- Home

- »

- Agrochemicals & Fertilizers

- »

-

Tertiary Amines Market Size & Share, Industry Report, 2030GVR Report cover

![Tertiary Amines Market Size, Share & Trends Report]()

Tertiary Amines Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (C-8 TA, C-10 TA, C-12 TA, C-14 TA, C-16 TA), By Application (Personal Care, Oilfield Chemicals, Water Treatment), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-879-4

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tertiary Amines Market Size & Trends

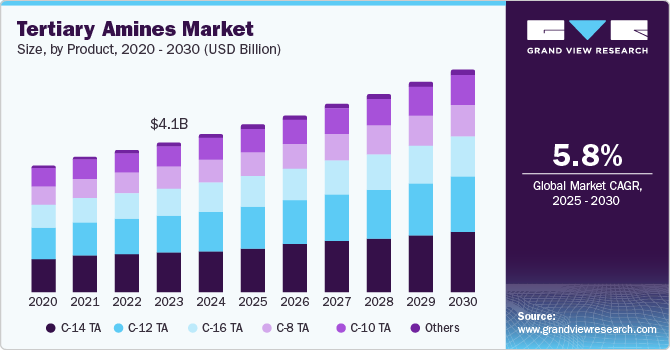

The global tertiary amines market size was estimated at USD 4.31 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. Tertiary amines are widely used in the formulation of surfactants, which are essential in personal care items like shampoos, conditioners, and detergents. With increased consumer spending on hygiene and grooming, especially in emerging markets, the demand for the market is rising.Tertiary amines are critical intermediates in synthesizing drugs and other healthcare products. The global increase in healthcare spending and pharmaceutical innovations fuels demand for these amines, as they are essential in producing various drugs and therapeutic agents.

Tertiary amines are used to produce herbicides, fungicides, and pesticides, which support the agriculture industry. As the global population grows and food demand increases, there is an ongoing need for agricultural productivity, driving demand for agrochemical inputs, including product. The use of market in industrial cleaning products is increasing, especially with heightened hygiene awareness in workplaces and institutions. These compounds help create cleaning agents and disinfectants, which are increasingly used in commercial and industrial facilities.

The market are utilized in the water treatment industry as they help in the removal of impurities and control of microorganisms. Rising global concerns about clean water availability and stricter regulations around water treatment bolster the demand for these chemicals. Innovations in the production of tertiary amines, such as bio-based alternatives and more efficient synthetic methods, are helping reduce costs and increase product quality. This opens up new applications and enhances adoption across industries, supporting market growth.

Product Insights

C-14 TA held the highest revenue market share of 26.89% in 2024. C-14 tertiary amines are commonly used as end use in the production of conditioning agents for personal care products such as hair conditioners and skin creams. Their antistatic and conditioning properties are highly valued in personal grooming and hygiene products, driving demand in line with the growth of the personal care and cosmetics industry.

C-16 TA is expected to grow significantly at a CAGR of 5.1% over the forecast period. It is highly effective in softening fabrics and reducing static cling, making it a popular ingredient in fabric conditioners and softeners. The demand for convenience in laundry products, combined with the rise in urbanization and busy lifestyles, is supporting growth in this segment.

End Use Insights

Personal Care held the highest revenue market share of 47.98% in 2024. With a shift toward natural and organic products, there is a demand for tertiary amines derived from bio-based sources or used in eco-friendly formulations. It contribute to the effectiveness and stability of these products, meeting the growing demand for sustainable and "green" personal care items. They are critical in haircare products such as shampoos and conditioners due to their emulsifying and anti-static properties. As the market for premium haircare products expands, driven by increasing awareness of hair health and care routines, the demand for product rises.

Pharmaceuticals is expected to grow at fastest CAGR of 6.6% over the forecast period. Advances in pharmaceutical synthesis technology, including green chemistry methods and more efficient synthetic pathways, make it easier to incorporate tertiary amines in drug manufacturing processes. These advancements reduce production costs, enhance product purity, increase the efficiency of tertiary amines, further fueling demand.

