- Home

- »

- Medical Devices

- »

-

Surgical Robotic Services Market Size, Industry Report, 2033GVR Report cover

![Surgical Robotic Services Market Size, Share & Trends Report]()

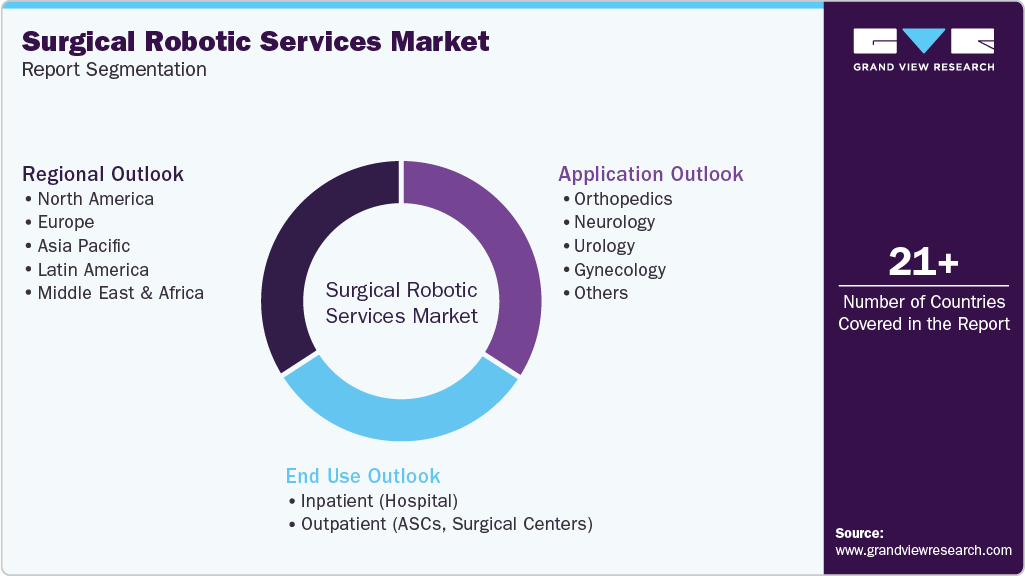

Surgical Robotic Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Orthopedics, Neurology, Urology), By End Use (Inpatient (Hospital), Outpatient (ASCs, Surgical Centers)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-158-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Robotic Services Market Summary

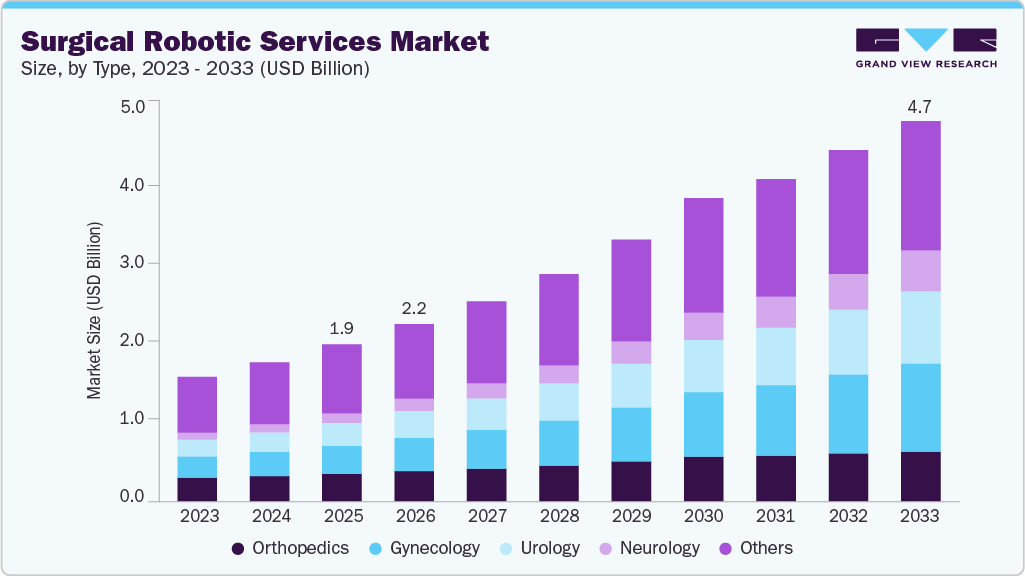

The global surgical robotic services market size was estimated at USD 1.93 billion in 2025 and is projected to reach USD 4.67 billion by 2033, growing at a CAGR of 11.5% from 2026 to 2033. Increasing adoption of robotic technology in surgical procedures, rising need for specialized surgical skills, growing demand for remote monitoring and telesurgery services, and increasing demand for cost-effective service models are some of the major factors driving the growth of the market.

