Superdisintegrants Market Size & Trends

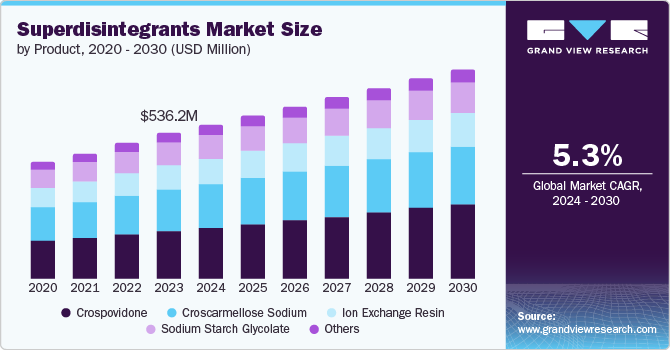

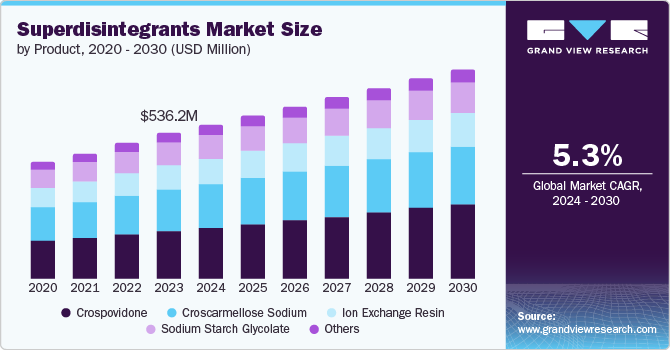

The global superdisintegrants market size was valued at USD 536.2 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. This growth is attributed to several factors, including the expansion of the generics market, which heavily utilizes orally disintegrating tablets (ODTs). Additionally, increased research & development (R&D) funding and technological advancements are driving the development of innovative superdisintegrants. These advancements are creating new opportunities within the pharmaceutical manufacturing market and serve as a major force propelling the global superdisintegrants market forward.

The growing geriatric population and rising prevalence of dysphagia (swallowing difficulties) in pediatrics are driving demand for ODTs and fast-dissolving dosage forms. Superdisintegrants play a critical role in facilitating the rapid disintegration of these formulations, improving patient compliance and medication adherence, particularly for these vulnerable populations. This, in turn, is propelling the global superdisintegrant market.

Increased government oversight and stricter regulations within the pharmaceutical industry are driving the demand for research and development of safe and natural superdisintegrants. This focus on patient safety creates a market opportunity for companies to develop innovative products, fostering competition and ultimately leading to significant market growth.

Product Insights

Crospovidone products dominated the market and accounted for a share of 32.1% in 2023. This segment is projected to maintain its lead position and exhibit the fastest growth trajectory throughout the forecast period. This robust expansion can be attributed to the increasing preference for fast-disintegrating excipients like locust bean gum, isapghula husk, and gellan gum. These natural ingredients offer superior patient compliance due to their rapid dissolution in water, which translates to easier swallowing and a more trustworthy user experience.

The ion exchange resin product segment is anticipated to grow at a CAGR of 5.8% from 2024 to 2030. This expansion is driven by the widespread adoption of ion exchange in water treatment applications. These resins offer exceptional efficacy in removing pollutants, including trace metals, organic compounds, and a variety of other contaminants. Furthermore, the growing industrial demand for ultrapure water, coupled with the increasing need for ion exchange in power generation and nuclear applications, is expected to significantly propel segment growth.

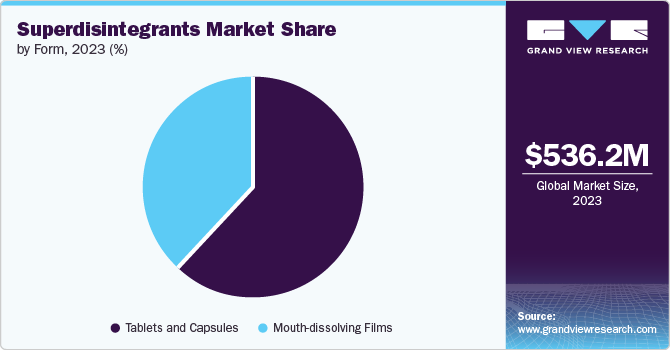

Form Insights

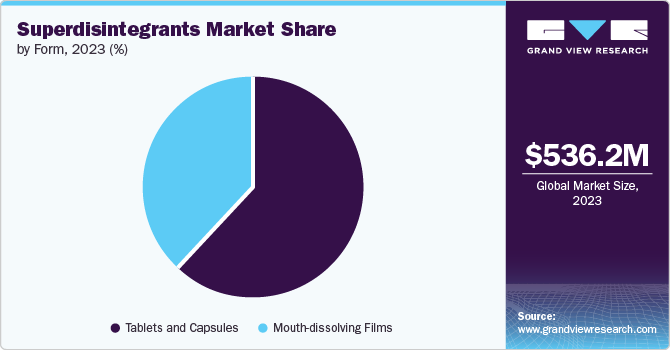

Tablets and capsules commanded a dominant market share of 62.3% in 2023, primarily driven by the extensive use of crospovidone as an excipient. Crospovidone's advantageous properties, including inhibition of recrystallization and enhancement of dissolution and disintegration of solid dosage forms, translate to improved swallowability for both geriatric and pediatric patients. Furthermore, ingredients like locust bean gum and others are routinely incorporated to facilitate tablet disintegration upon contact with water.

