- Home

- »

- Medical Devices

- »

-

Terminal Sterilization Services Market, Industry Report, 2033GVR Report cover

![Terminal Sterilization Services Market Size, Share & Trends Report]()

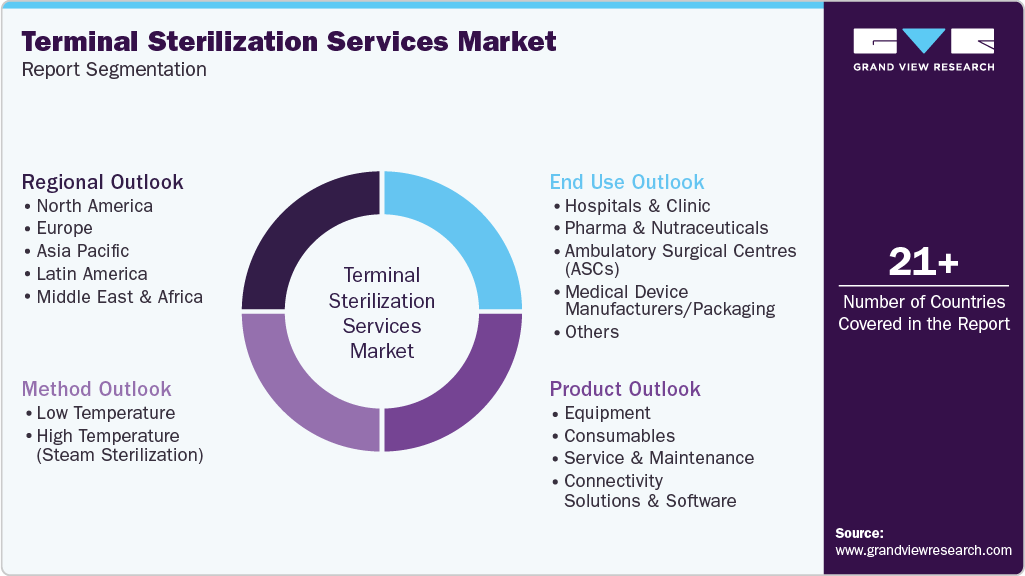

Terminal Sterilization Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Equipment, Consumables, Service & Maintenance, Connectivity Solutions & Software), By Method, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-416-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Terminal Sterilization Services Market Summary

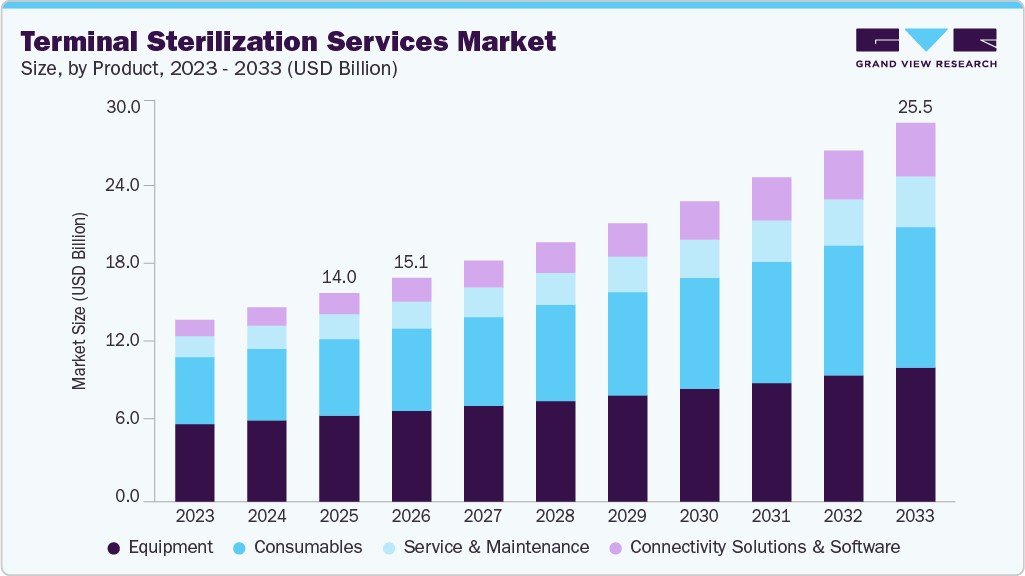

The global terminal sterilization services market size was estimated at USD 14.05 billion in 2025 and is projected to reach USD 25.54 billion by 2033, growing at a CAGR of 7.82% from 2026 to 2033. The increasing global prevalence of healthcare-associated infections and the rising number of surgical procedures are the primary driving factors contributing to the market growth.

