- Home

- »

- Advanced Interior Materials

- »

-

Textile Processing Machinery Market Size Report, 2030GVR Report cover

![Textile Processing Machinery Market Size, Share & Trends Report]()

Textile Processing Machinery Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Washing Machine), By Application (Garments & Apparels), By Raw Material (Cotton), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-219-4

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Textile Processing Machinery Market Summary

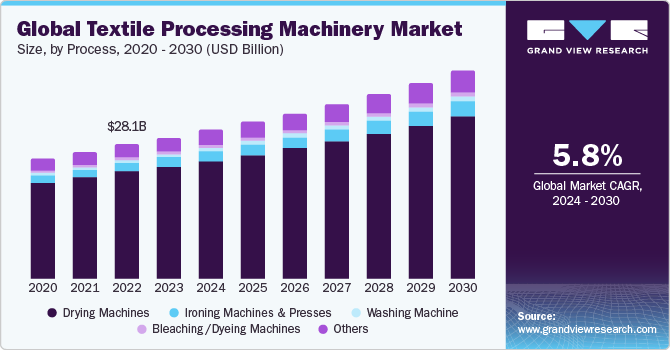

The global textile processing machinery market size was estimated at USD 29,490.0 million in 2023 and is projected to reach USD 42,721.9 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The growing textile sector is an important factor contributing to market growth across the globe.

Key Market Trends & Insights

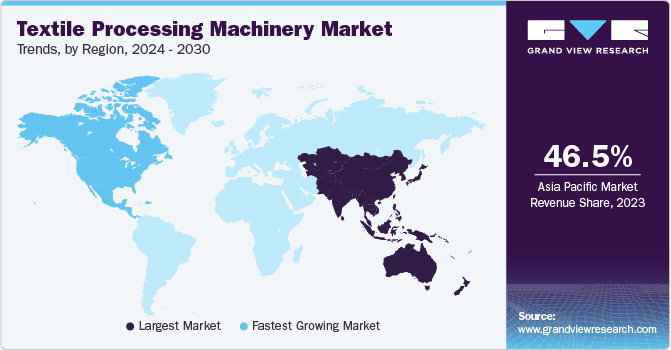

- Asia Pacific dominated the global textile processing machinery market and accounted for 46.5% market share in 2023

- North America textile processing machinery market is expected to witness fast-paced growth.

- The textile processing machinery market in Europe is the second-largest market for the textile industry.

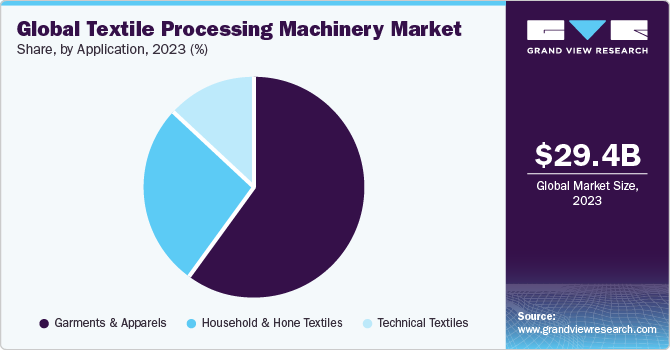

- Based on application, the garments & apparels application segment held the largest market share and accounted for 60.2% in 2023.

- In terms of raw material, cotton raw material segment led the global textile processing machinery market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 29,490.0 Million

- 2030 Projected Market Size: USD 42,721.9 Million

- CAGR (2024-2030):5.5%

- Asia Pacific: Largest market in 2023

- Asia Pacific: Fastest growing market

The improved quality of produced textiles and adequate customization offered by these machines are further acting as important drivers for market growth. The market demands a machine not only capable of producing high-quality textiles but also capable of handling different types of textiles. Hence, the quality assurance and flexibility offered by these machines are driving the market growth.