Mouth-dissolving films (MDFs) are projected to grow at a CAGR of 5.0% from 2024 to 2030. This growth is attributed to their increasing adoption in various therapeutic areas, including cardiology, oncology, and neurology. MDFs offer a significant advantage of convenient administration, dissolving rapidly in the mouth without requiring water. This eliminates the risk of choking, particularly beneficial for pediatric and geriatric patients or those with dysphagia. These patient-centric benefits are driving demand for MDFs within the pharmaceutical industry, leading to substantial market expansion.

Regional Insights

North America's superdisintegrants market dominated the market in 2023. This dominance can be attributed to significant investments in R&D for novel drug formulations, fostering a highly competitive landscape. This intense competition fuels continuous innovation, ultimately propelling market growth.

U.S. Superdisintegrants Market Trends

The U.S. superdisintegrants market dominated the North American market with a revenue share of 88.7% in 2023. This dominance can be attributed to a combination of factors, including proactive government initiatives, favorable healthcare policies, and a robust healthcare market. These elements not only stimulated the demand for superdisintegrants but also contributed significantly to the market’s expansion.

Europe Superdisintegrants Market Trends

Europe's superdisintegrants market was identified as a lucrative region in 2023. This expansion can be attributed to the ongoing increase in manufacturing capacity across the region and the development and implementation of enhanced drug delivery processes. This has resulted in a surge in superdisintegrants consumption, fueling significant demand growth and a positive market trajectory.

The superdisintegrants market in UK is anticipated to witness significant growth in the coming years. This expansion can be attributed to the trend of rising demand for orally disintegrating dosage forms and increasing investment in the development of higher-quality pharmaceutical products.

Asia Pacific Superdisintegrants Market Trends

Asia Pacific's superdisintegrants market is anticipated to witness significant growth in the upcoming years. This growth is driven by the confluence of an expanding healthcare sector and a rapidly expanding manufacturing base. This is expected to fuel demand for innovative pharmaceutical products, which will, in turn, significantly propel the regional superdisintegrants market.

The superdisintegrants market in China is held a substantial market share in 2023 owing to a cost-competitive manufacturing base, a regulatory environment that facilitates the production, and a growing domestic economy with rising disposable income, which has fueled significant demand for pharmaceutical products.

Key Superdisintegrants Company Insights

Some key global superdisintegrants market companiesinclude Merck KGaA, Ashland BASF, NIPPON SODA, and many more. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Superdisintegrants Companies:

The following are the leading companies in the superdisintegrants market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Ashland

- DuPont.

- Roquette Frères.

- DFE Pharma

- JRS PHARMA

- Asahi Kasei Corporation.

- Merck KGaA

- Corel Pharma Chem.

- NIPPON SODA CO., LTD.

Recent Developments

-

In April 2023, Ingredion Incorporated (INGR) announced the successful completion of two strategic investments in India. These acquisitions aimed to expand the company's presence in the high-value pharmaceutical ingredients market. As a result, Ingredion has significantly bolstered its portfolio of functional excipients, now including a wider range of offerings such as binders, fillers, superdisintegrants, lubricants, and more.

-

In October 2023, Ashland presented their novel Polyplasdone, a multifunctional superdisintegrant incorporating glidant and lubricant properties. This streamlines the production process by minimizing steps and equipment needs while enhancing tablet hardness and ensuring consistent quality in both batch and continuous manufacturing.

Global Superdisintegrants Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 567.8 million

|

|

Revenue forecast in 2030

|

USD 769.8 million

|

|

Growth rate

|

CAGR of 5.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

August 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, form, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

|

|

Key companies profiled

|

BASF SE; Ashland; DuPont.; Roquette Frères.; DFE Pharma; JRS PHARMA; Asahi Kasei Corporation.; Merck KGaA; Corel Pharma Chem.; NIPPON SODA CO., LTD.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

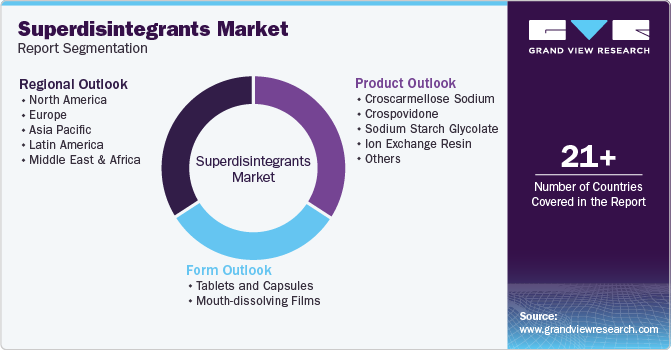

Global Superdisintegrants Market Report Segmentation

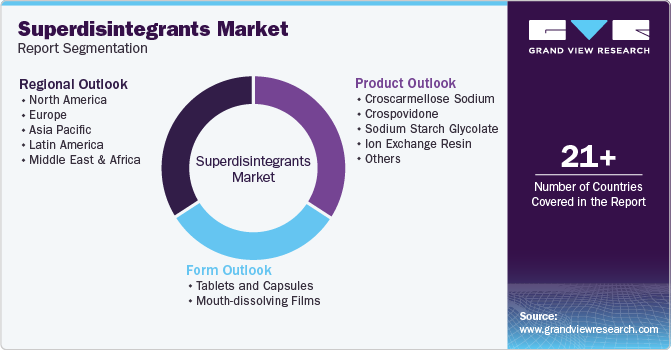

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global superdisintegrants market report based on product, form and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Croscarmellose sodium

-

Crospovidone

-

Sodium Starch Glycolate

-

Ion Exchange Resin

-

Others

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets and Capsules

-

Mouth-dissolving Films

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)