- Home

- »

- Next Generation Technologies

- »

-

Textile Printing Market Size & Share, Industry Report, 2033GVR Report cover

![Textile Printing Market Size, Share & Trends Report]()

Textile Printing Market (2025 - 2033) Size, Share & Trends Analysis Report By Printing Technology (Digital Printing, Screen Printing), By Application (Home Decor, Soft Signage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-770-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Textile Printing Market Summary

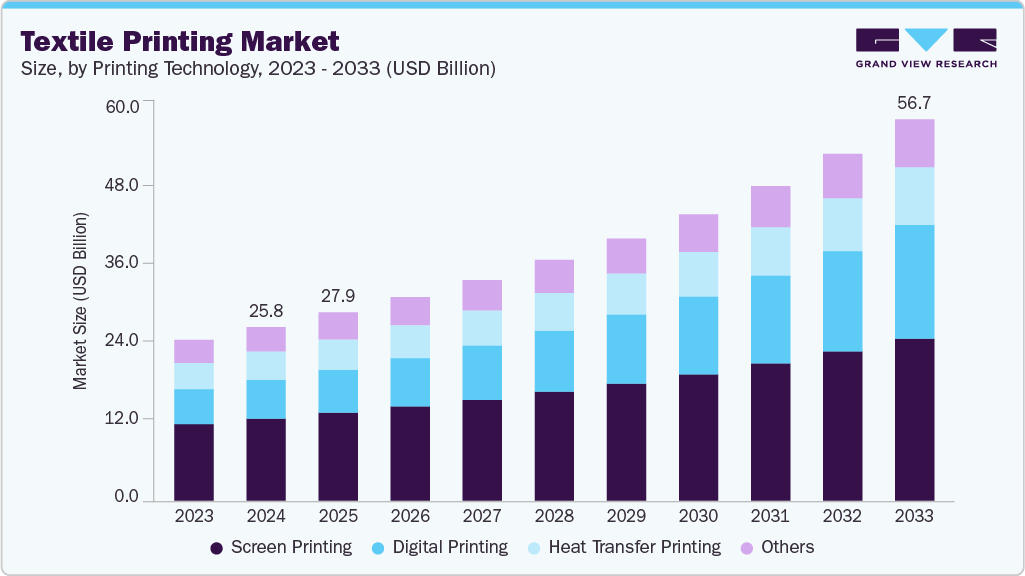

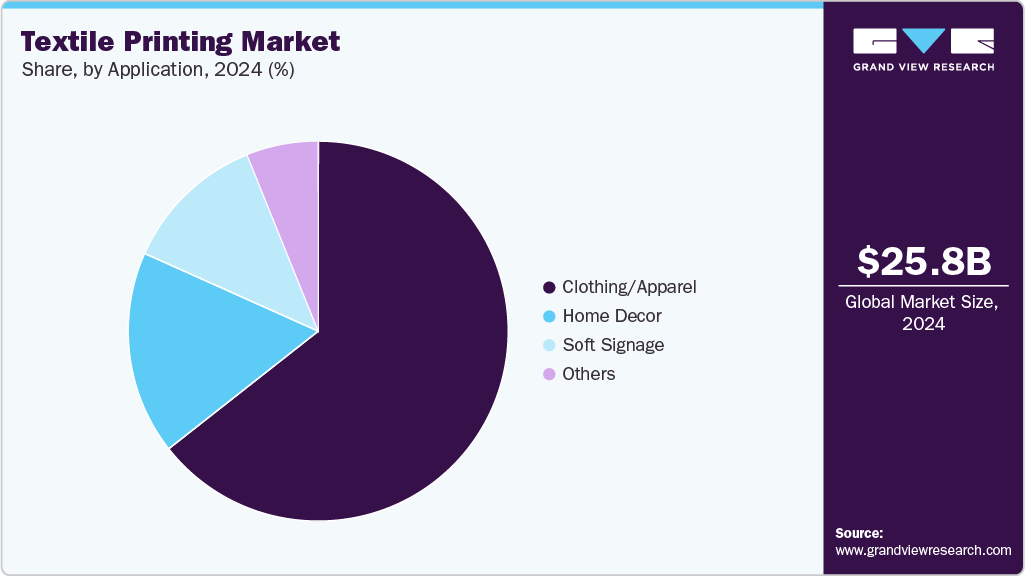

The global textile printing market size was estimated at USD 25.8 billion in 2024, and is projected to reach USD 56.7 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The rising demand for customized and sustainable textile designs and the rapid adoption of digital printing technologies drive market growth.

Key Market Trends & Insights

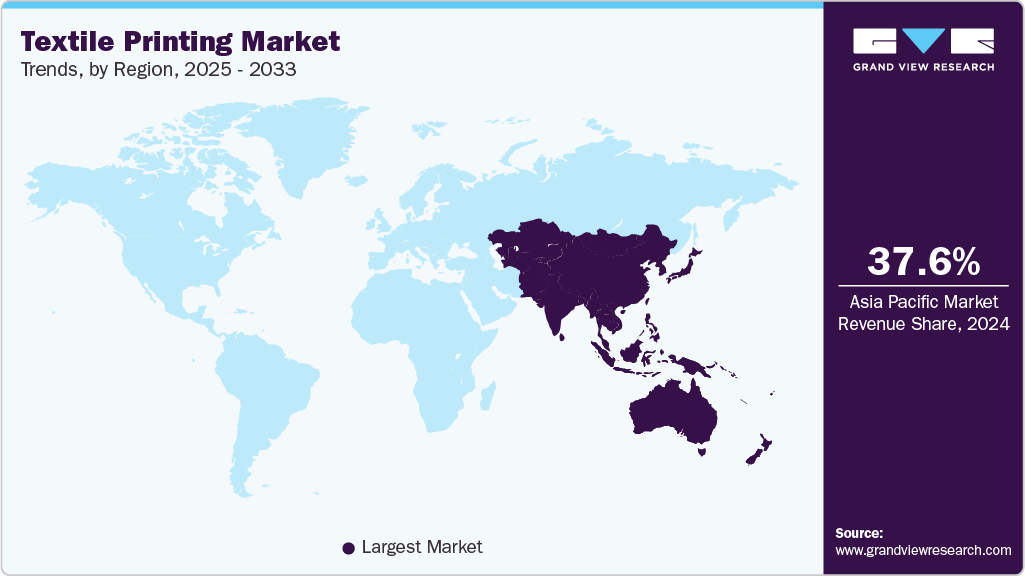

- The Asia Pacific textile printing market accounted for a 37.6% share of the overall market in 2024.

- The textile printing industry in China held a dominant position in 2024.

- By printing technology, the screen printing segment accounted for the largest share of 47.3% in 2024.

- By application, the clothing/apparel segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.8 Billion

- 2033 Projected Market Size: USD 56.7 Billion

- CAGR (2025-2033): 9.3%

- Asia Pacific: Largest market in 2024

Consumers’ increasing preference for personalized apparel, home décor, and fashion products encourages manufacturers to shift from traditional screen printing to digital and sublimation printing methods that offer faster turnaround times, reduced waste, and enhanced color precision. In addition, expanding e-commerce platforms and advancements in textile inks and printing machinery further propel market growth. The textile printing industry is witnessing a strong shift toward digitalization, with manufacturers increasingly replacing traditional screen-printing techniques with advanced inkjet and direct-to-garment (DTG) methods. The need for shorter production cycles, on-demand manufacturing, and enhanced design flexibility propels this transition. According to the United Nations Industrial Development Organization (UNIDO), digital production technologies are helping textile enterprises, especially small and medium-sized ones, respond faster to changing consumer tastes while improving operational efficiency. The ability to print complex patterns without multiple setups and achieve consistent quality significantly propels market growth toward digitally enabled textile manufacturing.

