- Home

- »

- Next Generation Technologies

- »

-

Technical And Vocational Education Market Size Report 2030GVR Report cover

![Technical And Vocational Education Market Size, Share & Trends Report]()

Technical And Vocational Education Market (2025 - 2030) Size, Share & Trends Analysis Report By Course (STEM, Non-STEM), By Learning Mode (Online, Offline), By Organization, By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-989-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Technical And Vocational Education Market Summary

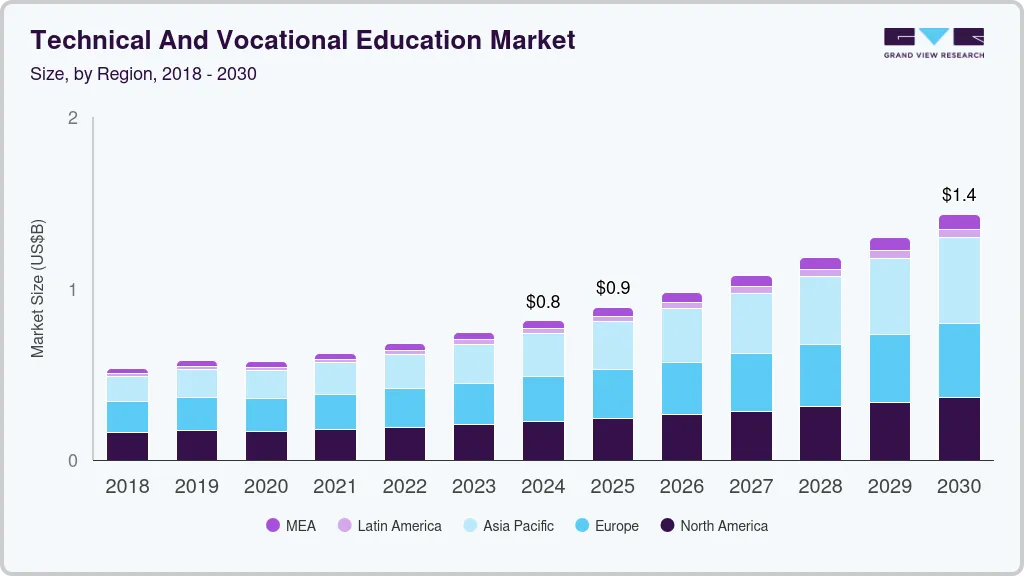

The global technical and vocational education market size was estimated at USD 812.3 billion in 2024 and is projected to reach USD 1,432.9 billion by 2030, growing at a CAGR of 10.0% from 2025 to 2030. Factors such as rapid technological advancements, increased AI-based education, and easy accessibility of technical & vocational education are driving the market growth.

Key Market Trends & Insights

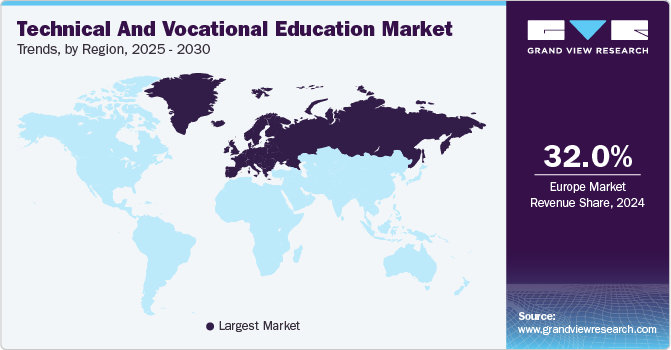

- The technical and vocational education market in Europe dominated in 2024 with a revenue share of over 32%.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- By course type, the STEM education segment led the market in 2024, accounting for over 78% share of the global revenue.

- By learning mode, the offline segment dominated the market in 2024 with the largest revenue share.

- By organization, the public institution segment dominated the market in 2024 with the largest revenue share in the market.

Market Size & Forecast

- 2024 Market Size: USD 812.3 Billion

- 2030 Projected Market Size: USD 1,432.9 Billion

- CAGR (2025-2030): 10.0%

- Europe: Largest market in 2024

In addition, technical and vocational education encourages skill-based learning and contributes to a better literacy rate globally.