Key Market Trends & Insights

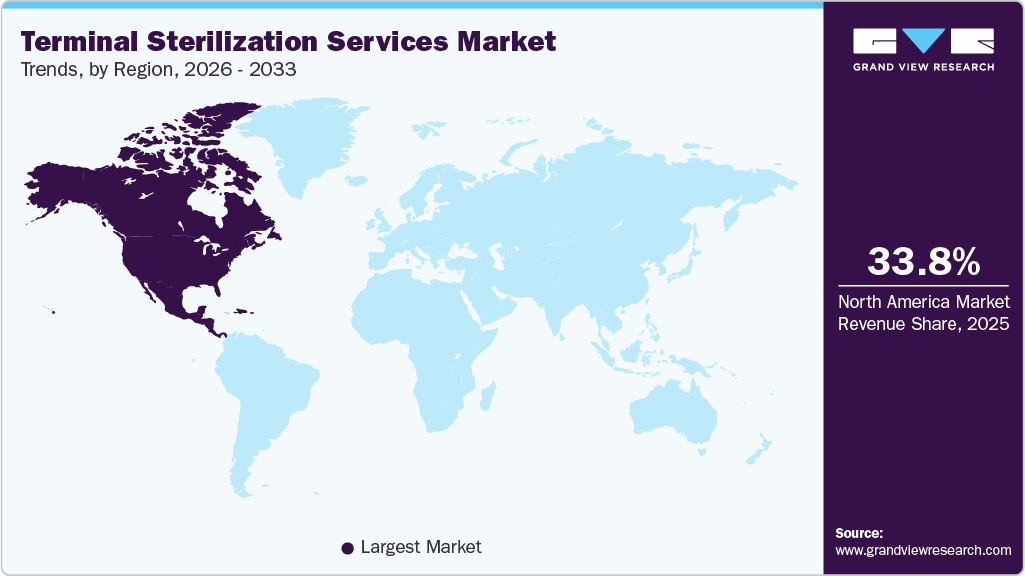

- North America dominated the terminal sterilization services market with the largest revenue share of 33.84% in 2025.

- The terminal sterilization services market in the U.S. accounted for the largest market revenue share of 88.77% in North America in 2025.

- Based on product, the equipment segment led the market with the largest revenue share of 41.08% in 2025.

- By method, the low temperature segment led the market with the largest revenue share of 59.25% in 2025.

- By end use, the hospitals segment led the market with the largest revenue share of 33.75% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 14.05 Billion

- 2033 Projected Market Size: USD 25.54 Billion

- CAGR (2026-2033): 7.82%

- North America: Largest market in 2025

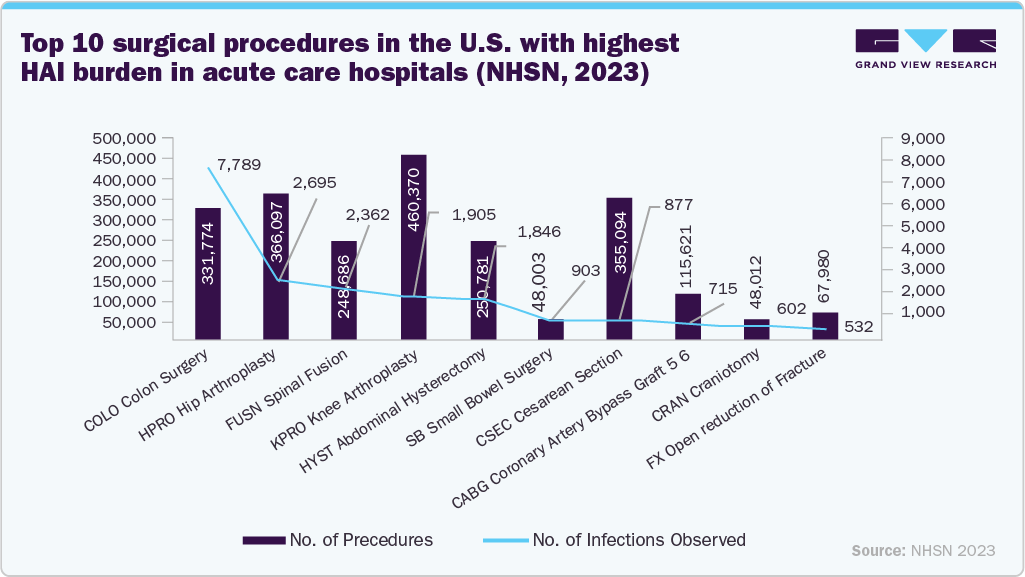

The increasing prevalence of healthcare-associated infections (HAIs) is projected to significantly contribute to the growth of the terminal sterilization services industry. Hospitals & Clinics are under continuous pressure to improve sterilization standards to prevent infections caused by inadequately sterilized equipment. For instance, according to data released by the European Centre for Disease Prevention and Control, a European Union Agency in May 2024, approximately 4.3 million hospitalized patients across the EU and European Economic Area (EEA) are affected by HAIs annually. These infections pose serious health risks and place a significant strain on healthcare systems.

Furthermore, in January 2024, a study published by ScienceDirect estimated that approximately 1.7 million patients are affected by HAIs each year in the U.S., with these infections responsible for an estimated 99,000 deaths annually. This reflects a serious public health concern and highlights the financial and operational burden placed on hospitals and healthcare systems. As a result, healthcare providers and regulatory authorities are placing increased emphasis on terminal sterilization services processes to ensure product sterility and reduce infection risk.

Terminal sterilization, performed after packaging, ensures microbial inactivation, making it an essential step in infection prevention protocols. The escalating demand for effective infection control measures due to the growing incidence of healthcare-associated infections is anticipated to significantly propel the industry.

Another major factor driving the terminal sterilization services market growth is the increasing number of surgical procedures in hospitals. For instance, according to the Eurostat report, the two most common surgical operations and procedures performed in EU hospitals are cataract surgery and caesarean sections.

