- Home

- »

- Next Generation Technologies

- »

-

Private Cloud Server Market Size And Share Report, 2030GVR Report cover

![Private Cloud Server Market Size, Share & Trends Report]()

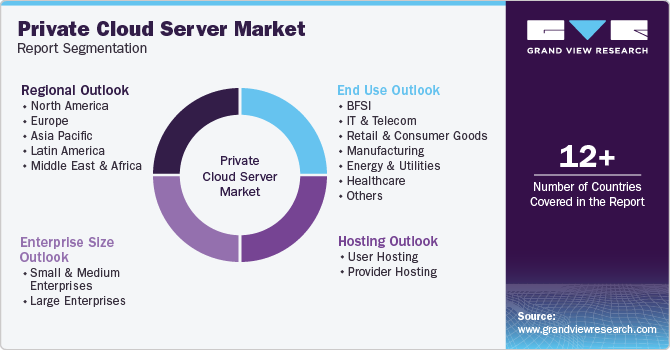

Private Cloud Server Market (2024 - 2030) Size, Share & Trends Analysis Report By Hosting (User Hosting, Provider Hosting), By Enterprise Size (Small & Medium, Large), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-764-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Private Cloud Server Market Summary

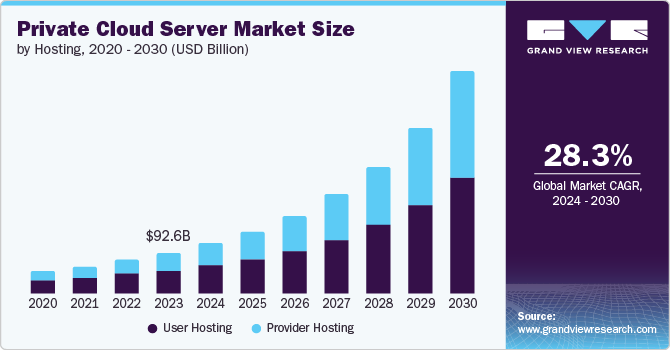

The global private cloud server market size was estimated at USD 92.56 billion in 2023 and is projected to reach USD 508.50 billion by 2030, growing at a CAGR of 28.3% from 2024 to 2030. The growing emphasis on ensuring real-time and quick access to data is also expected to drive market growth. Private cloud server envisages an infrastructure delivering hosted services fully dedicated to a single organization.

Key Market Trends & Insights

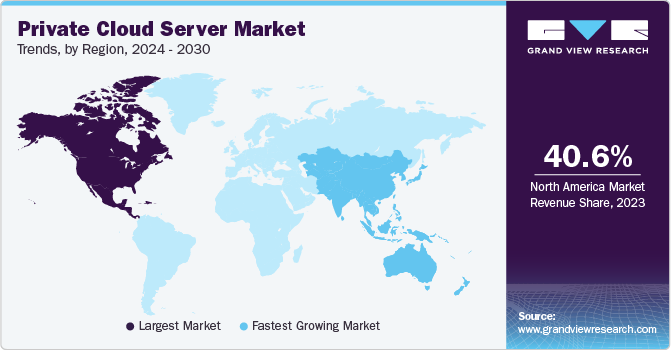

- North America private cloud server market held the largest share of 40.6% in 2023.

- The private cloud server market in the U.S. accounted for the largest market revenue share in 2023.

- By hosting, the user-hosting segment dominated the market and accounted for a market revenue share of 56.7% in 2023.

- By entreprise size, the small & medium enterprises (SMEs) segment accounted for the largest market revenue share in 2023.

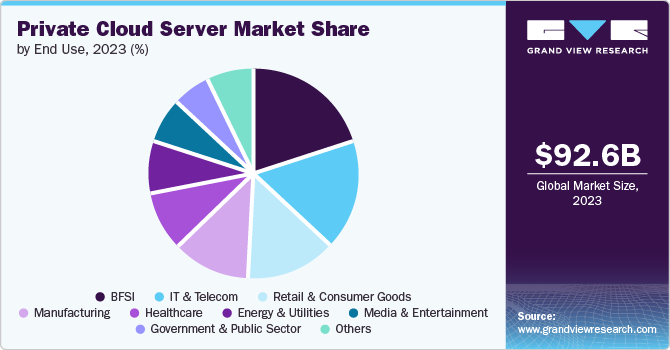

- By end use, the BFSI segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 92.56 billion

- 2030 Projected Market Size: USD 508.50 billion

- CAGR (2024-2030): 28.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

It offers all the benefits, such as agility, scalability, and ability to create multiple virtual machines for complex computing tasks and operations, associated with public cloud while maintaining a high level of data security and privacy protection. The rising concerns over data security encourage businesses to adopt private cloud servers. The organizations dealing with sensitive data such as healthcare, financial, government and other confidential data is fueling the demand for private cloud servers.

The private cloud servers help in changing computing needs that require complete control over the environment. As employees grow in an organization, companies more frequently utilize a mobile workforce. According to Spacelift, 84% of the companies use private cloud servers. Consequently, the increasing mobile workforce and the ensuing shifts in the need for accessing computing resources and applications are motivating companies to transition to a private cloud server.

