- Home

- »

- Medical Devices

- »

-

Tendon Repair Market Size & Share, Industry Report, 2030GVR Report cover

![Tendon Repair Market Size, Share & Trends Report]()

Tendon Repair Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Implants, Suture Anchor Devices, Grafts) By Application (Rotator Cuff Repair, Achilles Tendinosis Repair), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-940-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tendon Repair Market Size & Trends

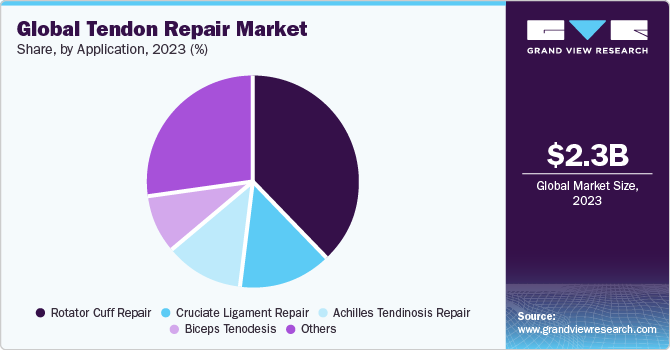

The global tendon repair market size was estimated at USD 2.3 billion in 2023 and is expected to grow at a CAGR of 8.5% from 2024 to 2030 owing to rising geriatric population, increasing demand for minimally invasive procedures, and growing number of tendon-related injuries in sports and other physical activity events. Multiple tissue injuries are more common in the elderly.

According to U.N. by 2050, people over 60 years of age will account for more than 20% of the world population. Modernization has brought about changes in lifestyle and lack of physical activity, among other things, making the population more vulnerable to musculoskeletal problems and diseases. In July 2022, WHO stated that the musculoskeletal conditions affect approximately 1.71 billion people worldwide Further in June 2023, it further highlights the low back pain is the most common musculoskeletal condition, affecting 619 million people worldwide.

Tendon rips, fissures, sprains, and tensions have become more common due to the population's sedentary lifestyle. Obesity causes several ailments, the most frequent cardiovascular disease and osteoarthritis, a degenerative joint condition. Obesity affects almost one billion individuals worldwide, including 650 million adults, 340 million teenagers, and 39 million children. According to the World Health Organization, in 2022, about 167 million children and adults will be overweight or obese by 2025, putting their health at risk.

Over the projection period, the rise in the incidence of sports-related injuries and the rapid growth in the number of athletes will be important impact-rendering drivers for the market. According to a John Hopkins Medicine article, 30 million individuals participate in organized sports, resulting in more than 3.5 million sports injuries annually in the United States alone, with sprains and strains being the most prevalent ailments. Repetitive movements (in sports) and strains in sports such as tennis and water sports can also lead to sports injuries such as rotator cuff injuries, tennis elbow, and joint dislocation

According to the American Academy of Pediatrics and the National SAFE KIDS Campaign, over 3.5 million children aged 14 and under suffer injuries each year while playing sports or engaging in recreational activities. Additionally, more than 775,000 children in the same age group are treated in emergency rooms for sports-related injuries annually. The Orthopedic Journal of Sports Medicine study showed that wearing a knee brace did not hinder physical performance. According to National safety council statistics, in 2022 near about 3.6 million went through serious emergency injuries involving from sports and recreational activities Furthermore, the increasing number of road injuries related to the sprains in the tendons is expected to drive market growth.

Several companies in the industry have recorded a reduction in sales of tendon restoration products. New technologies, such as tissue grafting, scaffolds, and other tissue matrices, and equipment, parts, and instruments used in surgical procedures for the regeneration of native tissue, are being effectively used to provide the repaired limb with better movement and flexibility and speed up healing.

