- Home

- »

- Next Generation Technologies

- »

-

Testing As A Service Market Size, Share, Growth Report 2030GVR Report cover

![Testing As A Service Market Size, Share & Trends Report]()

Testing As A Service Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Type (Functionality, Security, Compliance), By Deployment Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-185-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Testing as a Service Market Summary

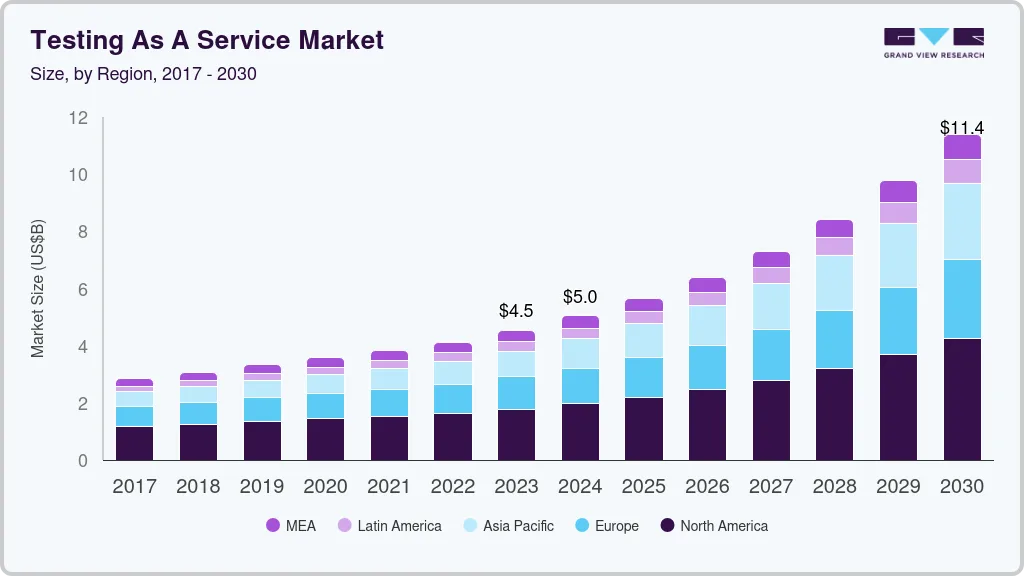

The global testing as a service market size was estimated at USD 4,541.8 million in 2023 and is projected to reach USD 11,376.8 million by 2030, growing at a CAGR of 14% from 2024 to 2030. The increasing complexity of software development, involving functionalities and dependencies, necessitates comprehensive testing approaches, driving the demand for Testing as a Service (TaaS).

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2024 to 2030.

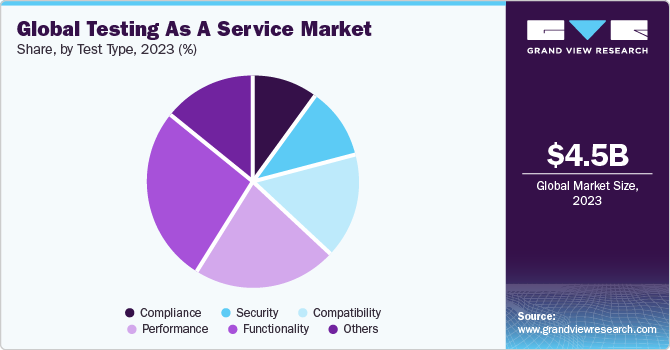

- In terms of segment, functionality accounted for a revenue of USD 1,246.2 million in 2023.

- Security is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 4,541.8 Million

- 2030 Projected Market Size: USD 11,376.8 Million

- CAGR (2024-2030): 14.0%

- North America: Largest market in 2023

The industry's shift towards agile and DevOps methodologies for faster development requires efficient testing solutions, making TaaS well-suited with its on-demand scalability and expertise.