Innovations such as AI, VR, and AR are revolutionizing vocational training delivery, making it more interactive and immersive. AI-driven platforms enable personalized learning experiences by adapting content to individual needs and can track the progress of each learner, enhancing the effectiveness of training programs. VR and AR technologies provide realistic simulations that allow learners to practice skills in a virtual environment, bridging the gap between theoretical knowledge and practical application.

The ease of accessibility in TVE is a crucial driver of market growth, as it broadens the reach and inclusivity of these programs. Advancements in digital technology have significantly enhanced the accessibility of TVE, allowing learners from diverse geographical locations and socio-economic backgrounds to access high-quality educational resources and training programs. Online platforms, virtual classrooms, and mobile learning applications have revolutionized the delivery of TVE, enabling flexible learning schedules that cater to working professionals, students in remote areas, and individuals with other commitments.

Identifying the crucial role of AI in driving inclusive economic growth has become vital for advancing both businesses and careers. To support this, organizations across the globe are launching AI-focused programs. For instance, in February 2024, the AI TEACH for Indonesia initiative was introduced to promote vocational education in the country. As part of a broader regional initiative and in partnership with the ASEAN Foundation, the AI TEACH for Indonesia program aims to equip 5,000 TVET educators across the country with advanced AI skills. This program partners with labor organizations, local non-profits, and government bodies to ensure that educators receive comprehensive AI training. They will then extend this training to 300,000 vocational school students, aiming to certify at least 60,000 of them.

Course Type Insights

The STEM education segment led the market in 2024, accounting for over 78% share of the global revenue. The segment growth can be attributed to the growing emphasis on STEM education across all levels of schooling as part of the efforts to address the increasing demand for STEM professionals. Educational reforms are prioritizing STEM subjects and incorporating hands-on, project-based learning to enhance student engagement. Initiatives aimed at early exposure to STEM concepts are helping build foundational skills and interest in these fields from a young age. As such, schools and institutions are expanding their STEM curricula to include emerging technologies and interdisciplinary approaches to prepare students for careers in high-demand STEM fields.

The non-STEM segment is predicted to foresee significant growth in the coming years. The growth of the segment can be attributed to the increasing recognition of the importance of practical skills across various industries and industry verticals and the subsequent emphasis on non-STEM education. Non-STEM vocational programs are gaining traction as they provide pathways to employment in areas critical to economic growth, such as healthcare, culinary arts, and construction. This trend indicates a broader acceptance of vocational education as a viable alternative to conventional education, emphasizing the value of hands-on experience and skill acquisition.

Learning Mode Insights

The offline segment dominated the market in 2024 with the largest revenue share. Technical and vocational education is mostly skill-based education that requires the physical presence of the students. Courses such as welding technology, interior designing, and printing technology, among others, require the physical presence of students. Such courses are non-effective without offline or physical learning. It is necessary to either have physical/offline learning or blended learning to provide a dynamic classroom experience and achieve results of technical and vocational education and training.

The online segment is predicted to foresee significant growth in the coming years. The preference for online TVE programs is increasing as learners seek flexible and accessible education options. Online learning allows students to balance their studies with work and other commitments, making it a popular choice for many. Online education is particularly appealing for those looking to gain specific skills or certifications without the need for conventional classroom attendance. The demand for online TVE programs is growing as the trend of remote working continues to gain traction, allowing learners to reskill or upskill in various domains at their convenience. Hence, academic institutions are expanding their online TVE offerings to meet evolving needs and accommodate diverse learner preferences.

Organization Insights

The public institution segment dominated the market in 2024 with the largest revenue share in the market. Technical and vocational education is largely provided by public institutions. Germany and France, among several other countries, have free public institutions for vocational education. Countries such as the U.S. and Canada have a high penetration of vocational education in public schools. Public institutions have fewer fees compared to private institutions. Thus, these institutions play an important role in providing access to skills for the underprivileged and from the rural areas, and provide them the education for bridging the skill gap. Several countries have associations for vocational education.