Big Data requires extensive storage capabilities across various business units of the organizations and real-time access to information databases. Modern big data platforms hosted by private cloud server providers ensure better resource utilization, lower costs, and better scalability as compared to the conventional big data deployments. Private and public clouds are emerging as the most-adopted big data analytics platforms for various customer segments. Such developments in the big data deployment technologies are anticipated to create lucrative opportunities for the market growth.

Hosting Insights

The user-hosting segment dominated the market and accounted for a market revenue share of 56.7% in 2023. A user-hosted or an on-premise cloud server allows organizations to have a hosted environment within the organization. User-hosted solutions require an in-house data center to host the private cloud. Such an infrastructure can be considered as a more protected infrastructure as it is managed internally by the organization’s own IT department.

The provider-hosting segment is expected to register the fastest CAGR of 30.2% during the forecast period. These servers are hosted at the providers’ end in the providers’ data center. It ensures customization and control that closely match customers’ individual needs. The implementation of private cloud servers is driven by the necessity for strong security and compliance measures. Moreover, provider-hosted solutions come with user-friendly dashboards and high-end scalability options along with an excellent support team deployed by the provider, driving the segment growth.

Enterprise Size Insights

The Small & Medium Enterprises (SMEs) segment accounted for the largest market revenue share in 2023. A private cloud server offers benefits, such as lower operational costs, options to pay as per usage, and offerings tailored to the business requirement. The improved security services that enhance flexibility and control over services, are fueling the private cloud server market in SMEs. The increasing instances of cybercrimes and digital breaches are anticipated to drive the increased adoption of private cloud services in businesses.

The large enterprises segment is anticipated to register a significant CAGR over the forecast period. Large organizations often face significant concerns over the security and reliability of their data. Thereby, private cloud servers are used in these organizations to ensure data security. The development of a mobile workforce allows employees to securely access data remotely over the internet, meeting the need for affordable and secure IT operations.

End Use Insights

The BFSI segment accounted for the largest revenue share in 2023. The BFSI sector is regulated with strict regulations such as CCPA, GDPR, and sector-specific compliance standards. The increasing frequency of cyberattacks has intensified the demand for strong security measures. Furthermore, banks and financial institutions are making significant investments in digital transformation to enhance customer experience, private clouds help in the quick installation of new apps and services.

The government & public sector segment is anticipated to register the fastest CAGR over the forecast period. The increasing amount of sensitive data in the government and public sector has generated a high demand for private cloud servers. The government sector frequently has varying workloads; private clouds can adapt to these differences in a flexible manner. The development of digital technology is making the public sector efficient and improving delivery services.

Regional Insights

North America private cloud server market held the largest share in 2023. The key companies in the region are utilizing their purchasing power to choose the most suitable hosting services. The huge investment in IT infrastructure is leading to the growth of regional demand for private cloud servers.

U.S. Private Cloud Server Market Trends

The private cloud server market in the U.S. accounted for the largest market revenue share in 2023. Private clouds provide detailed management and strict compliance adherence to sectors such as healthcare, financial, and others that are subject to strict data protection regulations.

Europe Private Cloud Server Market Trends

Europe private cloud server market was identified as a lucrative region in 2023. The strict data protection laws in Europe, especially the General Data Protection Regulation (GDPR) have led businesses to ensure data security in secured locations and under control. The emergence of edge computing allows private clouds to act as edge sites, decreasing latency and enhancing performance, resulting in the growth of private cloud server market. The UK private cloud server market is expected to grow rapidly in the coming years due to the increased adoption of cloud-native architectures in organizations to enhance agility and foster innovation.

Asia Pacific Private Cloud Server Market Trends

Asia Pacific private cloud server market is anticipated to witness the fastest growth during the forecast period. With the continuous development of SMEs and large enterprises, the requirement for private cloud servers has arisen. Approximately 44% of conventional small businesses utilize cloud infrastructure or hosting services. The increased demand for virtual data centers is also fueling the market growth in the region.

Key Private Cloud Server Company Insights

Some of the key companies in the private cloud server market include Amazon.com, Inc., Cisco Systems, Inc., Alphabet Inc., IBM, Microsoft, and others. Key players are undertaking strategies such as new product developments, enhancements to the current product line, mergers & acquisitions, and strategic partnerships to expand their presence.

- IBM is a multinational technology company that combines technology and skills to offer infrastructure, software, and consulting services for clients striving to digitally transform critical global businesses.

Private Cloud Server Companies:

The following are the leading companies in the private cloud server market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Alphabet Inc.

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft

- NetApp

- Oracle

- Broadcom

Private Cloud Server Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 113.85 billion

Revenue forecast in 2030

USD 508.50 billion

Growth rate

CAGR of 28.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Hosting, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Amazon.com, Inc.; Cisco Systems, Inc.; Dell Inc.; Alphabet Inc.; Hewlett Packard Enterprise Development LP; IBM; Microsoft; NetApp; Oracle; Broadcom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Private Cloud Server Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the private cloud server market report based on hosting, enterprise size, end use, and region:

-

Hosting Outlook (Revenue, USD Million, 2018 - 2030)

-

User Hosting

-

Provider Hosting

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 – 2030)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Media & Entertainment

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.