The expansion of the parent market and technological advancement are driving the U.S. market growth. Several advancements in washing machines, drying machines, dyeing machines, and ironing machines over the past few years have resulted in augmented efficiency for attaining sustainability. Hence, with the incorporation of automation-based textile processing machines to improve process control, reduce waste, and improve facility efficiency, the demand for textile processing machinery is expected to increase. High demand for textile processing machinery to ensure product safety and quality has resulted in increased investments from manufacturers of textile processing machinery.

In addition, new facilities have been opened in the U.S., to carry out large-scale textile production, which also offer recycling services. All these factors imply the market growth in the U.S. The industry is characterized by the presence of numerous small- and large-scale manufacturers, resulting in a high level of competition at both global and regional levels. This has a moderate effect on the bargaining power of buyers as product pricing is based on global demand. Furthermore, the competitive nature of this market is expected to contribute to its growth.

The majority of these companies are enhancing their production operations through automation to meet rising consumer demands. Moreover, manufacturers are focusing on sustainable production with minimal wastage and maximum hygiene. Due to these factors, the product demand is anticipated to increase in the coming years. The U.S. is a leading manufacturer of textiles, yarns, textile raw materials, fabrics, home furnishing, apparel, etc. It is also a key producer and exporter of raw cotton, as well as a top importer of raw textiles in the world. According to the National Council of Textile Organizations (NCTO), from 2012 to 2021, the textile industry in the U.S. invested USD 20.9 billion in the deployment of innovative equipment and the establishment of plants.

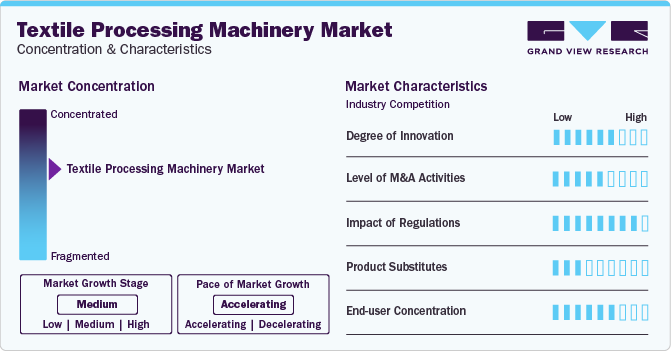

Market Characteristics

Market growth stage is medium and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations wield significant influence over the textile processing machinery market, shaping its trajectory and dynamics. Stringent environmental regulations, for instance, often necessitate the adoption of cleaner and more sustainable technologies within the textile industry. This has propelled the demand for eco-friendly machinery that reduces water and energy consumption, lowers emissions, and minimizes waste generation.

The textile processing machinery market has experienced a notable degree of innovation in recent years, driven by various factors including technological advancements, market demands, and regulatory requirements. Innovations have been witnessed across multiple aspects of textile processing machinery, ranging from enhanced automation and digitization to improvements in sustainability and efficiency. One significant area of innovation is the integration of advanced automation technologies such as artificial intelligence (AI), machine learning, and robotics. These technologies have enabled manufacturers to develop machinery that can perform complex tasks with greater precision, speed, and reliability, ultimately leading to improved productivity and reduced labor costs.

The end-user concentration in the textile processing machinery market can vary depending on several factors including geographical location, industrial structure, and market dynamics. In some regions, such as major textile manufacturing hubs like China, India, and Bangladesh, there might be a higher concentration of end-users due to the significant size and scale of the textile industry in these areas. Conversely, in smaller or emerging textile markets, the end-user concentration might be more dispersed.

One potential substitute for textile processing machinery is the utilization of pre-processed or pre-finished materials. Instead of investing in machinery for dyeing, printing, or finishing, textile manufacturers can opt to purchase fabrics and materials that have already undergone these processes. This approach allows manufacturers to bypass the need for specialized equipment and infrastructure, potentially reducing costs and lead times.