Stringent regulatory oversight from global health authorities is pivotal in accelerating the growth of the market for terminal sterilization services. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World Health Organization (WHO) have all emphasized the importance of validated Sterility Assurance Levels (SALs) for medical devices, surgical instruments, and sterile pharmaceutical products prior to market approval.

The FDA and EMA strongly advocate using terminal sterilization services, wherever feasible, as the preferred method of achieving sterility. The WHO's Good Manufacturing Practices (GMP) for sterile pharmaceutical products similarly recommend:

"Whenever possible, products intended to be sterile should be terminally sterilized by heat in their final container."

This preference is further highlighted in the European Pharmacopoeia, which states:

"Wherever possible, a process in which the product is sterilized in its final container (terminal sterilization services) is chosen."

In addition, the FDA's updated guidance, published in January 2024, highlighted a noticeable increase in 510(k) submissions involving non-traditional sterilization methods, underscoring the growing innovation and complexity in the field. However, the guidance also draws clear boundaries by excluding:

-

Sterilizers that are themselves medical devices

-

Processes relying on microbial exclusion

-

Devices containing materials of animal origin

-

Liquid chemical sterilization processes

-

Reprocessing methods for single-use devices

-

Sterile reprocessing procedures at healthcare facilities

The FDA's 2024 guidance stipulates that 510(k) submissions utilizing established sterilization methods must include a detailed process description, specifications, 510(k) clearance status, and a sterilization validation summary. While validation data is not required, the submission must confirm an SAL of 10⁻⁶ for sterile-labeled devices, unless intended only for intact skin contact. This reinforces the FDA's focus on industrial terminal sterilization services processes based on microbial inactivation, especially for devices labeled as sterile.

Further strengthening the demand for terminal sterilization services, Health Canada's guidance document published in November 2024 defines terminal sterilization services as the application of a lethal sterilizing agent to a finished product sealed in its final container, aiming to achieve a Sterility Assurance Level (SAL) of 10⁻⁶ or better. The document emphasizes that terminal sterilization services are the preferred method for producing sterile products, as they offer more sterility assurance than in-process sterilization.

Major Brands Operating in the Market

Companies

Brand Name

Sterilization Method

ASP (Fortive)

STERRAD NX

Hydrogen Peroxide

STERRAD 100S

BIOTRACE

Steam Sterilization

VERISURE

SEALSURE

STERIS

V-PRO

Low Temperature Sterilization

Celerity HP

VERIFY V24

ConnectAssure

Getinge

GEE

Ethylene Oxide

Getinge Assured MI

Getinge Poladus 150

Hydrogen Peroxide

Steelco S.p.A.

PL 40

Hydrogen Peroxide

PL 70

AMS Series

Steam Sterilization

ASW Series

Sterigenics U.S., LLC - A Sotera Health company (Services)

Low Temperature, Service

Ethylene Oxide, Nitrogen Dioxide, and Gamma Sterilization

Source: Company Websites

Key Opinion Leaders Responses

KoL Response

About KoL

“Vaporized hydrogen peroxide’s addition as an established sterilization method helps us build a more resilient supply chain for sterilized devices that can help prevent medical device shortages. As innovations in sterilization advance, the FDA will continue to seek additional modalities that deliver safe and effective sterilization methods that best protect public health.”

Suzanne Schwartz, M.D., M.B.A., director of the Office of Strategic Partnerships and Technology Innovation in the FDA’s Center for Devices and Radiological Health.

"To deliver on our big bets on next-generation modalities like small molecules, biologics and nucleic acid therapies, Lilly is investing in the state-of-the-art manufacturing infrastructure needed to deliver tomorrow's safe and reliable medicines,”

Edgardo Hernandez, executive vice president and president of Lilly Manufacturing Operations.

“The use of hydrogen peroxide gas plasma represents a significant shift in making it the gold standard of sterilization for duodenoscopes and thereby improving safety for patients, technicians, and the environment, The ULTRA GI Cycle sets a new benchmark for the entire industry on sterilization and environmental safety and will give healthcare professionals and their patients a heightened level of assurance that the duodenoscopes used are now being sterilized in a safe and effective way. ”

Ivan Salgo, MD, Chief Medical & Scientific Officer ats ASP

“Our state-of-the-art X-Ray facility features innovative technology designed to maximize product safety and provide high-throughput processing while accommodating a wide range of product configurations-giving customers the flexibility and the geographic capacity they are looking for in a sterilization provider”

Mike Rutz, President, Sterigenics

Source: Company Websites

Market Concentration & Characteristics

The global terminal sterilization services industry demonstrates a high degree of innovation, driven by growing regulatory requirements, the demand for safer and more eco-friendly methods, and advances in healthcare technology. For instance, in May 2025 MATACHANA announced the launch of its NEW S1000 Steam Sterilizer, featuring improved energy efficiency, faster cycle times, and advanced automation. This exemplifies the industry’s move toward smarter and more sustainable sterilization solutions.