TaaS offers substantial cost-saving opportunities for organizations. By leveraging TaaS, organizations eliminate the need for significant upfront capital investments and ongoing maintenance costs associated with testing infrastructure. The shared resource model of TaaS providers, offering a variety of advanced testing tools and platforms, translates to significant savings, which is particularly beneficial for smaller organizations or those with project-specific tool requirements. In addition, TaaS providers offer tool optimization by investing in and maintaining a variety of advanced testing tools, enabling organizations to pay for access as needed and avoiding individual license and subscription fees.

The adoption of Agile and DevOps methodologies, characterized by rapid development cycles, aligns seamlessly with the on-demand nature of Testing as a Service (TaaS). The flexibility provided by TaaS facilitates faster feedback loops, enhances overall product quality, and reduces time to market, which are essential factors for growth. Furthermore, in a business environment focused on innovation and speed, TaaS offers streamlining testing processes through access to skilled testers and automated testing tools. Thus, it alleviates development bottlenecks, enabling organizations to focus on core innovation activities, resulting in quicker product launches, heightened customer satisfaction, and a sustained competitive edge.

Market Concentration & Characteristics

The Testing as a Service (TaaS) market is characterized by a high degree of innovation owing to rapid technological advancements. Artificial Intelligence (AI) and Machine Learning (ML) play a pivotal role, automating repetitive testing tasks and utilizing ML to identify defects and predict testing outcomes, thereby enhancing efficiency and accuracy. Cloud-based platforms have become integral, providing flexibility, scalability, and access to a diverse range of testing tools, fostering faster innovation and the integration of new technologies. In addition, the increased adoption of APIs in software development has spurred the demand for robust API testing solutions, leading to the ongoing evolution and enhancement of automation tools and frameworks to address these needs.

The TaaS market is witnessing significant merger and acquisition (M&A) activity among major players. The industry, still fragmented with numerous small and medium-sized providers, is undergoing consolidation as larger companies seek to acquire businesses, aiming to secure market share and operational efficiencies. M&A activities also serve as a means for companies to broaden their service offerings, making them more appealing to clients and enhancing their competitive advantage.

Regulations play a pivotal role in the Testing-as-a-Service (TaaS) market, particularly in areas of data security and privacy. Stricter measures, such as GDPR and CCPA, compel TaaS providers to implement robust safeguards for client data during testing, aligning with stringent deletion and access control requirements. Industry-specific regulations, such as HIPAA in healthcare and PCI DSS in finance, necessitating adaptation to specific testing standards and compliance requirements, also influence the TaaS market. Meeting these standards requires TaaS providers to offer specialized testing solutions tailored to industry-specific regulations.

There are a limited number of direct product substitutes for testing as a service. TaaS provides flexibility and scalability by offering on-demand access to diverse testing expertise and resources, allowing businesses to easily adjust their testing efforts without the complexities of managing in-house infrastructure or personnel. The cost-effectiveness of TaaS is significant, primarily for businesses with fluctuating testing needs, as pay-as-you-go models eliminate upfront investments in infrastructure and personnel, making it a more affordable option.

End-user concentration significantly impacts the TaaS market as businesses increasingly prioritize user experience (UX) in the competitive landscape. TaaS providers are adapting by incorporating user-centric testing methodologies and tools, addressing aspects such as usability, accessibility, and overall satisfaction. TaaS providers are focusing on specific user segments by offering specialized testing services tailored to diverse demographics, accessibility requirements, and usage contexts, ensuring optimized software applications for each user group.

Test Type Insights

The functionality segment led the market and held 27.4% of the global revenue in 2023 as businesses prioritize delivering software with robust and user-friendly functionality, leading to a heightened focus on functionality testing. The need for optimal performance, reliability, and an enhanced user experience drives this emphasis on core software features. The adoption of agile and DevOps methodologies further propels functionality testing, aligning seamlessly with the frequent release and continuous integration/continuous delivery (CI/CD) pipelines and enabling integration of automated testing tools. As modern software applications become more complex, TaaS providers play a crucial role in addressing this complexity by offering expertise in managing intricate functionalities and tailoring testing methodologies to ensure thorough coverage, preventing critical issues in core features.

