- Home

- »

- Animal Feed and Feed Additives

- »

-

Global Swine Feed Market Size, Share, Industry Report, 2023-2030GVR Report cover

![Swine Feed Market Size, Share & Trends Report]()

Swine Feed Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Starter Feed, Grower Feed), By Form (Pellets, Crumbles, Mash), By Additives (Vitamins, Amino Acids), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-590-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Swine Feed Market Summary

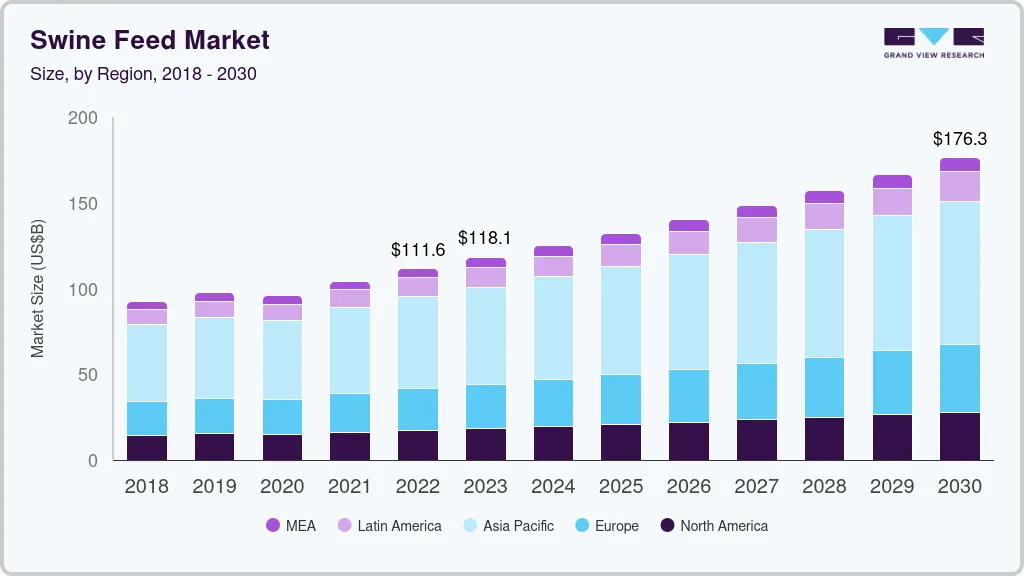

The global swine feed market size was estimated at USD 111,649.5 million in 2022 and is expected to reach USD 176,314.7 million by 2030, growing at a CAGR of 5.9% from 2023 to 2030. Rising consumption of pork meat is expected to drive the product demand in the market.

Key Market Trends & Insights

- Asia Pacific witnessed remarkable growth and emerged as the largest market in 2018.

- China accounted for nearly 50% percent of the global pork production in 2018.

- By form, the pellets segment emerged as the largest segment, both in terms of volume and revenue, in 2018.

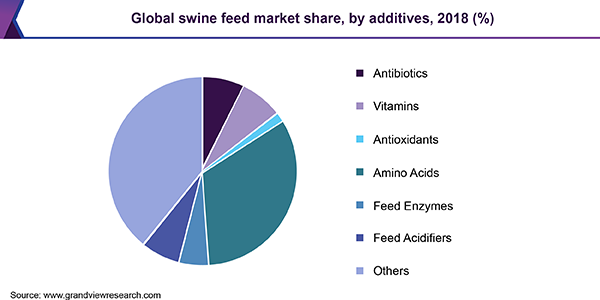

- By additive, amino acids segment emerged as the largest segment, in terms of volume, in 2018 with a market share of 24.1%.

Market Size & Forecast

- 2022 Market Size: USD 111,649.5 Million

- 2030 Projected Market Size: USD 176,314.7 Million

- CAGR (2023-2030): 5.9%

- Asia Pacific: Largest market in 2022

The product provides nutrition to swine and nurtures them. The additives are an important source of nutrition as they enhance as well as make the product more digestible. Enzymes, amino acids, antimicrobials, and antioxidants are the additives found in the diet of swine.

Feed additives, in particular, have been gaining tremendous popularity in the market on account of rising consumer awareness regarding their benefits that help in promoting swine health. Moreover, natural additives and their consumption have a negligible side effect on the swine health. Additives help in promoting optimum nutrition absorption and do not add pressure or interfere with the natural digestive enzymes secreted by the gut of swine.

Growing demand for animal protein including pork meat products is expected to augment the product demand. Additives such as amino acids, vitamins, antibiotics, and enzymes have been gaining tremendous popularity over the past few years as they help in improving immunity of swine and reduce the number of fatalities caused due to diseases. This is projected to drive the market growth over the forecast period.

Increasing consumption of pork in developing economies, such as China, India, and Brazil, is expected to fuel the demand for the product globally. North America is one of the major pork exporting regions and is expected to drive the demand for the product over the forecast period.

Product Insights

Newborn pigs growing at a faster rate are referred to as grower pigs. Grower pigs have high protein deposition capacity as well as better feed conversion rate.In the grower phase, intake is approximately in the range of 1.2 kg/day. The younger gilt is known as sow once it gives birth to a piglet.

