- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Thermal Insulation Coating Market Size, Share Report, 2030GVR Report cover

![Thermal Insulation Coating Market Size, Share & Trends Report]()

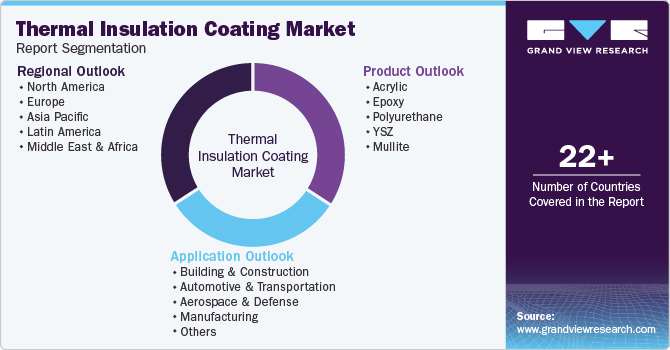

Thermal Insulation Coating Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Acrylic, Epoxy, Polyurethane, YSZ, Mullite), By Application (Building & Construction, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-568-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Insulation Coating Market Summary

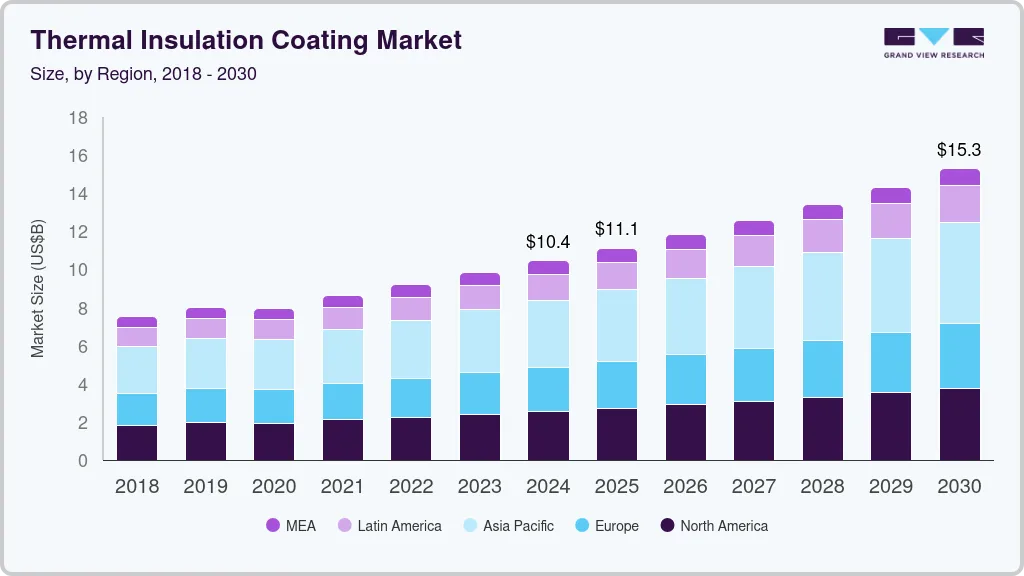

The global thermal insulation coating market size was estimated at USD 10,446.8 million in 2024 and is projected to reach USD 15,287.0 million by 2030, growing at a CAGR of 6.6% from 2025 to 2030. As governmental regulations become more stringent, directives such as the revised Energy Efficiency Directive by the European Union (EU/2023/1791) underscore the imperative of energy savings.

Key Market Trends & Insights

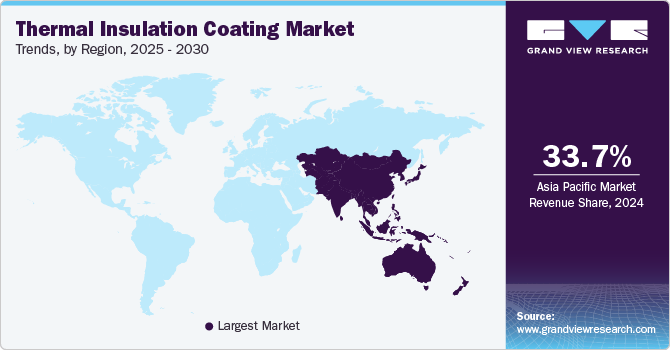

- Asia Pacific thermal insulation coating market dominated the global market with a revenue share of 33.7% in 2024.

