- Home

- »

- Advanced Interior Materials

- »

-

Talc Market Size, Share And Trends, Industry Report, 2030GVR Report cover

![Talc Market Size, Share & Trends Report]()

Talc Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product (Talc Carbonate, Talc Chlorite), By Application (Plastics, Pulp & Paper), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-607-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Talc Market Summary

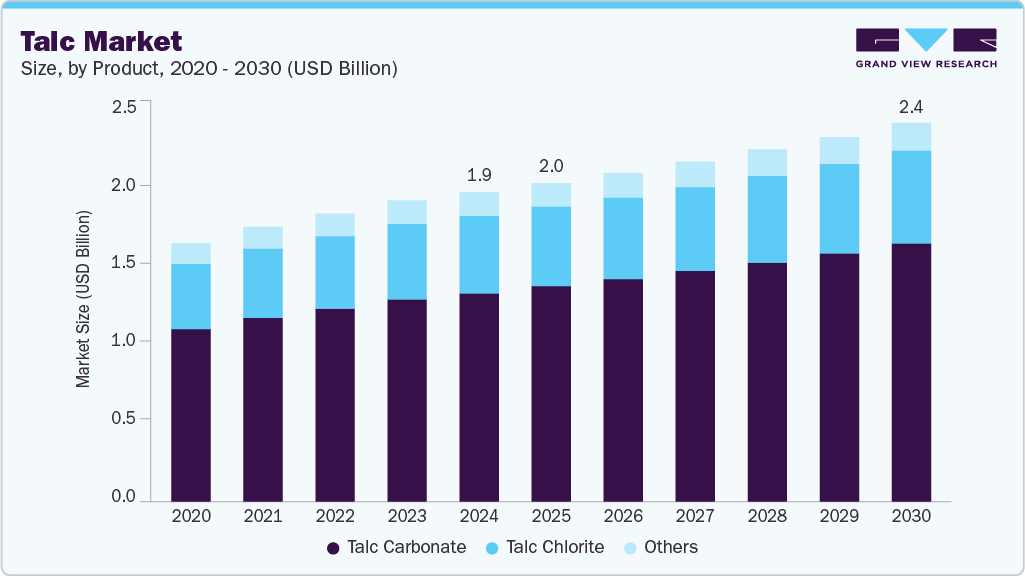

The global talc market size was estimated at USD 1.95 billion in 2024 and is projected to reach USD 2.39 billion by 2030, growing at a CAGR of 3.5% from 2025 to 2030. Talc acts as a filler and reinforcing agent, significantly enhancing the mechanical properties of plastics such as polypropylene, polyethylene, and polyamide.

Key Market Trends & Insights

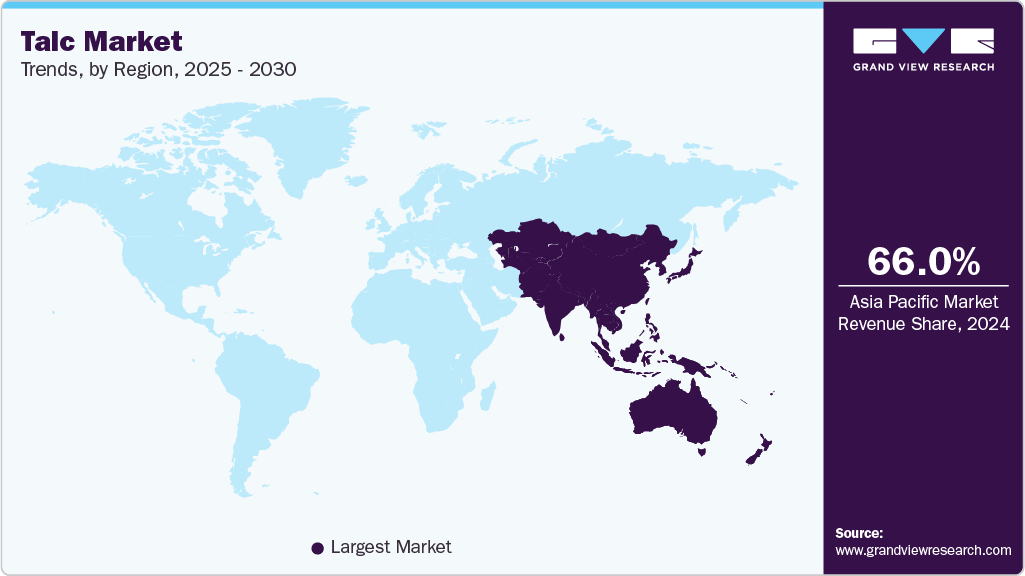

- Asia Pacific held over 66.0% revenue share of the overall talc market.

- The U.S. talc market is witnessing a shift toward stricter safety and quality standards.

