- Home

- »

- Food Additives & Nutricosmetics

- »

-

Tannin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Tannin Market Size, Share & Trends Report]()

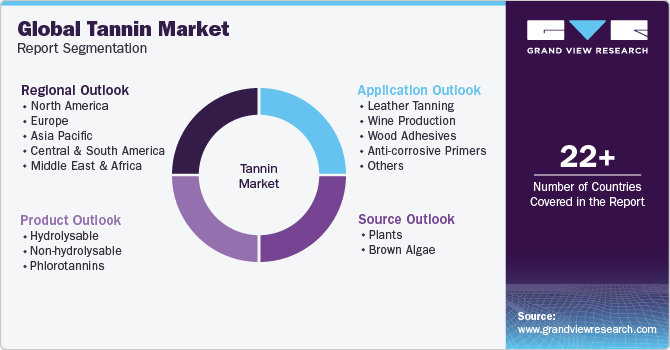

Tannin Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Plants, Brown Algae), By Product (Hydrolysable, Non-hydrolysable, Phlorotannins), By Application (Leather Tanning, Wine Production), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-786-5

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tannin Market Summary

The global tannin market size was estimated at USD 2.47 billion in 2022 and is projected to reach USD 4.12 billion by 2030, growing at a CAGR of 6.6% from 2023 to 2030. Increasing demand from the leather manufacturing and winemaking industry is expected to be a key factor driving market growth.

Key Market Trends & Insights

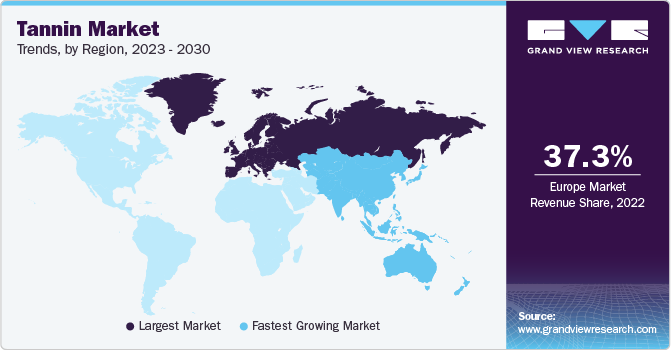

- Europe dominated the market and accounted for the largest revenue share of 37.3% in 2022.

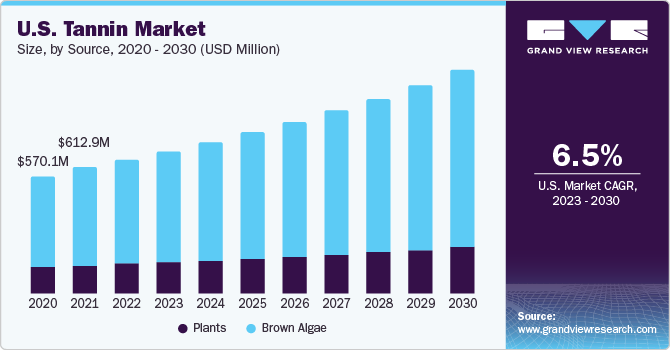

- The U.S. is one of the prominent consumers of tannin in the North America region.

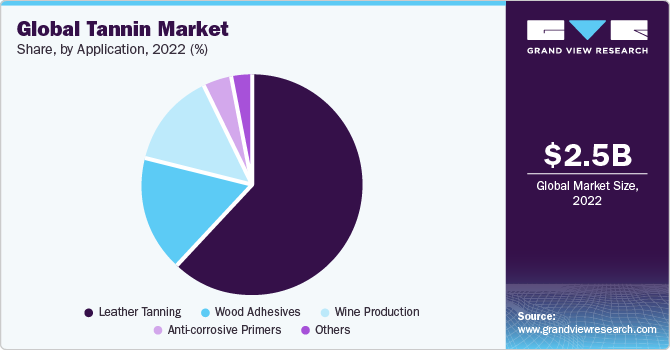

- By application, the leather tanning segment held the largest revenue share of 62.3% in 2022.

- By source, the brown algae accounted for the largest revenue share of 78.4% in 2022.

