- Home

- »

- Clothing, Footwear & Accessories

- »

-

Swimming Sports Apparel And Accessories Market Report 2030GVR Report cover

![Swimming Sports Apparel & Accessories Market Size, Share & Trends Report]()

Swimming Sports Apparel & Accessories Market Size, Share & Trends Analysis Report By Category (Apparel, Equipment), By Distribution Channel (Online, Sporting Goods Retailers, Supermarkets & Hypermarkets), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The global swimming sports apparel and accessories market size was estimated at USD 16.68 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. The growing global health consciousness, with more individuals recognizing the benefits of swimming as a fitness activity, driving demand for specialized apparel and accessories. The expansion of swimming clubs, competitive leagues, and recreational swimming facilities further boosts market growth, as these venues create a steady demand for high-performance swimwear and related gear. Technological advancements in swimwear materials and design also play a crucial role, offering swimmers enhanced comfort, durability, and performance benefits.

In addition, the growing popularity of national and international sports events is further contributing to the growth of the swimming sports apparel & accessories market. Participation of women in sports has witnessed a tremendous increase in the global over the past few years. According to 2022 data released by the Olympic committee, the U.S. Olympic team of 223 athletes for the Beijing Games includes 108 women, the most for any country in the history of the Winter Olympics.

Increasing disposable incomes in many regions are enabling consumers to invest more in premium swimwear brands and accessories, which in turn is fueling market expansion. Social trends promoting active lifestyles and wellness contribute to the growing popularity of swimming, driving sustained demand for specialized apparel that caters to various skill levels and swimming environments.

Innovations in fabric technology and design are revolutionizing swimwear. High-performance materials that offer enhanced flexibility, reduced drag, UV protection, and quick-drying capabilities are becoming increasingly popular. Features such as chlorine resistance and compression fit for muscle support are gaining traction among both competitive and recreational swimmers.

Sustainability is also becoming a significant focus within the market. Brands are increasingly using recycled materials, such as reclaimed ocean plastics, and adopting eco-friendly manufacturing processes. This trend is driven by consumer demand for environmentally responsible products and a broader industry commitment to sustainability.

Consumers are seeking more personalized products, leading to a rise in customizable swimwear and accessories. Options to select specific styles, colors, and fits, as well as the ability to add personal touches like monograms or unique designs, are becoming more prevalent.

Additionally, swimwear is increasingly being seen as a fashion statement beyond the pool or beach. This trend is evident in the rise of athleisure and multifunctional designs that can transition from swim activities to casual wear. Fashion-forward designs, vibrant patterns, and bold colors are becoming more common, appealing to a broader audience.

Category Insights

The swimming sports apparel market accounted for a revenue share of 91.2% in 2023. Swimming sports apparel is designed to enhance performance by reducing drag, improving hydrodynamics, and offering support. High-performance swimsuits, for instance, are constructed from advanced materials that provide compression, increase buoyancy, and ensure quick drying. These functional benefits are crucial for both competitive swimmers and recreational users, making swimming apparel an indispensable part of the sport.

The swimming sports equipment market is expected to grow at a CAGR of 6.8% from 2024 to 2030. Swimming equipment plays a crucial role in training and performance improvement. Products like resistance bands, paddles, and drag suits are designed to enhance strength, technique, and endurance. These training aids are indispensable for swimmers aiming to improve their skills and achieve competitive success, driving consistent demand in the market.

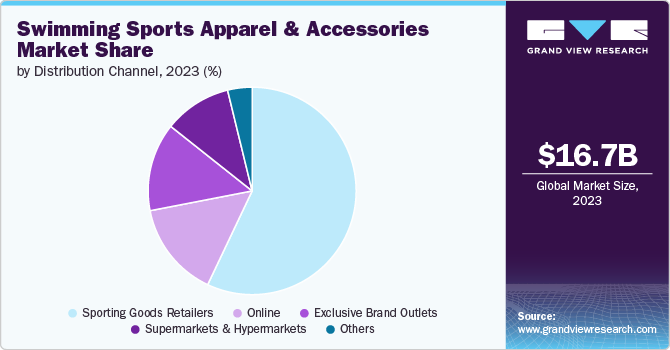

Distribution Channel Insights

Sales through sporting goods retailers accounted for a revenue share of 57.0 % in 2023. Sporting goods retailers typically offer a broad and diverse range of swimming sports apparel and equipment. This includes everything from swimwear, goggles, and caps to training aids and safety gear. The ability to find all necessary items in one place appeals to consumers, making these retailers a preferred shopping destination.

Sales of swimming sports apparel & accessories through online retail stores are expected to grow with a CAGR of 7.5% from 2024 to 2030. Online platforms typically offer a broader selection of products than brick-and-mortar stores. Consumers can find various brands, styles, sizes, and price points all in one place. This extensive range of options allows consumers to compare and choose products that best meet their specific needs and preferences.

Regional Insights

North America swimming sports apparel & accessories market accounted for a revenue share of 12.5% in 2023. North America, particularly the United States and Canada, has a high participation rate in swimming, both at recreational and competitive levels. Swimming is a popular sport in schools, community programs, and among individuals of all ages, which drives substantial demand for swimwear and related equipment. The region boasts extensive and well-developed infrastructure for swimming, including numerous public pools, private swimming clubs, aquatic centers, and competitive swimming leagues. This infrastructure supports a strong and sustained demand for swimming apparel and equipment.