Key Market Trends & Insights

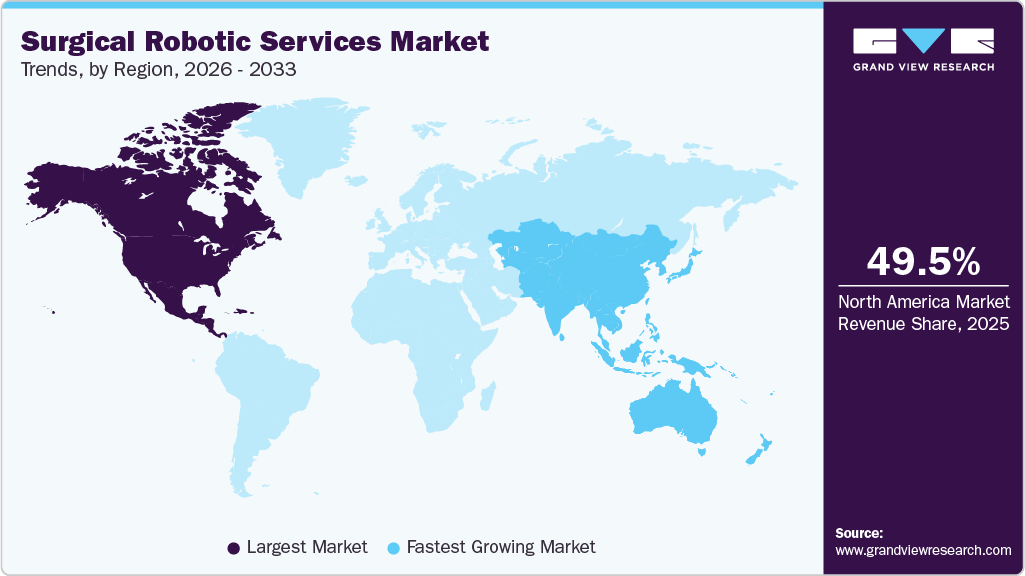

- North America surgical robotic services market dominated global market in 2025 and accounted for the largest revenue share of 49.51%.

- Surgical robotic services market in Canada is anticipated to register the fastest growth rate during the forecast period.

- By application, the gynecology segment held the largest revenue share in 2025.

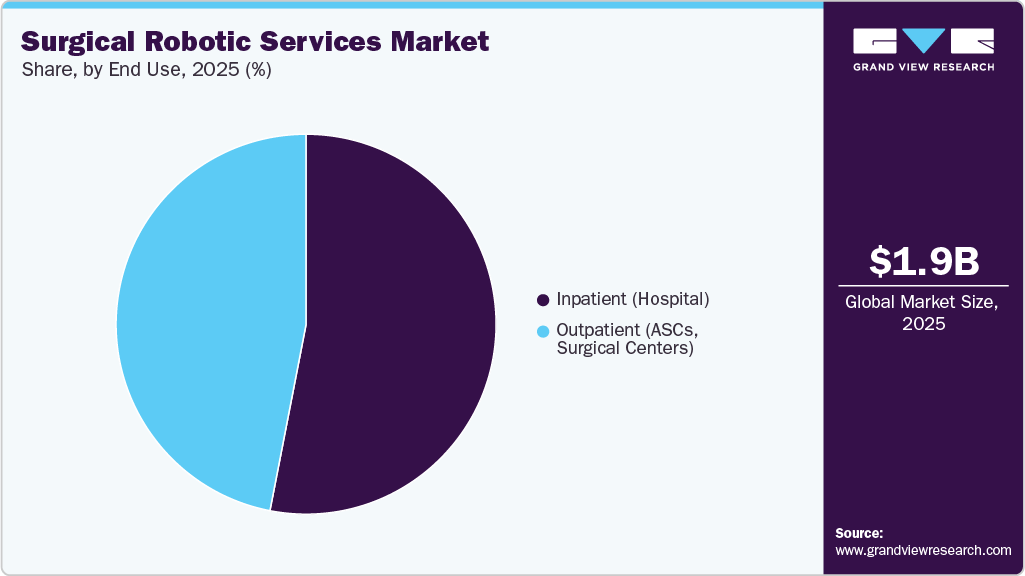

- By end use, the inpatient segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.93 Billion

- 2033 Projected Market Size: USD 4.67 Billion

- CAGR (2026-2033): 11.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

A shorter learning curve and training needs, increasing investment & funding from the government across the globe are further propelling the market growth.In September 2025, Quantum Surgical’s Epione robot received CE Mark approval in Europe for treating bone tumors, metastases, and bone consolidation. The platform enables precise percutaneous procedures for difficult-to-reach tumors, enhancing patient care in hospitals across Europe and the U.S.