- By product, the non-hydrolysable segment accounted for the largest revenue share of 85.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.47 Billion

- 2030 Projected Market Size: USD 4.12 Billion

- CAGR (2023-2030): 8.93%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

Tannin, an astringent biomolecule is extracted from plants and fruits. It is found in various parts of plants including, barks, seeds, stem tissues, roots, and leaves. Plants have tannin content in abundance, which protects them from predation and also helps for their growth regulation. Fruits with rich tannin content include cranberries, blueberries, strawberries, hazelnuts, pecans, walnuts, grapes, and oranges.

The three major forms include hydrolyzable, non-hydrolyzable, and phlorotannins. These tannins bind well with alkaloids, amino acids, and proteins. Owing to these properties, they find applications in various industries including winemaking, leather tanning, and wood adhesives. Tannin extracts obtained from oak, quebracho and mimosa trees are utilized for leather manufacturing and treatment.

The winemaking industry requires extracts in abundance for the purpose of vinification and aging. Aged wines are often characterized as a premium product and as a symbol of status for its consumers. The rising disposable income and the willingness to pay a hefty sum for premium products such as wine is driving wine industry growth thus benefitting the demand for wine applications.

Companies are investing in R&D activities and are striving towards the development of environment-friendly manufacturing process. Development of new technologies coupled with constant improvements is steering industry growth.

Tannin is extracted from tree barks, plant tissues, galls, and fruits. It is characterized as a brown colored, bitter-tasting organic substance. It is rich in oxidation properties and is thus utilized in the manufacturing of wines. It also helps in protection of cellular oxidative damage, which includes lipid peroxidation. In addition, tannins prevent various external entities, including micro-organisms, foodborne bacteria, and aquatic bacteria, from affecting the human body.

Tannin is used in the leather tanning process. Tannins derived from oak, quebracho, and mimosa trees are among those used by the leather industry. Availability of a wide product portfolio, rising population, and change in consumers’ perception toward dressing has benefitted the leather industry in the past and the trend is expected to continue over the forecast period, thereby benefitting the tannin industry.

Tannins extracted from several tree parts such as leaves, roots, and barks are widely used for the manufacturing of leather. Due to it insoluble proteins, the product does not decompose and is, therefore, used for tanning leathers. Tannins assist in augmenting the water-resistance, solidarity, and wearing properties of leather. The demand for leather and leather products, including footwear and clothing, and its use in the automotive and household applications is increasing. This has resulted in an increased demand for tannin extracts used for leather tanning purposes. The rising population and increasing disposable income of consumers are also anticipated to fuel the demand for leather. All these factors together are expected to drive the growth of the global tannin market over the forecast period

On the other hand, tannins are polyphenols that are water-soluble. Owing to this property, tannins are often utilized in food products and pharmaceuticals. Various food products including tea, coffee, cinnamon, thyme, clove, chocolate, and vanilla have tannin content in them. Products originated from Tannin are often considered as carcinogenic and may cause various diseases including esophageal cancer, heart diseases, intestinal bleeding, and diarrhea.

The sedentary lifestyle of people, irregular timetables, unhealthy eating habits, and work-life imbalance are some of the factors making them vulnerable to a number of heart diseases. Consumption of tannin products in such an environment adds fuel to the fire. Research studies have suggested that tannins have low efficiency in transforming absorbed nutrients to elements that are beneficial to the human body. This factor has often led to the characterization of tannin as a product with low nutritional value. Owing to the various shortcomings, tannin-rich foods are often considered low in nutritional content.

Application Insights

The global demand has seen a paradigm shift owing to the rising awareness among consumers regarding the advantages of tannin. The leather tanning segment held the largest revenue share of 62.3% in 2022. Tannins are insoluble proteins and do not decompose. Owing to this property, they are utilized for the manufacturing of leather. In leather tanning processes, the skins of animals are treated. The demand for leather is increasing owing to its varied applications in furniture, automotive seats, and clothing. The increasing disposable income of people and increasing demand for leather products are expected to fuel the growth of the industry.

Tannins have high anti-oxidation properties which are required for the production of wines. It provides color stabilization in wines and gives it the desired structure. These extracts help the wines to age better, ferment properly and gain a distinct aroma. Increasing alcohol production and its simultaneous consumption are factors anticipated to fuel the market over the next nine years.

Wood adhesives is expected to grow at the fastest CAGR of 6.9% over the forecast period. The growing manufacturing of wooden products has given rise to high demand for wood adhesives. They are also utilized in the manufacturing of wood adhesives. Non-hydrolyzable tannins are preferred for this purpose. Wood adhesives are utilized for various applications including, furniture, construction, and musical instruments.