Growing environmental awareness and stricter government regulations on wastewater discharge and chemical use are pushing textile printers to adopt sustainable production methods. The U.S. Environmental Protection Agency (EPA) has highlighted the presence of PFAS and other hazardous compounds in textile effluents, emphasizing the need for cleaner manufacturing practices. This has led to increased investments in water-efficient digital printing systems, eco-friendly pigment inks, and closed-loop dyeing processes that reduce resource consumption and pollution. As manufacturers aim to meet evolving compliance standards and sustainability goals, adopting green printing technologies is rapidly boosting market expansion.

The global textile industry is increasingly moving toward regionalized production models to reduce lead times and enhance supply chain resilience. Organizations such as the Organization for Economic Co-operation and Development (OECD) have noted a growing emphasis on shortening production cycles and establishing near-market facilities. This shift favors digital textile printing, which supports localized, small-batch production that can swiftly respond to customer demand. Localized printing hubs minimize logistics costs and carbon emissions and empower brands to deliver limited-edition, customized collections faster, propelling market growth across developed and emerging regions.

The rapid expansion of e-commerce platforms and the rising consumer preference for personalized products transform how textiles are designed and printed. According to OECD’s analysis of digital trade, online retail has opened up new revenue streams for on-demand textile printing, enabling smaller designers and start-ups to offer customized apparel, décor, and fashion accessories without large inventory risks. Digital printing allows these businesses to fulfill real-time orders, produce unique patterns, and deliver vibrant, durable prints. This trend toward mass customization and direct-to-consumer sales significantly boosts market growth, as brands increasingly rely on digital textile printing for agility and creative flexibility.

Continuous innovation in textile inks, print heads, and post-processing technologies is elevating the quality and sustainability of textile printing. Initiatives from bodies such as the EPA’s Design for the Environment program and UNIDO’s guidance on green manufacturing encourage using low-impact pigments, biodegradable binders, and water-recycling systems. These technological upgrades enhance colorfastness, reduce energy consumption, and minimize waste generation, aligning with global sustainability priorities. The combination of improved performance and eco-efficiency propels widespread adoption of advanced textile printing technologies and boosts overall market growth.

Printing Technology Insights

The screen printing segment accounted for the largest share of 47.3% in 2024. Despite the textile sector's accelerating digital transformation, screen printing maintains a solid foothold, driven by its unmatched color vibrancy, ink penetration, and durability. These qualities remain vital for high-volume industrial applications. Continuous technological refinements in mesh materials, emulsions, and automated carousel systems enable manufacturers to achieve better precision and lower waste. Adopting water-based and phthalate-free inks, in line with environmental guidelines from agencies such as the U.S. Environmental Protection Agency (EPA), also allows traditional screen printing to align with sustainability goals. This balance between legacy strength and modernization propels the continued demand for screen printing across segments that value tactile quality and long-lasting prints, such as workwear, sportswear, and promotional textiles.

Digital printing is projected to grow at the fastest CAGR over the forecast period. Digital textile printing is rapidly emerging as a market growth engine, fueled by rising demand for short-run, customized, and sustainable production. The technology enables high-resolution, on-demand printing without the need for screens or plates, drastically reducing setup times and water consumption. Reports from intergovernmental organizations like UNIDO emphasize how digitalization enhances textile manufacturing competitiveness through flexible production and minimal resource usage. Moreover, the growing adoption of pigment-based digital inks, which require less post-treatment, further reduces operational costs and environmental footprints. These advantages boost the widespread shift toward digital printing, especially among brands targeting fast fashion, e-commerce, and sustainable apparel lines.

