- Home

- »

- Biotechnology

- »

-

Targeted Sequencing And Resequencing Market Report, 2030GVR Report cover

![Targeted Sequencing And Resequencing Market Size, Share & Trends Report]()

Targeted Sequencing And Resequencing Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (NGS, Others), By Workflow, By Application, By Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-031-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

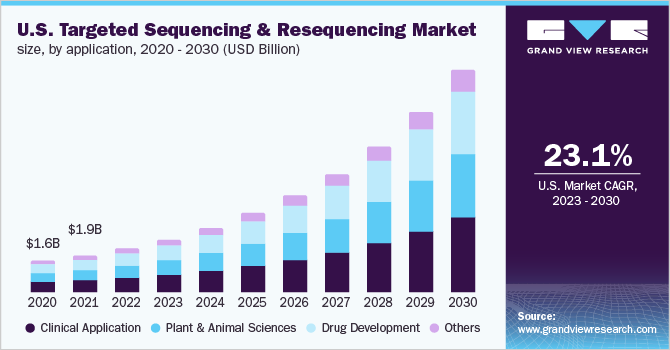

The global targeted sequencing and resequencing market size was valued at USD 5.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.59% from 2023 to 2030. Higher market penetration rate of technologies and the market presence for a relatively longer duration than whole genome sequencing and WES. Moreover, the presence of a significant number of market players involved in providing services for targeted sequencing are some of the factors driving the growth of the market.

The COVID-19 outbreak has impacted the market positively as genome sequencing has been widely used to understand the spread of COVID-19 and has the potential to understand the impact of interventions and help guide treatments in the future. It is a cost-effective and rapid technique used for the detection of a range of variants in selected sets of genomic regions. It offers a proper analysis of results compared to WGS and other survey methods and it avoids the false interpretation of sequencing data.

Furthermore, several companies offer targeted sequencing and resequencing services. For instance, Illumina offers targeted resequencing with the company’s gene panel and array finder, similarly, Pacific Biosciences of California offers Sequel System, SMRT technology that allows the targeted sequencing of variants. Targeted sequencing panels are a cost-effective technology for the provision of clear and actionable information to physicians. These panels are anticipated to continue to remain the mainstay for cancer molecular diagnostics and are expected to become the routine part of solid tumors and hematological malignancies diagnosis.

Growing research and development activities have boosted the demand for targeted sequencing technology in academic and research institutes. Within oncology, NGS was most often found to change the treatment paradigm in breast, lung, and hematologic malignancies, along with having an increasing impact on skin and colon cancer treatment workflows. Pathologists indicate a preference for targeted panels, due to greater efficiency and lower costs. The introduction of targeted gene panels for cancerous cells is expected to drive demand in the coming years

Technology Insights

The sequencing segment held 71.54% of the targeted sequencing and resequencing market share in 2022. Sequencing continues to find increasing momentum in several applications as sequencing costs continue to decrease and throughput capability strengthens, more companies are incorporating NGS into clinical applications. Consequently, rapid NGS uptake in the clinical setting is expected to continue in coming years, driven by market opportunities in applications such as liquid biopsy and average risk NIPT. In January 2021, Illumina announced multiple oncology partnerships with Merck, Myriad Genetics, Kura Oncology, and Bristol Myers Squibb to expand the utilization and reach of its TruSight Oncology pan-cancer assay

The re-sequencing segment is projected to witness considerable growth during the forecast period. Targeted methods use next-generation sequencing and enable researchers to focus on expenses, time, and data analysis on certain areas of interest. Such analysis includes mitochondrial DNA, the exome, targets within genes, and specific genes of interest (custom content

Application Insights

The clinical application segment dominated the targeted sequencing and resequencing market in 2022. An increase in the incidence of chronic diseases, such as cancer, infectious diseases, & diabetes, drives the demand for NGS technologies and associated data analysis tools. In August 2022, The Medical Device Innovation Consortium (MDIC) launched Somatic Reference Samples (SRS) Initiative, which aims to validate and develop public genomic datasets and clinically relevant samples to boost NGS-based cancer diagnostics.

