- Home

- »

- Semiconductors

- »

-

Telecom Electronic Manufacturing Services Market Report, 2030GVR Report cover

![Telecom Electronic Manufacturing Services Market Size, Share & Trends Report]()

Telecom Electronic Manufacturing Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Electronic Manufacturing, Electronic Engineering, Electronic Assembly, Supply Chain Management), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-419-2

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecom Electronic Manufacturing Services Market Summary

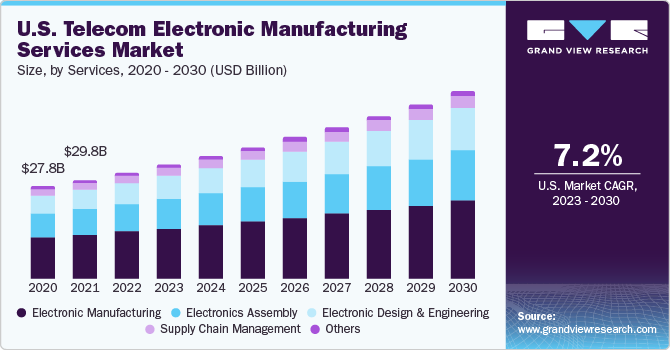

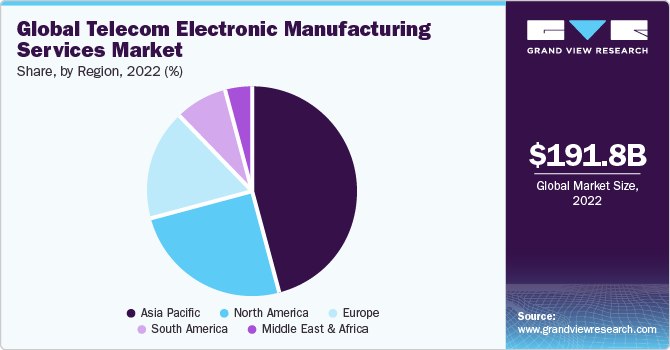

The global telecom electronic manufacturing services market size was valued at USD 191.8 billion in 2022 and is projected to reach USD 339.7 billion by 2030, growing at a CAGR of 7.4% from 2023 to 2030. Contract manufacturing or subcontracting plays a key role in the telecom industry.

Key Market Trends & Insights

- North America is expected to register a significant CAGR over the forecast period.

- Asia Pacific dominated the market and accounted for the largest revenue share of 46.2% in 2022.

- By services, the electronic manufacturing segment accounted for the largest revenue share of 44.5% in 2022.

- By services, the electronic design & engineering segment is expected to grow at the fastest CAGR of 9.3% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 191.8 Billion

- 2030 Projected Market Size: USD 339.7 Billion

- CAGR (2023-2030): 7.4%

- Asia Pacific: Largest market in 2022

Traditional telecom manufacturers are shifting their focus to activities aimed at bringing the highest value to their customers. At the same time, they subcontract activities where they need to have the required core competencies. This trend is anticipated to influence the growth of the market positively.

Subcontracting offers many benefits, such as reduced time to market, access to leading manufacturing technologies, logistic capabilities, and reduced capital investments. It is estimated to be a primary factor driving the market over the forecast years.

Additionally, economic growth, surging demand for communication services, technological innovations, and expansion of wireless communication are poised to be among the key trends escalating market growth. The telecommunication equipment vendor business model is highly technology-driven.

Equipment manufacturers are evolving from manufacturing switches to developing their equipment and integrating products with their service offerings. Vendors often face challenges while focusing on core competencies owing to rapid technological changes in product and service offerings, and thus, they prefer subcontracting.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 46.2% in 2022 and is expected to grow at the fastest CAGR of 7.9% over the forecast period. There is a burgeoning trend among OEMs to outsource product design processes, which allows them to focus on core competencies. The trend is gaining significant momentum in the region, estimated to supplement the market's growth. Furthermore, Asia Pacific has been an irreplaceable electronic production hub for almost a decade owing to low labor costs, and this factor has played a pivotal role in the region's dominance over the past few years.

However, in recent times, with a rise in labor costs in the region, several countries, such as China and other Southeast Asian countries, are focusing on re-inventing themselves as manufacturers of complex products. For instance, Vietnam is projected to emerge as the next hub of electronics component production owing to funds offered by giants such as Samsung Electronics and LG Electronics, which has increased the country's prominence in this supply chain. All these factors are poised to augment the regional market.

North America is expected to register a significant CAGR over the forecast period. The proliferation of smart devices and surging demand for green component manufacturing are likely to stoke the regional market's growth. Furthermore, the booming telecom industry in the region is providing a boost to the market in the region.

