- Home

- »

- Advanced Interior Materials

- »

-

Tappet Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Tappet Market Size, Share & Trends Report]()

Tappet Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Flat Tappet, Roller Tappet), By End Use (Heavy Commercial Vehicles, Light Duty Commercial) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-361-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tappet Market Summary

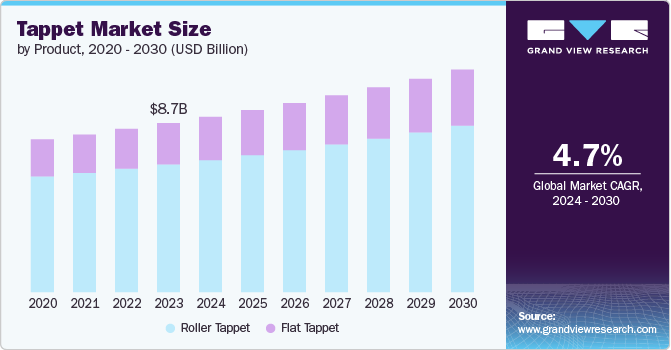

The global tappet market size was estimated at USD 8.69 billion in 2023 and is projected to reach USD 11.43 billion by 2030, growing at a CAGR of 3.5% from 2024 to 2030. Tappets play a critical role in internal combustion engines, where they facilitate the precise operation of valves by translating the rotational motion of the camshaft into a vertical movement to open and close engine valves at the correct timing.

Key Market Trends & Insights

- Asia Pacific dominated the market with the highest revenue share of 45.8% in 2023.

- Based on product, flat tappet is forecasted to grow at a significant CAGR from 2024 to 2030.

- Based on end use, light duty vehicles dominated the tappet market in 2023 with a revenue share of 71.43%.

Market Size & Forecast

- 2023 Market Size: USD 8.69 Billion

- 2030 Projected Market Size: USD 11.43 Billion

- CAGR (2024-2030): 3.5%

- Asia Pacific: Largest market in 2023

The automotive sector remains the primary driver of the market. As global demand for automobiles continues to rise, particularly in emerging economies, there is a proportional increase in the need for engine components like tappets, also known as cam followers or valve lifters. These are crucial in controlling valve operation, ensuring precise timing and efficient engine performance. With advancements in vehicle design focusing on fuel efficiency, emission reduction, and performance enhancement, there is a growing demand for high-quality tappets that meet these stringent requirements.

The transportation industry is witnessing growth due to the rising population and increasing per capita income, leading to rising demand for transportation facilities. The demand for niche and luxury cars is also rising due to changing consumer preferences and interests. Moreover, consumers are inclined toward vehicles with variations in shapes, automobile bodies, and styles. This has led to technological developments in the manufacturing of different types of vehicles, which, in turn, act as a growth driver for the transportation industry.

Moreover, continuous innovation in engine technology is another factor influencing market growth. Modern engines increasingly adopt variable valve timing (VVT) and cylinder deactivation technologies, which require more sophisticated and durable tappets. These advancements aim to improve engine efficiency and power output and reduce emissions, necessitating tappets capable of precise and reliable operation under varying conditions.

Beyond automotive applications, tappets are essential in various industrial machinery such as generators, agricultural equipment, construction machinery, and marine engines. The expanding industrial sectors, driven by infrastructure development, agriculture mechanization, and industrial automation, contribute to the demand for robust, high-performance tappets. Industrial applications often require tappets that can endure heavy-duty operations and harsh environments, further boosting market growth.

Product Insights

Based on product, flat tappet is forecasted to grow at a significant CAGR from 2024 to 2030. This is influenced by several factors rooted in their crucial role within internal combustion engines and industrial applications. Flat tappets are generally simpler and more cost-effective to manufacture compared to their roller counterparts. This affordability makes them attractive for a wide range of applications, particularly in engines where cost considerations are paramount, such as in budget-friendly vehicles, entry-level industrial machinery, and aftermarket replacements. These are versatile and find applications in various internal combustion engines, including gasoline and diesel engines across automotive, industrial, marine, and agricultural sectors. Their ability to function effectively in different engine designs and configurations contributes to their widespread adoption and sustained demand in the market.

Roller tappets dominated the market with the largest revenue share in 2023. While roller tappets offer benefits in high-performance and specialized applications, technological advancements in metallurgy and surface treatments have bolstered the performance of flat tappets. Improved materials and surface hardening techniques enhance wear resistance and reduce friction, extending service intervals and enhancing overall engine efficiency.

End Use Insights

Based on end use, light duty vehicles dominated the tappet market in 2023 with a revenue share of 71.43%. This is expected to grow at the highest CAGR of 3.6% from 2024 to 2030. Modern light-duty vehicles are increasingly designed to meet stringent fuel efficiency and emissions standards. Tappets are crucial in achieving these goals by ensuring precise valve timing and operation. Proper valve timing facilitated by tappets enhances combustion efficiency, reduces emissions, and improves overall engine performance, aligning with regulatory requirements and consumer expectations. Advances in engine technology have led to the development of more sophisticated valve control systems, such as variable valve timing (VVT) and variable valve lift (VVL). These systems rely on precise tappet operation to adjust valve timing and lift according to engine load and speed conditions.