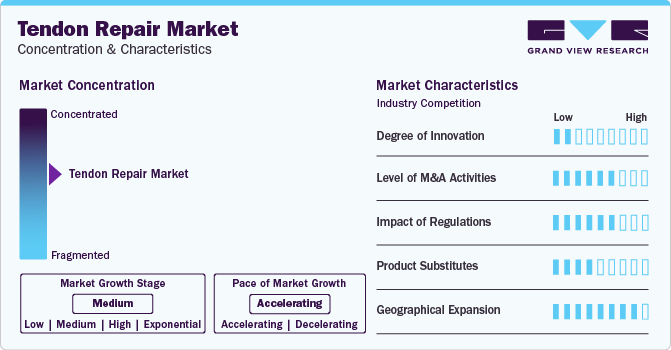

Market Concentration & Characteristics

The treatment of orthopedic conditions and injuries has significantly transformed by recent advancements in the field of orthopedic surgeries. New tools and technologies for surgery of ruptured tendons are being developed every year around the world. The constant search for best treatments has led to innovation in the field of sports medicine, boosting the market growth. For instance, in January 2022, a team of researchers at Harvard’s Wyss Institute for Biologically Inspired Engineering collaborated with Novartis Technical Research and Development, to developed “Janus Tough Adhesives (JTA’s ) a biomaterial-based adhesive, having high-capacity drug depots which slowly releases small molecules into tendon tissue to help facilitate faster healing in long withstanding tendon bone injuries.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for tendon repair and to maintain a competitive edge. For instance, in January 2023, Zimmer Biomet announced its acquisition of Embody, Inc. a medical device company focused on soft tissue healing, the acquisition seeks to leverage and incorporate Embody’s portfolio of collagen-based biointegrative solutions, including products like TAPESTRY RC, designed for arthroscopic implant systems for rotator cuff repair, and TAPESTRY, a biointegrative implant for tendon healing. This integration will bolster Zimmer Biomet's product offerings in the market.

Tendon repair devices must meet strict regulatory requirements to ensure that they meet high standards of quality, safety, and effectiveness before they can be introduced to the market. There are few stringent regulations on import and export of medical devices, which make the approval process more complex, and delay launch of products. Furthermore, the stringent regulatory framework also hampers innovation and competition within the market. This can limit patients' access to new and advanced tendon fixation systems and other options.

Product expansion in tendon repair refers to the introduction of new products, services, or technologies that aim to improve the overall efficiency, durability, and cost-effectiveness of tender repair processes. For instance in April 2022, lindare medical and Integra life sciences collaborated to distribute the cutting edge regenerative tissue products addressing soft tissue, nerve and tendon repairs to the UK market. With this collaboration Integra will expand its distribution channel in UK.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in January 2022, Smith+Nephew announced its expansion of its Next-Gen handheld robotics platform, as CORI Surgical System in Japan. This expansion aims at providing robotic-assisted surgery with minimal set up time and portability during various surgeries including knee surgery.

Product Insights

The suture anchor devices held the market with the largest revenue share of 38.5% in 2023. Sutures are available in absorbable and non-absorbable materials. Suture anchor devices are popular in arthroscopy treatments due to their superior strength and ability to be knotless or knotted depending on the injury. Suture anchors are often used in rotator cuff arthroscopy, an open surgical technique. Biodegradable suture anchors were introduced to address the problems associated with all-metal sutures, which has led to various market players launching biodegradable suture anchor devices globally. For instance, in December 2022, Stryker introduced a disposable suture anchor system named as Citrefix’ which was primarily made up from bioresorbable elastomeric material- Citregen, and the system is used in tendon fixation and ankle fixation.

The scaffolds product type segment is anticipated to witness at the fastest CAGR over the forecast period. Due to the limitations of existing technologies and the difficulties that come with each of them when used for a prolonged period, the use of alternative therapies for tendon restoration has grown in popularity. Tissue engineering for tendon regeneration has been an emerging technique in tendon repair recently. For instance, in October 2023, a group of researchers highlighted in their study that they have innovated a type of flexible network scaffolds capable of meticulously controlling non-linear mechanical responses. These engineered tissue scaffolds enhance tissue regeneration by minimizing the mechanical disparity between the graft-host, thereby promoting a more seamless integration and recovery process.