Process Insights

The drying machines segment dominated the industry in 2023. Dryers are equipped with motorized centering and tensioning devices for specific conveyors. Heating methods, burner, and chamber are some of the key points manufacturers consider while buying a drying machine. Key manufacturers of drying machines are G.A. BRAUN, Inc., Continental Girbau, B&C Technologies, Pellerin Milnor Corporation, and CLMTexfinity. Drying machines are used to efficiently remove moisture from the fabric, thereby accelerating textile production. Due to these machines, manufacturers can ensure controlled and consistent drying, which ultimately reduces the process time and improves the drying process quality. These factors drive the segment growth.

The ironing machines & presses segment is expected to register the fastest CAGR from 2024 to 2030. These machines provide a uniform fabric finish during the last stage of manufacturing, thereby improving the product quality. In addition, ironing and pressing machines are utilized for ironing out seams, folding edges, and raising the pile during textile manufacturing. In the textile manufacturing facility, a semi-finished garment is shaped by an ironing and pressing machine, which first makes the fabric fibers highly elastic before deforming and setting them. This is accomplished by applying pressure, heat, and moisture to the fabric. Due to these process characteristics, and to improve the surface finish of the manufactured textiles, the demand for ironing machines & presses is expected to increase.

Raw Material Insights

Cotton raw material segment led the global textile processing machinery market in 2023 in terms of market revenue. advancements in cotton processing technologies and techniques drive the need for upgraded or specialized machinery to handle tasks such as ginning, spinning, weaving, and finishing. Innovations in cotton breeding, farming practices, and harvesting methods also impact the characteristics and properties of raw cotton, necessitating machinery adaptations to accommodate changing raw material specifications.

The polyester raw material segment is anticipated to show lucrative growth from 2024 to 2030 due to its versatility, durability, and cost-effectiveness. As polyester continues to gain popularity in various textile applications, including apparel, home furnishings, and industrial fabrics, there is a growing demand for specialized processing machinery capable of handling polyester fibers efficiently.

Application Insights

The garments & apparels application segment held the largest market share and accounted for 60.2% in 2023. The garments and apparel sector represents one of the largest and most diverse segments of the textile industry, encompassing a wide range of products including clothing, footwear, accessories, and fashion textiles. As consumer preferences and fashion trends evolve, manufacturers in this segment require versatile and flexible textile processing machinery to produce a diverse array of fabrics, finishes, and designs.

Sustainability is an increasingly important driver in the household and home textiles segment, with consumers and brands alike showing a growing preference for eco-friendly materials and production practices. Textile processing machinery that enables resource-efficient manufacturing processes, such as water-saving dyeing, energy-efficient weaving, and recycled fabric production, allows manufacturers to reduce environmental impact and meet sustainability goals while appealing to environmentally-conscious consumers.

Regional Insights

North America textile processing machinery market is expected to witness fast-paced growth on account of the growing industrial manufacturing coupled with the rising number of product launches in the sports and fashion industries. The textile market is witnessing a huge product demand for industrial manufacturing as well as the home textile sector owing to the increase in awareness about the uses of technical textiles. These factors are expected to fuel the demand for textile processing machines in the region.

U.S. Textile Processing Machinery Market Trends

The textile processing machinery market in the U.S. is anticipated to grow owing to the expansion of the parent market and technological advancement are driving the U.S. market growth. Several advancements in washing machines, drying machines, dyeing machines, and ironing machines over the past few years have resulted in augmented efficiency for attaining sustainability. Hence, with the incorporation of automation-based textile processing machines to improve process control, reduce waste, and improve facility efficiency, the demand for textile processing machinery is expected to increase. High demand for textile processing machinery to ensure product safety and quality has resulted in increased investments from manufacturers of textile processing machinery.

Canada textile processing machinery market is quite diverse and competitive. There are several major players in the industry, including Rieter, Trutzschler, and Savio. The market is driven by the growing demand for high-quality textiles in various sectors, such as fashion, home decor, and industrial applications. The increasing focus on sustainability and eco-friendliness is also driving innovation in the industry, with many companies developing new and more efficient processing technologies. Overall, the outlook for the textile processing machinery market in Canada looks positive, with steady growth expected in the coming years.

