- Home

- »

- Advanced Interior Materials

- »

-

Tantalum Mining Market Size & Share, Industry Report, 2033GVR Report cover

![Tantalum Mining Market Size, Share & Trends Report]()

Tantalum Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Electronics, Aerospace & Defense, Chemical Processing Equipment, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-788-7

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tantalum Mining Market Summary

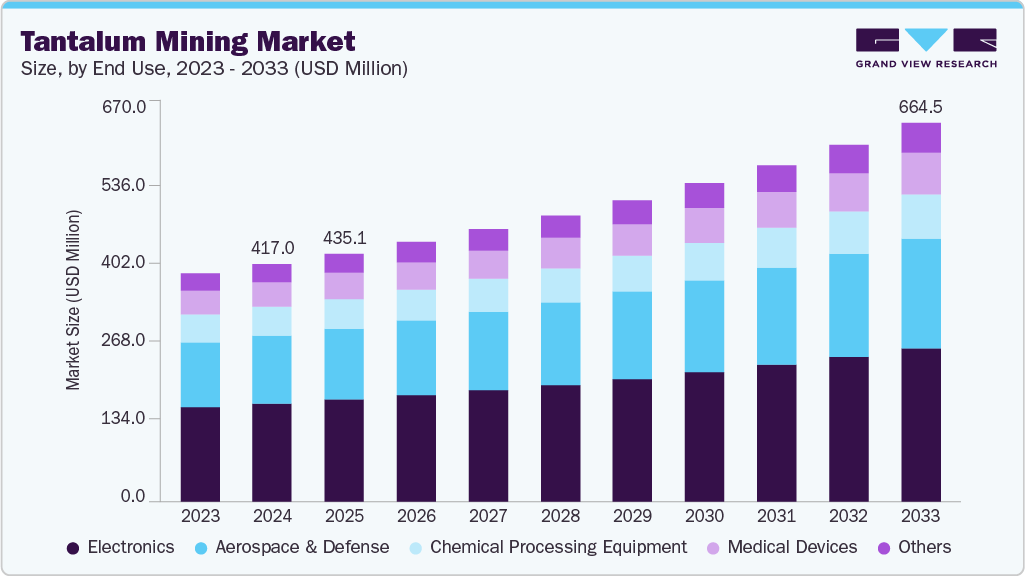

The global tantalum mining market size was valued at USD 417.0 million in 2024 and is projected to reach USD 664.5 million by 2033, growing at a CAGR of 5.4% from 2025 to 2033. Market growth is driven by increasing demand for critical minerals such as tantalum and cobalt and the adoption of sustainable, low-emission extraction technologies.