“The clinical study conducted at Gustave Roussy has demonstrated the relevance of Epione in the practice of bone percutaneous procedures.We will keep integrating robotics in these procedures which allow for better patient care.” -Gustave Roussy in Villejuif

Growing need for specialized surgical skills, rising adoption of robotic technology in surgical procedures, increasing demand for remote monitoring and telesurgery services, and growing demand for cost-effective service models are major factors driving the market's growth. In August 2025, WHO and the Society of Robotic Surgery announced a program to improve access to telesurgery and virtual care in underserved areas, emphasizing remote surgical support, scalable technologies, and enhanced healthcare capacity in low- and middle-income countries.

Continuous technological advancements and innovations in surgical robots drive the evolution of surgical robot services, catering to the needs of training programs for surgeons and maintenance services for surgical robots. Increasing adoption of robotic-assisted surgeries across different medical specialties, and ongoing technological advancements in surgical robots are some of the key factors driving market growth. In August 2025, Singapore’s NHG Health partnered with Cornerstone Robotics and NTU’s LKCMedicine to advance robot-assisted surgery. The collaboration focuses on telesurgery training, surgical education, and cost-effectiveness studies to expand access.

As per the report published by the Royal College of Surgeons Edinburgh on the Development of New Robotic Surgical Services, every member of the robotic surgical team should undergo a comprehensive training program to gain a complete understanding of the essential operations of the specific robotic systems. This training involves a series of self-guided online modules provided by the robotic system vendor and other relevant organizations in robotic surgical training, such as the Robotic Training Network. In October 2025, the UK opened its largest robotic-assisted surgery training centre in Winnersh, near Reading, providing global surgeons with hands-on training on the da Vinci system. The facility supports NHS plans to expand robotic assistance in keyhole surgeries and enhances proficiency in complex procedures such as oesophageal and gastric cancer operations.

"It is referred to as robotic-assisted surgery but it is very much controlled by an experienced, qualified surgeon who manipulates the instruments using a different part of the machine to allow us to do the surgery" -Consultant Upper Gastrointestinal surgeon in Portsmouth.

In addition, surgeons are required to complete all fundamental modules, focusing on psychomotor skills crucial for robotic-assisted surgery. For the remaining members of the surgical team, their training modules should encompass a basic understanding of the robotic system, as well as content related to robotic team training and effective communication skills. The goal of this training phase is to ensure that robotic surgical teams are proficient in the fundamental operations of the robotic system while surgeons possess the theoretical knowledge essential for successful robotic-assisted surgeries. In September 2025, AIIMS New Delhi inaugurated the da Vinci robotic system, becoming the first government medical college in India to provide robotic surgery training. The centre offers practical training across specialties such as urology, gynaecology, general surgery, surgical oncology, and head and neck surgery.

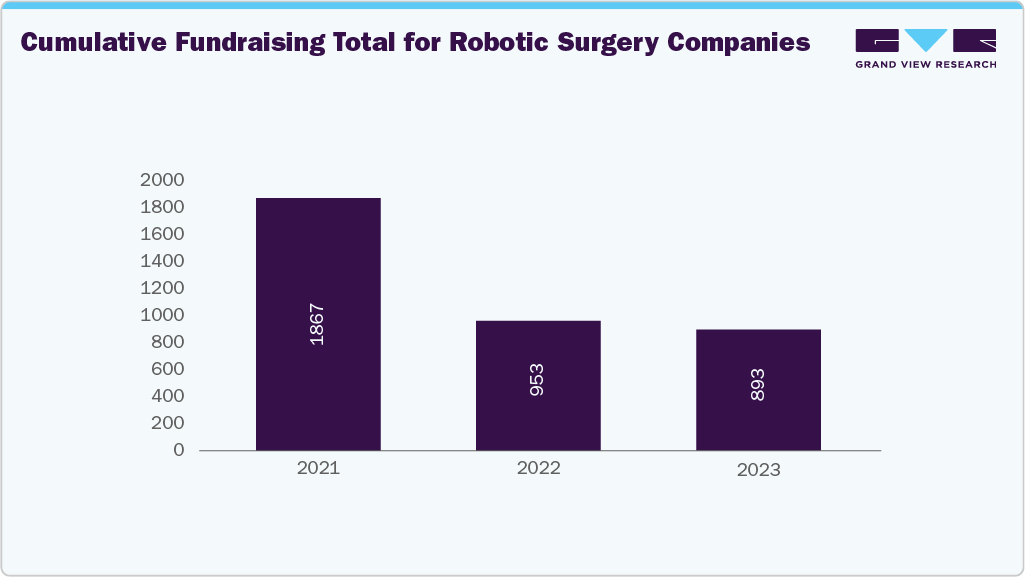

Funding Flow of Robotic Surgery Companies

-

Major Funding Rounds: CMR Surgical (Versius system): Raised USD 600 million (2021, UK’s largest MedTech round) to expand commercial rollouts across Europe, India, and the Middle East.

