetic products, including soap, detergent, moisturizers, and others. In addition, shifting customer lifestyles, growing urbanization, and increasing disposable incomes have increased the use of cosmetics and personal care items, which in turn has increased the demand for fatty acids.

Moreover, the growing concerns regarding the side effects of oleic acids present a barrier to growth. The excess consumption can lead to lipid accumulation in the liver as well as a blockage from linoleic acid, which is another important fatty acid. Additionally, high consumption of the product can cause some high-risk deficiencies, which can eventually lead to heart failure. Similarly, combining oleic acid with other blood pressure and diabetes medications could cause high-risk outcomes such as low blood sugar levels.

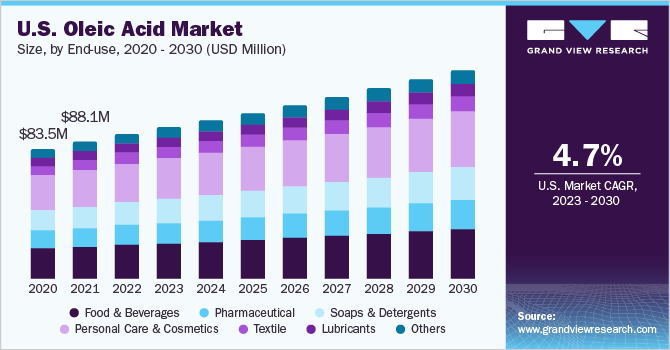

The U.S. is the largest consumer of the product in North America with a revenue share of over 68% in 2022. This market growth in North America is driven by its flourishing cosmetics market. According to Forbes, the U.S. accounted for a share of approximately 20% of the global cosmetics market in terms of revenue in 2021. Moreover, as per Toptal, LLC, the skin care business segment accounted for a share of more than 23% of the total the U.S. beauty and cosmetics market in 2021. As oleic acid is used widely in the formulation of various skin care products such as sunscreens, moisturizers, and anti-aging creams & lotions, it is anticipated to fuel the demand for this acid in the country.

End-use Insights

The personal care and cosmetics end-use segment is expected to dominate the market with a revenue share of over 26% in 2022. This growth is attributed to the fact that calcium plays a vital role in the human body as it is an essential micronutrient. The global healthcare and pharmaceutical industries have been growing rapidly over the last few years owing to the increasing population and surging awareness among the masses about healthy living.

Although COVID-19 severely impacted different industries worldwide, it boosted the growth of global healthcare and pharmaceutical industries. The pandemic further made people highly conscious of the benefits of a healthy diet and proper intake of micronutrients and macronutrients such as calcium. This, in turn, led to a strong demand for precipitated calcium carbonate, thereby fueling the growth of the market.

The growing demand for organic and anti-aging products to maintain a youthful appearance is driving the demand for personal care products, which, in turn, is expected to trigger the demand for oleic acid in the personal care & cosmetics application segment. Over the past decade, this industry has shown continuous growth coupled with increasing shelf space in supermarkets, hypermarkets, retail stores, and boutique stores across the world. This, in turn, is also anticipated to fuel the demand for the oleic acid industry during the forecast period.

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of more than 24% in 2022. This regional segment is projected to grow significantly in the coming years owing to the rapid increase in demand for oleic acid from the rubber and plastics industries. Asia Pacific leads the global rubber and plastics industries, accounting for over half of the global output of these industries with China leading the global rubber and plastic production in 2021. Despite the presence of a high number of small-sized rubber and plastic manufacturers in the Asia Pacific, it is the large- and medium-sized companies that generate the most revenue from rubber and plastics in the region.

North America is another region witnessing strong growth over the forecasted period. The oleic acid industry in North America is expected to witness steady growth during the forecast period owing to an increase in demand for this acid from the personal care & cosmetics industry in the region. In addition, the surge in the consumption of oleic acid to produce soaps, detergents, and other cleaning products, especially in countries such as the U.S. is also driving the growth of the market in North America.

The soap industry in the U.S. is one of the largest in the world. The country has a prominent position in the global production, exports, and consumption of soaps. Companies such as Procter & Gamble; Colgate-Palmolive; and Church & Dwight are some leading soap manufacturers in the U.S.

Key Companies & Market Share Insights

The global oleic acid industry is highly competitive with the presence of a large number of independent small-scale and large-scale manufacturers and suppliers. While large-scale companies concentrate on mergers, expansions, and product development, small-scale players primarily compete based on price.

Players are entering into mergers and partnerships to establish their position in the market. For instance, BASF announced an innovative partnership with RiKarbon for personal care products like emollients, which bodes well for market growth. Oleic acid is mostly used as an emollient in the cosmetic industry. Some prominent players in the global oleic acid market include:

-

AkzoNobel N.V.

-

BASF SE

-

Emery Oleochemicals

-

Vantage Specialty Chemicals

-

KLK Oleo

-

IOI Oleochemicals.

-

Shuangma Chemical

Oleic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 497.4 million

Revenue forecast in 2030

USD 684.7 million

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

End-use, Region

Key companies profiled

AkzoNobel N.V., Ltd.; BASF SE; Emery Oleochemicals; Vantage Specialty Chemicals; KLK Oleo; IOI Oleochemicals.; Shuangma Chemical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oleic Acid Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global oleic acid market report based on end-use, and region:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceutical

-

Soaps & Detergents

-

Personal Care & Cosmetics

-

Textile

-

Lubricants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oleic acid market size was estimated at USD 476.1 million in 2022 and is expected to reach USD 497.4 million in 2023.

b. The global oleic acid market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 684.7 million by 2030.

b. North America dominated the oleic acid market with a share of 28.4% in 2022. This is attributable to increasing demand from personal care & cosmetics industry especially from developed countries like the U.S. Moreover, increasing usage of oleic acid as a flavoring agent in multiple food products is boosting the market in North America region.

b. Some key players operating in the oleic acid market include AkzoNobel N.V., BASF SE, Emery Oleochemicals LLC, Vantage Specialty Chemicals, KLK Oleo, IOI Oleochemicals, and Shuangma Chemical.

b. Key factors that are driving the market growth include the rising usage of oleic acid in other end-use industries like food & beverages, mining, plastics & rubber, textile, as well as lubricants is fueling the market growth. Furthermore, the market for oleic acid is majorly driven by its usage in formulation of soaps and detergents, especially in developing economies of Asia Pacific.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.