- By product, talc carbonate segment held the revenue share of over 67.0% in 2024.

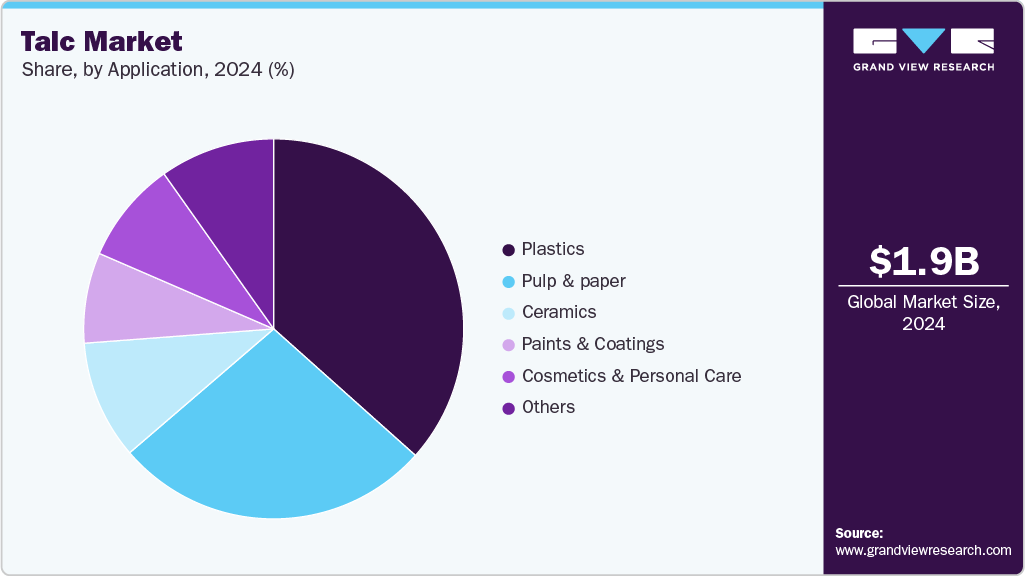

- By application, plastics segment held the revenue share of over 36% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.95 Billion

- 2030 Projected Market Size: USD 2.39 Billion

- CAGR (2025-2030): 3.5%

- Asia Pacific: Largest market in 2024

The increasing demand for lightweight automotive components to improve fuel efficiency has boosted the consumption of talc-reinforced plastics. Moreover, the growing use of talc-filled polypropylene in packaging, automotive parts, and consumer goods contributes to the market's expansion. As the automotive and packaging sectors continue to grow globally, particularly in emerging economies, the demand for talc as a key additive in polymer compounds is projected to rise steadily.The paints and coatings industry is another significant driver of the talc market. Talc is widely used as an extender pigment in paints due to its high dispersion and opacity properties and ability to improve weather resistance and corrosion protection. With the robust growth of the construction sector worldwide, especially in regions like Asia Pacific and the Middle East, the demand for decorative and protective coatings has surged. Additionally, talc is utilized to enhance the rheological properties of coatings, making them more durable and resistant to environmental factors. As infrastructure projects and residential construction continue to rise, the demand for paints and coatings industry talc is expected to grow consistently.

The pulp and paper industry remains a vital application segment for talc, as it is used as a pitch control agent and filler to improve paper brightness, opacity, and printability. The steady rise in the production of specialty papers, packaging materials, and tissue products fueled the demand for talc. Additionally, the increasing consumer preference for high-quality, eco-friendly paper products has prompted manufacturers to enhance their production processes, where talc is a cost-effective and efficient additive.

The cosmetics and personal care industry contributes to the growth of the talc market. Talc is a crucial ingredient in a wide range of cosmetic products, including face, body, and skin care formulations, due to its ability to absorb moisture and provide a smooth, silky texture. The increasing awareness of personal grooming and hygiene, particularly in emerging economies, has spurred the demand for talc-based products. Furthermore, the trend toward natural and mineral-based cosmetics has bolstered talc's relevance, as manufacturers opt for talc in formulations to offer safe and skin-friendly products.

Government policies promoting mineral resource development and favorable mining activity regulations have positively impacted the talc market. Countries such as China, India, and the U.S. are key talc producers and have introduced policies to streamline mining operations and encourage investments in mineral processing industries. Moreover, strategic collaborations between governments and mining companies have enhanced the production and export capacities, stabilizing supply chains.