-

Strategic Partnerships: Hospitals & IDNs (Integrated Delivery Networks) are co-investing in robotic platforms, especially where procedure economics align with shorter hospital stays and reduced complications.

-

Government & Public Market Support: Public listings (e.g., Vicarious Surgical IPO 2021, Asensus Surgical) demonstrate strong public market appetite, although valuations fluctuate based on adoption pace.

Cumulative fundraising total for robotic surgery companies

Growing demand for enhanced operational support is also reshaping the landscape of surgical robot services, as hospitals increasingly prioritize reliability, standardization, and system uptime. Continuous expansion of robotic programs has led to higher dependence on vendor-led service frameworks that include routine maintenance, predictive diagnostics, and instrument lifecycle management. To support increasing surgical volumes, manufacturers are strengthening their service offerings through real-time system monitoring, AI-driven maintenance alerts, and rapid-response technical assistance. These service models reduce downtime and help hospitals optimize resource planning and ensure uninterrupted access to robotic-assisted procedures.

Moreover, the integration of advanced digital tools into surgical workflows is elevating the value proposition of robotic service platforms. Hospitals are adopting data-driven services such as cloud-based case analysis, surgeon performance dashboards, and OR workflow insights to drive quality improvement initiatives. These software-enabled services are becoming essential components of robotic programs, supporting consistent surgical outcomes and enhancing cost-efficiency. As surgical robots continue to evolve with improved imaging, automation, and AI-assisted guidance, the service ecosystem is expanding to include continuous software updates, remote system enhancements, and digital decision-support capabilities.

Expanding adoption of robotic-assisted surgery in emerging markets is further driving demand for region-specific service infrastructure. To support new installations across Asia, the Middle East, and Latin America, vendors are investing in local training centers, certified technical teams, and country-level support hubs. These initiatives align with government-led digital health strategies and capacity-building programs, enabling healthcare institutions to scale their robotic surgery capabilities with appropriate training and operational readiness. As procedure volumes increase across specialties, the availability of robust service networks plays a critical role in ensuring consistent system performance and sustaining long-term adoption of robotic technologies.

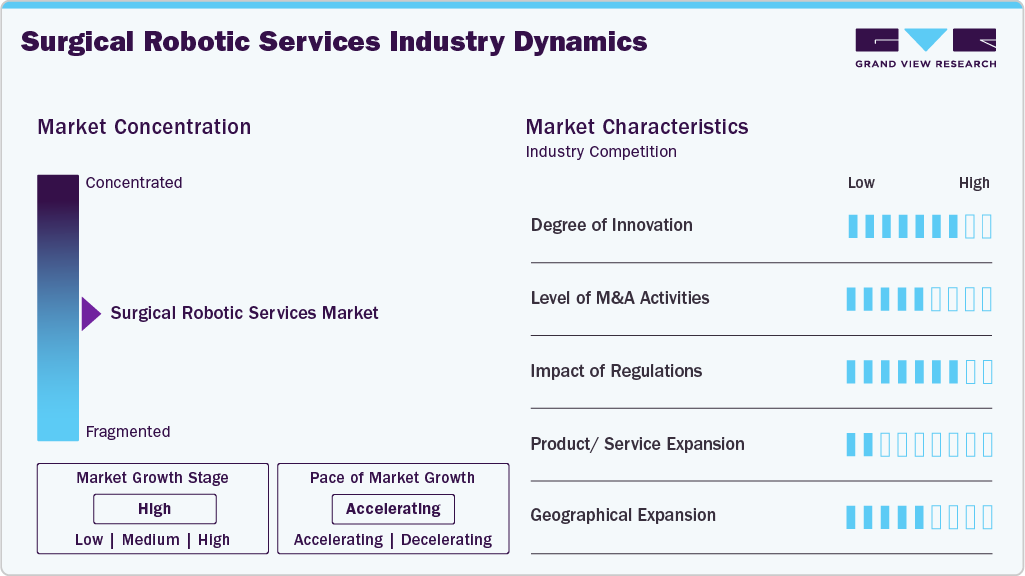

Market Concentration & Characteristics

The surgical robotic services market has witnessed high degrees of innovation over the years due to technological advancements in surgical techniques. Furthermore, novel and innovative products require skilled trainers for their operation and maintenance services. In June 2025, a successful remote surgery was performed using Medicaroid’s hinotori robotic system between Strasbourg, France, and Kobe, Japan. The procedure, conducted over approximately 23,000 kilometers, demonstrated the potential for international telesurgery and expanded global access to expert surgical care.