Application Insights

The clothing/apparel segment held the largest market share in 2024 and is projected to grow at the fastest CAGR over the forecast period. The clothing and apparel segment continues to dominate the market, propelled by evolving consumer preferences toward personalized and expressive fashion. The rise of online retail and print-on-demand business models has made small-batch customization both profitable and scalable. Digital textile printing plays a crucial role in meeting the fast fashion industry’s need for rapid design changes, minimal inventory, and high-quality prints. Supportive government and industry initiatives encouraging local production and sustainable practices, such as cleaner dyeing programs promoted by the U.S. Department of Commerce’s Office of Textiles and Apparel (OTEXA), also foster innovation in apparel printing. This convergence of sustainability, digital agility, and fashion creativity drives robust growth in textile printing for the clothing segment globally.

Soft signage is projected to grow significantly over the forecast period. Soft signage has evolved into a high-growth application area, driven by the transition from PVC-based rigid signage to fabric-based alternatives that are lightweight, reusable, and eco-friendly. Advancements in sublimation and direct-to-fabric printing technologies are allowing businesses to produce vivid, wrinkle-resistant graphics suitable for indoor and outdoor environments. As public and corporate sectors increasingly adopt sustainable advertising practices, fabric signage aligns with environmental guidelines and waste reduction goals outlined by the U.S. EPA and other sustainability-driven organizations. The expanding use of soft signage across trade shows, retail environments, and sports venues propels strong demand for textile-based visual communication solutions, further boosting the market’s overall growth momentum.

Regional Insights

The North America textile printing market accounted for a 24.3% share of the overall market in 2024. The market is undergoing a major transformation, led by the rapid integration of digital printing technologies and sustainability-driven manufacturing practices. Rising adoption of pigment-based inks and water-efficient printing systems aligns production with the region’s stricter environmental regulations. Government-backed programs supporting domestic textile innovation and circularity, such as the U.S. Department of Energy’s initiatives on advanced manufacturing and recycling, reinforce the move toward cleaner, digitally enabled processes. In addition, the region’s thriving e-commerce ecosystem and demand for fast-turnaround fashion and décor are propelling the market’s growth through localized, on-demand print production hubs.

U.S. Textile Printing Market Trends

The textile printing market in the U.S. held a dominant position in 2024. In the U.S., digital textile printing is gaining remarkable traction as brands emphasize sustainability and supply chain agility. The Office of Textiles and Apparel (OTEXA) under the U.S. Department of Commerce reports a steady rise in domestic textile production supported by nearshoring strategies and the reshoring of fashion supply chains. American print houses increasingly adopt pigment ink systems and direct-to-garment technologies to minimize water use and chemical discharge, responding to EPA-led environmental standards. The growth of print-on-demand apparel platforms, particularly for customized t-shirts and sportswear, is boosting market demand, positioning the U.S. as a leading adopter of high-speed, eco-conscious textile printing.

Europe Textile Printing Market Trends

The textile printing market in Europe holds a substantial share of the global market. The European Commission’s Circular Economy Action Plan and REACH regulations motivate manufacturers to invest in non-toxic inks, biodegradable materials, and low-emission print technologies. Countries across the continent are embracing waterless printing and UV-curable inks to meet green compliance standards. Furthermore, partnerships between textile clusters and technology developers, such as those supported by the European Textile Technology Platform (ETTP), foster digital innovation. These coordinated sustainability efforts propel the region’s transition toward next-generation digital printing solutions.

Germany textile printing market is defined by engineering precision, automation, and a commitment to sustainability. The Federal Ministry for Economic Affairs and Climate Action (BMWK) supports textile innovation under Industry 4.0 frameworks, encouraging automation, robotics, and smart production integration. German companies are leading in developing advanced pigment inks, energy-efficient dryers, and fully automated digital print lines that optimize fabric throughput and quality. With its strong technical base and emphasis on resource-efficient processes, Germany is boosting the regional market, setting high standards for performance and environmental responsibility.

