- Home

- »

- IT Services & Applications

- »

-

Tenant Billing Software Market Size, Industry Report, 2030GVR Report cover

![Tenant Billing Software Market Size, Share & Trends Report]()

Tenant Billing Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-Premise), By Application (Residential, Commercial), By Region (North America, Europe, ASPA, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-510-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tenant Billing Software Market Size & Trends

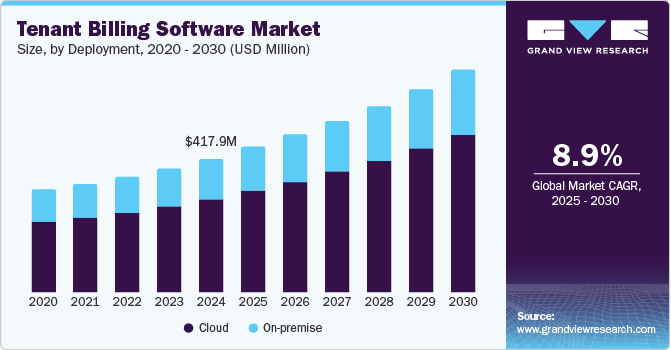

The global tenant billing software market size was valued at USD 417.9 million in 2024 and is expected to grow at a CAGR of 8.9% from 2025 to 2030. This growth is attributed to the increasing adoption of cloud-based solutions among property management companies. These solutions streamline billing processes by automating tasks such as generating invoices and tracking payments, which enhances operational efficiency. For instance, a property management firm using cloud-based tenant billing software can reduce manual errors and save time, allowing staff to focus on more strategic activities.

The rising demand for smart grid technology in utility management has further driven the tenant billing software industry. This technology enables precise energy consumption tracking, allowing property owners to allocate costs accurately among tenants. As more properties implement smart meters and other IoT devices, tenant billing software becomes essential for managing the resulting data and ensuring transparent billing practices. This trend is particularly evident in residential complexes where utility costs vary significantly among tenants based on individual usage.

Moreover, the expansion of retail stores, hotels, and business buildings necessitates efficient billing solutions that can handle multiple tenants and complex cost allocations. As businesses increasingly prioritize operational efficiency and customer satisfaction, they are turning to advanced tenant billing systems that offer features such as real-time reporting and integration with other property management tools. This shift improves administrative productivity and enhances tenant relationships through clear and accurate billing.

Furthermore, the increasing focus on sustainability and energy efficiency is driving demand for tenant billing software that can support green initiatives. Property owners are looking for ways to monitor and manage energy consumption effectively, which can be facilitated by sophisticated billing solutions that provide insights into usage patterns. For instance, a commercial building implementing tenant billing software can encourage tenants to reduce energy consumption by providing detailed reports on their usage compared to benchmarks. This alignment with sustainability goals meets regulatory requirements and appeals to environmentally conscious consumers, further propelling the tenant billing software industry's growth.

Deployment Insights

The cloud segment held the largest revenue share of 69.7% in the tenant billing software industry in 2024 due to its numerous advantages over traditional on-premises solutions. The increased accessibility and flexibility that cloud-based systems offer allow property managers to access billing information from anywhere, anytime, using various devices. This capability is particularly beneficial for companies managing multiple properties, streamlining operations and enhancing team collaboration. For instance, a property management firm can quickly generate and send invoices to tenants remotely, reducing delays in payment processing. In addition, cloud solutions often come with lower upfront costs and reduced IT maintenance requirements, making them more attractive for small to medium-sized enterprises looking to optimize their billing processes without significant investment.

The on-premise segment is expected to grow at a significant CAGR over the forecast period due to the enhanced data security that on-premise solutions offer compared to cloud-based alternatives. Organizations handling sensitive tenant information often prefer on-premise systems as they allow for greater control over data access and storage, reducing the risk of data breaches. For instance, a large property management firm may choose an on-premise solution to ensure compliance with stringent data protection regulations, safeguarding tenant information from potential cyber threats. In addition, on-premise software can be seamlessly integrated with existing IT infrastructure, allowing businesses to leverage their current technology investments while customizing billing processes to meet specific operational needs.

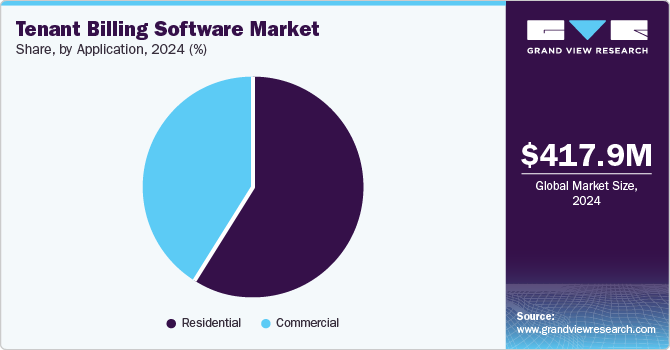

Application Insights

The residential segment held the largest revenue share in the tenant billing software industry in 2024, owing to the increasing complexity of managing multiple rental properties and the growing demand for efficient billing solutions. As property owners and managers face challenges in tracking utility costs, lease agreements, and tenant information, tenant billing software offers a streamlined approach to automate these processes. For instance, a residential property management company can utilize this software to automatically generate and distribute monthly invoices to tenants, significantly reducing administrative workload and minimizing errors.

The commercial segment is expected to grow at the fastest CAGR over the forecast period due to the increasing number of commercial properties, such as retail stores, hotels, and office buildings, which require efficient billing solutions to manage multiple tenants and complex cost allocations. As businesses expand, they seek automated billing systems that streamline operations and enhance productivity, reducing manual errors associated with traditional billing methods. For instance, a hotel chain using tenant billing software can automate utility billing for each room, ensuring accurate charges based on individual usage patterns.

