- Home

- »

- Plastics, Polymers & Resins

- »

-

Wood Adhesives Market Size, Share & Trends Report, 2030GVR Report cover

![Wood Adhesives Market Size, Share & Trends Report]()

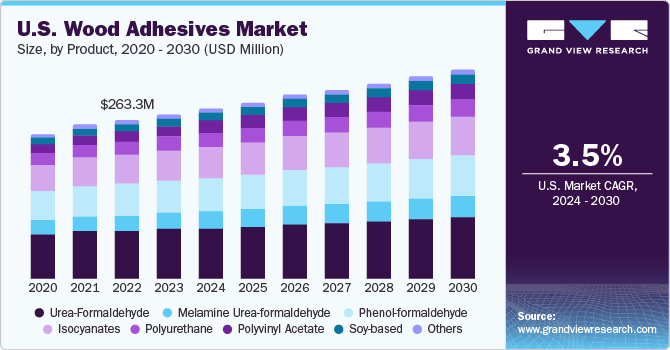

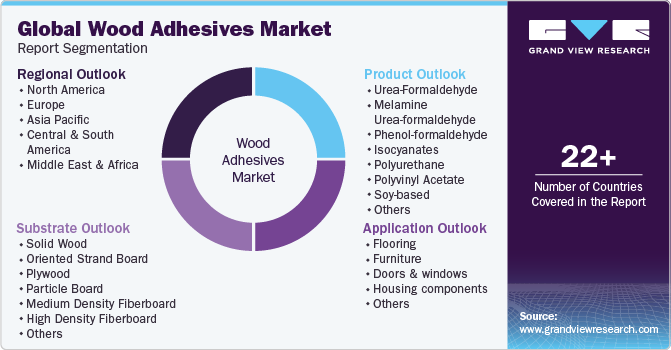

Wood Adhesives Market Size, Share & Trends Analysis Report By Product (Urea-Formaldehyde, Soy-based), By Application, By Substrate, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-853-4

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Wood Adhesives Market Size & Trends

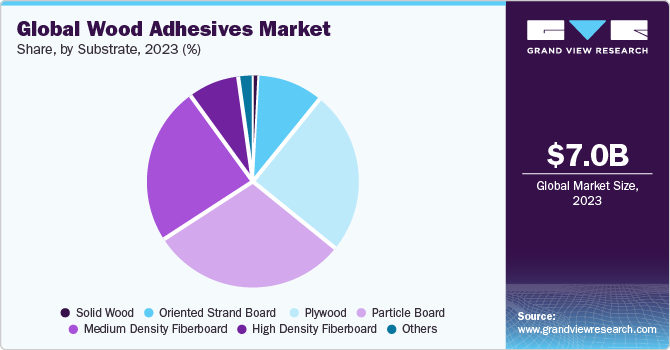

The global wood adhesives market size was estimated at USD 7.03 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030. Growing global engineered wood-based panel production is a significant factor driving the market. Engineered wood-based panels such as plywood, oriented strand board, and particle board consume a significant volume of adhesives during their manufacturing process. For instance, plywood is produced by binding veneers with adhesive.

The market is anticipated to grow over the forecast period owing to the increasing demand for eco-friendly and green furniture. Rising concerns among people regarding the abatement of trees and global warming have led to a surge in the use of engineered wood-based panels. Rapid urbanization coupled with an increase in disposable income has contributed to a higher demand for engineered wood furniture. This is estimated to be a significant factor in influencing product demand.

Wood panel manufacturers, especially in Asia Pacific, rely on in-house production capabilities to produce adhesives for their products. Adhesive production is considered to be a part of wood-based panel manufacturing in the woodworking industry. However, most small to medium panel manufacturers do not have adequate adhesive production and quality control capabilities. Adhesive formulation and monitoring of quality is solely dependent on the operator’s knowledge, skill, and experience.

The market is characterized by the presence of a stringent regulatory framework associated with the emission levels of formaldehyde during wood-based panel manufacturing. This is expected to open new growth avenues for soy-based, polyurethane, and polyvinyl acetate adhesives over the next seven years.

Growing refurbishment and renovation activities coupled with increasing number of constructions is anticipated to boost market growth. Moreover, government initiatives towards sustainable construction have resulted in an increased need for engineered wood and wood products in the form of furniture for use in both residential as well as commercial applications, which is expected to augment demand for the market across the forecast period.

Remodeling and renovation activities on account of rising living standards are expected to contribute to the demand for furniture. The growing service sector in emerging economies has led to the development of office spaces and corporate buildings, which have consequently impacted the demand for wood furniture’s, which is expected to drive the market growth.