Drivers, Opportunities & Restraints

The talc market is primarily driven by its versatile applications across various industries, including plastics, paints and coatings, pulp and paper, and personal care. In the plastics industry, talc acts as a reinforcing filler, improving polymers' stiffness, impact resistance, and dimensional stability, particularly in automotive applications. Additionally, the demand for lightweight automotive components has propelled the consumption of talc-filled polypropylene. The paints and coatings sector also significantly contributes to market growth, as talc enhances the product's weather resistance and smooth texture. Furthermore, the cosmetics industry relies on talc for its moisture-absorbing and skin-friendly properties, while the pulp and paper sector uses it to improve printability and opacity. The consistent demand from these end-use industries forms the backbone of the talc market's expansion.

The increasing focus on sustainable and eco-friendly materials presents substantial opportunities for the talc market. As industries like automotive and packaging strive for lightweight and recyclable materials, talc-based composites are gaining traction as a cost-effective and durable solution. Moreover, the rapid growth of emerging economies, particularly in Asia-Pacific, where construction and automotive industries are booming, creates new avenues for talc demand. Given the growing consumer preference for non-toxic and natural ingredients, the cosmetics sector's shift towards natural and mineral-based formulations also bodes well for the talc market. Additionally, advancements in mining technologies and the exploration of high-purity talc products can enhance supply efficiency and reduce production costs, further boosting market potential.

Despite its wide applications, the talc market faces challenges that could hinder its growth. Health concerns related to the use of talc, particularly in cosmetics and personal care products, have led to increased regulatory scrutiny and lawsuits, affecting market sentiment. Allegations of asbestos contamination in talc-based products have prompted companies to invest in rigorous quality testing and certification processes, increasing operational costs.

Product Insights

Talc carbonate segment held the revenue share of over 67.0% in 2024. The talc carbonate segment is the dominant deposit type in the global talc market, attributed to its superior purity and physical properties. Talc carbonate ores, primarily composed of talc and carbonates like magnesite or dolomite, are typically found in metamorphosed ultramafic rocks. These deposits yield talc with a specific gravity of up to 2.86 and a density of up to 2.8 g/cm³, making them highly desirable for industrial applications. The processing of these ores involves removing associated minerals to produce a pure talc concentrate, which is extensively utilized across various industries due to its softness, chemical inertness, and hydrophobic nature.

Talc chlorite is anticipated to register the fastest CAGR over the forecast period. Talc chlorite deposits, comprising a mixture of talc and chlorite minerals, are known for their softness and organophilic nature. These properties make talc chlorite particularly valuable in ceramics, paints, cosmetics, pharmaceuticals, and food processing industries. For instance, talc chlorite enhances thermal shock resistance in ceramics, making it suitable for refractory applications. The paints and coatings industry benefits from its ability to provide corrosion protection, solvent reduction, and good adhesion.

Application Insights

Plastics segment held the revenue share of over 36% in 2024.Talc serves as a functional filler in plastics, improving properties such as stiffness, heat resistance, and dimensional stability. These enhancements are particularly valuable in industries like automotive manufacturing, where talc-filled polypropylene produces lightweight components that contribute to fuel efficiency and reduced emissions. Additionally, talc's incorporation into plastic formulations can lower production costs by allowing for the substitution of more expensive resins without compromising product quality.

Cosmetics & personal care is anticipated to register the fastest CAGR over the forecast period owing to talc's desirable properties such as moisture absorption, smooth texture, and ability to prevent caking. Talc is extensively utilized in products like baby powders, body powders, deodorants, foundations, and various makeup items. Its application enhances product feel and performance, making it a preferred ingredient in personal care formulations.

Regional Insights

Asia Pacific held over 66.0% revenue share of the overall talc market growth in 2024, driven by significant demand across key industries such as plastics, automotive, construction, and personal care. In the plastics sector, talc's role as a reinforcing filler enhances the mechanical properties of materials, making it indispensable in manufacturing lightweight automotive components and durable construction materials. The automotive industry, particularly in China and India, saw increased production of electric vehicles (EVs), which utilize talc-filled plastics to reduce vehicle weight and improve fuel efficiency.

North America Talc Market Trends

In North America, especially the U.S. and Canada, the automotive industry significantly influences the talc market. Talc is extensively used as a filler and reinforcement agent in automotive plastics to enhance mechanical properties such as stiffness, impact resistance, and dimensional stability. The push towards lightweight vehicles to improve fuel efficiency and reduce emissions has led to increased adoption of talc-reinforced polypropylene in automotive parts, including dashboards, bumpers, and interior components. As EVs and fuel-efficient cars gain traction, the demand for talc-based composites continues to rise, thereby boosting the talc market in the region. In 2024, the U.S. and Canada achieved around 9.0% growth in EV sales, with 1.8 million units sold.