The security segment is predicted to register the fastest CAGR during the forecast years. The increase in cyberattacks emphasizes the critical need for robust security measures as organizations become more aware of vulnerabilities and potential consequences of data breaches. The shifting IT landscape, due to the growing adoption of cloud technologies, IoT devices, and complex software applications, introduces new attack surfaces and security challenges that traditional testing methods may need to be more effectively addressed. Stringent data privacy regulations, such as GDPR and HIPAA, are compelling organizations to prioritize data security and implement comprehensive security testing practices, often seeking specialized expertise from TaaS providers. As businesses aim to safeguard against cyber threats and ensure compliance, the security segment is poised for substantial growth.

End-use Insights

IT & telecommunication held the largest market revenue share in 2023. The escalating demand for digital transformation in the IT sector places businesses under constant pressure to innovate and embrace new technologies. TaaS emerges as a solution by offering access to a skilled pool of testing professionals and resources, eliminating the need for substantial internal testing infrastructure investments. The increasing complexity of IT systems further emphasizes the role of TaaS providers, who provide specialized expertise and tools to effectively test intricate systems that are challenging and expensive to test in-house. In addition, TaaS aids IT & telecommunication companies in meeting the demands for high-quality product and service delivery by providing access to various testing services, including performance, security, and compatibility testing, contributing to enhanced quality and efficiency.

The healthcare segment is expected to register the fastest CAGR during the forecast period. Modern healthcare heavily relies on intricate IT systems, encompassing electronic health records, medical devices, and telehealth platforms. Thus, TaaS is an effective and flexible solution for healthcare organizations, delivering comprehensive testing to ensure patient safety, data security, and operational efficiency. The stringent regulatory requirements in the healthcare industry, such as HIPAA and GDPR, drive the demand for TaaS providers who specialize in compliance testing, helping organizations adhere to privacy and security protocols and avoid regulatory penalties. In addition, TaaS plays a pivotal role in supporting precision medicine and personalized care by providing the specialized testing expertise and tools needed to analyze vast amounts of patient data accurately and ensure the integrity of healthcare technologies, including advancements in artificial intelligence, robotics, and wearable devices.

Deployment Type Insights

The public segment held a significant market revenue share in 2023. The pay-as-you-go model of public cloud eliminates the need for upfront investments in expensive hardware and software, specifically advantageous for startups and small to medium-sized enterprises (SMEs). Public cloud infrastructure's scalability and flexibility seamlessly align with the dynamic requirements of agile development, allowing businesses to adapt testing resources as needed effortlessly. The accessibility of testing tools and environments, accessible from anywhere with an internet connection, facilitates remote work and collaboration.

The private segment will witness significant growth in the coming years. Heightened concerns over security and data privacy, majorly in industries like healthcare, finance, and government, drive the growth of private clouds as they assist businesses with sensitive data or strict compliance requirements. The increased customization and control offered by private clouds are advantageous to organizations with complex applications or customized testing needs, providing a tailored testing environment. Furthermore, ongoing advancements in private cloud technology, focusing on performance, scalability, and features, enhance the need for private clouds as a viable option for various businesses.

Regional Insights

North America dominated the market and held a 39.2% share in 2023. This growth is attributed to the region's growing software development market, where there is a demand for quality assurance (QA) services, enabling the growth of a robust TaaS market. Additionally, North America has the presence of major TaaS providers, including industry leaders such as Infosys Limited, and Cognizant, renowned for delivering high-quality testing services. Furthermore, North American companies offer cutting-edge testing tools and techniques, such as AI and ML-based testing, to enhance the efficiency and effectiveness of their services.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The region's increasing adoption of cloud computing is driving the demand for TaaS. Additionally, there is a growing awareness among businesses in the region about the benefits of outsourcing testing activities, including cost reduction, improved quality, and accelerated time. Government initiatives in some Asia Pacific countries, such as China and Japan, to promote the adoption of cloud computing and digital technologies create a strong demand for the TaaS in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include Capgemini, Atos SE, and Accenture.

