- Home

- »

- Communications Infrastructure

- »

-

Telecom Power Systems Market Size & Share Report, 2030GVR Report cover

![Telecom Power Systems Market Size, Share & Trends Report]()

Telecom Power Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (DC Power Systems, AC Power Systems, Digital Electricity), By Grid Type, By Power Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-476-5

- Number of Report Pages: 179

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecom Power Systems Market Summary

The global telecom power systems market size was valued at USD 3.30 billion in 2022 and is projected to reach USD 7.69 billion by 2030, growing at a CAGR of 12.2% from 2023 to 2030. These power systems are designed for fixed-line applications and wireless broadband access.

Key Market Trends & Insights

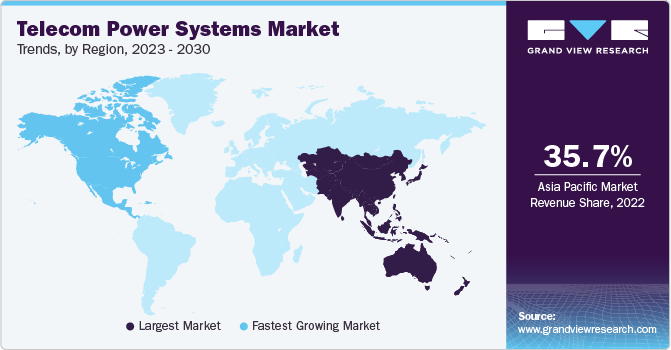

- Asia Pacific held the largest revenue share of 35.7% in 2022 in the market.

- North America is expected to witness significant growth during the forecast period.

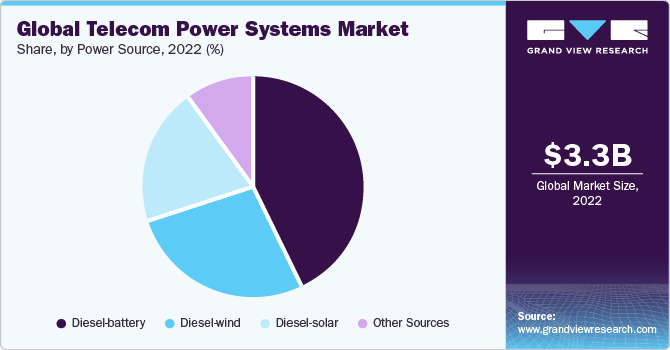

- By power source, the diesel-battery segment held the largest revenue share of 43.1% in 2022.

- By product type, the DC power systems segment accounted for the largest revenue share of 62.7% in 2022.

- By grid-type, the on-grid segment accounted for the largest revenue share of around 41.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.30 Billion

- 2030 Projected Market Size: USD 7.69 Billion

- CAGR (2023-2030): 12.2%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

Factors such as the growing penetration of telecom towers in remote locations, as well as the increasing deployment of cell power systems used for LTE networks, are expected to fuel market growth over the forecast period. Telecom power systems are designed to support telecommunication services by controlling and monitoring the flow of power in case there are any disruptions or grid power fluctuations in the network. The market has evolved in recent years due to the large-scale adoption of digital disruptive technologies and their integration into telecom infrastructure.The significant rise in cellular data traffic has encouraged the expansion of mobile networks even in remote and rural areas. Moreover, the rapid increase in the adoption of a range of connected devices has stimulated the deployment of picocells and femtocells, which require power systems. This continuous expansion of cellular networks for improving connectivity infrastructure is creating opportunities for the market globally.

To cater to the rising demand for faster connections, telecom operators are integrating their products with next-generation Wi-Fi 6, and 5G networks, and other advanced wireless technologies. Telecom operators are also offering products equipped with increased data capacities, lower latency, precise location sensing, and greater device density. For instance, Robert Bosch GmbH, an industrial technology conglomerate, collaborated with Nokia and launched a new private 5G network at its lead Industry 4.0 plant in Stuttgart-Feuerbach, Germany, in November 2020.

The rising focus of businesses on reducing the environmental impact and carbon footprint of their operations could create growth avenues for renewable energy-powered telecom power systems in the future. The global telecom power system market can benefit from renewable power by allowing businesses to reduce operational costs while also meeting carbon emission targets significantly.

Several regulatory bodies worldwide are favoring the establishment of hybrid power plants to ensure the viability of power systems in locations with more consumption requirements. For instance, directives issued by the Department of Telecommunication (DoT), India, recommended that 33% of the telecom towers in India’s urban areas and 75% of telecom towers in its rural areas be hybrid-powered by 2020.

The COVID-19 pandemic and subsequent restrictions imposed by the governments of various countries compelled a large share of the global population to spend more time working remotely from their homes. This led to a sudden increase in data consumption and a significant rise in demand for faster internet, overloading the existing telecom infrastructure and boosting the demand for advanced telecom power systems. Leading telecom service providers are leveraging advanced telecom power systems to maintain a continuous power supply without any outages and fluctuations in the IT sector.