Sow feed contains ingredients that help in supplying energy, protein, vitamin, mineral, and amino acid levels necessary for sows. Such a product helps fulfill the needs of sows and helps them remain healthy during lactation. Rising occurrences of diseases due to infected pork meat consumption have altered the product demand in South Africa. In addition, enhanced properties of additives are expected to lower the occurrence of animal epidemics, thereby fueling the demand for the product globally.

Form Insights

Pellets segment emerged as the largest form type segment, both in terms of volume and revenue, in 2018 in the swine feed market. The growth can be attributed to excellent palatability, improvement in feed efficiency, and increased swine performance. Swine farmers are more inclined toward pelleted products owing to their convenient feeding applications and contribution to Average Daily Gain (ADG).

Apart from pellets, form is also segmented into mash and crumbles. Mash form is relatively less expensive on account of less expensive processing techniques. However, mash should be finely ground for easy digestibility. Also, the intake and feed conversion ratio can be improved if the feed is finely ground. Dependency on form also varies with swine health, nutrient requirement, and costs. Pelleted form is majorly preferred by swine producers owing to its health benefits, however, the response of swine varies as per the form types.

Additives Insights

Based on additives, the market has been segmented into vitamins, feed enzymes, feed acidifiers, antioxidants, antibiotics, amino acids, and others. Additives play an important role in enhancing the nourishment given to swine i.e. they mainly improve the food and feed quality.

Vitamins naturally exist in most ingredients, however, to provide proper nutrition, additional vitamin supplements are mixed in livestock feeds. Vitamin A, Vitamin D, Vitamin E, Vitamin K, and riboflavin are the majorly used vitamin additives and these are added as supplements into the mixture to improve and maintain animal health.

The primary reasons for the slow growth rate of feed additives in the vitamin market are that vitamin in feed additives are only used when the livestock is deficient and the natural vitamins present in the feed prove insufficient. Vitamins are additionally given to animals for improving their reproductivity and resistance to diseases.

Regional Insights

Asia Pacific witnessed remarkable growth and emerged as the largest market, both in terms of volume and revenue, in 2018. Increasing meat consumption and rising meat production in countries such as China, Vietnam, South Korea, and Thailand are projected to be the major factors driving the market growth.

China accounted for nearly 50% percent of the global pork production in 2018 and is projected to witness increasing demand for swine feed, which, in turn, is expected to fuel the demand for the product in Asia Pacific. Countries such asNew Zealand, Australia, and Korea import large amounts of pork, which, in turn, is expected to influence the market growth positively.

North America is the largest exporter of pork and is likely to see high demand for the product over the forecast period. Increasing consumption of pork and stringent regulations are the factors contributing to the rising demand for the product in the European region.

Key Companies & Market Share Insights

The global market is highly competitive in nature and is relatively concentrated with market participants such as Archer Daniels Midland Company; BASF SE; Koninklijke DSM N.V.; Associated British Foods plc; Lallemand, Inc.; Cargill, Inc.; and Alltech, Inc. These companies are involved in joint ventures and mergers & acquisitions to develop swine feed products and maintain their market position. The introduction of customized feed products for swine in conjunction with additives is projected to emerge as the major factor contributing to the market growth.

Integration throughout the value chain is one of the significant factors providing increased profit margin to swine feed producers, which, in turn, translates into significant growth potential for the market. The presence of regional regulations governing the market can hamper the production of key players. However, innovation in products and creative packaging could give a competitive advantage to the manufacturers and help them increase their market presence.

Swine Feed Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 118,124.5 million

Revenue forecast in 2030

USD 176,314.7 million

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2014 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, additives, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Spain, Russia, Germany, Netherlands, Italy, China, Vietnam, Thailand, South Korea, Brazil, Argentina, South Africa

Key companies profiled

Archer Daniels Midland Company; BASF SE; Koninklijke DSM N.V.; Associated British Foods plc; Lallemand, Inc.; Cargill, Inc.; and Alltech, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global swine feed market report on the basis of product, form, additives, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Starter Feed

-

Grower Feed

-

Sow Feed

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Pellets

-

Crumbles

-

Mash

-

Others

-

-

Additives Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Antibiotics

-

Vitamins

-

Antioxidants

-

Amino Acids

-

Feed Enzymes

-

Feed Acidifiers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Spain

-

Russia

-

Germany

-

Netherlands

-

Italy

-

-

Asia Pacific

-

China

-

Vietnam

-

Thailand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global swine feed market size was estimated at USD 110.1 billion in 2019 and is expected to reach USD 114.2 billion in 2020.

b. The global swine feed market is expected to grow at a compound annual growth rate of 3.5% from 2019 to 2025 to reach USD 135.6 billion by 2025.

b. Asia Pacific dominated the swine feed market with a share of 37.2% in 2019. This is attributable to increasing pork meat consumption in China, Taiwan and South Korea.

b. Some key players operating in the swine feed market include Archer Daniels Midland Company; BASF SE; Koninklijke DSM N.V.; Associated British Foods plc; Lallemand, Inc.; Cargill, Inc.; and Alltech, Inc.

b. Key factors that are driving the market growth include increasing demand for high-quality pork meat products along with the use of swine feed in conjunction with feed additives for better conversion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.