The drug development segment is anticipated to witness lucrative growth in the coming years. Several developments by market players have contributed to the segment’s growth. For instance, in September 2022, QIAGEN collaborated with Neuron23 to develop NGS companion diagnostics for Parkinson’s disease drug. Similarly, in September 2022, Predicine, Inc. announced receiving authorization from U.S. FDA for PredicineCARETM cfDNA Assay, an NGS assay for tumor mutation profiling.

Type Insights

DNA-based segment captured the highest targeted sequencing and resequencing market share in 2022. DNA-based targeted sequencing panels are predesigned and contain important genes or gene regions associated with a disease or phenotype. By aiming at the genes which are most likely to be involved, the targeted gene panels conserve resources and reduce data analysis consideration. DNA-based targeted sequencing accounted for a larger share when compared to RNA-based targeted sequencing, owing to the higher usage of targeted gene panels.

RNA-based segment is projected to witness considerable growth during the forecast period owing to rising demand for differential expression analysis. The use of the Amplicon RNA-Seq technology for the targeted RNA sequencing for the diagnosis of Schizophrenia and other disorders can be attributed to the estimated share of the segment.

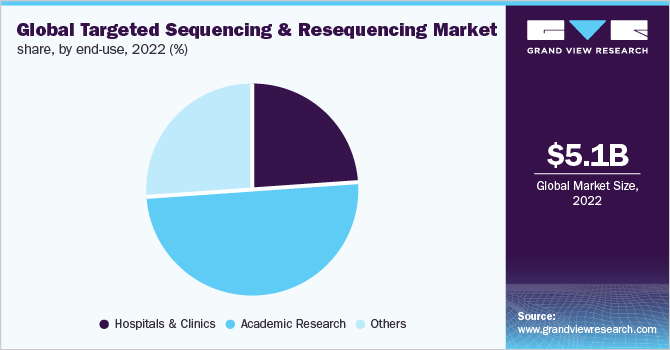

End-use Insights

Academic research segment captured the highest market share of 49.87% in 2022. The application of NGS solutions in research projects that are carried out in universities and research centers can be attributed to the considerable share of this segment. Furthermore, scholarships offered for Ph.D. projects in NGS are anticipated to drive demand for NGS products and services.

Hospitals and clinics segment is anticipated to witness considerable growth owing to the increasing number of patients opting for personalized care. The rise in the adoption of NGS services in hospitals and clinics in order to determine the rate of disease progression and scale up the appropriate treatment regimen for chronic diseases has contributed to the segment’s growth. Provision of clinical services by leading players of the market, such as Illumina, which includes CLIA-certified tests for predisposition screening, molecular diagnostic tests for cystic fibrosis, and postnatal cytogenetics is anticipated to boost revenue in the coming years.

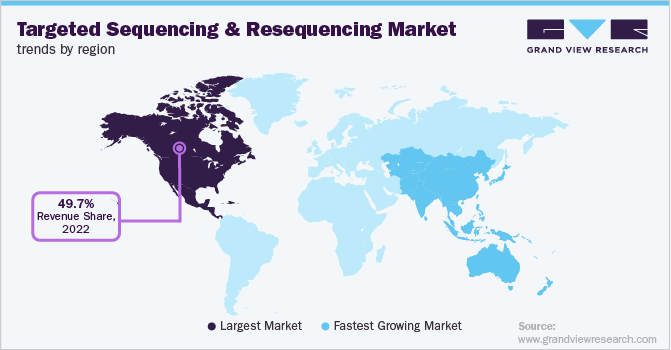

Regional Insights

North America segment dominated the targeted sequencing and resequencing market in 2022, capturing a market share of 49.71%. The presence of market players, such as Illumina, Roche, and Life Technologies, which are involved in the development of rapid and high-throughput sequencing capabilities, has contributed to the region’s market growth. These players are undertaking several strategic initiatives to strengthen their market presence in the country. For instance, in April 2021, Thermo Fisher and Mayo Clinic collaborated to offer novel solutions to patients by accelerating clinical validation and commercialization of selected NGS, immunology diagnostic tools, and mass spectrometry.