Tannin is extensively utilized in the manufacturing of anti-corrosive primers, which withstand harsh weather conditions. Primers manufactured with tannins as additives, also help to smoothen rusted steel surfaces. These factors combined are expected to positively drive the growth of the industry over the forecast period.

Source Insights

The brown algae accounted for the largest revenue share of 78.4% in 2022 and is expected to grow at the fastest CAGR of 6.8% during the forecast period. Brown algae are found in various water bodies including, rock pools, tidal splash zone, intertidal zone, and near shore waters and usually consist of fast-growing and large seaweeds. Brown algae is a potential source of tannins for leather tanning and wood adhesives due to its high phlorotannin content.

Plants segment is expected to grow at a CAGR of 6.0% over the forecast period. Tannins occur in various species in the plant kingdom. The most common occurrence of tannins is found in angiosperms and gymnosperms. Other species which also have tannin in abundance include, dipterocarpaceae, bixaceae, grossulariaceae, aceraceae, combretaceae, myriacaceae, actinidiaceae, burseraceae, najadaceae, ericaceae, and typhaceae. Condensed tannins are the most abundant organic compounds, which are found in almost all families of plants.

Plants containing tannin include wattle, trefoil, sainfoin, quebracho, mangroves, eucalyptus, and canaigre. These plants are easy to procure, and the processes of manufacturing tannins from these plants are also easy. These factors are anticipated to accelerate the growth over the forecast period.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 37.3% in 2022. The wine industry is highly developed in Europe, and thus the requirement of tannin in the region is high. Particularly France has a well-established wine industry and thus has a large share in the market. Market growth can be attributed to rising consumption of tannin in leather and wine processing and wine. Germany is the third largest leather producer in Europe region. The leather industry in the country has over 100 leather manufacturers. A significant amount of tannin is also utilized in wine processing. Germany is the fourth largest wine producer in the European Union after Spain, Italy and France, Italy. Germany wine production is estimated at 8.4 million hectoliters for the year 2019 as published by United States Department of Agriculture (USDA).

Europe was followed by North America, which accounted for a significant share of the total revenue in 2022. Growing alcohol consumption and rising demand for leather commodities are expected to remain key driving factors for the industry. The region of North America is characterized by the presence of major players; this factor is expected to drive the industry over the forecast period.

The U.S. is one of the prominent consumers of tannin in the North America region. Most of the tannin produced in the country is primarily utilized by leather industry for tanning and dyeing process. The country is one of the major exports of tanned skins and hides with the value accounting for USD 3 billion as of 2019, as stated by The United States Hide, Skin and Leather Association (USHSLA). The major importers of U.S. hides and skins include China, Italy, Vietnam, UK, Thailand and Taiwan.

But, on the contrary, the leather industry in the country is witnessing downfall for the past years. The manufacturers are turning to synthetic alternatives due to consumer inclination towards use of non-animal derived products. In addition, U.S. and China trade war has severely affected the trade activities sending repercussions across the globe.

Asia Pacific is expected to grow at the fastest CAGR of 7.5% during the forecast period. The increasing leather and food manufacturing industry in the region of Asia Pacific, specifically in emerging economies such as China and India is projected to positively drive the demand over the forecast period. China, India, and Japan are expected to account for the highest share owing to rising manufacturing cost benefits, living standards, increasing overseas demand, and domestic demand induced by the rising population demand.

Additionally, the leather industry in Australia is expected to witness sluggish growth as the consumers are shifting more towards the adoption of vegan lifestyles. According to the Australian Hide Skin and Leather Exporters Association, the cost of prepping and shipping of untanned hides in Australia has increased over the years and is now greater than the sale price. The country exports animal skins to the international markets where the processes of tanning are carried out. Tanned skins are then reshipped to Australia for the production of leather goods such as jackets, shoes and bags. On the other hand, the wine making industry of Australia projects more lucrative opportunities of growth to the market. As reported by the Wine Australia, the total exported volume of wine from Australia was 729 million liters (valued at USD 2.8 billion) between 2019 and 2020. An estimated 2,361 wineries are present across the country, that contribute around USD 45.0 billion to the country’s economy.

The regions of Central and South America and The Middle East & Africa are also anticipated to show significant growth. Lenient regulations in these markets also contribute towards growing demand and encourage foreign players to invest, making the market more competitive.