The surgical robotic services market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. In October 2025, Zimmer Biomet acquired Monogram Technologies, adding semi- and fully autonomous orthopedic robotics to its portfolio and enhancing surgical solutions for knee arthroplasty and other procedures worldwide. These mergers and acquisitions facilitate access to complementary technologies, expertise, and distribution channels, enabling companies to accelerate product development, improve operational efficiency, and capture a larger market share. For instance, in April 2022, a new Robotic Surgical Program was launched in Saskatchewan, Canada. The cost of acquiring the robotic system is USD 2.5 million.

Surgical robots are often referred to as robotic-assisted surgery devices. To receive approval for these devices, manufacturers need to demonstrate that the benefits of this technology outweigh the risks. Moreover, the FDA reviews each surgical robot individually and recommends proper training for surgeons operating surgical robots. It also warns that surgical robots must be operated differently than other medical devices and require unique training. Furthermore, it issues warning letters to companies if the device is suspected to be faulty. These regulations are essential for safeguarding patient health and promoting innovation.

Product substitutes in surgical robotic services present a low level of substitutability. Key alternatives include manual surgery, non-robotic laparoscopic procedures, and independent third-party service vendors, primarily used to lower service costs and avoid OEM contract commitments. These substitutes provide reduced uptime assurance, limited system integration, and lower technical capability compared to OEM service models. Independent vendors operate with basic maintenance offerings and price-led service structures, lacking predictive maintenance, lifecycle performance management, and standardized clinical training support.

Several market players are adopting this strategy to expand their business by entering new geographical regions to strengthen their market position. For instance, in June 2023, Newcastle Hospitals collaborated with Intuitive to introduce the UK's first training program in robotic surgery to train the next generation of robotic surgeons. This initiative enables surgical trainees from the North East of England to gain training in robotic surgery at the Newcastle Surgical Training Centre.

Application Insights

Gynecology segment dominated the global market in 2025 with a revenue share of 17.85%. This segment includes general surgery, which involves a wide range of procedures. Surgical robots are increasingly used to assist in surgeries related to the liver, gastrointestinal tract, pancreas, and other abdominal areas. The precision offered by surgical robots makes them highly effective in performing complex general surgical procedures. These robots require maintenance services after every periodic time to perform precisely and accurately. In April 2025, a trial at the PLA General Hospital treated 15 gynecological cases with China’s Cornerstone C1000 robotic system, achieving successful surgeries, minimal blood loss, and high satisfaction, while noting room for improvement.

Neurology segment is anticipated to register the fastest growth over the forecast period. This significant growth is attributable to rapid technological advancements in neurology practice. Neurology is one of the most complex surgical specialties and is recording the highest demand for minimally invasive surgical approaches. In addition, introducing advanced surgical robots such as the ROSA One Brain robotic platform, which requires intensive hands-on training and the highest-quality maintenance services, is expected to boost segment growth. In October 2025, MMI completed the first robotic brain surgeries using the Symani System on three adults with Moyamoya Disease, marking a milestone in robotic neurosurgery. The procedures demonstrated the system’s precision in delicate neurovascular maneuvers, potentially transforming treatment for complex brain conditions.

End Use Insights

The inpatient facilities dominated the end use segment, with the largest revenue share of 53.05% in 2025. Inpatient facilities, such as hospitals, usually have superior infrastructure and abundant resources, enabling seamless integration and effective utilization of surgical robots. These medical facilities often hire specialized surgical teams extensively trained in operating robotic systems, establishing them as a preferred choice for performing surgeries using robotic assistance. In November 2025, Royal Surrey NHS Foundation Trust marked a milestone by performing its 10,000th robotic-assisted surgery, spanning specialties such as urology, ENT, and colorectal procedures. The hospital, which began with just three robotic surgeries in its first year, now operates four surgical robots and has become one of the UK’s busiest centers for minimally invasive cancer surgery.