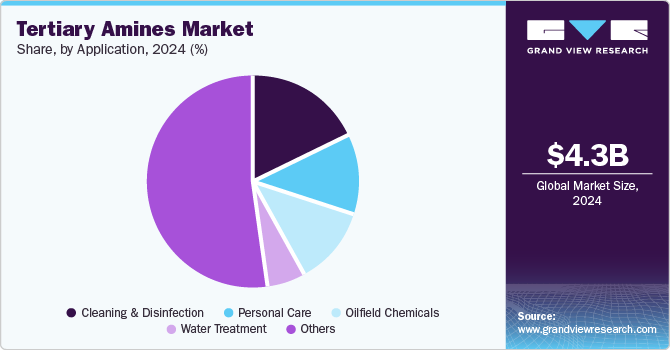

Application Insights

Cleaning & Disinfection held the highest revenue market share of 18.45% in 2024. Growing urbanization, rising income levels, and increased awareness of hygiene in homes and commercial establishments drive the need for cleaning products. Tertiary amines contribute to high-performance disinfectant formulations, allowing companies to meet the rising demand for effective household cleaners.

Oilfield chemicals is expected to grow at the fastest CAGR of 6.2% over the forecast period. Growing global energy demand has led to an increase in oil and gas exploration, particularly in offshore and unconventional reserves. Tertiary amines are essential in producing various oilfield chemicals like corrosion inhibitors, drilling fluids, and surfactants, which are critical for efficient and safe operations. New technologies, such as horizontal drilling and hydraulic fracturing, require specialized chemicals for wellbore stabilization and smooth drilling operations. Tertiary amines play a key role in producing these specialty chemicals, particularly in lubricants and emulsifiers for stable and efficient drilling in complex geological formations.

Regional Insights

Asia Pacific dominated the tertiary amines market in 2024 with a revenue share of 46.98% and is further expected to grow at the fastest CAGR of 6.3% over the forecast period. Tertiary amines are integral to manufacturing herbicides, pesticides, and fungicides. With agriculture being a critical industry in the Asia Pacific region, especially in China, India, and Southeast Asia, the need for agrochemicals continues to rise. The drive to increase crop yields to meet the food demands of a growing population supports this trend.

China Tertiary Amines Market Trends

China’s growing middle class and rising disposable incomes have led to an increased demand for personal care and cosmetic products. It is used in products such as shampoos, conditioners, and lotions, which are seeing higher demand as a result of this consumer trend. China is one of the largest and fastest-growing pharmaceutical markets globally. They are used in synthesizing various active pharmaceutical ingredients (APIs) and in formulations for numerous drugs. The ongoing expansion of pharmaceutical manufacturing, coupled with government efforts to make healthcare more accessible, supports the demand for tertiary amines.

North America Tertiary Amines Market Trends

The North American water treatment industry is expanding due to increasing concerns about water quality, pollution, and regulatory standards. Tertiary amines are commonly used in water treatment chemicals, and with rising infrastructure investment in the U.S. and Canada, demand for these compounds is expected to grow.

The product is used to create herbicides, fungicides, and other agrochemicals that support large-scale farming. In the U.S., where agricultural productivity is a priority, the demand for efficient crop protection solutions is strong. This supports the use of tertiary amines in producing agrochemicals that enhance crop yields and pest control.

Europe Tertiary Amines Market Trends

European Union (EU) regulations governing water quality and treatment are stringent, driving the demand for tertiary amines in the water treatment industry. These chemicals are used for purifying water and controlling microorganisms, aligning with the EU’s goals of maintaining high water quality standards.