Regulations play a critical role in shaping the market by setting safety, efficacy, and environmental standards that manufacturers must comply with. Stringent regulatory requirements drive innovation and the adoption of advanced sterilization technologies, ensuring patient safety while encouraging the development of more efficient and sustainable sterilization methods. For instance, in January 2024, the FDA approved vaporized hydrogen peroxide (VHP), a low-temperature sterilization technique, for medical device sterilization. This authorization facilitated broader adoption of VHP within the medical device industry. Such regulatory approvals are expected to accelerate the adoption of VHP, opening up new opportunities for market growth and technological advancement in the years to come.

The market for terminal sterilization services has seen M&A activity as companies seek to expand their services and geographic reach and adopt advanced technologies, including electron beam and vaporized hydrogen peroxide sterilization. These acquisitions enable firms to improve efficiency, diversify their portfolios, and meet the growing demands of healthcare. For example, in August 2023, Orrick represented Ionisos, one of the prominent European providers of outsourced terminal sterilization services and irradiation services owned by 3i Infrastructure, in the acquisition through a carve-out of an E-beam sterilization and crosslinking facility from Studer Cables AG in Däniken, Switzerland.

Product substitutes include alternative methods, such as aseptic processing, which is commonly used in pharmaceutical manufacturing to maintain sterility without applying terminal processes. High-level disinfection (HLD) is a substitute for semi-critical medical devices where complete sterility is not required. Sterile filtration (membrane filtration) is also another product substitute that helps remove microorganisms from liquids or gases before packaging.

The industry is moderately to highly concentrated, dominated by key players like ASP (Fortive), STERIS, Getinge, and Sterigenics U.S., LLC - A Sotera Health company, among others, who leverage extensive service networks and regulatory expertise. High entry barriers, such as strict regulations and costly infrastructure, limit new competition; however, regional and specialized providers add diversity, especially in emerging markets. For instance, in June 2025, Solventum launched the Attest Super Rapid Vaporized Hydrogen Peroxide (VH₂O₂) Clear Challenge Pack, a single-use test combining FDA-cleared biological and chemical indicators in a transparent pack, reflecting continued innovation in the sterilization space.

Product Insights

Based on product, the equipment segment held the largest revenue share of 41.08% in 2025. This segment includes steam autoclaves, ethylene oxide sterilizers, and hydrogen peroxide (H₂O₂) sterilizers, including plasma-based systems, which serve as the technological foundation of terminal sterilization services in healthcare, pharmaceutical, and medical device industries. These sterilization systems are essential for ensuring the sterility of medical instruments, drugs, and packaged devices, with each type designed to accommodate specific material sensitivities, sterility assurance requirements, and operational demands.

Modern terminal sterilization service equipment is evolving rapidly to meet the demands of efficiency, safety, and regulatory compliance. Key advancements include digital monitoring, shorter sterilization cycles, and automated validation systems, all of which significantly improve workflow, reduce human error, and ensure consistent sterilization performance. For instance, in June 2024, Getinge introduced the Poladus 150, its latest low-temperature sterilizer, to address the increasing need for safe and effective reprocessing of heat-sensitive surgical instruments. Utilizing vaporized hydrogen peroxide (VH₂O₂) and operating at a controlled temperature of up to 55°C, the Poladus 150 is engineered to sterilize non-lumen, flexible lumen, and rigid lumen instruments, making it highly suitable for the complex requirements of endoscopic and robotic surgeries.

