- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Technical Textile Chemicals Market Size, Share Report, 2030GVR Report cover

![Technical Textile Chemicals Market Size, Share & Trends Report]()

Technical Textile Chemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Agrotech, Buildtech, Geotech, Medtech, Miltech, Packtech, Protech, Transtech) By Region, And Segment Forecasts

- Report ID: 978-1-68038-315-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Technical Textile Chemicals Market Trends

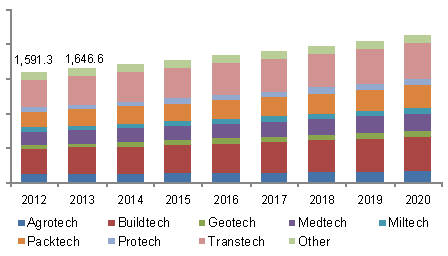

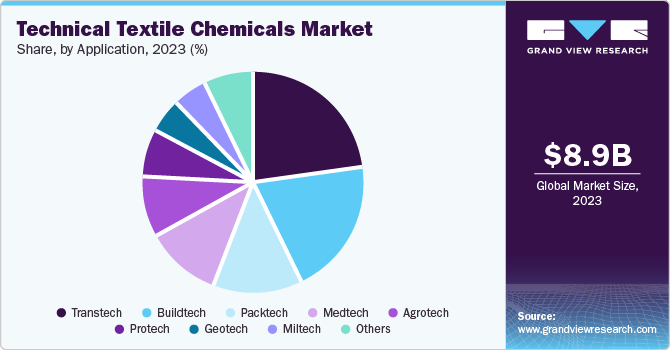

The global technical textile chemicals market size was valued at USD 8.93 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. This growth is driven by the increasing demand for technical textiles, heightened focus on sustainability leading to investments in biodegradable and non-toxic chemicals, and advancements in specialized chemicals with enhanced features due to technological progress.

Rapid urbanization and infrastructure development in emerging economies, including China, India, and Japan, are driving substantial technological advancements across industries, including technical textile chemicals. The integration of Industry 4.0 principles, such as IoT, into manufacturing processes is enabling real-time monitoring, predictive maintenance, and data analytics, leading to more efficient production and cost reductions. Consequently, market demand for technical textile chemicals is on the rise. Additionally, the shift towards digital printing, offering enhanced customization and precision compared to traditional methods, is stimulating demand for products capable of producing vibrant, high-definition patterns.

Application Insights

The transtech application segment dominated the market with a revenue share of 23.0% in 2023 driven by the expanding application scope of transtech textiles across diverse industries, including sports equipment, aerospace, and medical devices. Concurrently, the escalating demand for protective apparel in healthcare, automotive, and industrial sectors is propelling market expansion. Transtech applications, renowned for their chemical resistance, durability, and flame retardancy, are directly addressing these industry needs. Furthermore, the automotive sector’s pursuit of lightweight materials to enhance performance and fuel efficiency is significantly influencing segment dynamics.

The geotech application segment is anticipated to witness the fastest growth at a CAGR of 6.6% over the forecast period from 2024 to 2030 driven by the increasing versatility of geotextiles across various industries. Notably, their application in mining for waste management and agriculture for land reclamation is significantly contributing to market growth. Furthermore, advancements in material science have endowed geotextiles with enhanced properties such as durability, tensile strength, and chemical resistance. These improvements are fostering wider adoption by engineers in critical applications, including drainage systems, soil stabilization, and erosion control.

Regional Insights

North American technical textile chemical market is anticipated to grow at a CAGR of 4.4% from 2024 to 2030. Key drivers propelling market expansion include robust economic growth and urbanization within the region, stimulating construction and infrastructure development, and consequently increasing demand for advanced chemicals. Additionally, the broadening applications of these products across diverse industries are significantly shaping market dynamics.

U.S. Technical Textile Chemicals Market Trends

The U.S. technical textile chemicals market dominated the North American market in 2023 due to shifting consumer preferences towards eco-friendly products that lead to stringent environmental regulations, which increase the adoption of biodegradable materials. Additionally, growing smart textiles with electronic features require chemical treatments for maintenance and enhancing their performance thus growing the demand for the products in the market.

Canada technical textile chemicals market is expected to grow significantly from 2024 to 2030. The growth of the market is influenced by consumer awareness of safety, environmental considerations, and health impacts regarding textile products thus increasing the demand for innovative products to suit their choices. Moreover, the growing demand for technical textiles in various industries such as agriculture, health, and other industries is also increasing the demand for the products.