As automakers continue to innovate towards more efficient and responsive engines, the demand for tappets capable of supporting these technologies grows correspondingly. The global demand for light-duty vehicles, particularly in emerging markets and regions experiencing economic growth, continues to rise. As more consumers worldwide gain access to personal transportation, the production and sales of light-duty vehicles correspondingly increase. This growth drives the demand for tappets as essential components in engines powering these vehicles.

Regional Insights

North America is expected to grow significantly over the forecast period. This region has a robust automotive manufacturing base, with the United States, Canada, and Mexico collectively producing millions of vehicles annually. The region's automotive sector is characterized by a diverse market that includes passenger cars, light trucks, SUVs, and commercial vehicles. Tappets are essential components in these vehicles, supporting engine efficiency, emissions control, and overall performance. As consumer demand for new vehicles remains steady and fleet replacement cycles continue, the demand for tappets as integral engine components remains high.

U.S. Tappet Market Trends

The tappet market in the U.S. dominated North America, with the largest revenue share in 2023. Regulatory standards set by federal agencies such as the Environmental Protection Agency (EPA) and state authorities mandate stringent emissions and fuel efficiency requirements for vehicles and industrial equipment in the U.S. Tappets contribute to compliance with these regulations by optimizing valve timing and operation, thereby enhancing engine efficiency and reducing emissions. Manufacturers must integrate these to meet regulatory standards to market compliant vehicles and equipment, fostering demand for advanced tappet technologies.

Europe Tappet Market Trends

The tappet market in Europe is forecasted to grow lucratively during the forecast period. European consumers and manufacturers prioritize quality, reliability, and performance in automotive and industrial applications. Tappet manufacturers must adhere to stringent quality standards and regulatory requirements to meet market expectations. Innovations in tappet design, materials, and manufacturing processes are driven by the need to deliver products that enhance engine performance, reduce maintenance costs, and comply with regulatory standards.

Asia Pacific Tappet Market Trends

The tappet market in Asia Pacific dominated with the highest revenue share of 45.8% in 2023 and is forecasted to grow at the highest CAGR of 3.8% from 2024 to 2030. Asia Pacific region is a key driver of global automotive production and sales, with countries like China, Japan, India, and South Korea leading. As the middle class expands and urbanization accelerates, there is a rising demand for personal vehicles, including passenger cars, motorcycles, and commercial vehicles. Tappets are essential in these vehicles, supporting efficient engine operation and compliance with emissions standards. The vehicle production and sales growth in Asia-Pacific drives demand for tappets as integral engine components.

Key Tappet Company Insights

Some key players operating in the market include Schaeffler Technologies AG & Co. KG and OTICS Corp.

-

Schaeffler Technologies AG & Co. KG is a German multinational company that produces bearings and automotive components. This company operates globally with divisions in automotive and industrial technologies and an aftermarket segment. It specializes in precision engineering and offers bearings, engine components, transmissions, and solutions for electric mobility and industrial applications.

-

OTICS Corp is involved in producing automotive components focusing on optical devices like sensors and camera modules for ADAS and autonomous driving. They also manufacture precision components for industrial applications. The company operates globally with manufacturing facilities, research and development centers, and sales offices in key markets worldwide.

Federal-Mogul LLC. is one of the emerging market participants.

-

Federal-Mogul LLC is related to the automotive industry and primarily operates in two primary segments: powertrain products and motor parts. This company has a global footprint with manufacturing facilities, distribution centers, and sales offices in various countries, serving original equipment manufacturers (OEMs) and aftermarket customers.

Key Tappet Companies:

The following are the leading companies in the tappet market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton Corporation

- NSK Ltd.

- Schaeffler AG

- Federal-Mogul LLC.

- Rane Engine Valve Limited

- Wuxi Xizhou Machinery Co. Ltd.

- AC Delco

- TRW

- Competition Cams, Inc.

- SKF

Recent Developments

-

In October 2018, Tenneco acquired Federal-Mogul, a leading global supplier of original equipment manufacturers, for USD 5.40 billion.

Tappet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.01 billion

Revenue forecast in 2030

USD 11.43 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Eaton Corporation; NSK Ltd.; Schaeffler AG; Federal-Mogul LLC.; Rane Engine Valve Limited; Wuxi Xizhou Machinery Co. Ltd.; AC Delco; TRW; Competition Cams, Inc.; SKF

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tappet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tappet market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flat Tappet

-

Roller Tappet

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy Commercial Vehicle

-

Light Duty Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global tappet market size was estimated at USD 8.69 billion in 2023 and is expected to reach USD 9.01 billion in 2024.

b. The tappet market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 11.43 billion by 2030.

b. Among product, flat tappet accounted for the largest market in 2023 with a revenue share of 72.2% as simpler and more cost-effective to manufacture compared to their roller counterparts.

b. Some of the key players operating in the tappet market include Eaton Corporation, NSK Ltd., Schaeffler AG, Federal-Mogul LLC., Rane Engine Valve Limited, Wuxi Xizhou Machinery Co. Ltd., AC Delco, TRW, Competition Cams, Inc., SKF

b. The key factor that is driving the Tappet includes the rising demand for automotives and vehicles in the developing countries around the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.