Application Insights

Based on application, the rotator cuff segment led the market with the largest revenue share of 37.6% in 2023. Rotator cuff tear can occur because of a sudden fall on an outstretched arm, repetitive activities over time, or degenerative tears because of age. This repair frequently necessitates surgical intervention. The prevalence of rotator cuff tears has increased with age due to deterioration, according to an article on NCBI. According to studies, full-thickness RCT prevalence is 28% in adults under the age of 60, 50% in those over the age of 70, and 80% in people over the age of 80. For instance, in April 2023, the article released by Healio, highlights scientists take on cuff tears treatment, as instances have been seen where a significant rotator cuff tear results from trauma if not addressed promptly, without muscle atrophy development and maintaining tendon elasticity. Timely intervention and preservation of tendon properties contribute to a more favourable surgical outcome and recovery for the affected individual.

The biceps tenodesis segment is anticipated to witness at the fastest CAGR of 13.2% over the forecast period. This type of injury is common amongst athletes in sports like swimming, baseball, tennis, etc., where the arm is routinely stretched over the head. The tears can also occur due to degeneration of tissue due to age. As per a single-center study conducted in the UK in 2023, for patients aged 70 and above, the incidence rate of biceps tendon ruptures was 0.53 per 100,000 over 5 years. Biceps tenodesis is done either by arthroscopy or by open surgery and is successful in 70% cases. Open tenodesis involves pulling the biceps tendon via the incision and release it from the labrum, reattaching it to the humerus bone with the help of suture anchors and screw systems.

Regional Insights

North America dominated the tendon repair market with the largest revenue share of over 44.9% in 2023. The growth is attributed to the growing need for advanced healthcare services, owing to presence of major industry players, well-established healthcare infrastructure, and in recent years, the number of individuals participating in sporting activities has increased, which is a major driver driving the market growth in the region. Every year, Canadians itself spend more than USD 187 million on sports injury treatment.

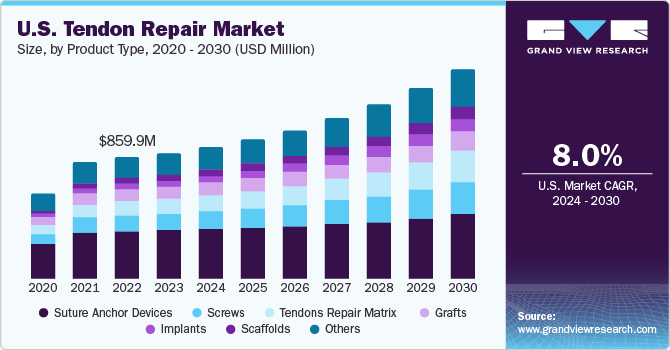

U.S. Tendon Repair Market Trends

The tendon repair market in the U.S. held the largest share of 93.4% in 2023 in the North American region. In December 2023, the U.S. National Health Expenditure released data suggesting an increase of 3.5% in Medicare spending, amounting to USD 944.3 billion in 2022. The growth in disposable income has increased the per capita participation in sports around the country. Sports-related injuries are among major factors responsible for high market share of the region. Another major factor contributing to the market growth is the rapidly increasing geriatric population in the region. Tendons and soft tissue seem to degenerate as one ages, and tendon ruptures along with other musculoskeletal problems are common among in this age group. According to the American Academy of Orthopedic Surgeons, an average of 200,000 ACL injuries occur annually, and the number is only expected to increase in the coming years in U.S. Presence of key players in the region, such as Arthrex, DePuy Synthes, and Smith & Nephew, is also a key factor fueling growth in this region.

Europe Tendon Repair Market Trends

The tendon repair market in Europe is anticipated to register at a significant CAGR during the forecast period. This is attributed to growing number of people actively participating in some form of sports and the advancements in the field of medical technology are contributing to market growth. The presence of major MedTech giants such as Smith & Nephew also significantly contributes to market growth in the region. For instance, in January 2022, Smith & Nephew expands capabilities of its hand-held robotics system CORI to include total hip arthroplasty are among factors boosting the market growth in Europe.