Key Market Trends & Insights

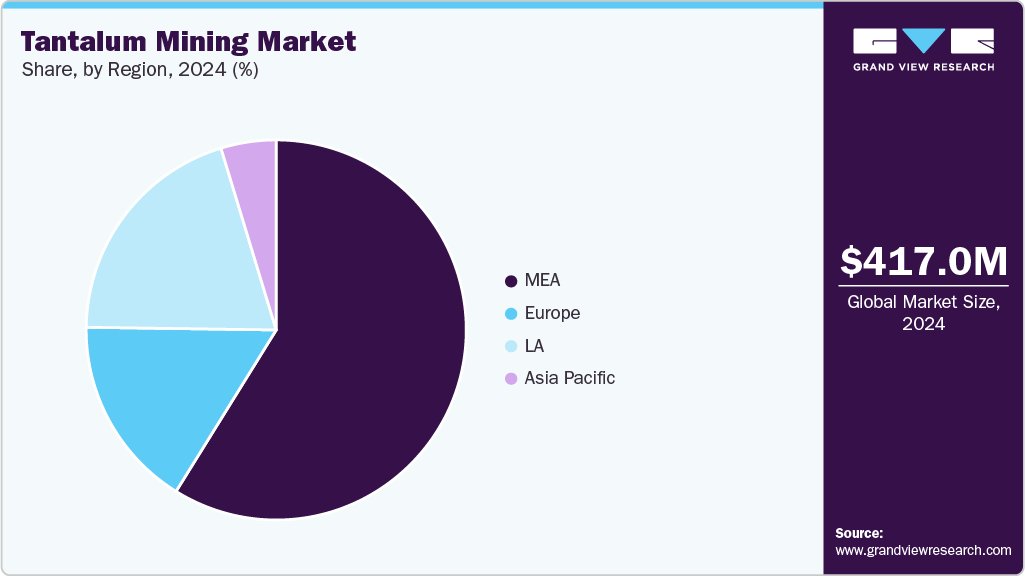

- Middle East & Africa dominated the tantalum mining market with a revenue share of 58.9% in 2024.

- Tantalum mining market in the Asia Pacific is expected to grow at a substantial CAGR of 5.4% from 2025 to 2033.

- By end use, electronics dominated the market with a revenue share of over 41.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 417.0 Million

- 2033 Projected Market Size: USD 664.5 Million

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enhanced waste recycling, improved resource efficiency, and government initiatives to strengthen mineral security and reduce import dependency further support tantalum mining growth. Sustainability is becoming central to the tantalum mining market, with companies and governments emphasizing energy-efficient operations, ethical sourcing, and traceable supply chains to minimize environmental impact. Integrating recycled and secondary materials reduces reliance on virgin ores, enhances resource efficiency, and aligns mining operations with Environmental, Social, and Governance (ESG) standards. These practices position electrochemical processing as a key enabler of sustainable metal production while supporting global environmental targets.

Technological innovations improve process efficiency, lower operational costs, and enable recovery from complex ores and mining waste. Supportive government policies and strategic initiatives to secure critical minerals are accelerating adoption across major regions, including Asia Pacific, North America, and Latin America. As global energy transitions drive increased demand for metals and critical minerals, advanced recycling and processing solutions, particularly electrochemical methods, are emerging as environmentally responsible, commercially viable, and strategically essential for the modern mining industry.

Drivers, Opportunities & Restraints

The global tantalum mining market is driven by the escalating demand for tantalum in high-performance applications such as capacitors, aerospace components, and medical devices. This growth is particularly evident in regions like the Asia Pacific, North America, and Latin America, where advancements in electronics and energy sectors are prominent. Additionally, the rapid growth of electric vehicles and renewable energy technologies is increasing the need for high-purity tantalum in batteries and energy storage systems. Companies like Tesla and Apple are sourcing tantalum for capacitors and miniaturized electronic components, further boosting demand.

Adopting advanced electrochemical processing technologies presents significant opportunities for the tantalum mining sector. These technologies enhance metal recovery from complex ores and mining waste, improving process efficiency and reducing environmental impact. Governments in regions such as Europe and North America provide incentives and strategic support for sustainable mining and critical mineral security, creating investment opportunities. Recycling tantalum from electronic waste also allows companies to lower costs while supporting responsible resource management.

The tantalum mining industry faces challenges related to ethical sourcing and environmental concerns. Mining activities, particularly in the Democratic Republic of Congo (DRC), have been linked to deforestation, soil erosion, and contamination of water sources. Trade of tantalum from conflict zones has raised human rights issues, prompting stronger regulation enforcement to ensure responsible sourcing and mitigate environmental degradation. Strict compliance requirements can increase operational costs and delay project approvals, while reputational risks from conflict-affected sourcing may impact partnerships with global electronics and aerospace companies.

End Use Insights

Electronics remains a leading end use of tantalum due to its critical role in capacitors, high-performance chips, and miniaturized components for smartphones, laptops, and electric vehicles. Rising demand has accelerated the adoption of tailings reprocessing and metal recovery technologies, enabling efficient extraction of valuable metals from mine waste. Companies are also increasingly recycling tantalum from electronic scrap, reducing reliance on virgin ores and minimizing environmental impact.