Power Source Insights

The diesel-battery segment held the largest revenue share of 43.1% in 2022. This power system helps reduce carbon emissions and needs lower capital investment. Consequently, these power sources are majorly preferred in developing countries, including Mexico, Brazil, and India. Telecom operators in these countries are increasingly employing diesel-battery solutions to charge telecom towers as an economically feasible option. The diesel-wind segment is expected to foresee significant growth over the forecast period owing to the installation of new plants, long-term contracts, and priority access to the grids.

The diesel-solar segment is expected to expand at the fastest CAGR of 14.3% through 2030. This can be attributed to the rising demand for hybrid energy sources with a low operational cost. Diesel-solar systems combine solar power from a photovoltaic system with a diesel energy source. These systems are reliable and help reduce maintenance, and operational & logistics costs by minimizing fuel consumption and diesel runtime. Hybrid power sources are gaining popularity due to the rising need for reducing carbon footprint and boosting the adoption of green telecom infrastructure over the forecast period.

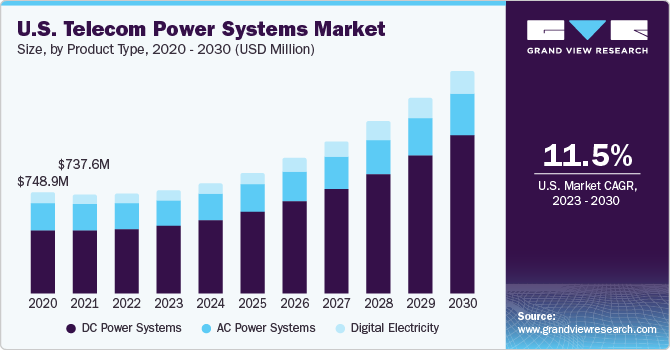

Product Type Insights

The DC power systems segment accounted for the largest revenue share of 62.7% in 2022 and is expected to further expand at the fastest CAGR over the forecast period. In Direct Current (DC) power systems, a rectifier converts the Alternating Current (AC) to DC and provides the required power to charge the batteries. DC power systems also control and monitor the power being sourced to the equipment, retain accurate voltage, and activate alarms when required.

DC power systems have a wide range of applications in areas such as telecommunication systems, data centers, electric vehicles, aircraft, commercial buildings, and residential homes, among others. DC distribution systems in data centers and telecommunication systems utilize low-voltage 48 VDC systems, thereby enhancing the efficiency, flexibility, and reliability, and reducing the cost of the systems.

The digital electricity segment is expected to grow at a significant rate during the forecast period. The evolution of digital electricity in recent years has offered performance improvements that were earlier not achievable. Digital electricity, also known as switching power supply, comprises smart meters that manage and record electricity and performance of electronic equipment. It also offers accurate & detailed digital algorithms on power usage in real-time or at scheduled intervals. As per the U.S. Department of Energy, over 94.8 million smart meters were installed in the U.S. in 2019.

Regional Insights

Asia Pacific held the largest revenue share of 35.7% in 2022 in the market. Furthermore, the region is expected to expand at the fastest CAGR over the forecast period. This growth can be attributed to the rapid digital transformation of several industries in developing countries of the region, offering a promising growth opportunity for telecom operators to create a sustainable ecosystem.

Moreover, telecom service providers are focusing on expanding telecommunication networks to meet the growing cellular subscriber base in the region. Asia Pacific has accounted for the highest number of smartphone users over the past few years. This development has led to an increased deployment of telecom towers in rural and remote locations in this region.

North America is expected to witness significant growth during the forecast period, owing to the robust and consistent regional network connectivity. This region has been one of the early adopters of several innovative developments and telecommunication technologies, owing to the high penetration rate of mobile devices and 4G-LTE networks.

The rising demand to commercialize 5G networks in the U.S. is encouraging telecom companies to develop advanced telecom infrastructure and related equipment. For instance, according to 5G Americas, a wireless industry trade association that facilitates the transformation of LTE networks, the LTE penetration rate was 130.0% for the U.S. in the third quarter of 2019. Thus, the rapid adoption of digital electricity solutions and smart devices is supporting the growth prospects of the regional market.

Grid Type Insights

The on-grid segment accounted for the largest revenue share of around 41.7% in 2022 in the telecom power systems market. An on-grid system is a power generation system connected to the utility grid. The electricity generated by the system is transmitted to the grid, from where it is utilized to run multiple appliances. These grid systems are the simplest, most cost-effective to install, and, most likely, pay for themselves by compensating utility bills in a span of 3 to 8 years.

The bad grid segment is estimated to register the fastest CAGR of 13.5% over the forecast period. This demand can be attributed to the expansion of telecom networks in rural areas in several countries, owing to a rise in the mobile subscriber base and investments by tower companies to achieve universal coverage. Most of the population in developing countries resides in rural areas that lack telecommunication networks and electricity. According to ‘Our World In Data,’ around 13.0% of the global population does not have access to grid-based electricity.