The outpatient facilities segment is expected to record the fastest growth rate over the forecast period. Outpatient facilities are progressively adopting surgical robots due to advancements in minimally invasive procedures, aligning with the trend of less invasive surgeries performed outside traditional hospital settings. Technological advancements are making surgical robots more compact, portable, and versatile, making them suitable for outpatient settings. In March 2025, Northtowns Ambulatory Surgery Center in the U.S. acquired Distalmotion’s DEXTER Robotic Surgery System, marking a milestone in expanding outpatient robotic surgery. The system’s compact, mobile design allows seamless integration into existing workflows, enhancing surgical precision and patient access to minimally invasive procedures.

Regional Insights

North America dominated the market with the largest revenue share of 49.51% in 2025. The region has a strong healthcare infrastructure with well-established hospitals and surgical centers that are early adopters of surgical robotic services. North America is home to major players and innovators in surgical robotics, leading to a high level of research, development, and adoption within the region. There is significant support from both government and private sector investments in healthcare technologies, encouraging the adoption of surgical robots. In December 2025, Guyana is expected to perform its first robotic-assisted surgery with U.S.-based surgeons operating remotely, marking a major step in digital health and medical innovation. The initiative aligns with broader efforts to modernize healthcare, expand telemedicine, and prepare youth for careers in AI, robotics, and connected technologies.

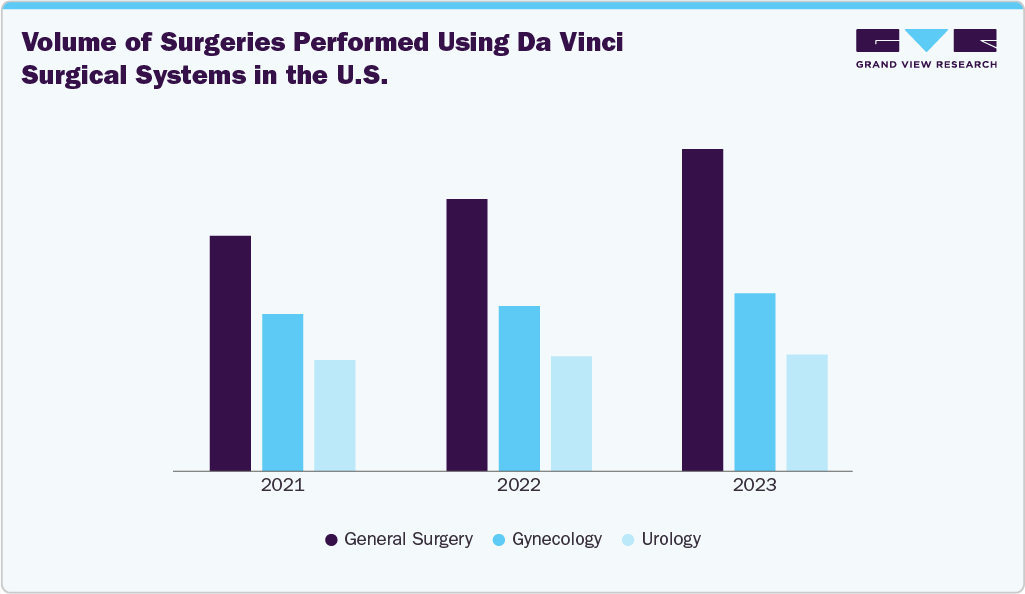

U.S. Surgical Robotic Services Market Trends

The surgical robotic services market in the U.S. held the largest share in 2025. Major factors driving the market include growing adoption of minimally invasive procedures in the country due to the high standard of living and need for shorter recovery periods. Presence of a well-developed healthcare infrastructure in the country, ongoing advancements in robotics, and presence of key market players are anticipated to drive the market over the forecast period. In December 2025, SS Innovations International reported rising demand for its SSi Mantra 3 surgical robot, driven by its design features and affordability. Revenue, installations, and procedures are increasing as the system gains traction in the U.S. market.

Canada surgical robotic services market is anticipated to register the fastest growth rate during the forecast period. Canada invests more in healthcare infrastructure than any other sector. Various factors contributing to market growth in the country include the presence of key market players and the increasing usage of surgical robots. In November 2025, Kingston Health Sciences Centre expanded its surgical robotics program by adding a second Da Vinci XI system, doubling its capacity for robotic-assisted procedures and increasing access for patients across the region. This investment strengthens KHSC’s leadership position in robotic surgery and supports growth into additional clinical specialties.

Europe Surgical Robotic Services Market Trends

Europe surgical robotic services market is anticipated to register the fastest growth rate during the forecast period. Factors such as the rising adoption of robotic surgeries, joining training programs, and rapid advancements in robotic-assisted surgeries, which result in minimal scarring, lower health risks, and faster patient recovery, boosted the market growth in Europe. In May 2025, MedTech Europe highlighted robotic-assisted surgery (RAS) as a key innovation for European healthcare, emphasizing its potential to improve surgical precision and patient outcomes. The organization called for coordinated policy actions to raise awareness, establish reimbursement frameworks, and support wider adoption of RAS across healthcare facilities in Europe.