-

Capgemini's Testing as a Service (TaaS) is a pay-as-you-go testing solution that provides organizations with a comprehensive suite of testing services. This offering aims to enhance the quality of software applications while also helping to lower the overall testing costs for businesses.

-

Atos SE provides Testing as a Service (TaaS) solutions under its "Digital Assurance" segment. Atos Digital Assurance segment offers a comprehensive array of testing and quality assurance services. These services cover various aspects of testing, including functional Testing, non-functional Testing, performance testing, security testing, and automation testing.

Testim and Applitools are some of the emerging market participants in the TaaS market.

-

Testim is a prominent provider of AI-based software testing solutions that specialize in end-to-end test automation. The platform empowers developers and testers to efficiently create and maintain UI and end-to-end tests for both web and mobile applications, utilizing both code and codeless approaches.

-

Applitools is a TaaS provider specializing in visual testing to ensure consistent user experiences across various platforms and devices. The company also offers self-healing tests that adapt to minor UI changes, reducing maintenance efforts and enhancing test reliability. The platform supports cross-browser compatibility, allowing testing across a diverse range of browsers and devices, including mobile, web, and desktop applications.

Key Testing As A Service Companies:

- Accenture

- Atos SE

- Capgemini

- DeviQA Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Qualitest Group

Recent Developments

-

In December 2023, GitLab B.V. launched a Browser-Based Dynamic Application Security Testing (DAST) feature as part of version 16.4 (or DAST 4.0.9). The launch is part of GitLabB.V.'s initiative to improve browser-based DAST by integrating passive checks. The update includes active check-in capabilities to enhance the platform's security testing capabilities.

-

In September 2023, LTIMindtree Limited introduced TaaS specifically designed for Oracle SaaS (Software as a Service). This service aims to tackle challenges related to Oracle Cloud testing and validation, including issues with manual processes, outdated test scripts, system integration failures, and compliance concerns. The offering is delivered through LTIMindtree Limited's RELY platform, a comprehensive suite providing assurance and compliance services for enterprise applications.

-

In June 2023, Opkey, Inc. introduced new features specifically designed for Oracle E-Business Suite (EBS) load and performance testing. These enhancements empower organizations to ensure seamless application performance, reducing the risk of downtime and outages and improving overall user experience and satisfaction.

Testing As A Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.05 billion

Revenue forecast in 2030

USD 11.38 billion

Growth rate

CAGR of 14.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, end-use, deployment type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil; KSA; UAE

Key companies profiled

Accenture; Atos SE; Capgemini; DeviQA Solutions; Deloitte Touche Tohmatsu Limited; DXC Technology Company; IBM Corporation; Infosys Limited; TATA Consultancy Services Limited; Qualitest Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Testing As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global testing as a service market report based on test type, end-use, deployment type, and region.

-

Test Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Functionality

-

Performance

-

Compatibility

-

Security

-

Compliance

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecommunication

-

Healthcare

-

BFSI

-

Automotive

-

Manufacturing

-

Retail & Consumer Goods

-

Energy & Utilities

-

Others

-

-

Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global testing as a service market size was estimated at USD 4.54 billion in 2023 and is expected to reach USD 5.05 billion in 2024.

b. The global testing as a service market is expected to grow at a compound annual growth rate of 14.0% from 2024 to 2030 to reach USD 11.38 billion by 2030.

b. North America dominated the market and accounted for a 39.2% share in 2023. This growth is attributed to the region's growing software development market, where there is a demand for quality assurance (QA) services, enabling the growth of a robust TaaS market.

b. Some key players operating in the TaaS market include Accenture; Atos SE; Capgemini; DeviQA Solutions; Deloitte Touche Tohmatsu Limited; DXC Technology Company; IBM Corporation; Infosys Limited; TATA Consultancy Services Limited; Qualitest Group.

b. Key factors driving the testing as a service market growth include increasing agile and DevOps integration and cost efficiency and resource optimization

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.