U.S. Swimming Sports Apparel & Accessories Market Trends

The swimming sports apparel & accessories market in the U.S. is expected to grow at a CAGR of 5.8% from 2024 to 2030. Competitive swimming is a well-established and highly regarded sport in the U.S., with a robust culture of training and competition at various levels, from youth leagues to collegiate and professional circuits. This competitive environment drives the demand for high-performance swimwear and equipment.

The rise of e-commerce has made it easier for consumers in the U.S. to access a wide range of swimming products. Online retail platforms offer convenience, extensive product selection, and competitive pricing, which contribute to the market's growth.

Europe Swimming Sports Apparel & Accessories Market Trends

Europe swimming sports apparel & accessories market is expected to grow at a CAGR of 5.6% from 2024 to 2030. Europe has a strong culture of swimming, with high participation rates in both recreational and competitive swimming. Countries like Germany, France, and the U.K. have extensive swimming clubs and programs that promote the sport from a young age. This widespread participation drives demand for high-quality swimming apparel and equipment.

Europe has a well-established market infrastructure with numerous specialized sports retailers and brands that cater specifically to swimming. The presence of renowned brands and a robust distribution network ensures easy availability of advanced swimming gear and apparel, meeting the diverse needs of consumers.

Asia Pacific Swimming Sports Apparel & Accessories Market Trends

Asia Pacific swimming sports apparel & accessories market is expected to grow with a CAGR of 6.1% from 2024 to 2030. The region boasts a significant population with a growing interest in sports and fitness activities, including swimming. Countries like China, Japan, Australia, and South Korea have large populations actively participating in swimming, driving demand for related apparel and equipment. Hosting of major international sporting events, such as the Olympics and Asian Games, in the Asia Pacific region has further spurred interest and investment in swimming sports. This exposure raises the profile of swimming and increases demand for related products.

Key Swimming Sports Apparel And Accessories Company Insights

The global swimming sports apparel & accessories market is characterized by the presence of numerous well-established players such as Speedo International Ltd., TYR Sport Inc, Arena Italia S.p.A., Adidas AG, Nike, Inc., Mizuno Corporation, Zoggs International Ltd., Decathlon S.A, Aqua Sphere, and others. In the swimming sports apparel and accessories industry, top manufacturers face intense competition among themselves, leveraging diverse product categories. These companies maintain robust distribution networks, facilitating effective reach across regional and global markets to serve a wide customer demographic.

Key Swimming Sports Apparel And Accessories Companies:

The following are the leading companies in the swimming sports apparel and accessories market. These companies collectively hold the largest market share and dictate industry trends.

- Speedo International Ltd.

- TYR Sport Inc

- Arena Italia S.p.A.

- Adidas AG

- Nike, Inc.

- Mizuno Corporation

- Zoggs International Ltd.

- Decathlon S.A

- Aqua Sphere

- Finis Inc.

Recent Developments

-

In June 2024, In June 2024, Speedo introduced its latest U.S. Federation Suit in preparation for the Paris Olympics. The suits, named LZR Intent 2.0 and LZR Valor 2.0, which American swimmers will sport during the Games, were crafted by Speedo's Aqualab research and development center. They feature Lamoral Space Tech, a coating technology initially designed for satellite protection, highlighting Speedo's advanced engineering in swimwear innovation.

-

In April 2024, FORM, a leading fitness technology company known for its pioneering real-time visual feedback to enhance athletic performance, launched its eagerly awaited second-generation augmented reality swim goggles, the FORM Smart Swim 2.

Swimming Sports Apparel And Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.51 billion

Revenue forecast in 2030

USD 24.41 billion

Growth rate (Revenue)

CAGR of 5.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Speedo International Ltd.; TYR Sport Inc; Arena Italia S.p.A.; Adidas AG; Nike, Inc.; Mizuno Corporation; Zoggs International Ltd.; Decathlon S.A; Aqua Sphere; Finis Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Swimming Sports Apparel And Accessories Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global swimming sports apparel & accessories market report based on category, distribution channel, and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Equipment

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global swimming sports & apparel market size was estimated at USD 16.68 billion in 2023 and is expected to reach USD 17.51 billion in 2024.

b. The global swimming sports & apparel market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 24.41 billion by 2030.

b. The swimming sports apparel market dominated the swimming sports apparel & accessories market with a share of 91.2% in 2023. Swimming sports apparel is designed to enhance performance by reducing drag, improving hydrodynamics, and offering support. High-performance swimsuits, for instance, are constructed from advanced materials that provide compression, increase buoyancy, and ensure quick drying.

b. Some key players operating in the swimming sports & apparel market include Speedo International Ltd., TYR Sport Inc, Arena Italia S.p.A., Adidas AG, Nike, Inc., Mizuno Corporation, Zoggs International Ltd., Decathlon S.A, Aqua Sphere, and others.

b. Increasing disposable incomes in many regions are enabling consumers to invest more in premium swimwear brands and accessories, which in turn is fueling market expansion. Social trends promoting active lifestyles and wellness contribute to the growing popularity of swimming, driving sustained demand for specialized apparel that caters to various skill levels and swimming environments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."