UK surgical robotic services market is anticipated to register a considerable growth rate during the forecast period. Increasing adoption of surgical robots in the country due to rising awareness regarding the benefits of robotic-assisted surgery, technological advancements, the introduction of training programs for robotic-assisted surgeries, and growing funding for medical robot research are among the factors contributing to market growth. In April 2025, NICE approved 11 robotic surgery systems for NHS use, 5 for soft tissue and 6 for orthopaedic procedures. They offer greater precision, faster recovery, and fewer complications. Cost effectiveness will be reviewed over three years before wider adoption.

“These innovative technologies have the potential to transform both soft tissue and orthopaedic surgical care in the NHS. The data gathered over the next three years will allow us to evaluate exactly how these technologies can improve patient care and help ensure NHS resources are directed toward interventions that deliver meaningful clinical benefits and long-term value to our health service.”

-programme director of NICE’s HealthTech programme

Germany surgical robotic services market is anticipated to register a lucrative growth rate during the forecast period. The presence of high-quality healthcare infrastructure and favorable reimbursement policies are key factors expected to drive this market. In September 2025, Saarland University’s Homburg Medical Campus unveiled a pin-free robotic system for joint replacement surgery, eliminating the need for bone pins and external infrared cameras. The robot uses built-in sensors to create a 3D model of the surgical field, enhancing precision and safety in orthopaedic procedures.

Asia Pacific Surgical Robotic Services Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period. The lower number of physicians in key Asian countries such as China, India, and Japan encounter challenges in efficiently managing hospital patients due to a shortage of skilled healthcare staff. This creates a need for automated and efficient surgical robots. In April 2025, a Hyderabad based hospital launched robotic surgery services across surgical gastroenterology, urology, and oncology departments, expanding its capabilities with the latest da Vinci robotic system.

Japan surgical robotic services market is anticipated to register the fastest growth rate during the forecast period. Advanced healthcare systems, with a strong focus on innovation and technological advancements, are boosting market growth. Furthermore, the growth can be attributed to significant developments in surgical robotics that aim to introduce robots and related services at a lower cost in the country. In October 2025, an article published in the International Journal of Clinical Oncology reported five years of validation of Japan’s hinotori surgical robot, highlighting ~100 ms latency over 5G and stable stereoscopic video transmission during over 30 remote sessions.

Surgical robotic services market in China is anticipated to register considerable growth during the forecast period. Key factors contributing to market growth include increasing partnerships and the launch of new training programs in the Chinese market. In November 2025, a paper in Nature highlighted a breakthrough by Chinese scientists at Zhejiang University, enabling robotic arms to perform surgical suturing and knot-tying with precision rivaling experienced surgeons. The study demonstrated that even simple knots could guide force control, improving safety and accuracy in critical surgical steps.

Latin America Surgical Robotic Services Market Trends

Latin America is witnessing steady growth in the surgical robotic services market due to increasing awareness regarding the availability and benefits of robotically assisted surgeries. In December 2025, Brazil’s ANS approved mandatory coverage of robot-assisted radical prostatectomy for prostate cancer from April 2026, aiming to reduce bleeding, shorten hospital stays, and modernize healthcare access nationwide.

Brazil surgical robotic services market is anticipated to register considerable growth during the forecast period. The country has made substantial progress in the use of technology in recent years. Increasing preference and growing availability of minimally invasive surgical procedures have led to an overall increase in the number of surgical procedures performed in hospitals and other healthcare facilities. In July 2025, Johns Hopkins University made history with the first fully autonomous AI-guided surgery on human tissue, while 31.3 million jobs in Brazil face AI-driven transformation. The milestone demonstrates AI’s potential to amplify human capability, reshape industries, and underscores the urgent need for strategic adoption and balanced regulation.

MEA Surgical Robotic Services Market Trends

The Middle East and Africa region is experiencing notable growth in the surgical robotic services market. Associated benefits and ongoing research activities about the development of innovative technologies are anticipated to boost the usage rate of surgical robotic systems, which is likely to increase the adoption of training services for robotic surgeries.In May 2025, Saudi Arabia’s Health Minister Fahad bin Abdulrahman AlJalajel inaugurated a robotic surgical system and reviewed the first advanced PET-CT scanner at King Abdullah Medical City, enhancing minimally invasive surgery and diagnostic capabilities.