The Germany tendon repair market is anticipated to register at a considerable CAGR during the forecast period. According to OECD data, 20.86% of the total population in Germany is aged 65 and above. The prevalence of wear & tear of ligaments and degeneration of soft tissue increases with age, and often physical therapy or surgical intervention is required, which is one of the key factors fueling the market growth in the country. Germany acts as a hub for many local and global manufacturers, where players are involved in strategic initiatives driving the regional market growth.

The tendon repair market in UK is anticipated to register at the fastest CAGR during the forecast period. The UK market showcases a competitive landscape, with various players offering innovative solutions to address tendon-related injuries. The market growth is driven by factors such as an aging population, increasing sports injuries, and advancements in medical technology. For instance, the Statistics report for Work-related Musculoskeletal Disorders published indicated that there were about 470 000 musculoskeletal disorders at work recorded in 2020. Some of those cases were neck and upper-limb 212,000 (45.1%), spine 182,000 (38.7%), and lower limbs 76,000 (16.2%). Competitors often collaborate with healthcare providers and research institutions to develop effective tendon repair strategies and improve patient outcomes. This competitive environment fosters innovation and drives the market growth in the UK.

Asia Pacific Tendon Repair Market Trends

The tendon repair market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, due to the rapidly developing healthcare infrastructure in major countries in the region. Asia Pacific has the world's largest population due to the high population density in the area, there is a higher occurrence of age-related tendon ruptures. Increased attention to health and well-being, as well as active engagement in sports, are all attributing to an increase in the number of people who suffer from sports injuries. Furthermore, the ongoing advances of the research on the benefits of minimally invasive Achilles tendon repair, as compared to that of open repairs in countries such as Singapore are creating a waiver of consent. In addition, the growing awareness campaigns from government programs and organizations such as the Pro Health Asia, Singapore Sports Council (SSC), Sports Ayurveda Research Cells (SARC) India, related to the acute injury management, correct treatment awareness, and sports Injury rehabilitation, such factors are poised to drive market growth.

The China tendon repair market is anticipated to grow at the lucrative CAGR during the forecast period. China being one of the largest population in the world, is a highly lucrative market. China is one of the major manufacturing hubs of different technological devices and components in the world, such as tendon culture system and biomaterial scaffold being technically licensed and is in process to be patented. For instance, in March 2024,group of scientists from Shanghai Institute of Ceramics in China developed the inorganic bio ceramics based multicellular scaffold for treatment of tendon-to-bone injuries. Further the country’s medical device market has predominant presence of local medical device manufacturers, and around 25% of the local market is held by foreign companies.

The tendon repair market in Japan is expected to grow at the fastest CAGR over the forecast period. Japan has a highly developed orthopedic innovator MedTech space with advanced manufacturing facilities and technologies. Growing geriatric population has, in turn, increased the burden of age-related musculoskeletal diseases in the country, which is a primary factor driving market growth. The overall prevalence of muscle-related pain due to aging was found to be more than 41% in the Japanese population.

Middle East & Africa Tendon Repair Market Trends

The tendon repair market in Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period. The advancement of orthopedic devices including those used in tendon repair is driving the market growth, coupled with increasing prevalence of musculoskeletal diseases. A study published on ScienceDirect states that musculoskeletal diseases were the second leading cause of disability-adjusted life years in Saudi Arabia. High prevalence of such diseases is a primary factor driving market growth in the Middle East. In Africa, the prevalence ranges from 59.7% to 68.1%. Various government initiatives being undertaken to improve health practices for patients and to educate patients regarding their condition are contributing to market growth in the region

The tendon repair market in UAE is anticipated to grow at the significant CAGR over the forecast period.In the UAE, ACL injuries are more common than in other regions across the globe. Recently, in March 2024, Med Care Orthopedics & Spine Hospital in Dubai was involved with the treatments for one the first Ligament Augmentation and Reconstruction Surgery (LARS), which helped it to achieve a significant milestone in the region’s healthcare sector. Such advancements is poised to drive market growth over the forecast period.