The private institution segment is anticipated to witness significant growth in the coming years. Private institutions are adopting innovative teaching methods, such as using e-learning platforms and Virtual Reality (VR)/Augmented Reality (AR)-driven interactive simulations, to complement conventional teaching methods, enhance the learning experience, and improve student outcomes. AR/VR-based learning solutions help provide students with immersive learning experiences and develop practical skills in a dynamic environment. As such, the incorporation of innovative teaching methods reflects the broader drive being pursued by private TVE institutions to offer modern and effective educational solutions, allowing them to differentiate themselves in the competitive market.

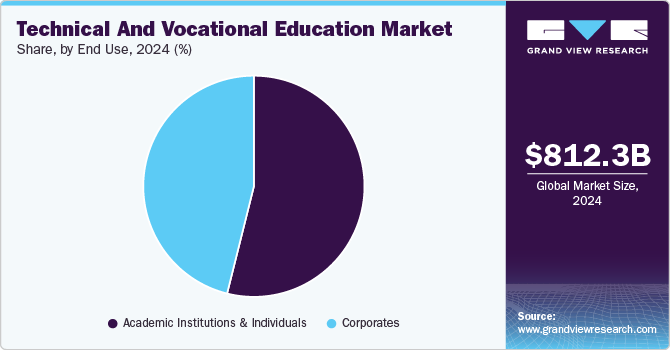

End Use Insights

The academic institutions & individuals segment dominated the market in 2024. The growth of the segment can be attributed to the growing emphasis on practical skills and workforce readiness. Employers are increasingly prioritizing candidates possessing hands-on experience and relevant skills, leading to a shift from theoretical knowledge to practical application. This trend is particularly evident in industries such as healthcare, construction, and hospitality, where specific skill sets are essential for job performance. Academic institutions are responding to the evolving trend by enhancing their curricula to include more experiential learning opportunities, such as internships and apprenticeships, which provide students with real-world experience. As such, the emphasis on practical skills is driving the development of vocational programs that better prepare individuals for the changing demands of the job market.

The corporate workers segment is anticipated to exhibit a significant CAGR over the forecast period. The growth of the segment can be attributed to increasing focus on learning technical and vocational skills and acquiring certifications. Corporate workers have realized that employers are increasingly valuing certifications to validate the skills and competencies of employees and gauge their credibility in the job market. This trend is driving the demand for vocational training programs that help workers build their professional profiles and acquire recognized certifications. The emphasis on continuous learning is fostering a culture of lifelong education, encouraging employees to pursue ongoing skill development to adapt to changing industry demands.

Regional Insights

The technical and vocational education market in the North America region is expected to witness significant growth over the forecast period. Various factors are driving the growth of the TVE market in the region, such as technological advancements, government initiatives and policies, economic growth, and demand for skilled force. In addition, there is a growing need for skilled workers in various industries, such as healthcare, technology, construction, and manufacturing. TVE provides the practical skills and training required to fill these positions.

U.S. Technical And Vocational Education Market Trends

The U.S. technical and vocational education market held a dominant position in 2024 in the North American region. The U.S. houses leading universities and research institutions, fostering innovation and research in the TVE market. Moreover, the growing EdTech industry provides advanced tools and resources to enhance technical and vocational learning experiences. Companies are undertaking strategic initiatives to stay competitive in the market.

Europe Technical And Vocational Education Market Trends

The technical and vocational education market in Europe dominated in 2024 with a revenue share of over 32%. The European Union (EU) supports vocational education through various programs and funding initiatives, such as Erasmus+ and the European Social Fund (ESF). These programs promote mobility, cooperation, and modernization of vocational training systems across member states. In addition, various countries such as Germany, Switzerland, and Austria have well-established dual education systems that blend classroom learning with on-the-job training. These systems are highly effective in providing practical skills and improving employability.

Asia Pacific Technical And Vocational Education Market Trends

The technical and vocational education market in the Asia Pacific region is anticipated to register a significant CAGR over the forecast period. Factors such as advanced innovations, including the hybrid model, rapidly growing technological advancements, rising awareness about vocational training, and peer-to-peer learning to bridge the gap between education and job requirements are propelling industry growth.

Key Technical And Vocational Education Company Insights

Some key players in the technical and vocational education market, such as Coursera Inc., Udacity Inc., and Adobe Inc., are driving innovation by offering cutting-edge, skill-based learning solutions. These companies lead the market by integrating advanced digital tools, ensuring their platforms remain competitive and aligned with industry trends. With a focus on providing up-to-date, practical education, they enable learners to acquire essential skills that meet the evolving demands of the workforce. This approach has significantly increased the demand for educational solutions across industries, particularly as businesses seek specialized training to upskill their employees.