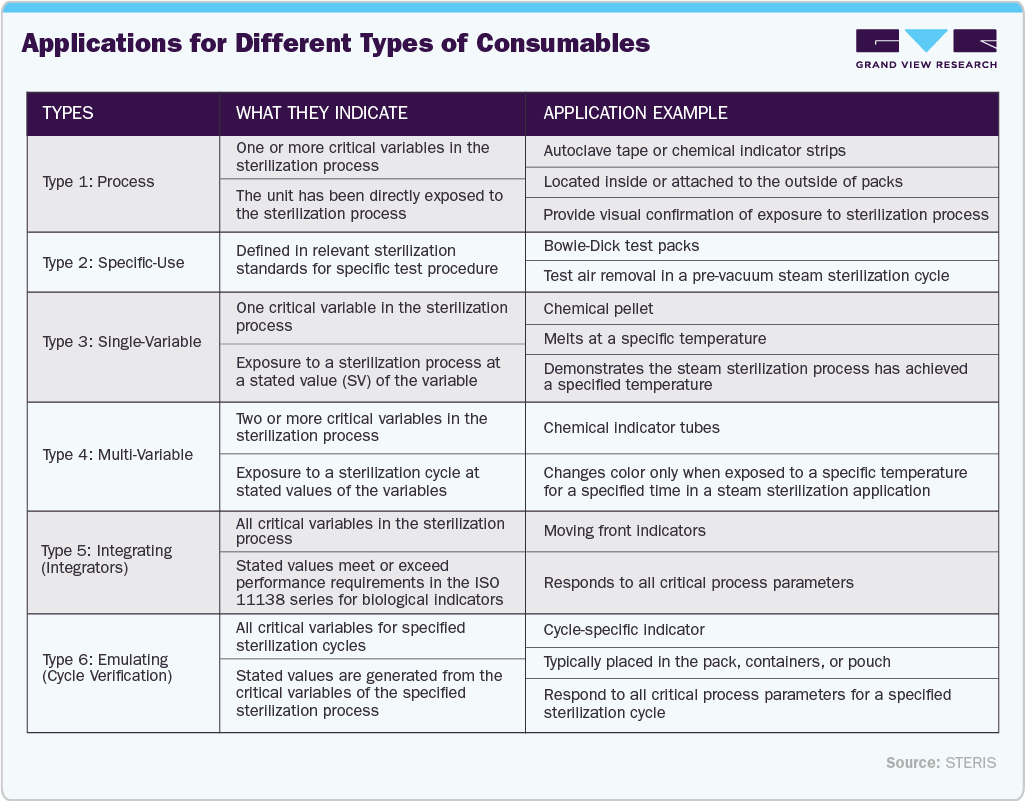

The consumables segment is expected to witness a significant growth of 7.90% during the forecast period, driven by the rising demand for rapid sterilization verification, increased surgical procedures, and stricter infection control regulations. For instance, in August 2025, Advanced Sterilization Products (ASP) introduced the BIOTRACE Instant Read Steam Biological Indicator System, which delivers results in just 7 seconds. This innovation significantly enhances workflow efficiency by eliminating delays, supporting continuous operation, and ensuring speed, accuracy, and confidence in every sterilization cycle. Growing investments in terminal sterilization services and the shift toward automation in central sterile services departments (CSSDs) further support the strong demand for high-performance consumables.

Method Insights

Based on method, the low temperature sterilization segment held the largest share in 2025. The growth is attributed to its effectiveness in sterilizing heat- and moisture-sensitive medical devices. Using chemical agents like ethylene oxide (EtO), hydrogen peroxide gas plasma, ozone, and vaporized peracetic acid ensures sterility without damaging delicate instruments. It is increasingly preferred for sterilizing minimally invasive surgical tools, flexible endoscopes, and implantable devices. Market growth is driven by the rise in reusable medical equipment, the expansion of outpatient surgical centers, and advancements that reduce cycle times and enhance sterilization efficiency.

For instance, in January 2024, the U.S. FDA officially recognized Vaporized Hydrogen Peroxide (VHP) as an established sterilization method for medical devices, boosting its credibility and adoption. VHP is highly effective against resistant pathogens, such as C. difficile and MRSA, and can penetrate small lumens and cavities, making it ideal for sterilizing complex instruments. With growing concerns over hospital-acquired infections, healthcare facilities are increasingly turning to VHP sterilizers to ensure the adequate disinfection of critical devices, such as endoscopes and surgical tools.

“The FDA’s commitment is to protect public health, a critical mission in today’s complex medical device ecosystem,” said Suzanne Schwartz, M.D., M.B.A., director of the Office of Strategic Partnerships and Technology Innovation in the FDA’s Center for Devices and Radiological Health. “Vaporized hydrogen peroxide’s addition as an established sterilization method helps us build a more resilient supply chain for sterilized devices that can help prevent medical device shortages. As innovations in sterilization advance, the FDA will continue to seek additional modalities that deliver safe and effective sterilization methods that best protect public health.”

The high temperature (steam sterilization) segment is expected to witness significant growth over the forecast period. High temperature sterilization, primarily through steam sterilization (autoclaving), remains among the most established and widely used methods in the terminal sterilization services market. Operating at 121°C to 134°C effectively eliminates a broad range of microorganisms, including spores, making it ideal for heat- and moisture-resistant devices such as surgical tools, stainless steel instruments, and reusable glassware. Known for its cost-effectiveness, reliability, and environmental safety, it is standard in hospitals, surgical centers, and labs. Despite the rise of low-temperature methods for sensitive devices, high-temperature sterilization remains dominant due to its simplicity, short cycle times, and proven efficacy.

One of the major drivers of this segment is the increasing number of surgical procedures. As the volume of surgical procedures rises, there is a heightened need for effective sterilization methods to ensure patient safety and prevent healthcare-associated infections. According to a report by the NIH in March 2025, approximately 266 million surgical procedures are performed worldwide each year. In addition, the rising global focus on infection control, particularly in the wake of hospital-acquired infections, has increased the demand for effective and validated sterilization systems.

End Use Insights

On the basis of end use, the hospitals segment held the largest revenue share in 2025. Hospitals & Clinics drive demand for terminal sterilization services because it ensures the highest level of device sterilization, which is critical for patient safety by eliminating all microorganisms and reducing healthcare-associated infections. With rising surgeries, stricter regulations, and increased infection awareness, hospitals prioritize terminal sterilization services to meet standards, improve outcomes, and comply with laws, avoiding costly recalls and reputational damage. For instance, in August 2025, the International Trade Administration highlighted Brazil as the most significant healthcare market in Latin America, spending 9.7% of its GDP (US$135 billion) on healthcare, with 7,309 hospitals (63% private), over 500,000 beds, nearly 576,000 physicians, and a public system (SUS) serving 72% of the population.

The ambulatory surgery centers segment is anticipated to experience the fastest growth over the forecast period, driven by increasing preference for outpatient procedures and expansion of ambulatory surgery center facilities, among others. For instance, according to UPMC HealthBeat, a publishing website for UPMC, an integrated health care system based in Pittsburgh, reports that many procedures and surgeries are now routinely performed on an outpatient basis. Common outpatient procedures and types of outpatient surgeries include:

-

Cataract surgery: Removing the cloudy natural lens of the eye and replacing it with an artificial lens.