Key Tendon Repair Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Tendon Repair Companies:

The following are the leading companies in the tendon repair market. These companies collectively hold the largest market share and dictate industry trends.

- Integra Lifesciences Corporation

- Arthrex, Inc.

- Tendomend

- Depuy Synthes

- Conmed Corporation

- Stryker Corporation

- Biopro, Inc

- Parcus Medical, Llc

- Aevumed, Inc.

- Smith & Nephew

- Alafair Biosciences

- Amniotics Ab

- Amniox Medical, Inc.

- Mimedx Group, Inc.

Recent Developments

-

In March 2023, Smith &Nephew launched the UltraTRAD QUAD ACL Reconstruction Technique, comprising with Quadriceps Tendon Harvest Guide System, which directly provides ease for tendon visualization during the surgical procedures

-

In December 2022, Stryker introduced a disposable suture anchor system named as Citrefix’ which was primarily made up from bioresorbable elastomeric material- Citregen, further the system is used in tendon fixation and ankle fixation

-

In May 2022, CoNextions Inc. announced first patient treated via its revolutionary tendon repair Implant ‘CoNextions TR’. Further the company is introducing its system across the U.S. This innovative device will be distributed through a well-established network of orthopedic distributors, who are already committed to offering effective solutions for upper extremity surgeons

Tendon Repair Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.4 billion

Revenue forecast in 2030

USD 4.0 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Russia; China; Japan; India; South Korea; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Arthrex, Inc.; Medical Device Business Services, Inc.; CONMED Corporation; Integra LifeSciences; Smith+Nephew; TendoMed; BioPro, Inc; aevumed; Alafair Biosciences; Amniotics AB; Amniox Medical, Inc; MIMEDX

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

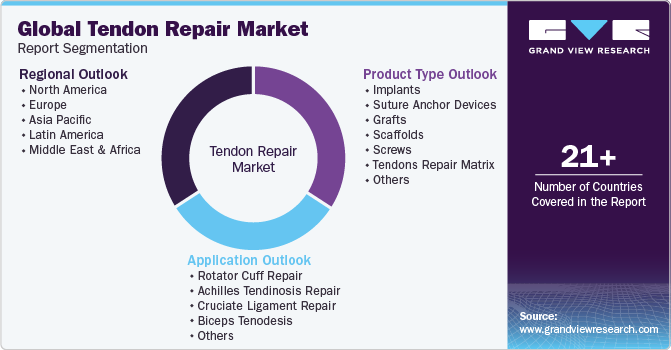

Global Tendon Repair Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global tendon repair market report based on product type, application, and region.

-

Tendon Repair Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Suture Anchor Devices

-

Grafts

-

Scaffolds

-

Screws

-

Tendons Repair Matrix

-

Others

-

-

Tendon Repair Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotator Cuff Repair

-

Achilles Tendinosis Repair

-

Cruciate Ligament Repair

-

Biceps Tenodesis

-

Others

-

-

Tendon Repair Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia-Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tendon repair market size was estimated at USD 2.3 billion in 2023 and is expected to reach USD 2.4 billion in 2024.

b. The global tendon repair market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 4.0 billion by 2030.

b. North America dominated the tendon repair market with a share of 44.9% in 2023. In the United States, there is a growing geriatric population of 54 million people. In recent years, the number of individuals participating in sporting activities has increased, which is a major driver driving the tendons repair market growth in the region.

b. Some key players operating in the tendon repair market include Stryker, Arthrex, Inc., Medical Device Business Services, Inc., CONMED Corporation, Integra LifeSciences, Smith+Nephew, TendoMed, BioPro, Inc, aevumed, Alafair Biosciences, Amniotics AB, Amniox Medical, Inc and MIMEDX.

b. Key factors that are driving the tendon repair market growth include multiple tissue injuries are more common in the elderly. A rotator cuff injury affects more than 40% of the total population aged 60 and up, according to an article published in the Advances in Orthopedic Surgery journal. Modernization has brought about changes in lifestyle and lack of physical activity, among other things, making the population more vulnerable to musculoskeletal problems and diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.