Europe Technical Textile Chemicals Market Trends

Europe technical textile chemicals market is expected to grow at a significant growth rate over the forecast period. The factors that have impacted the growth of the market in the region are the competitive nature of the market that brings innovation in the products with enhanced feature offerings thus appealing to the consumers to buy and growing the market in the region. Increasing R&D funding with government support is also driving the market.

The UK technical textile chemicals market is projected to witness steady growth in the coming years. This growth is driven by many factors, such as increasing demand from several industries, technological improvement, supportive policies that include aspects of sustainability, an enhanced economy implying increased spending, and the growth of various industries such as health care and international trade.

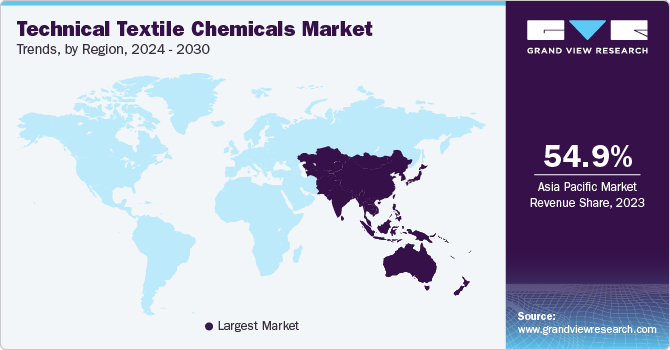

Asia Pacific Technical Textile Chemicals Market Trends

Asia Pacific technical textile chemicals market dominated the market share with 54.9% in 2023. The factors for the growth of the market are attributed to the growth in urbanization, broadening industrial usage across various industries, the introduction of new technologies to improve the products, involving environment-friendly chemicals, with increased economic growth resulting in elevated purchasing power, government incentives encouraging technical textile chemicals market R&D’s, and the global trade liberalization that helps in easy market entry and investment for Asia Pacific technical textile chemicals market.

China technical textile chemicals market held a 68.6% market share in Asia Pacific in 2023 owing to factors such as tendencies of urbanization, government support, technologic development, initiatives focused on sustainability, versatility of technical textiles applications, customers’ awareness, global supply chain, as well as investments in the development of new materials are considered as the key driving forces of China market for technical textile chemicals.

Technical textile chemicals market in Japan is expected to witness significant growth from 2024 to 2030.Key drivers propelling this expansion include technological advancements, escalating consumer demand for functional textiles, and a regulatory environment increasingly focused on sustainability. The market is further boosted by growth across diverse industries utilizing technical textiles, evolving urbanization patterns, rising disposable incomes, and the influence of social media on fashion trends.

Key Technical Textile Chemicals Company Insights

Some of the key companies in the technical textile chemicals market include Dow, Lubrizol, BASF SE, Archroma, and many other companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Dow is a global materials science company offering various solutions in many segments and industries; it is relevant in the technical textile chemical market. Specialties include performance coatings, adhesives, and specialty chemicals used in automotive, protective industrial wear apparel, and other industrial uses including home textiles.

-

BASF SE is a Germany-based multinational chemical company that offers a variety of products and services, including technical textile chemicals. The company provides solutions for textile auxiliaries, functional coatings, and special additives to improve the performance and durability of textile materials and satisfy the growing needs and expectations of today’s consumers for sustainable and high-performing textiles.

Key Technical Textile Chemicals Companies:

The following are the leading companies in the technical textile chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- DyStar Singapore Pte Ltd

- The Lubrizol Corporation

- Dow

- Huntsman International LLC.

- Kiri Industries Ltd.

- Solvay

- Tetra Laval International S.A.

- Archroma

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Evonik Industries AGt

Recent Developments

-

In January 2024, Archroma, a color and specialty chemicals company, renewed its long-term partnership with SANITIZED AG. This strategic alliance underscores the companies' continued collaboration and achievements within the textile industry.

-

In June 2024, Globe Textiles India Ltd. acquired Globe Denwash Pvt Ltd. Globe Denwash's zero liquid discharge (ZLD) facility and Zero Discharge of Hazardous Chemicals (ZDHC) certification align with its focus on sustainability and environmental responsibility.

Technical Textile Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.40 billion

Revenue forecast in 2030

USD 12.43 billion

Growth Rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Tons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Brazil, Argentina

Key companies profiled

DyStar Singapore Pte Ltd; The Lubrizol Corporation; Dow; Huntsman International LLC.; Kiri Industries Ltd.; Solvay; Archroma; BASF SE; Sumitomo Chemical Co., Ltd.; Evonik Industries AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Technical Textile Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global technical textile chemicals market report based on application and region.

-

Application Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

Agrotech

-

Buildtech

-

Geotech

-

Medtech

-

Miltech

-

Packtech

-

Protech

-

Transtech

-

Others

-

-

Regional Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.