- Home

- »

- Plastics, Polymers & Resins

- »

-

Supplements And Nutrition Packaging Market Report, 2030GVR Report cover

![Supplements And Nutrition Packaging Market Size, Share & Trends Report]()

Supplements And Nutrition Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper & Paperboard, Glass, Metal), By Product (Pouches, Sachet), By Formulation, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-771-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

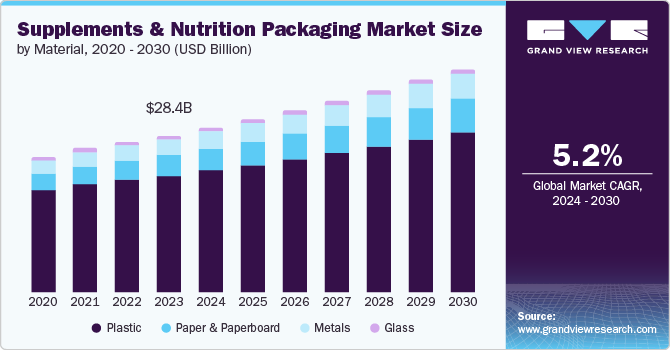

The global supplements and nutrition packaging market size was estimated at USD 28.43 billion in 2023 and is expected to expand at a CAGR of 5.2% from 2024 to 2030. The rising adoption of immunity-boosting supplements and increasing demand for sports nutrition are the major factors driving the growth of the market. Moreover, the outbreak of the pandemic has raised awareness regarding nutrition, health, wellness and benefits of nutraceutical products across the globe, which is expected to trigger the demand for supplements and nutrition, which in turn is anticipated to positively influence the market.

The supplements and nutrition packaging industry is driven by several factors that have emerged in recent years. The increasing consumer awareness about health and wellness has been a significant driving factor. Consumers are becoming more conscious about the ingredients in their supplements and nutrition products, and they are actively seeking out products with clean labels, organic, and natural ingredients. This trend has led to a rise in demand for packaging solutions that can effectively communicate these attributes to consumers.

Additionally, the rise of e-commerce and direct-to-consumer sales channels has had a profound impact on the packaging needs of the supplements and nutrition industry. Increasing consumer purchasing rate of these products online has led packaging manufacturers to ensure that their packaging can withstand the rigors of shipping and handling while still maintaining product integrity and shelf-life. This has led to the adoption of innovative packaging solutions, such as moisture-resistant barrier films, tamper-evident seals, and cushioning materials that protect the products during transit.

Moreover, the increasing popularity of personalized and customized nutrition solutions has created a demand for packaging that can accommodate smaller batch sizes and individual portion control. Companies such as Nourished and Vitaminpacks, Inc. offer personalized vitamin packs tailored to individual nutritional needs, and their packaging are designed to accommodate this level of customization. This has led to the use of innovative packaging techniques such as single-serve sachets, blister packs, and even 3D-printed packaging solutions that can be tailored to specific product formulations and portion sizes.

Leading companies in the supplements and nutrition packaging market are undertaking multiple strategic initiatives to enhance their competitive position and capitalize on market opportunities. These strategies include launching new products, engaging in mergers and acquisitions, forming joint ventures, and expanding into new geographic regions. For instance, in September 2022, Glenroy, Inc. and Nature Nate's collaborated to introduce the premade STANDCAP Pouch, a groundbreaking sustainable packaging solution. This collaboration aims to revolutionize the way customers experience their products by offering an innovative, eco-friendly, and convenient packaging option. The premade STANDCAP Pouch is lightweight, portable, and ideal for on-the-go consumers and ecommerce. Moreover, it does not require a spoon or knife for accessing the inner product hence, it prevents cross-contamination of product from utensils.

Industry Dynamics

Major supplements and nutrition packaging companies operating in market include Glenroy, Inc., Alpha Packaging, Comar, LLC, Graham Packaging Company, Gerresheimer AG, ePac Holdings, LLC, Law Print & Packaging Management Ltd., MPS (Molded Packaging Solutions), OPM Labels, Container and Packaging Supply, Inc., PRETIUM PACKAGING, Eagle Flexible Packaging, TRL Packaging, Uniflex, and Altium Packaging.

Health and wellness companies are actively collaborating and partnering with packaging companies to develop tailored packaging solutions that meet the specific requirements of the product, such as dosage forms, delivery methods, and portability. For instance, in May 2024, Hamdard, the Indian manufacturer of the health and wellness products, partnered with SIG to adopt its aseptic carton packaging and filling technology. This investment aims to meet the diverse consumer demands for affordability, variety, and quality. The advanced technology is expected to enable Hamdard to package its health and wellness products in SIG’s packaging products.