-

Coursera Inc. offers a broad array of technical and vocational courses, ranging from data science, AI, and cybersecurity to healthcare and business management. This diversity allows learners from various fields to gain skills that are directly applicable to industries with high demand for specialized technical expertise.

-

Udacity, Inc.’s programs are centered on emerging technologies and skills that are crucial for the modern workforce. By focusing on in-demand technical areas, the platform addresses skill gaps in sectors such as software development, autonomous systems, and digital marketing, making it suitable for learners and employers.

Key Technical And Vocational Education Companies:

The following are the leading companies in the technical and vocational education market. These companies collectively hold the largest market share and dictate industry trends.

- Acumatica, Inc.

- Adobe Inc.

- Amazon Web Services, Inc.

- Articulate Global LLC

- Babcock International Group PLC

- CEGOS

- Coursera Inc.

- International Business Machine Corp. (IBM)

- learndirect

- Pearson

- TUV Rheinland

- Udacity, Inc.

Recent Developments

-

In July 2024, Acumatica, Inc. announced to broaden a scheme designed to equip digital-native students with workforce readiness through college-level courses. The Acumatica College Education Program is focused on offering hands-on practical experience using the Acumatica Cloud ERP solution. This extensive course provides learners with a thorough insight into the principles of ERP systems and their fundamental operations. Leveraging a Learning Management System (LMS) and Acumatica ERP, the program offers a comprehensive online learning environment that encompasses textual content, video materials, customer case studies from Acumatica, and direct interaction with the Acumatica Cloud ERP software for practical application.

-

In June 2024, Babcock announced a strategic partnership with the Air and Space Institute (ASI) in the UK to enhance educational experiences and career opportunities for ASI students through practical aviation industry insights and hands-on experience. This partnership, launched with a visit to RAF Wittering, aims to provide students with access to industry knowledge and potential employment or apprenticeship pathways in aviation.

-

In April 2024, Amazon Web Services collaborated with employers, academic institutions, and governments in Brazil and Colombia through the Skills to Jobs Tech Alliance initiative. It addresses the tech talent gap by aligning curricula with industry demands. This initiative equips learners with in-demand skills and increases diversity in the tech workforce, particularly through programs such as AWS Women in Cloud, ensuring a robust pipeline of job-ready talent.

Technical And Vocational Education Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 890.48 billion

Revenue forecast in 2030

USD 1,432.94 billion

Growth Rate

CAGR of 10.0% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Course type, learning mode, organization, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Acumatica, Inc.; Adobe Inc.; Amazon Web Services, Inc.; Articulate Global LLC; Babcock International Group PLC; CEGOS; Coursera Inc.; International Business Machine Corp.; learndirect; Pearson; TUV Rheinland; Udacity, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Technical And Vocational Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global technical and vocational education market report based on course, learning mode, organization, end use, and region.

-

Course Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

STEM

-

Non-STEM

-

-

Learning Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Organization Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public

-

Private

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Academic Institutions & Individuals

-

Corporates

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global technical and vocational education market size was estimated at USD 812.33 billion in 2024 and is expected to reach USD 890.48 billion in 2025.

b. The global technical and vocational education market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2030 to reach USD 1,432.94 billion by 2030

b. Europe dominated the technical and vocational market with a share of 32.1% in 2024. This is attributable to the increasing awareness regarding vocational education in the region. Europe’s technical and vocational systems are supported by a strong network of collaborators in the field of vocational education. Social partners, including businesses and labor unions, are involved in the governance of these networks through a variety of chambers, committees, and councils

b. Some key players operating in the technical and vocational education market include Acumatica, Inc.; Adobe Inc.; Amazon Web Services, Inc.; Articulate Global LLC; Babcock International Group PLC; CEGOS; Coursera Inc.; International Business Machine Corp. (IBM); learndirect; Pearson; TUV Rheinland; and Udacity, Inc.

b. Key factors that are driving the market growth include the rapid adoption of vocational education globally, increasing focus on skill-based learning, and increasing technologies in the education system

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.