The market in Asia Pacific is anticipated to witness the fastest growth rate in the coming years owing to increasing R&D expenditure coupled availability of advanced technology for drug discovery and development. Furthermore, several developments in Japan and China for integrating NGS technologies along with clinical development frameworks of emerging economies such as Australia and India have created significant growth opportunities. In August 2022, Illumina announced of expanding its regional footprint by establishing a new manufacturing unit in China to supply gene sequencing products.

Key Companies & Market Share Insights

Major players operating in the targeted sequencing and resequencing market are entering into several strategic alliances to fuel the adoption of sequencing technologies for research and development activities. For Instance, in March 2022, QIAGEN N.V. collaborated with NHS England and NHS Improvement by providing its Human Gene Mutation Database to interpret NGS data for inherited diseases. The initiative strengthened the company’s market position. Similarly, in September 2021, Illumina, Inc. announced its plans to expand genomics operations in Latin America. The company plans to develop Illumina Colombia S.A.S. & Illumina Mexico and increase its reach to local customers & other stakeholders. Some of the prominent players in the global targeted sequencing and resequencing market are:

-

Agilent Technologies

-

Illumina, Inc.

-

F. Hoffmann-La Roche Ltd

-

Thermo Fisher Scientific, Inc.

-

DNASTAR Inc.

-

PacBio

-

Bio-Rad Laboratories, Inc.

-

Integrated DNA Technologies, Inc.

-

Perkin Elmer, Inc.

-

RainDance Technologies, Inc.

-

PierianDx

-

BGI

-

Genomatix GmbH

-

Macrogen, Inc.

-

GATC Biotech Ag

-

Oxford Nanopore Technologies

-

QIAGEN

Targeted Sequencing And Resequencing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.18 billion

Revenue forecast in 2030

USD 25.7 billion

Growth rate

CAGR of 22.59% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand; South Korea, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies; Illumina, Inc.; F. Hoffmann-La Roche Ltd; GATC Biotech Ag; DNASTAR Inc.; QIAGEN; BGI; Oxford Nanopore Technologies; Thermo Fisher Scientific, Inc.; Perkin Elmer, Inc.; PacBio; RainDance Technologies, Inc.; Bio-Rad Laboratories, Inc.; Integrated DNA Technologies, Inc.; PierianDx; Genomatix GmbH; Macrogen, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Targeted Sequencing And Resequencing Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global targeted sequencing and resequencing market report based on technology, application, type, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing

-

Re-sequencing

-

Electrophoresis-based resequencing

-

NGS

-

Array-based resequencing

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical application

-

Plant and animal sciences

-

Drug development

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA-based targeted sequencing

-

RNA-based targeted sequencing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Academic research

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global targeted sequencing and resequencing market size was estimated at USD 5.08 billion in 2022 and is expected to reach USD 6.18 billion in 2023.

b. The global targeted sequencing and resequencing market is expected to grow at a compound annual growth rate of 22.6% from 2023 to 2030 to reach USD 25.74 billion by 2030.

b. North America dominated the targeted sequencing and resequencing market with a share of 49.71% in 2022. This is attributable to rising adoption of next-generation sequencing services and increasing number of product launches.

b. Some key players operating in the targeted sequencing and resequencing market include Agilent Technologies; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; DNASTAR Inc.; PacBio; Bio-Rad Laboratories, Inc.; Integrated DNA Technologies, Inc.; Perkin Elmer, Inc.; RainDance Technologies, Inc.; PierianDx; BGI; Genomatix GmbH; Macrogen, Inc.; GATC Biotech Ag; Oxford Nanopore Technologies; and QIAGEN

b. Key factors that are driving the market growth include increasing research and development activities, increasing number of product launches, decreasing cost of sequencing, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.