Services Insights

The electronic manufacturing segment accounted for the largest revenue share of 44.5% in 2022. OEMs are tapping into the trend of outsourcing product design and development to subcontractors to gain two major advantages: a shift from fixed to variable cost and a reduction in the overall cost. Several telecommunication electronic contract manufacturers focus on expanding their capabilities by offering new services with higher profit margins. This initiative by electronic manufacturers is expected to propel segment growth over the forecast period.

The electronic design & engineering segment is expected to grow at the fastest CAGR of 9.3% during the forecast period. Advancements in wireless communication sensor technologies and big data capabilities enable IoT to transform the technology landscape. Electronic advancements are penetrating product engineering and designing processes owing to increasing consumer expectations and requirements. It, in turn, is projected to contribute to the segment's growth.

Key Companies & Market Share Insights

A few growth avenues for the players in the market include diverse global presence and investments in supply chain models. As the telecommunication sector continues to expand due to new service providers' entry, telecom electronic manufacturing services (EMS) providers can leverage their capabilities to offer the best possible solutions and enable OEMs to focus on their core competencies. The industry players are undertaking strategies such as product launches, expansion, acquisitions, and collaborations to increase their global reach. For instance, in March 2022, Sanmina Corporation and Reliance Strategic Business Ventures Limited (RSBVL), a subsidiary of Reliance Industries Limited (RIL), announced their partnership to establish a joint venture by investing in Sanmina's existing Indian entity, Sanmina SCI India Private Ltd (SIPL). This collaboration aimed to create a world-class electronic manufacturing hub in India, aligning with the "Make in India" vision.

Key Telecom Electronic Manufacturing Services Companies:

- FLEX LTD.

- Jabil Inc.

- Plexus Corp.

- Benchmark Electronics, Inc.

- Celestica Inc.

- COMPAL Inc.

- Creation Technologies LP

- Fabrinet

- Foxconn Technology

- Sanmina Corporation

- Venture Corporation Limited

Recent Developments

- In August 2022, Celestica Inc., a provider of design, manufacturing, and supply chain solutions for leading innovative companies, introduced a range of new storage solutions. Among them are the Athena G2, a next-generation 2U rackmount NVMe storage array; the Nebula G2, an all-flash storage expansion featuring PCIe 4.0 NVMe SSDs; and the Titan G2, a next-generation 4U dense storage array. These cutting-edge products offer unparalleled flexibility and customizable options to meet the demanding requirements of today's applications, whether deployed on-premises or in public clouds.

- In June 2022, Flex revealed its plans to enhance its presence in the automotive industry by expanding operations in Jalisco, Mexico. The company's upcoming project involves the construction of a cutting-edge facility covering an area of 145,000 square feet. This state-of-the-art facility will serve as a crucial manufacturing hub within the region, focusing on producing advanced electronic components to drive the progress of electric and autonomous vehicles.

- In March 2021, PleXUs, a leader in complex product design, manufacturing, supply chain, and aftermarket services, began constructing a cutting-edge manufacturing facility in Bangkok, Thailand. This new facility spans an impressive 400,000 square feet and features two production and warehousing levels and four office space levels. Committed to upholding environmental, social, and governance (ESG) best practices, PleXUs has incorporated various energy-efficient and green building initiatives into the facility's design.

Telecom Electronic Manufacturing Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 206.0 billion

Revenue forecast in 2030

USD 339.7 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

FLEX LTD.; Jabil Inc.; Plexus Corp.; Benchmark Electronics, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecom Electronic Manufacturing Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global telecom electronic manufacturing services market report based on service and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronic Design & Engineering

-

Electronics Assembly

-

Electronic Manufacturing

-

Supply Chain Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global telecom electronic manufacturing services market size was estimated at USD 191.8 billion in 2022 and is expected to reach USD 206.0 billion in 2023.

b. The global telecom electronic manufacturing services market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 339.7 billion by 2030.

b. Asia Pacific dominated the telecom electronic manufacturing services market with a share of 46.2% in 2022. This is attributable to the burgeoning trend among OEMs of outsourcing product design processes to ensure focus on their core competencies.

b. Key players operating in the telecom electronic manufacturing services market include Flex Ltd.; Jabil Circuit, Inc.; Plexus Corp.; Celestica Inc.; COMPAL Inc.; Creation Technologies LP; Fabrinet; Foxconn Technology; Sanmina Corporation; Venture Corporation Limited; and Benchmark Electronics, Inc.

b. Key factors that are driving the market growth include the rising need to keep pace with evolving technologies in the telecom sector, surging internet traffic, and an increase in demand for green electronics. Traditional telecom manufacturers are shifting their focus to activities aimed at bringing the highest value to their customers. supporting the industry trend.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.