In November 2023, Kate Farms, a major company in plant-based nutrition for healthcare, announced the launch of its first whole food blended meals for pediatric applications. Kate Farms Pediatric Blended Meals will be the first whole food formulas inspired by meals at home, packaged in resealable pouches that directly connect to common tube feeding devices. Each pouch contains the equivalent of 0.4 cups or more of fruits and vegetables, along with easily digested organic pea protein, organic MCT oil, and key vitamins and minerals to support a healthy immune system. The resealable pouches with twist-off caps are made for tolerance, easy use, and travel.

Material Insights

Based on material, the market has been segmented into glass, plastics, paper & paperboard, and metals. Plastics dominated the market with the largest revenue share of over 74% in 2023. Plastic is lightweight compared to materials such as glass and metal, making plastic bottles and containers easier to transport and carry, which is desirable for supplements and nutrition, especially those consumed on-the-go.

The paper and paperboard packaging segment is anticipated to grow at the highest CAGR of 7.9% during the forecast period owing to its sustainable and eco-friendly solutions. Folding cartons made from paperboard are widely used for packaging supplements, vitamins, and other nutritional products. These cartons provide a sturdy and protective enclosure for bottles, blister packs, and sachets, ensuring product integrity and shelf appeal.

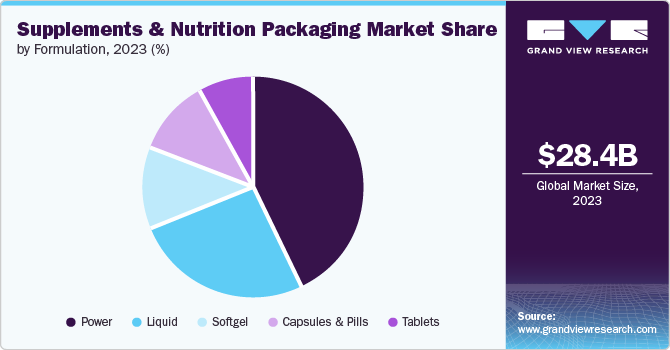

Formulation Insights

Based on the formulation, the industry is segmented into tablets, capsules & pills, powder, soft gel, and liquid. The powder segment dominated the market with the largest revenue share in 2023 and is projected to progress at the fastest CAGR of 4.3% over the forecast period. Divided powders, commonly referred to as charts, are individual packages containing a single dose of medicine in powdered form. These powders are typically divided into smaller, precise dosages compared to bulk powder and are conveniently packaged in blister packs as small units.

Soft gel and liquid packaging formats are widely used in the supplements and nutrition industry to encapsulate and deliver various types of dietary supplements, vitamins, minerals, and other functional ingredients. These packaging solutions offer several advantages and are gaining popularity due to their convenience, versatility, and enhanced bioavailability. Liquid packaging solutions are also widely used in the supplements and nutrition industry. These include bottles, sachets, and stick packs, among others.

Product Insights

Based on product, the bottle & jar segment dominated the market with the largest revenue share in 2023. Bottles and jars, especially those made of glass or certain types of plastic, provide an effective barrier against oxygen, moisture, and light, which can degrade the quality and shelf life of supplements and nutrition. This helps preserve the taste, aroma, and freshness of the supplements and nutrition for a longer period.

On the other hand, the pouches segment is expected to witness robust growth with a CAGR of 9.4% over the forecast period. Pouches designed to contain pre-measured or single-serving portions, helping consumers control their intake and adhere to recommended dosages or dietary requirements.

Regional Insights

North America supplements and nutrition packaging market is projected to expand at the fastest CAGR of 5.1% from 2024 to 2030 driven by the increasing demand for health and wellness products among consumers. The market was characterized by a surge in the demand for sustainable and eco-friendly packaging solutions. Manufacturers actively sought packaging materials derived from renewable sources, such as plant-based plastics and recycled materials, to cater to the growing consumer preference for environmentally conscious products.

U.S. Supplements And Nutrition Packaging Market Trends

The supplements and nutrition packaging market in the U.S. is a dynamic and ever-evolving industry, driven by growing demand for the dietary supplements and increasing number of health-conscious consumers in the country. The U.S. is home to several major players in the supplements and nutrition packaging market, such as Sonic, NutraPakUSA, Glenroy, Inc., Comar, LLC, ePac Holdings, LLC, PRETIUM PACKAGING, Graham Packaging Company and others. These companies invest heavily in research and development, product innovation, and sustainable practices, which drive the growth of the market.