Key Companies & Market Share Insights

The market features the presence of both large- and medium-scale telecom power system companies. Providers are emphasizing the development of advanced telecom power systems, improved energy efficiency, product reliability, scalability, optimal system design, product management, control, security, and cost-effective deployment, to gain a competitive advantage. For instance, in October 2020, Cummins Inc. introduced two new digital master controls, DMC2000 and DMC6000, in its portfolio of power systems. These control equipment solutions provide faster delivery time at an economical cost.

Prominent industry players are collaborating with other companies to upgrade their telecom power systems portfolio in accordance with dynamic customer requirements. For instance, in March 2020, Corning Incorporated partnered with US Conec Ltd., a manufacturer of industry connectors, to deploy MDC connector solutions that would significantly enhance carrier distribution networks, hyper-scale data centers, and other high-density patching applications.

Key Telecom Power Systems Companies:

- Alpha Technologies Services, Inc.

- Ascot

- Eaton

- General Electric

- Huawei Technologies Co., Ltd.

- Schneider Electric

- ZTE Corporation

Recent Developments

-

In March 2023, ZTE Corporation collaborated with China Mobile to successfully conduct the world's first pilot of 400G QPSK (Quadrature Phase Shift Keying) technology. This helped achieve ultra-high-speed transmission capabilities over 2,808 km on G.652.D optical fibers and a high transmission distance of 5,616 km on land cables

-

In May 2022, Huawei Digital Power Technologies introduced PowerPOD 3.0, a next-generation power supply solution. By leveraging core technological advancements and component integration, this solution enhances the design. It establishes an efficient data center power supply system that effectively minimizes space requirements, energy consumption, and implementation time

-

In March 2022, Huawei introduced a brand-new microwave solution catering to the demand for ultra-high bandwidth in densely populated urban regions. The solution focuses on the 50 Gbps E-band, providing a transmission range that surpasses the industry average by 50%. With this extended range, the E-band can cover dense urban areas with just a single hop

-

In January 2022, Eaton unveiled a new UPS system for the North American market. The iteration, known as 5PX G2, provides significantly extended standard runtime compared to its predecessor, the 5PX UPS technology, as well as improved surge protection capabilities. Additionally, this version introduces optional connectivity functionalities aimed at streamlining maintenance procedures in distributed IT or edge environments, such as medical facilities, university campuses, and retail offices

-

In August 2021, Cummins India Limited introduced the QSK60 G23: 2500-2750 kVA Diesel Generator set. This diesel generator set serves as an Integrated Power Solution and has been specifically developed to cater to the growing power demands from various industry sectors in India. It particularly targets data centers, as well as large-scale infrastructure projects such as airports and commercial realty

-

In August 2021, Stealth Power, a company specializing in idle mitigation and scalable hybrid energy systems, partnered with Tower Solutions, a provider of mobile towers. Through this alliance, Tower Solutions would utilize Stealth Power's mobile power solutions to help in powering its mobile towers across various sectors

Telecom Power Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.44 billion

Revenue forecast in 2030

USD 7.69 billion

Growth Rate

CAGR of 12.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, grid type, power source, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Alpha Technologies Services, Inc.; Ascot; Eaton; General Electric; Huawei Technologies Co., Ltd.; Schneider Electric; ZTE Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

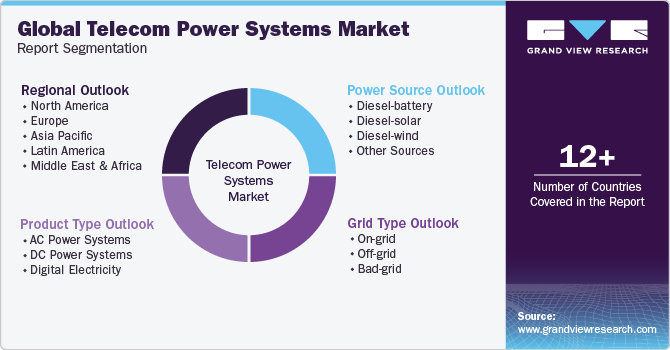

Global Telecom Power Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global telecom power systems market report on the basis of product type, grid type, power source, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

AC power systems

-

DC power systems

-

Digital electricity

-

-

Grid Type Outlook (Revenue, USD Million, 2017 - 2030)

-

On-grid

-

Off-grid

-

Bad-grid

-

-

Power Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Diesel-battery

-

Diesel-solar

-

Diesel-wind

-

Other Sources

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global telecom power systems market size was estimated at USD 3.30 billion in 2022 and is expected to reach USD 3.44 billion in 2023.

b. The global telecom power systems market is expected to grow at a compound annual growth rate of 12.2% from 2023 to 2030 to reach USD 7.69 billion by 2030.

b. Asia Pacific region dominated the telecom power systems market with a share of 35.7% in 2020. This is attributed due to constant growth in telecom infrastructure and deployment of 5G network services.

b. Some key players operating in the telecom power systems market include Alpha Technologies Services, Inc., Eaton, General Electric, Huawei Technologies Co., Ltd., Schneider Electric, and ZTE Corporation.

b. Key factors that are driving the telecom power systems market growth include ever-increasing growth in the telecom sector coupled with the rising inclination of service providers towards introducing telecom towers in off-grid and rural areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.