Product Insights

The non-hydrolysable segment accounted for the largest revenue share of 85.5% in 2022. Non-hydrolyzable are also known as condensed tannins. These products are formulated when the plant extracts are condensed. These are usually found in tropical trees including, quebracho, mimosa, pine, and spruce, and are utilized for the manufacturing of dietary supplements and wood adhesives.

The hydrolysable segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. Hydrolyzable tannins when heated, form gallic acids. These products have beneficial antibacterial effects and thus are also used in the manufacturing of pharmaceuticals. Recent studies have also suggested that hydrolyzable are effective against cancer.

Phlorotannins are usually extracted from various brown algae including, rockweed and kelp. Phlorotannins have oxidizing abilities and can precipitate proteins. These products have various beneficial medical properties including, radio-protective, anti-cancer, antibacterial, anti-oxidation, anti-HIV, and anti-diabetic. Owing to these varied beneficial properties, phlorotannins are often utilized in the manufacturing of pharmaceuticals.

Key Companies & Market Share Insights

This industry is highly competitive and fairly concentrated. Product development and customized products are expected to be the key parameter for being competitive in this industry, with frequent joint ventures, mergers, and acquisitions being undertaken as an attempt to diversify product portfolio and gain market share.

Key Tannin Companies:

- Tannin Corporation

- Ajinomoto OmniChem.

- Polson Ltd.

- Ever s.r.l.

- UCL Company (Pty) Ltd

- LaffortSA

- W. ULRICH GmbH

- Tanin d.d.

- Jyoti Dye Chem AgencyTANAC

Recent Developments

-

In August 2020, Tannin Corporation, a U.S.-based manufacturer and distributor specializing in wet-end leather chemicals, bisulfates, and fatliquors, made an announcement regarding the addition of a series of new fatliquors and dispersing agents to its portfolio. The introduction of these new products has significantly enriched the company's product portfolio.

-

In January 2019, Stahl Holdings B.V. selected Tannin Corporation as the exclusive agent and distributor for their Leather Chemicals portfolio in the U.S. and Canada. Notably, Tannin Corporation holds the position of the largest supplier of wet-end chemicals in North America. This strategic partnership with Tannin Corporation reflects Stahl's commitment to optimizing and enhancing their sales and distribution operations in both countries. Under this arrangement, Tannin Corporation will assume key responsibilities, including providing support, overseeing sales management, delivering customer service, handling invoicing and distribution, and offering technical support to Stahl's valued tannery customers.

-

In October 2018, Tannin Corporation introduced two innovative segments, Wax and Fat Liquor, to its product lineup. This strategic move not only broadened the company's product portfolio but also conferred upon it a significant competitive edge, setting it apart from its industry rivals.

Tannin Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.63 billion

Revenue forecast in 2030

USD 4.12 billion

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report update

November 2023

Quantitative units

Revenue in USD million, Volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; Japan; India; South East Asia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Tannin Corporation; Ajinomoto OmniChem.; Polson Ltd.; Ever s.r.l.; UCL Company (Pty) Ltd; LaffortSA; W. ULRICH GmbH; Tanin d.d.; Jyoti Dye Chem Agency; TANAC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tannin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global tannin market report on the basis of source, product, application, and region:

-

Source Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

Plants

-

Brown Algae

-

-

Product Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

Hydrolysable

-

Non-hydrolysable

-

Phlorotannins

-

-

Application Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

Leather Tanning

-

Wine Production

-

Wood Adhesives

-

Anti-corrosive Primers

-

Others

-

-

Regional Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South East Asia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tannin market size was estimated at USD 2.47 billion in 2022 and is expected to reach USD 2.63 billion in 2023.

b. The global tannin market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 4.12 billion by 2030.

b. Leather tanning dominated the tannin market with a share of 62.3% in 2022. This is attributable to the rising demand for tannin in leather tanning processes.

b. Some key players operating in the tannin market include Tannin Corporation; S.A. Ajinomoto OmniChem N.V.; Polson Ltd.; Forestal Mimosa Ltd.; Ever s.r.l.; UCL Company (Pty) Ltd.; LaffortSA; Zhushan County Tianxin Medical & Chemical Co., Ltd.; W. Ulrich GmbH; Tanin Sevnica d.d.; Jyoti Dye Chem Agency; Tanac S.A.

b. Key factors that are driving the market growth include increasing demand for the product from the leather manufacturing and wine-making industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.