The aerospace and defense sector heavily relies on tantalum alloys for jet engines, turbine blades, and other high-temperature components. Large-scale mine waste utilization, including overburden and slag, allows conversion into backfill materials, reducing the environmental footprint. Growing demand from aerospace and defense manufacturers is driving sustainable mining practices and advanced metal recovery technologies to ensure a reliable supply while supporting resource efficiency.

Tantalum’s corrosion resistance, biocompatibility, and high melting point make it ideal for chemical processing equipment and medical devices. Water recycling and waste-to-value initiatives enhance operational efficiency and environmental compliance. Increasing adoption of renewable energy technologies, electric mobility, and industrial manufacturing further boosts demand across these end uses, promoting waste reprocessing and secondary metal recovery.

In other industrial and specialized applications, tantalum is used for high-performance alloys, superalloys, and emerging technologies requiring durable and heat-resistant materials. ESG-aligned practices and government incentives encourage responsible mining and transparent supply chains. Integrating advanced electrochemical processing and recycling technologies ensures long-term resource security and positions tantalum mining as sustainable, resilient, and commercially viable.

Regional Insights

Asia Pacific Tantalum Mining Market Trends

Asia Pacific continues to lead the global tantalum and electrochemical processing markets, driven by rapid industrialization, increasing energy transition demands, and strong government support for strategic mineral reserves. Countries such as China, India, and South Korea actively invest in electrochemical processing infrastructure to secure domestic supplies of critical minerals like lithium, cobalt, and rare earth elements. These efforts enhance supply chain security and promote sustainable extraction and processing practices in line with regional and global environmental standards.

However, concerns over rising processing fees and operational costs have emerged in countries like Japan, South Korea, and Spain, highlighting the need for more efficient and cost-effective mining and processing technologies to maintain competitiveness in the global market.

Europe Tantalum Mining Market Trends

Europe is accelerating the development of electrochemical processing capabilities to support its green energy transition and reduce dependence on external sources of critical minerals. The European Union has launched 47 strategic projects across 13 countries focused on extracting, processing, and recycling essential metals, including aluminium, lithium, and rare earth elements.

These initiatives aim to enhance regional resource self-sufficiency, foster sustainable mining and processing practices, and strengthen the competitiveness of Europe’s clean energy, defense, and high-tech industries. Improved materials management-including reduction, reuse, and recovery measures-could help the EU industry reduce between 189 and 231 million tonnes of CO₂ equivalent annually, reinforcing Europe’s commitment to low-carbon, sustainable, and resource-efficient operations.

Middle East & Africa Tantalum Mining Market Trends

The Middle East and Africa regions are witnessing growing investment in tantalum mining and processing, driven by rising global demand for critical minerals in energy, defense, and high-tech sectors. Countries such as Rwanda, Nigeria, and the Democratic Republic of Congo (DRC) are expanding mining operations while promoting responsible sourcing practices to comply with ESG standards.

Advanced electrochemical processing and tailings reprocessing are gaining traction in the region to improve metal recovery, reduce environmental impact, and increase operational efficiency. Strategic partnerships with global mining firms and supportive government initiatives are helping the region enhance supply chain reliability, strengthen sustainable mining practices, and ensure long-term resource security.

Key Tantalum Mining Company Insights

Some of the key players operating in the market include Advanced Metallurgical Group N.V., H.C. Starck Solutions, Mineracao Taboca S.A., and Others.

-

Advanced Metallurgical Group N.V. (AMG), established in 2002 and headquartered in Amsterdam, Netherlands, is a global supplier of specialty metals, including tantalum. The company focuses on sustainable extraction and refining processes, emphasizing recycling, energy efficiency, and high-purity metal production for electronics, aerospace, and chemical industries. AMG invests in research to improve metal recovery rates and minimize environmental impact across its global operations.