Asia Pacific Textile Processing Machinery Market Trends

Asia Pacific dominated the global textile processing machinery market and accounted for 46.5% market share in 2023 owing to the increasing foreign investment in the textile and apparel sector, which is one of the main factors driving the market growth in Asia Pacific. Moreover, the expanding population, changing purchasing patterns, growing disposable income, increasing demand for garments and home furnishings, decreased production costs, and cheap labor costs are the primary drivers of the regional textile industry.

The textile processing machinery market in China has been experiencing steady growth in recent years. This growth can be attributed to the increasing demand for textile products, both domestically and internationally. China is the world's largest textile producer and exporter, and as such, the demand for textile processing machinery in the country is significant. One of the emerging trends in the market is the increasing use of automation and robotics in textile processing. This technology helps to improve efficiency, reduce labor costs, and improve product quality. In addition, there is a growing focus on environmental sustainability in the industry, with many manufacturers investing in eco-friendly production methods and materials.

Europe Textile Processing Machinery Market Trands

The textile processing machinery market in Europe is the second-largest market for the textile industry. The textile industry plays an important role in the European manufacturing industry. This is a major driving factor behind the growing demand for textile processing machinery in Europe.

Germany textile processing machinery is driven by the country's strong textile industry, which is one of the largest in Europe. The industry is supported by a highly skilled workforce and a robust research and development infrastructure. German machinery manufacturers are known for their high-quality products, which are exported worldwide.

Central & South America Textile Processing Machinery Market Trands

The textile processing machinery market in Central & South America is the largest producer of textiles including apparel owing to the availability of textile raw materials, such as polyester and cotton, coupled with the existence of textile manufacturing units in the region. The Central & South American textile market is expected to witness growth over the forecast period on account of growing population, increasing middle-class population, and increasing job opportunities in developing nations such as Brazil, Venezuela, and others. This is expected to boost the production of textile products, in turn contributing significantly to the overall textile processing machinery market growth in the region.

The Brazilian textile processing machinery market is one of the largest in Latin America, contributing significantly to the country's economy. The demand for textile processing machinery is driven by the growth of various textile segments, including apparel, home textiles, and industrial textiles. Despite facing challenges such as competition from low-cost manufacturing countries and fluctuations in raw material prices, the textile industry in Brazil continues to grow, thus driving the demand for textile processing machinery.

Middle East & Africa Textile Processing Machinery Market Trands

The textile processing machinery market in Middle East & Africa is boosting owing to the increased clothing spending by Middle Eastern countries which is expected to augment textile production over the forecast period.In addition, the Gulf Cooperation Council (GCC) countries have their focus on promoting textile production in their countries. This is expected to increase the demand for textile processing machinery over the next few years.

Saudi Arabia textile processing machinery market is growing due to the Saudi Arabian government’s active investment in diversifying its economy, including the development of the textile and apparel sector as part of its Vision 2030 agenda. Initiatives such as the establishment of industrial cities and free zones, coupled with incentives for foreign investment, aim to attract textile manufacturers and drive the demand for textile processing machinery in Saudi Arabia. With a growing population and increasing disposable income, there is a rising demand for textiles and apparel products within Saudi Arabia. This domestic consumption drives the need for textile processing machinery to produce finished goods to meet the local market demand.

Key Companies & Market Share Insights

The market is fragmented with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants' strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base. In addition, evolving consumer preferences along with quality requirements, as well as energy efficiency, are projected to offer new opportunities for key participants in the coming years.

In November 2023, Alliance Laundry Systems LLC introduced the revolutionary dryer feature (ProCapture) in its dryer machines. This new feature is designed to eliminate the problems caused by lint and improve the yarn strength during the drying process.

Key Textile Processing Machinery Companies:

The following are the leading companies in the textile processing machinery market. These companies collectively hold the largest market share and dictate industry trends.

- A.T.E. Enterprises Private Limited

- Trutzschler Group

- Savio Macchine Tessili S.p.A

- Rieter Holding AG

- Lakshmi Machine Works Ltd

- Murata Machinery Ltd.