Canada supplements And nutrition packaging market is expected to witness growth, owing to an increasing demand for health-conscious products, driven by factors such as an aging population, growing awareness of preventive healthcare, and a heightened interest in active lifestyles. This demand has fueled the growth of the supplements and nutrition market, which in turn has proven beneficial for the respective market growth. Hence, many Canadian companies have responded by developing innovative packaging designs that not only protect the integrity of the products but also enhance their shelf appeal and convenience for consumers. For instance, in May 2023, Nutralab Canada Corp commenced its second generation of powder supplements manufacturing and packaging line into operation. This new line is designed to enhance the efficiency of producing custom private label powder supplements, allowing the company to better serve the demands of the market.

Asia Pacific Supplements And Nutrition Packaging Market Trends

The supplements and nutrition packaging market of Asia Pacific dominated the global market and accounted for the largest revenue share of over 33.0% in 2023. The Asia Pacific market witnessed significant growth in 2023, driven by the region's burgeoning health and wellness industry. Rising disposable incomes and growing health consciousness among the urban population, particularly in countries like China, India, and Southeast Asian nations. Expansion of e-commerce platforms and online sales channels for supplements and nutrition products, necessitating innovative packaging solutions for safe and secure delivery. Major players in the Asia Pacific supplements and nutrition packaging market included companies like Amcor, Berry Global, Gerresheimer, and local manufacturers tailoring their offerings to meet the region's diverse preferences and regulatory requirements.

India supplements and nutrition packaging market is primarily driven by the increasing disposable income, rising health awareness, and thriving nutraceutical industry. India has a flourishing nutraceutical industry, which includes companies such as Uniray Lifesciences, Amway India Enterprises Pvt. Ltd., Dabur, Himalaya Wellness Company, and others. These companies require innovative and effective packaging solutions to cater to the increasing demand for their products, which in turn is positively influencing the supplements and nutrition packaging market in the country.

Europe Supplements And Nutrition Packaging Market Trends

The supplements and nutrition packaging market in Europeis driven by the increasing demand for convenient and sustainable packaging solutions within the health and wellness industry. As consumers became more conscious about their dietary choices and the environmental impact of packaging, manufacturers sought innovative solutions to meet these evolving needs. Key players in the market focused on developing innovative packaging formats, such as single-serve sachets, blister packs, and user-friendly containers, catering to the convenience-driven consumer demand.

The UK supplements and nutrition packaging market has a well-established and thriving supplements and nutrition industry, driven by a health-conscious population and a strong demand for dietary supplements, sports nutrition products, and functional foods. Hence, UK based packaging companies are investing in research and development to create innovative packaging products that ensure product protection, extended shelf life, and attractive presentation. For instance, Heights, a UK based wellness company, offers a subscription-based "smart supplement" service delivering omega 3 capsules packed with 18 key nutrients targeting brain and body health. The product comes in completely recyclable packaging made of sugarcane starch and recycled plastic.

Central & South America Supplements And Nutrition Packaging Market Trends

The supplements and nutrition packaging market of Central & South America is projected to expand at a moderate CAGR from 2024 to 2030 owing to a growing awareness about healthy lifestyles and preventive healthcare in the region. This has led to an increased demand for nutritional supplements and functional foods among the Central & South American countries, including Brazil and Argentina. This trend has been driven by factors such as urbanization, changing dietary habits, and the increasing prevalence of lifestyle-related diseases.

Brazil supplements and nutrition packaging market is expected to register a healthy growth rate over the forecast period. Brazil's supplements and nutrition market has attracted significant international investment from global players. Companies such as Amway Corp. and Herbalife Ltd. have established operations in Brazil, recognizing the country's potential in this sector. This investment outlook is driving the demand for packaging products, thus benefiting the supplements and nutrition packaging market in the country.

Middle East & Africa Supplements And Nutrition Packaging Market Trends

The supplements and nutrition packaging market in the Middle East & Africais influenced by increasing health consciousness and demand for dietary supplements. Many countries in the Middle East, particularly the Gulf Cooperation Council (GCC) nations, have experienced significant economic growth and rising disposable incomes. This has led to increased spending on health and wellness products, including supplements and nutritional products. Additionally, rapid urbanization has contributed to changing lifestyles and a greater emphasis on preventive healthcare measures, further fueling the demand for packaged supplements.

South Africa supplements and nutrition packaging market growth can be attributed to the growing popularity of sports nutrition and weight management supplements. This outlook has driven the demand for packaging solutions that showcase product information, such as nutritional facts and ingredient lists, prominently and in compliance with local regulations.