Furthermore, rising concerns among people regarding the abatement of trees and global warming have led to a surge in the use of engineered wood panels. The manufacturing of engineered wood panels such as oriented strand board, plywood, and particle board requires a significant volume of adhesives. For instance, plywood is produced by applying adhesive resin to veneers. As a result, the growing demand for wood panels is likely to boost demand for wood adhesives.

In addition, rising awareness regarding environmental degradation, growing customer base, and enhanced & consistent R&D activities are anticipated to grow the bio-based wood adhesives demand. In addition, according to the World Agricultural Production Outlook, global production of soy (soybean) was 391.17 million metric tons, which represented a 10% increase in the production. To sum up, abundant raw material availability of bio-based adhesives such as starch, soy and corn are expected to positively influence the market growth over the forecast period.

However, volatile organic compound (VOC) emissions resulting from commercial and industrial use of adhesives pose both environmental and health risks. In order to regulate such industrial emissions, several countries have set guidelines to restrict the amount of gaseous emission during the use of adhesives. Thus, stringent government regulations prevalent in the industry is expected to restrict the market growth across the forecast period.

For instance, in the U.S., the Environmental Protection Agency states that manufacturers and suppliers of adhesives and sealants must comply with the established volatile organic compound standards. Moreover, European adhesives industry also complies with the regulations under Registration, Evaluation, Authorization and Restriction of Chemicals (REACH). These environmental regulations restrict the growth of adhesives market as the violation of such government-defined regulations can result in heavy penalties and losses.

Substrate Insights

Plywood dominated the substrate segment with a revenue share of over 26.7% in 2022. Increasing demand for plywood in construction and furniture industries, especially in Asia Pacific, is expected to have a favorable impact on the wood adhesive market growth over the forecast period.

Plywood is manufactured by gluing multiple thin layers of veneer wood. Superior properties such as high strength, moisture resistance, impact resistance, chemical resistance, fire resistance, and durability offered by the product are expected to drive the market over the forecast period. It can also be used as an insulating material for wall cladding, ceilings, roofing, and flooring.

Oriented strand board (OSB) is yet another significant segment for the product. The logs are sliced into strands of a specific size and assembled in wet bins until they get ready to be dried. The dried strands are mixed with adhesive to construct the board and a minimal amount of wax to improve the resistance to water absorption and moisture. Increasing demand for oriented strand board (OSB) as an alternative to plywood and solid boards, especially in North America and Europe, is projected to drive the demand for the product in OSB over the forecast period.

Medium-density fiberboard (MDF) finds extensive application scope in the construction and furniture industries. Rising demand for wood furniture, flooring, and cabinetry is expected to drive the market over the forecast period. The rapid growth of the residential and commercial building & construction sector in Asia Pacific is expected to have a positive impact on the segment growth over the forecast period.

Product Insights

Urea-formaldehyde (UF) dominated the market with a revenue share of 33.1% in 2022. This is attributed to its wide utilization as a non-transparent thermosetting resin for wood. It exhibits superior properties includes high tensile strength and flexural modulus. Fillers and extenders are added to the resin to control flow, viscosity, and resin penetration in wood. They are widely used in the manufacturing of interior grade plywood and particleboard. A major drawback of UF adhesives is their poor water resistance.

The melamine urea-formaldehyde (MUF) resins possess superior water-resistance properties as compared to other resins. A recent trend indicates the development of MUF resin adhesives for finger jointing of sawmill waste timbers and also for manufacturing flooring tiles from bamboo and bamboo laminates. These resins are the popular choice for exterior and semi-exterior panels.

Isocyanates exhibit excellent resistance to moisture and are used to bond agricultural cellulosic wastes such as bagasse and straw. The most commonly used isocyanates are methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI). However, the product causes irritation of skin, eyes, and respiratory tract when used in high concentrations.

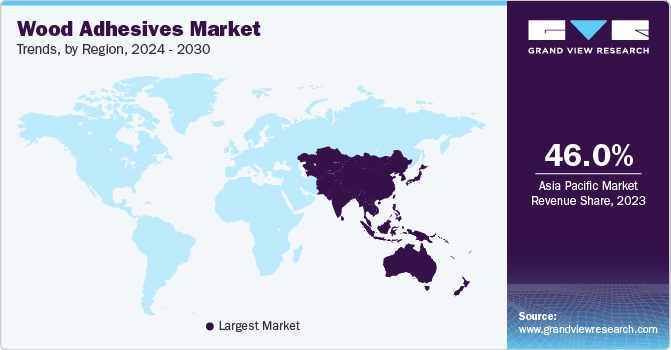

Regional Insights

The Asia Pacific region dominated the market with a revenue share of more than 46.8% in 2022. This is attributed to exponential rise in population in the Asia Pacific countries, coupled with the high demand for affordable housing, and government schemes promoting basic amenities such as food & shelter have led to the expansion of construction industry in the region.