-

H.C. Starck Solutions GmbH, established in 1920 and headquartered in Goslar, Germany, is a leading producer of refractory metals, including tantalum and niobium. The company specializes in advanced materials and powder metallurgy solutions for electronics, aerospace, and medical applications. H.C. Starck emphasizes environmentally responsible mining practices, material recycling, and high-quality refining processes to ensure sustainable supply chains.

-

Mineracao Taboca S.A., established in 1987 and headquartered in São Paulo, Brazil, is a major producer of tantalum concentrates from coltan ores. The company focuses on ethical sourcing, environmentally sustainable mining practices, and community engagement in mining regions. Mineracao Taboca invests in modern extraction and processing technologies to enhance recovery efficiency and reduce ecological impact while supplying tantalum to global high-tech industries.

Key Tantalum Mining Companies:

The following are the leading companies in the tantalum mining market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Metallurgical Group N.V.

- Avalon Advanced Materials Inc.

- Coltan Mining Limited

- Global Advanced Metals Pty Ltd

- Liontown Ltd

- Mineracao Taboca S.A.

- Ningxia Orient Tantalum Industry Co., Ltd.

- Pilgangoora Minerals Ltd.

- Pilgangoora Minerals Ltd.

- Tancomine

Recent Developments

-

In March 2025, AMG Advanced Metallurgical Group announced the commissioning of a new tantalum recycling facility in Germany. The facility focuses on recovering high-purity tantalum from electronic waste and scrap materials, reducing dependency on mined ore, lowering energy consumption, and supporting sustainable and resource-efficient practices in the specialty metals sector.

-

H.C. Starck Solutions GmbH, in June 2025, launched an upgraded tantalum refining process at its German plant that minimizes chemical waste and enhances metal recovery rates by 15%. The initiative improves production efficiency, reduces environmental footprint, and supports sustainable sourcing for high-tech industries.

-

Mineracao Taboca S.A., in January 2025, began implementing an advanced tailings management system at its Brazilian coltan mines. The system reprocesses tailings to recover residual tantalum, reduces land use for storage, lowers environmental impact, and extends the operational life of its mining sites while supporting ethical and sustainable mining practices.

Tantalum Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 435.1 million

Revenue forecast in 2033

USD 664.5 million

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use and region

Regional scope

Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

Germany; France; UK.; Italy; China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

Advanced Metallurgical Group N.V.; Avalon Advanced Materials Inc.; Coltan Mining Limited; Global Advanced Metals Pty Ltd; Liontown Ltd; Mineracao Taboca S.A.; Ningxia Orient Tantalum Industry Co., Ltd.; Pilgangoora Minerals Ltd.; Tancomine

Market definition

The tantalum mining market represents the total revenue generated from the extraction, processing, and sale of tantalum-bearing ores. Market revenue is calculated by multiplying the total production volume (in tons) by the average selling price (per ton) of tantalum during a specific period.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tantalum Mining Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global tantalum mining market report by end use and region.

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Electronics

-

Aerospace & Defense

-

Chemical Processing Equipment

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tantalum mining market size was estimated at USD 417.0 million in 2024 and is expected to reach USD 435.1 million in 2025.

b. The global tantalum mining market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033, reaching USD 664.5 million by 2033.

b. By end use, electronics dominated the market with a revenue share of over 41.0% in 2024.

b. Some of the key vendors in the global tantalum mining market are Advanced Metallurgical Group N.V. (AMG), Almonty Industries Inc., ASM International N.V., Global Advanced Metals Pty Ltd, H.C. Starck Solutions GmbH, Metallurgical Products India Pvt. Ltd., Mineracao Taboca S.A., Ningxia Orient Tantalum Industry Co., Ltd., Pilgangoora Minerals Ltd., and Ulba Metallurgical Plant JSC.

b. The global tantalum mining market is driven by rising demand for tantalum in electronics, aerospace, and high-tech industries, along with the adoption of sustainable mining and recycling practices. Government initiatives promoting mineral security and resource efficiency further support market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.