-

Ear, nose, and throat (ENT) surgeries: Such as tonsil and adenoid removal.

-

Cosmetic surgeries: Including breast reconstruction and skin grafts.

-

Urologic procedures: Such as vasectomy.

-

Orthopedic procedures: Including knee and hip replacements, as well as surgeries on toes, feet, ankles, and legs.

-

Gallbladder removal.

-

Skin procedures: Such as mole removal and other skin repairs.

-

Lumpectomy: Removal of a cancerous tumor in the breast.

-

Colonoscopy and endoscopy.

-

Hand, wrist, elbow, and ankle surgeries: Including procedures for arthritis.

-

Tendon and muscle repairs: Such as rotator cuff surgery.

-

Gynecological procedures: Including dilation and curettage (D&C) and tubal ligation.

-

Hemodialysis: For patients with kidney disease.

-

Hernia repairs.

-

Hemorrhoid procedures.

-

Kidney stone treatment

Regional Insights

The terminal sterilization services industry in North America accounted for the largest revenue share of 33.84% in 2025, driven by the increasing demand for infection control and patient safety in healthcare settings. The North American market is witnessing significant growth, primarily fueled by the rising incidence of healthcare-associated infections (HAIs), increasing surgical procedure volumes, and the growing need for effective infection control in hospitals and medical facilities. Stricter regulatory standards set by agencies such as the FDA and CDC have increased the demand for validated sterilization services, particularly in the pharmaceutical and medical device industries. Additionally, the rise in chronic diseases, an aging population requiring more invasive treatments, and the expansion of the biologics and personalized medicine sectors have further fueled the need for terminal sterilization services. Outsourcing trends among pharma and MedTech companies and advancements in sterilization technologies, such as low-temperature hydrogen peroxide and irradiation methods, support market expansion by offering safer, faster, and environmentally friendly alternatives to traditional methods like ethylene oxide.

U.S. Terminal Sterilization Services Market Trends

The U.S. terminal sterilization services industry held the largest share of 88.77% in 2025 in North America. The market is primarily driven by the growing demand for infection control and the increasing volume of surgical procedures and hospital admissions. According to a report by the CDC in November 2023, approximately one in 31 hospital patients and one in 43 nursing home residents in the U.S. acquire at least one healthcare-associated infection each day. This highlights the need to strengthen infection prevention measures across all healthcare settings. Despite notable progress in recent years, further improvements are essential to enhance patient safety and reduce the burden of HAIs throughout the U.S. healthcare system. With the rising burden of chronic conditions such as diabetes, cardiovascular diseases, and cancer, the need for surgeries and, thus, sterile surgical instruments has grown significantly. Additionally, the continued use of implantable and disposable medical devices, including catheters, pacemakers, and orthopedic implants, has intensified the reliance on terminal sterilization services to ensure patient safety. The ongoing emphasis on hospital-acquired infection reduction, especially post-COVID-19, has also compelled healthcare facilities to strengthen sterilization protocols.

Europe Terminal Sterilization Services Market Trends

The terminal sterilization services industry in Europe is driven by growing infection control focus, rising surgical volumes, and strict enforcement of sterilization standards, fueled by an aging population and increased chronic diseases. The EU’s Medical Device Regulation (MDR) has heightened emphasis on product safety, pushing the adoption of validated sterilization processes. Growth is also supported by increased use of single-use devices and expansion in the pharmaceutical and biotech sectors. Awareness of healthcare-associated infections and government efforts to improve hygiene further boost demand for advanced sterilization solutions. For instance, in October 2024, the Medical Device Coordination Group clarified that ethylene oxide (EtO) used for sterilizing medical devices is regulated under MDR/IVDR, not the Biocidal Products Regulation, exempting it from specific biocide rules.

The UK terminal sterilization services industry is expected to grow consistently, primarily fueled by stringent healthcare regulations and an increasing emphasis on infection prevention and patient safety. The country's aging population plays a significant role in this growth trajectory. According to the Centre for Ageing Better, around 11 million people in England were aged over 65 as of 2023, with projections indicating a 10% rise in the next five years and a 32% increase by 2043. Older adults are more susceptible to chronic diseases, often requiring hospitalization for surgeries and other medical procedures. This demographic trend is expected to increase the demand for sterile medical equipment, thereby driving the adoption of terminal sterilization services across healthcare facilities.

In addition, the high incidence of healthcare-associated infections (HAIs) is a pressing concern driving market expansion. For instance, in March 2025, the UK Health Security Agency reported that approximately 7.6% of hospitalized patients are affected by healthcare-associated infections (HAIs). This alarming rate has intensified the focus on infection control, prompting hospitals and clinics to strengthen sterilization protocols. Terminal sterilization plays a crucial role in ensuring medical devices, surgical tools, and pharmaceuticals meet sterility standards, making it essential to healthcare operations. With growing awareness of HAIs and increasing regulatory scrutiny, demand for terminal sterilization services is expected to rise significantly across the UK healthcare sector.