The wood- panel industry in China has a high economic importance, since it is one of the largest producers of wood-based panels in the world. The well-established wood panel industry in the region coupled with the steady supply of wood products is anticipated to further boost the wood adhesives market growth.

Germany is one of the largest producers of wood adhesives in Europe. The wood adhesives market has witnessed rapid growth over past few years owing to robust demand from furniture and construction industry. Robust economic development has substantially profited the furniture industry and has resulted in increased private consumption.

However, the macroeconomic insecurity in context to European debt crisis is likely to hamper the growth of numerous industrial sectors in Germany, including furniture and housing construction, which in turn is expected to negatively impact the market over the forecast period.

Application Insights

Furniture application dominated the market with a revenue share of over 46.6% in 2022. This is attributed to growing utilization of wood-based panels as they are lightweight, well finished, and durable as compared to traditional wood. Unlike glass, these panels can be used to manufacture sturdy and durable interior decoration items which are expected to have a positive impact on the segment growth over the next seven years.

Flooring application is poised to observe the fastest growth with a CAGR, from 2023 to 2030. Increasing per capita disposable income coupled with the growing demand for residential space is anticipated to fuel the demand for flooring. Plywood floors enable customers to achieve enhanced aesthetics at a lower cost. An increasing number of restoration & refurbishment projects in developed economies are likely to augment the demand for wooden flooring, thereby propelling the adhesives market growth.

Wood adhesives are increasingly being applied on residential and commercial doors & windows for waterproofing and enhancing the overall texture & appeal. The product is also used during the manufacturing of window films as it enhances the UV filtration of the films.

Housing components including studs, joists, rafters, sheathing, and siding are made from wood. Increasing demand for residential space owing to rapid urbanization along with higher living standards is expected to drive market growth significantly over the forecast period. New residential & commercial construction activities are also propelling the demand for engineered housing components to ensure energy sustainability, attractiveness, and efficiency.

Key Companies & Market Share Insights

The global market is fragmented with the presence of numerous global and regional players. The market is characterized by the presence of key companies such as HB Fuller, Henkel AG & Co., KGaA, Bostik SA, and 3M and other small to medium regional players.

The global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations. For instance, in January 2023, Sika AG has recently introduced MB EZ Rapid, a high-performance single-component adhesive substrate consolidator and rapid-drying moisture barrier designed specifically for both residential and commercial floor covering installations. In addition, companies in the market compete on the basis of quality offered and the technology used for the manufacturing of the product.

Key Wood Adhesives Companies:

- DuPont

- H.B. Fuller Company

- Henkel AG & Co., KGaA

- Bostik S.A.

- 3M

- Sika AG

- Ashland, Inc.

- Pidilite Industries Ltd.

- Jubiulant Industries Ltd.

- Akzo Nobel N.V.

- Franklin Adhesives & Polymers

Global Wood Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.63 billion

Revenue forecast in 2030

USD 12.52 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, substrate, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan, Brazil; Saudi Arabia

Key companies profiled

Henkel AG & Co. KGaA; 3M Company; H.B. Fuller; Sika AG; Ashland Inc.; Bostik S.A.; Pidilite Industries Ltd.; Jubilant Industries Ltd.; AkzoNobel N.V.; Franklin Adhesives & Polymers.; DowDuPont Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Adhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood adhesives market report based on product, application, substrate, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Urea-formaldehyde (UF)

-

Melamine Urea-formaldehyde (MUF)

-

Phenol-formaldehyde (PF)

-

Isocyanates

-

Polyurethane

-

Polyvinyl Acetate (PVA)

-

Soy-based

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Flooring

-

Furniture

-

Doors & Windows

-

Housing Components

-

Others

-

-

Substrate Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Solid Wood

-

Oriented Strand Board (OSB)

-

Plywood

-

Particle Board (PB)

-

Medium-density Fiberboard (MDF)

-

High-density Fiberboard (HDF)

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global wood adhesives market was estimated at USD 7.03 billion in 2023 and is projected to reach USD 7.63 billion by 2030

b. The global wood adhesives market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 12.52 billion by 2030.

b. Urea-formaldehyde dominated the wood adhesives market with a share of over 33.1% in 2022. These adhesives are widely used in the production of wood-based panels and are gaining wide popularity owing to their good performance and high reactivity.

b. Some key players operating in the wood adhesives market include Henkel AG & Co., KGaA, H.B. Fuller, 3M, Bostik S.A., Sika AG, Pidilite Industries Ltd., Ashland, Inc., Jubilant Industries Ltd., and AkzoNobel N.V., among others.

b. Key factors that are driving the market growth include increasing demand for wood based panels, and rising awareness regarding bio based wood adhesives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."