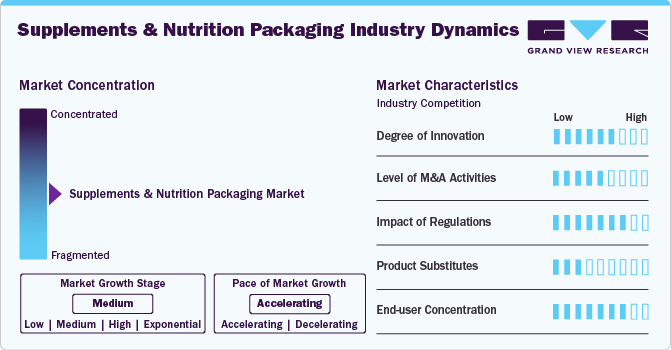

Supplements And Nutrition Packaging Company Insights

The supplements and nutrition packaging market is considered to be moderately fragmented, with the presence of both large multinational companies and numerous smaller regional and local players. Supplements and nutrition packaging market has been witnessing a significant number of new product launches, merger & acquisitions, and expansions over the past few years.

Key Supplements And Nutrition Packaging Companies:

The following are the leading companies in the supplements and nutrition packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Glenroy, Inc.

- Alpha Packaging

- Comar, LLC

- Graham Packaging Company

- Gerresheimer AG

- ePac Holdings, LLC

- Law Print & Packaging Management Ltd.

- MPS (Molded Packaging Solutions)

- OPM Labels

- Container and Packaging Supply, Inc.

- PRETIUM PACKAGING

- Eagle Flexible Packaging

- TRL Packaging

- Uniflex

- Altium Packaging

Recent Developments

-

In April 2024, Blue Ocean Closures launched a new fiber screw cap designed to help reduce plastic waste. This product was launched for Sweden-based supplement company Great Earth Scandinavia AB. This innovative product is made from biobased cellulose fibers, which are recyclable as paper and biodegradable in soil and the ocean. The screw caps are durable, strong, and water-resistant, making them suitable for various applications.

-

In November 2023, ProAmpac introduced ProActive PCR Retort pouches, a sustainable alternative to traditional retort packaging for shelf-stable, ready-to-eat protein products. These innovative pouches incorporate 30% or more post-consumer recycled (PCR) content by weight, thereby reducing the reliance on virgin plastics while maintaining the high-performance characteristics of standard retort pouches.

Supplements And Nutrition Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.83 billion

Revenue forecast in 2030

USD 40.54 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, formulation, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Glenroy, Inc.; Alpha Packaging; Comar, LLC; Graham Packaging Company; Gerresheimer AG; ePac Holdings, LLC; Law Print & Packaging Management Ltd.; MPS (Molded Packaging Solutions); OPM Labels; Container and Packaging Supply, Inc.; PRETIUM PACKAGING; Eagle Flexible Packaging; TRL Packaging; Uniflex; Altium Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Supplements And Nutrition Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global supplements and nutrition packaging market report based on material, product, formulation, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Plastic

-

PET

-

HDPE

-

PP

-

Others

-

-

Paper & Paperboard

-

Glass

-

Metals

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Bottles & Jars

-

Tins & Cans

-

Pouches

-

Sachets

-

Blisters

-

Other Products

-

-

Formulation Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules & Pills

-

Powder

-

Soft Gel

-

Liquid

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global supplements and nutrition packaging market was estimated at USD 28.43 billion in 2023 and is expected to reach USD 29.83 billion in 2024.

b. The global supplements and nutrition packaging market is expected to witness a moderate CAGR of 5.2% in terms of revenue. Owing to the rising demand for immunity-boosting supplements and increasing accessibility due to the emergence of e-commerce.

b. The factors attributed to driving the market are the growing adoption of immunity-boosting supplements, rising demand for sports nutrition, and increasing consumer awareness regarding nutrition, health, and wellness.

b. The bottles and jars commanded the largest revenue share of 69.23% in 2023. They protect the formulation from environmental influences and help smooth the distribution and evacuation of the product.

b. Glenroy, Inc.; Alpha Packaging; Comar, LLC; Graham Packaging Company; Gerresheimer AG; ePac Holdings, LLC; Law Print & Packaging Management Ltd.; MPS (Molded Packaging Solutions); OPM Labels; Container and Packaging Supply, Inc.; PRETIUM PACKAGING; Eagle Flexible Packaging; TRL Packaging; Uniflex; Altium Packaging

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.