The textile printing market in the UK benefits from a dynamic blend of creative design capabilities and strong sustainability commitments. Government-supported programs under the Innovate UK initiative are helping small and mid-sized textile businesses adopt digital printing technologies to reduce waste and increase customization. The country’s vibrant fashion sector, coupled with growing consumer preference for ethically produced garments, is fueling the adoption of eco-friendly printing methods and locally sourced production. The rapid rise of independent designers using digital platforms to sell customized prints and apparel propels the market’s momentum, particularly in digitally printed fashion and décor textiles.

Asia Pacific Textile Printing Market Trends

The textile printing market in Asia-Pacific held the largest market share of 37.6% and is projected to grow at the fastest CAGR over the forecast period. The Asia-Pacific region represents the manufacturing backbone of the global textile printing industry, with a strong shift toward digitalization and sustainability in recent years. Supported by large-scale textile exports and rising domestic consumption, countries across APAC are integrating advanced digital printing machinery to improve productivity and reduce water and dye usage. Intergovernmental organizations such as UNIDO highlight the region’s growing focus on cleaner production practices and resource optimization. The combination of cost-effective labor, strong export networks, and government-led modernization efforts boosts APAC’s leadership in the global market.

China textile printing market continues to dominate global textile printing output, driven by large-scale investments in automation, digital printing, and sustainability upgrades. Government initiatives under the Made in China 2025 strategy emphasize technological innovation and environmental compliance within the textile sector. Domestic manufacturers are rapidly replacing traditional rotary and flatbed printing with high-speed digital printers capable of handling complex designs and short production runs. With rising international demand for sustainable and custom-printed fabrics, China’s focus on high-tech textile printing and export competitiveness propels its market leadership and reshapes global supply dynamics.

The textile printing market in Japan is characterized by precision-driven innovation and a focus on high-quality outputs. The country’s government-backed Green Growth Strategy and industrial R&D programs promote sustainable manufacturing and advanced materials. Japanese companies are pioneers in inkjet head technology, high-performance dye sublimation inks, and automation systems that enhance print accuracy. The domestic demand for premium, aesthetically refined textiles, especially in fashion and interior applications, is boosting the adoption of advanced digital textile printing, allowing Japan to maintain its reputation as a hub for innovation and premium-quality production.

India textile printing market is expanding rapidly due to its vast textile manufacturing base, rising export demand, and growing preference for sustainable printing technologies. Government programs such as the Ministry of Textiles’ PM MITRA Parks scheme foster integrated textile clusters equipped with modern infrastructure and eco-friendly production systems. Indian manufacturers increasingly embrace digital printing to serve domestic fashion brands and international buyers seeking fast, flexible production. The country’s push for innovation, digital transformation initiatives, and rising disposable incomes are propelling strong market growth across apparel, home décor, and technical textile applications.

Key Textile Printing Company Insights

Some major market players include M&R Printing Equipment, MHM Industries GmbH, Anatol Equipment Manufacturing Co., Workhorse Products, Seiko Epson Corporation, Kornit Digital, Durst Group AG, MIMAKI ENGINEERING CO., LTD., Brother Industries, Ltd., and Ricoh, among others. These companies lead the market due to their advanced printing machinery portfolios, continuous investment in digital printing innovation, and strategic partnerships with textile manufacturers and apparel brands worldwide. Their technologies cater to the growing demand for sustainable, high-speed, and customizable textile printing solutions, driving the transition from traditional screen printing to digital formats. By integrating automation, eco-friendly inks, and smart printing systems, these firms are boosting production efficiency, print quality, and environmental compliance, thereby strengthening their global market presence. Furthermore, their global manufacturing footprints, strong after-sales networks, and emphasis on R&D-driven ink and print head advancements continue to enhance their competitiveness in this rapidly evolving industry.

-

M&R Printing Equipment is a leading U.S.-based manufacturer of screen-printing presses and automated equipment known for its engineering excellence and durable production systems. The company’s innovations in high-speed automatic carousel presses and eco-efficient dryers propel productivity for large-scale apparel manufacturers. M&R’s emphasis on precision, automation, and sustainability positions it as a cornerstone player in the global textile screen-printing ecosystem.