U.S. Talc Market Trends

The U.S. market is witnessing a shift toward stricter safety and quality standards. In April 2024, the U.S. Food and Drug Administration (FDA) proposed mandatory asbestos testing for all cosmetic products containing talc, a move supported by leading companies such as Estée Lauder and Johnson & Johnson to reinforce consumer trust. This regulatory momentum has encouraged pharmaceutical-grade, asbestos-free talc, particularly in baby powders, setting powders, and facial makeup. As companies emphasize transparency and compliance, demand for high-purity talc is increasing, helping the segment maintain its relevance and drive growth within the U.S. personal care industry.

Europe Talc Market Trends

Europe has a well-established plastics and polymer industry that extensively uses talc as a cost-effective filler and performance enhancer. Talc's use in plastic production helps improve thermal resistance, rigidity, and process ability, making it an essential component in various industrial applications. The increasing adoption of engineered plastics in packaging, automotive, consumer electronics, and construction sectors drives the demand for talc-filled polymer.

Latin America Talc Market Trends

Latin America’s automotive industry, particularly in countries like Brazil, Mexico, and Argentina, is a major growth driver for the talc market. Talc is extensively used as a reinforcing filler in automotive plastics, enhancing their stiffness, impact resistance, and thermal stability. The rising demand for lightweight automotive components, driven by fuel efficiency regulations and consumer preferences for eco-friendly vehicles, has bolstered the use of talc-filled polypropylene and other plastic composites.

Middle East & Africa Talc Market Trends

The personal care and cosmetics industry in the Middle East and Africa is growing rapidly, driven by increased disposable incomes and a strong cultural emphasis on grooming and hygiene. Talc, recognized for its superior moisture-absorbing and smoothing qualities, is a vital component in numerous cosmetic products, including body powders, face powders, and skincare formulations. The rise of mineral-based and natural cosmetics, coupled with consumer awareness about product safety, promotes the use of high-purity, asbestos-free talc. Countries like Saudi Arabia, South Africa, and Nigeria are witnessing a surge in demand for talc-based personal care products, boosting the overall market growth.

Key Talc Company Insights

Some of the key players operating in the market include American Talc Company, Beihai Group, and others

-

American Talc Company (ATC), formerly known as Wold Talc Co., is a prominent talc producer based in Texas. ATC specializes in producing various grades of talc, catering to industries such as ceramics, paints, plastics, and rubber. Their talc products are known for their high purity and consistent quality, making them suitable for applications that require fine particle size and brightness. The company's strategic location and control over regional talc resources enable it to effectively meet the specific needs of its diverse clientele.

-

Beihai Group, officially known as Liaoning Beihai Industry (Group) Co., Ltd., is a leading Chinese mining and powder processing enterprise. The company operates the Yangjiadian Talc Mine, among others, and produces a wide range of talc products in various industries, including rubber, ceramics, plastics, and cosmetics. Beihai Group's talc is known for its high purity and fine particle size, making it suitable for applications that demand superior quality.

Key Talc Companies:

The following are the leading companies in the talc market. These companies collectively hold the largest market share and dictate industry trends.

- American Talc Company

- Beihai Group

- Golcha Associated

- Himalaya International

- Magris Talc

- Minerals Technologies Inc.

- Specialty Minerals Inc.

- Talc de Luzenac

- Wollastonite

- Xinyu Talc

Recent Development

-

In December 2024, APEX-VN officially launched its new premium talc powder product, designed to serve various industrial applications, including plastics, rubber, coatings, paper, and inks. Sourced from natural talc mines in the Middle East and China, this finely milled talc powder boasts high purity, is free from harmful impurities, and is eco-friendly.

Talc Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.01 billion

Revenue forecast in 2030

USD 2.39 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; India; Japan; Brazil

Key companies profiled

Minerals Technologies Inc.; Wollastonite; Specialty Minerals Inc.; Xinyu Talc; Magris Talc; American Talc Company; Himalaya International; Talc de Luzenac; Golcha Associated; Beihai Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Talc Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global talc market report on the basis of product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Talc Carbonate

-

Talc Chlorite

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Pulp & Paper

-

Ceramics

-

Paints & Coatings

-

Cosmetics & Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global talc market size was estimated at USD 1.95 billion in 2024 and is expected to reach USD 2.01 million in 2025.

b. The global talc market is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 2.39 billion by 2030.

b. The talc carbonate segment dominated the market with a revenue share of 67.3% in 2024.

b. Some of the key vendors of the global talc market are Minerals Technologies Inc., Wollastonite, Specialty Minerals Inc., Xinyu Talc, Magris Talc, American Talc Company, Himalaya International, Talc de Luzenac, Golcha Associated, Beihai Group, and others.

b. The key factor that is driving the growth of the global talc market is the growing demand from end-use industries such as plastics, paints & coatings, cosmetics, ceramics, and pharmaceuticals, where talc is valued for its properties like softness, chemical inertness, and high thermal resistance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.