Asia Pacific Terminal Sterilization Services Market Trends

The terminal sterilization services industry in the Asia Pacific is growing rapidly, driven by healthcare modernization and increased surgical volumes in countries such as China, India, Japan, and Australia. Ethylene oxide remains the dominant sterilization method, while radiation and low-temperature techniques gain popularity for heat-sensitive products. Outsourced sterilization services are favored by device manufacturers, pharma companies, and hospitals for efficiency and compliance. Market leaders are expanding into new regions, tailoring solutions to local needs. Rising healthcare-associated infections, aging populations, and chronic diseases further drive demand for professional sterilization across the region.

The China terminal sterilization services industry is experiencing rapid growth driven by healthcare expansion, regulatory modernization, and rising industrial demand. The development of hospital infrastructure, particularly in Tier II and III cities, has heightened the need for validated sterilization to support increased surgical volumes and enhanced infection control. In contrast, the government's emphasis on infection prevention has accelerated the adoption of advanced technologies in both public and private hospitals. For instance, in January 2024, the NIH published a report noting that MRSA detection rates in Macau increased from 30.1% in 2017 to 45.7% in 2022, highlighting the urgent need for stringent sterilization measures. In addition, the shift toward contract sterilization services is gaining momentum among small and mid-sized manufacturers aiming to reduce operational burdens and ensure regulatory compliance. The government’s promotion of green sterilization practices, including limiting ethylene oxide emissions and encouraging the use of energy-efficient equipment, further supports the rapid modernization and expansion of China’s market.

Latin America Terminal Sterilization Services Market Trends

The terminal sterilization services industry in Latin America is growing rapidly, driven by rising healthcare demand, stricter regulations, and technological advancements. A key growth factor is the increasing rate of hospital-acquired infections, pushing healthcare facilities to adopt more stringent sterilization practices to enhance patient safety. For instance, in July 2024, the American Journal of Infection Control emphasized the critical role of sterile processing in reducing HAIs, which remain a major global issue, especially in low- and middle-income countries with 134 million adverse events and 2.6 million deaths annually. While urban hospitals in Latin America have improved sterile processing standards, significant disparities persist in rural and regional areas. To address this, an expert panel of SPD professionals from five Latin American countries convened in São Paulo, supported by 3M Health Care, to review best practices, share challenges, and develop guidance for improving SPD performance across the region.

Middle East and Africa Terminal Sterilization Services Market Trends

The terminal sterilization services industry in the Middle East and Africa is growing, driven by rising surgical volumes, increased focus on infection prevention, and higher healthcare-associated infections (HAIs) rates. Demand is strong across hospitals, outpatient centres, and medical manufacturing sites, with notable low-temperature and radiation sterilization equipment growth. Hospitals & Clinics and manufacturers increasingly outsource sterilization services to ensure regulatory compliance and efficiency. The pharmaceutical and biopharmaceutical sectors, especially sterile drug and vaccine producers, are significant growth drivers. Within the broader infection control market, services are expanding faster than consumables and equipment, reflecting a stronger emphasis on hygiene protocols across the MEA region. For instance, in January 2025, De Lama presented the latest innovations in sterilization, washing, and decontamination equipment at the DUPHAT Pharma exhibition in Dubai. Highlights included advanced solutions designed to meet the stringent requirements of the new Annex 1 guidelines and the HyPerPure Hydrogen Peroxide sterilizer, recognized as the most efficient and environmentally friendly sterilizer currently available on the market.

Key Terminal Sterilization Services Company Insights

The market is moderately fragmented, featuring major global players and local competitors. As companies intensify their efforts to capture market share, competition is expected to become increasingly fierce. Many participants are pursuing strategic initiatives such as product launches, mergers and acquisitions, and geographic expansion to strengthen their competitive position. With these diverse strategies in place, the market is expected to experience significant growth during the forecast period.

Key Terminal Sterilization Services Companies:

The following are the leading companies in the terminal sterilization services market. These companies collectively hold the largest market share and dictate industry trends.

- ASP (Fortive)

- Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.)

- DE LAMA S.P.A.

- Genist Technocracy Pvt. Ltd.

- Getinge

- Andersen Sterilizers

- Labotronics Scientific

- Labtron Equipment Ltd

- STERIS

- Stryker

- Qingdao Antech Scientific Co., Ltd.

- MATACHANA

- Solventum

- Steelco S.p.A.

- RENOSEM CO., LTD.

- Tuttnauer

- Sterile Safequip and Chemicals LLP

- MMM Group

- SOLSTEO

- Sterigenics U.S., LLC - A Sotera Health company

- Canon Singapore Pte. Ltd.

- INSTECH SYSTEMS

- Syntegon Technology GmbH

- Mudanjiang Plasma Physics Application Technology Co., Ltd (CASP)

- Fedegari Autoclavi S.p.A.

- NovaSterilis

Recent Developments

-

In September 2025, Noxilizer, Inc. announced a USD 30 million growth capital financing. The funding was led by NewVale Capital, a growth equity firm specializing in the pharmaceutical services sector. “This investment allows us to broaden availability of NO₂ sterilization at a time when manufacturers urgently need validated, commercial-ready alternatives to existing methods,” said Christopher Thatcher, President and Chief Executive Officer of Noxilizer. “We’re proud to provide a platform that is already trusted in commercial-stage products. With NewVale Capital’s support, we are strengthening our foundation to serve our customers at scale, with long-term reliability, especially as EtO contract sterilization providers face increasing remediation mandates and capacity constraints.”