- Santoni S.p.A.

- Saurer Intelligent Technology AG

- TMT Machinery Inc.

- Mayer & Cie. GmbH & Co. KG

- Batliboi Ltd, Benninger AG

- Itema S.p.A

- Kirloskar Toyoda Pvt. Ltd

- Picanol Group

- Lakshmi Machine Works Ltd

Recent Developments

-

In June 2023, the Trützschler Group unveiled its newest machines and technologies designed for card clothing, nonwovens, spinning, and man-made fibers. This latest technology for carding, draw frame, and combing addresses key customer needs in fiber processing: increased efficiency, enhanced sustainability in raw material utilization, and intelligent automation.

-

In September 2023, Santoni Shanghai acquired Terrot, a manufacturer of circular knitting machines. The acquisition forms part of Santoni Shanghai's overarching strategy to create a sustainable, digitally advanced ecosystem within the knitting machinery sector. This acquisition represents a significant step towards realizing their joint vision of a cohesive, integrated ecosystem.

Textile Processing Machinery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30,955.7 million

Revenue forecast in 2030

USD 42,721.9 million

Growth Rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, raw material, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

A.T.E. Enterprises Private Limited; Trutzschler Group; Savio Macchine Tessili S.p.A; Rieter Holding AG; Lakshmi Machine Works Ltd; Murata Machinery Ltd.; Santoni S.p.A.; Saurer Intelligent Technology AG; TMT Machinery Inc.; Mayer & Cie. GmbH & Co. KG; Batliboi Ltd; Benninger AG; Itema S.p.A; Kirloskar Toyoda Pvt. Ltd; Picanol Group; Lakshmi Machine Works Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Processing Machinery Market Report Segmentation

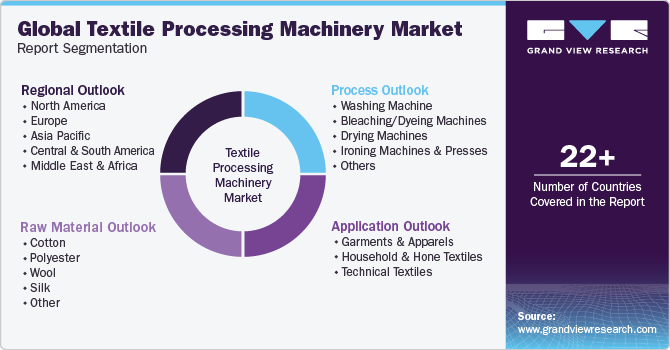

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the textile processing machinery market based on process, raw material, application, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Washing Machine

-

Bleaching/Dyeing Machines

-

Drying machines

-

Ironing machines and presses

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton

-

Polyester

-

Wool

-

Silk

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Garments & Apparels

-

Household and Hone Textiles

-

Technical Textiles

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global textile processing machinery market size was estimated at USD 29,490.0 million in 2023 and is expected to reach USD 30,955.7 million in 2024.

b. The global textile processing machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 42,721.9 million by 2030.

b. Asia Pacific dominated the global textile processing machinery market and accounted for a 46.5% share, in terms of revenue, in 2023 owing to the increasing foreign investment in the textile and apparel sector is one of the main factors driving the market growth in Asia Pacific.

b. Some of the key players operating in the textile processing machinery market include A.T.E. Enterprises Private Limited, Trutzschler Group, Savio Macchine Tessili S.p.A, Rieter Holding AG, Lakshmi Machine Works Ltd, Murata Machinery Ltd., Santoni S.p.A., Saurer Intelligent Technlogy AG, TMT Machinery Inc., Mayer & Cie. GmbH & Co. KG, Batliboi Ltd, Benninger AG, Itema S.p.A, Kirloskar Toyoda Pvt. Ltd, Picanol Group, Lakshmi Machine Works Ltd.

b. The key factors that are driving the textile processing machinery market include the growing textile sector is an important factor contributing to market growth across the globe. The improved quality of produced textiles and adequate customization offered by these machines are further acting as important drivers for market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.