Saudi Arabia surgical robotic services market is anticipated to register a fastest growth rate during the forecast period. Rapid technological advancements, increasing prevalence of chronic diseases, congestion in operating rooms, increasing number of treatments & surgeries being performed, and introduction of training programs for surgeons are among the factors contributing to the growth of the surgical robotic services market in the countryIn October 2025, King Faisal Specialist Hospital and Research Centre (KFSHRC) in Riyadh achieved a global first by performing robotic intracranial tumor surgery, removing a 4.5 cm brain tumor with the patient fully conscious and discharged within 24 hours, setting a new standard in neurosurgical precision and recovery.

Key Surgical Robotic Services Company Insights

Key participants in the surgical robotic services market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Surgical Robotic Services Companies:

The following are the leading companies in the surgical robotics services market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Medtronics

- Smith & Nephew

- Asensus Surgical US, Inc. (TransEnterix)

- Renishaw plc.

- Intuitive Surgical Operations, Inc.

- Medtronic

- THINK Surgical, Inc.

- Zimmer Biomet.

Recent Developments

-

In December 2025, Medtronic received FDA clearance for its Hugo robotic-assisted surgery (RAS) system for urologic procedures in the U.S. The system features a modular design, integrates with the Touch Surgery digital ecosystem, and supports minimally invasive surgeries such as prostatectomy, nephrectomy, and cystectomy, aiming to expand access and efficiency in robotic-assisted surgery.

"As we begin our purposeful launch of the Hugo RAS system in the U.S., our focus is on building a strong foundation with leading hospitals through our differentiated approach to partnership, rooted in our enduring commitment to provide an excellent customer experience and enable surgical teams to deliver the best possible outcomes for their patients." -Vice president and general manager of Robotic Surgical Technologies within the Surgical business of Medtronic

-

In May 2025, Washington Health announced advances in robotic-assisted surgery with the da Vinci Xi Surgical System, introduced in June 2024. Benefits include smaller incisions, faster recovery, reduced blood loss, and improved access to deep or tight anatomical areas across multiple surgical specialties.

-

In July 2025, an AI-powered robot autonomously performed gall bladder surgery on a dead pig, completing 17 tasks with full success. It self-corrected six times and required minimal human help. Next steps include testing on live animals, with clinical regulation still a key challenge.

-

In December 2025, SS Innovations submitted a 510(k) premarket notification to the FDA for its SSi Mantra surgical robot, intended for use in several surgical specialties. The system is already deployed in 138 units across eight countries, completing over 7,300 procedures, and the company is seeking EU CE certification.

-

In December 2025, Horizon, Intuitive, and Medtronic highlighted advances in surgical robotics integrating AI and imaging, improving precision, workflow, and patient outcomes across ophthalmology, bronchoscopy, and hernia repair procedures.

-

In September 2025, AIIMS Raipur inaugurated Central India’s first government robotic surgery facility, Devhast, featuring a dual-console da Vinci Xi system to provide precise, minimally invasive procedures and serve as a hub for surgical training and research.

-

In November 2023, the European Endometriosis League (EEL) introduced the European Robotic Endometriosis Surgery Masterclass, a new educational project to train healthcare professionals in robotic surgery for gynecology and endometriosis with advanced skills.

Surgical Robotic Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.18 billion

Revenue forecast in 2033

USD 4.67 billion

Growth rate

CAGR of 11.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Medrobotics; Smith & Nephew; Asensus Surgical US, Inc. (TransEnterix); Renishaw plc.; Intuitive Surgical Operations Inc.; Medtronic; THINK Surgical, Inc.; Zimmer Biomet.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Robotic Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the surgical robotic services market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics

-

Neurology

-

Urology

-

Gynecology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Inpatient (Hospital)

-

Outpatient (ASCs, Surgical Centers)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia-Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical robot services market size was estimated at USD 1.93 billion in 2025 and is expected to reach USD 2.18 billion in 2026.

b. The global surgical robot services market is expected to grow at a compound annual growth rate of 11.5% from 2026 to 2033 to reach USD 4.67 billion by 2033.

b. North America dominated the surgical robot services market with a share of 49.51% in 2025, owing to the presence of strong healthcare infrastructure with well-established hospitals and surgical centers that are early adopters of advanced medical technologies

b. Some key players operating in the surgical robot services market include Stryker; Medrobotics; Smith & Nephew; Asensus Surgical US, Inc. (TransEnterix); Renishaw plc.; Intuitive Surgical Operations Inc.; Medtronic; THINK Surgical, Inc.; Zimmer Biomet.

b. Increasing adoption of robotic technology in surgical procedures, rising need for specialized surgical skills, growing demand for remote monitoring and telesurgery services, and increasing demand for cost-effective service models are some of the major Factors driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.