The UK’s agricultural sector is increasingly adopting sustainable practices, with an emphasis on productivity and environmental responsibility. Tertiary amines are used in herbicides, pesticides, and fungicides, which support these goals. As agricultural regulations become stricter, tertiary amines' role in eco-friendly crop protection solutions is growing.Tertiary amines are used in water treatment chemicals to control microbial growth and remove contaminants. In the UK, with its strong focus on clean water initiatives and environmental standards, tertiary amines play a key role in municipal and industrial water treatment systems.

Key Tertiary Amines Company Insights

Some of the key players operating in the market are Albemarle Corporation,KLK Oleo:

-

In the tertiary amines market, Albemarle provides a range of high-quality amines used across various industries, including personal care, water treatment, and agriculture. Their product offerings include fatty amines, methyl amines, and a broad spectrum of custom amine solutions tailored to meet specific industrial needs.

-

KLK Oleo’s product offerings include tertiary amines, fatty acids, fatty alcohols, glycerine, and specialty esters. In the product segment, KLK Oleo supplies products tailored for use in personal care, home care, industrial applications, and agrochemical formulations.

Key Tertiary Amines Companies:

The following are the leading companies in the tertiary amines market. These companies collectively hold the largest market share and dictate industry trends.

- Kao Corporation

- Eastman Chemical Company

- Arkema

- Balaji Amines

- Temix Oleo Srl

- Indo Amines Ltd.

- Dow Chemical

- Solvay

- BASF SE

- Lonza

- Albemarle Corporation

- KLK Oleo

Tertiary Amines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.56 billion

Revenue forecast in 2030

USD 6.05 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2022

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Belgium; China; India; Japan; South Korea; Brazil

Key companies profiled

Kao Corporation; Eastman Chemical Company; Arkema; Balaji Amines; Temix Oleo Srl; Indo Amines Ltd.; Dow Chemical; Solvay; BASF SE; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

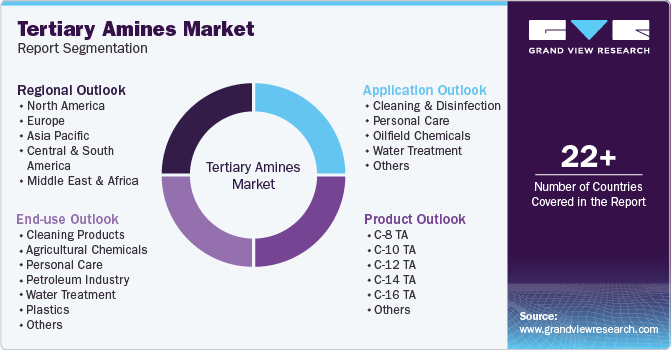

Global Tertiary Amines Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the tertiary amines market on the basis of application, product, end use and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

C-8 TA

-

C-10 TA

-

C-12 TA

-

C-14 TA

-

C-16 TA

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cleaning & Disinfection

-

Personal Care

-

Oilfield Chemicals

-

Water Treatment

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cleaning Products

-

Agricultural Chemicals

-

Personal Care

-

Petroleum Industry

-

Water Treatment

-

Plastics

-

Pharmaceuticals

-

Textiles & Fibers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global tertiary amines market size was estimated at USD 4.31 billion in 2024 and is expected to reach USD 4.56 billion in 2025.

b. The global tertiary amines market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030 to reach USD 6.05 billion by 2030.

b. Cleaning & Disinfection held the highest revenue market share of 18.45% in 2024. Growing urbanization, rising income levels, and increased awareness of hygiene in homes and commercial establishments drive the need for cleaning products.

b. Key players in the tertiary amines market are Kao Corporation, Eastman Chemical Company, Arkema, Balaji Amines, Temix Oleo Srl, Indo Amines Ltd.,

b. Tertiary amines are used to produce herbicides, fungicides, and pesticides, which support the agriculture industry. As the global population grows and food demand increases, there is an ongoing need for agricultural productivity, driving demand for agrochemical inputs, including tertiary amines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.