Regional Insights

The North America tenant billing software market dominated with the largest revenue share of 34.2% in 2024, primarily due to the region's high urbanization rate and the increasing adoption of automated billing systems among property managers. As cities expand and the number of residential and commercial properties increases, property management companies are turning to sophisticated billing solutions to manage tenant accounts and utility costs efficiently. For instance, a large apartment complex in the U.S. can utilize tenant billing software to automate utility invoicing, ensuring accurate charges based on individual consumption while reducing administrative workload. In addition, the presence of advanced technological infrastructure supports the integration of cloud-based solutions, enhancing accessibility and real-time data management.

U.S. Tenant Billing Software Market Trends

The U.S. tenant billing software market dominated North America in 2024, driven by the rapid adoption of advanced technology among property management companies and the increasing complexity of managing diverse tenant portfolios. As urbanization continues to rise, property managers require efficient systems to handle multiple billing processes, including rent, utilities, and service charges. For instance, a large apartment complex in New York City can utilize tenant billing software to automate invoicing and track payments for hundreds of tenants, significantly reducing administrative burdens and minimizing errors.

Europe Tenant Billing Software Market Trends

The Europe tenant billing software market is expected to grow significantly over the forecast period due to the high level of digitalization and the increasing complexity of property management across the region. As more residential and commercial buildings are constructed, property managers need efficient systems to handle diverse billing processes, including rent, utilities, and service charges. For instance, a large property management firm in Germany can implement tenant billing software to automate invoicing for multiple properties, ensuring accurate and timely billing while reducing administrative burdens.

Asia Pacific Tenant Billing Software Market Trends

Asia Pacific tenant billing software market is expected to grow at the fastest CAGR over the forecast period due to the rapid urbanization occurring in countries such as India and China, leading to an increase in residential and commercial properties that require efficient billing solutions. As more people move to urban areas, property managers face the challenge of managing utility costs and tenant accounts for a growing number of tenants. For instance, a large residential complex in Mumbai can implement tenant billing software to automate invoicing for utilities, ensuring accurate charges based on individual consumption while minimizing administrative workload. In addition, the increasing adoption of cloud-based solutions enhances accessibility and scalability for property managers, allowing them to manage billing processes seamlessly.

The China tenant billing software market dominated Asia Pacific in 2024 with the largest revenue share, driven by the rapid urbanization and growth of the real estate sector. As cities expand and the population increases, there is a significant rise in residential and commercial properties that require efficient management systems for billing and utilities. Large property management companies in Shanghai can utilize tenant billing software to automate invoicing hundreds of apartments, ensuring accurate utility charges based on individual consumption. In addition, the increasing adoption of smart grid technology in China allows for precise energy usage tracking, further enhancing tenant billing processes' efficiency.

Key Tenant Billing Software Company Insights

Some key players in the tenant billing software industry are Buildium, A RealPage Company, Utility Management Solutions, Inc., Yardi Systems, Inc., and RealPage, Inc. These companies employ various strategies to maintain a competitive edge, including the development of user-friendly interfaces that enhance tenant engagement and streamline billing processes. They also focus on integrating advanced technologies such as real-time data analytics and automated invoicing to improve operational efficiency and accuracy.

-

Yardi Systems specializes in comprehensive property management solutions, including advanced tenant billing software for residential and commercial properties to automate invoicing and payment tracking. By leveraging cloud technology, Yardi enables property managers to access real-time data, enhancing decision-making and operational efficiency.

-

RealPage offers innovative tenant billing software that focuses on optimizing the financial operations of property management companies. Through its platform, RealPage provides automated billing solutions that ensure accurate invoicing based on individual tenant consumption, particularly in utility management.

Key Tenant Billing Software Companies:

The following are the leading companies in the tenant billing software market. These companies collectively hold the largest market share and dictate industry trends.

- Yardi Systems, Inc.

- RealPage, Inc.

- AppFolio, Inc

- Buildium, A RealPage Company

- Entrata, Inc.

- MRI Software

- Accuenergy Inc.

- Energy Hippo, Inc.

- Enertiv, Inc.

- Utility Management Solutions, Inc

Recent Developments

-

In October 2024, AppFolio unveiled its innovative Realm-X capabilities during the FUTURE: The Real Estate Conference. This new suite of AI-powered tools is designed to save property managers over 10 hours of work per week by automating routine tasks and enhancing resident communication. Realm-X includes features such as the Realm-X Assistant for generating reports and managing vendor interactions, and Realm-X Messages, which streamlines resident communications. With nearly half a million messages generated in just 30 days, the platform significantly improves operational efficiency, allowing property managers to focus on enhancing the resident experience.

-

In September 2024, RealPage announced that its revenue management software allows customers to exclude nonpublic competitor data when calculating rent recommendations. This decision comes in response to a recent ordinance passed by the San Francisco Board of Supervisors to regulate the use of certain algorithms in rent-setting practices. RealPage emphasizes that its software remains valuable regardless of data configuration, providing property managers with options that enhance pricing competitiveness while ensuring compliance with evolving regulations.

Tenant Billing Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 453.3 million

Revenue forecast in 2030

USD 693.0 million

Growth Rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Yardi Systems, Inc.; RealPage, Inc.; AppFolio, Inc; Buildium, A RealPage Company; Entrata, Inc.; MRI Software; Accuenergy Inc.; Energy Hippo, Inc.; Enertiv, Inc.; Utility Management Solutions, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tenant Billing Software Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tenant billing software market report based on deployment, application, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.