-

In June 2025, Solventum announced the launch of its Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack. This ready-to-use test combines two FDA-cleared indicators- a biological indicator (BI) that confirms microbial neutralization and a chemical indicator (CI) that verifies proper sterilizer performance- into a single-use pack featuring a transparent container.

-

In May 2025, MATACHANA launched its NEW S1000 Steam Sterilizer, featuring improved energy efficiency, faster cycle times, and advanced automation. This exemplifies the industry’s move toward smarter and more sustainable sterilization solutions.

-

In May 2025, Sterigenics, a Sotera Health company and one of the leading global providers of outsourcing terminal sterilization services, announced the expansion of its Haw River, North Carolina campus to include a new X-Ray facility situated next to its existing gamma facility. The new facility is scheduled to open in late 2025.

-

In April 2025, DE LAMA S.P.A. announced that it had been awarded as the Top Sterilization Company in Europe for 2025 by the authoritative PharmaTech Outlook magazine. One of the company's major innovations is HyPerPure, a sterilization technology that addresses the limitations of traditional methods. For instance, when a pharmaceutical client required sterilization of a heat-sensitive syringe containing blood derivatives, conventional techniques proved inadequate. HyPerPure provided reliable sterilization for temperature-sensitive products, reduced energy consumption by 70% compared to saturated steam sterilization, and eliminated water waste, thereby significantly decreasing environmental impact and operating costs.

-

In March 2025, the CASP Company announced that it successfully obtained the da Vinci test report for its Hydrogen Peroxide Low Temperature Plasma Sterilizers on March 4, 2025.

-

In November 2024, ASP was recognized with four esteemed 2024 Medical Device Network Excellence Awards. These awards in the categories of Innovation, Product Launch, Safety, and Environmental reflect the company's dedication to advancing sterilization technology, enhancing healthcare safety, and promoting sustainability.

- In August 2023, Orrick represented Ionisos, one of the prominent European providers of outsourced terminal sterilization services and irradiation services owned by 3i Infrastructure, in the acquisition through a carve-out of an E-beam sterilization and crosslinking facility from Studer Cables AG in Däniken, Switzerland.

Terminal Sterilization Services Market Report Scope

Report Attribute

Details

Market size in 2026

USD 15.08 billion

Revenue forecast in 2033

USD 25.54 billion

Growth rate

CAGR of 7.82% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

ASP (Fortive); Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.); DE LAMA S.P.A.; Genist Technocracy Pvt. Ltd.; Getinge; Andersen Sterilizers; Labotronics Scientific; Labtron Equipment Ltd; STERIS; Stryker; Qingdao Antech Scientific Co., Ltd.; MATACHANA; Solventum; Steelco S.p.A.; RENOSEM CO.,LTD.; Tuttnauer; Sterile Safequip And Chemicals LLP; MMM Group; SOLSTEO; Sterigenics U.S., LLC – A Sotera Health company; Canon Singapore Pte. Ltd.; INSTECH SYSTEMS; Shinva Medical Instrument Co., Ltd.; Syntegon Technology GmbH; Mudanjiang Plasma Physics Application Technology Co., Ltd (CASP); Fedegari Autoclavi S.p.A.; NovaSterilis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Terminal Sterilization Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global terminal sterilization services market report on the basis of product, method, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Consumables

-

Service & Maintenance

-

Connectivity Solutions and Software

-

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Low Temperature

-

Hydrogen Peroxide (H2O2)

-

Ethylene Oxide (EtO)

-

Others

-

-

High Temperature (Steam Sterilization)

-

Systems

-

Consumables

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinic

-

Pharma and Nutraceuticals

-

Ambulatory Surgical Centres (ASCs)

-

Medical Device Manufacturers/Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global terminal sterilization services market size was estimated at USD 14.05 billion in 2025 and is expected to reach USD 15.08 billion in 2026.

b. The global terminal sterilization services market is expected to grow at a compound annual growth rate of 7.82% from 2026 to 2033 to reach USD 25.54 billion by 2033.

b. North America dominated the terminal sterilization services market with a share of 33.84% in 2025. This market growth is attributable to the high prevalence of chronic diseases, and rising incidence of Healthcare Acquired Infections (HAIs).

b. Some key players operating in the terminal sterilization services market include ASP (Fortive), Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.), DE LAMA S.P.A., Genist Technocracy Pvt. Ltd., Getinge, Andersen Sterilizers, Labotronics Scientific, Labtron Equipment Ltd, STERIS, Stryker, Qingdao Antech Scientific Co., Ltd., MATACHANA, Solventum, Steelco S.p.A., RENOSEM CO., LTD., Tuttnauer, Sterile Safequip And Chemicals LLP, MMM Group, SOLSTEO, Sterigenics U.S., LLC - A Sotera Health company, Canon Singapore Pte. Ltd., INSTECH SYSTEMS, Shinva Medical Instrument Co., Ltd., Syntegon Technology GmbH, Mudanjiang Plasma Physics Application Technology Co., Ltd (CASP), Fedegari Autoclavi S.p.A., NovaSterilis

b. Key factors that are driving the terminal sterilization services market growth include an increasing number of surgical procedures and a rising prevalence of hospital-acquired infections across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.