-

MHM Industries GmbH stands out as a European pioneer in textile screen printing, integrating digital automation and robotics into traditional print workflows. Based in Austria, MHM is recognized for its modular printing systems and high-throughput solutions, enabling flexible production for both large runs and short batches. Its continuous focus on quality engineering and sustainability strengthens its market footprint across Europe and North America.

Key Textile Printing Companies:

The following are the leading companies in the textile printing market. These companies collectively hold the largest market share and dictate industry trends.

- M&R Printing Equipment

- MHM Industries GmbH

- Anatol Equipment Manufacturing Co.

- Workhorse Products

- Seiko Epson Corporation

- Kornit Digital

- Durst Group AG

- MIMAKI ENGINEERING CO., LTD.

- Brother Industries, Ltd.

- Ricoh

Recent Developments

-

In July 2025, Seiko Epson Corporation inaugurated its first manufacturing facility in India for high-capacity ink tank inkjet printers at the RIKUN Manufacturing Pvt. Ltd. plant in Chennai, with mass production slated to begin in October 2025. These printers are engineered to offer lower ink cost per milliliter and easier ink replacement relative to traditional cartridge models. This move underscores Epson’s strategy to localize production, support India’s industrial growth, and deepen ties with community stakeholders.

-

In October 2024, Ricoh announced the establishment of Ricoh Printing Solutions Europe Limited (RPSE), a new subsidiary based in Telford, UK, which began operations in April 2025. RPSE consolidates Ricoh’s industrial printing business in Europe, covering textile printers, inkjet heads, engineering support, and sales operations. This structural realignment aims to enhance Ricoh’s ability to deliver sophisticated, energy-efficient, and on-demand printing solutions across the European textile and industrial markets.

Textile Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.9 billion

Revenue forecast in 2033

USD 56.7 billion

Growth rate

CAGR of 9.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printing technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

M&R Printing Equipment; MHM Industries GmbH; Anatol Equipment Manufacturing Co.; Workhorse Products; Seiko Epson Corporation; Kornit Digital; Durst Group AG; MIMAKI ENGINEERING CO., LTD.; Brother Industries, Ltd.; Ricoh

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Printing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global textile printing market report based on printing technology, application, and region:

-

Printing Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Screen Printing

-

Digital Printing

-

Direct to Fabric (Roll to Roll Printing)

-

Sublimation

-

Pigment

-

Reactive

-

Acid

-

Others

-

-

Direct to Garment (DTG)

-

Sublimation

-

Pigment

-

Reactive

-

Acid

-

Others

-

-

-

Heat Transfer Printing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clothing/Apparel

-

Home Decor

-

Soft Signage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global textile printing market size was estimated at USD 25.8 billion in 2024 and is expected to reach USD 27.9 billion in 2025.

b. The global textile printing market size is expected to grow at a significant CAGR of 9.3% to reach USD 56.7 billion in 2033.

b. Asia Pacific held the largest market share of 37.6% in 2024. The Asia-Pacific region represents the manufacturing backbone of the global textile printing industry, with a strong shift toward digitalization and sustainability in recent years. Supported by large-scale textile exports and rising domestic consumption, countries across APAC are integrating advanced digital printing machinery to improve productivity and reduce water and dye usage.

b. Some of the players in the market are M&R Printing Equipment, MHM Industries GmbH, Anatol Equipment Manufacturing Co., Workhorse Products, Seiko Epson Corporation, Kornit Digital, Durst Group AG, MIMAKI ENGINEERING CO., LTD., Brother Industries, Ltd., and Ricoh.

b. The key driving trend in the textile printing market is the increasing adoption of digital textile printing technologies, driven by demand for customization, faster turnaround times, and sustainable production methods. Digital printing allows manufacturers to produce small batches and personalized designs with lower water and energy consumption compared to traditional screen printing, which aligns with the growing consumer preference for eco-friendly and on-demand fashion products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.