- The thermal insulation coating market in China dominated Asia Pacific with a significant revenue share in 2024.

- By product, the Yttria-Stabilized Zirconia (YSZ) led the market with a revenue share of 33.7% in 2024.

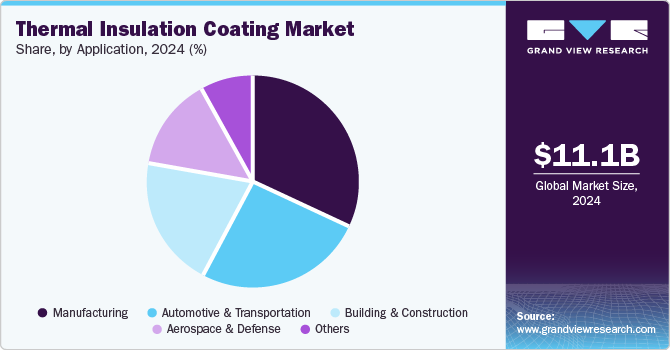

- By application, the manufacturing segment dominated with a revenue share of 31.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10,446.8 Million

- 2030 Projected Market Size:USD 15,287.0 Million

- CAGR (2025-2030): 6.6%

- Asia Pacific: Largest market in 2024

With targets for cumulative end-use energy savings projected to rise from 0.8% to 1.3% in the near term and further to 1.9% by 2028 - 2030, a compelling mandate exists for adopting thermal insulation coatings in buildings and industrial applications. Rapid urbanization necessitates a surge in commercial and residential projects, further amplifying the need for advanced thermal insulation coatings. As new infrastructure developments take shape, such as refineries and industrial facilities, integrating these coatings will be essential for enhancing energy efficiency and reducing operational costs, making them indispensable in modern construction strategies.Technological advancements are also paving the way for innovation in thermal insulation materials. Research from the Universiti Putra Malaysia has yielded promising results regarding incorporating aerogel powder in paint solutions, showing a notable 7% improvement in thermal insulation properties with just 5% aerogel content. Similarly, the Institute of Packaging Industry (IPI) Singapore has developed silica aerogel-based insulation paint that can lower surface temperatures by up to 12°C, enhancing energy efficiency and acoustic properties. These advancements improve insulation performance and align with eco-friendly building standards, further driving market adoption.

Moreover, the automotive industry is increasingly adopting thermal insulation coatings to comply with stringent fuel efficiency regulations and environmental standards. The integration of innovative materials, including phase-change materials and infrared-reflective coatings, offers enhanced performance and positions thermal insulation solutions at the forefront of sustainable technology. As governments continue to support initiatives to reduce carbon emissions and promote energy-efficient products, demand for increased innovations in thermal insulation coatings is guaranteed.

Product Insights

Yttria-Stabilized Zirconia (YSZ) led the market with a revenue share of 33.7% in 2024, attributed to its outstanding thermal resistance and durability in extreme temperatures. YSZ coatings offer superior thermal barrier performance, making them ideal for aerospace, automotive, and power generation applications, fueled by ongoing advancements in research and development.

Epoxy coatings are expected to grow at the fastest CAGR of 5.8% over the forecast period. Epoxy coatings exhibit exceptional durability and enhanced dimensional stability, making them ideal for construction and manufacturing applications. Their VOC-free formulation aligns with the increasing demand for environmentally friendly products. This combination of resilience, energy efficiency, and adherence to green building standards has substantially driven the demand for thermal insulation coatings.

Application Insights

The manufacturing segment dominated with a revenue share of 31.6% in 2024. Stringent energy efficiency regulations compel industries to implement thermal insulation solutions to reduce heat loss and improve operational efficiency. Moreover, increasing focus on worker safety and regulatory compliance drives the use of these coatings in industrial environments. Enhanced process efficiency and lowered maintenance costs further elevate the demand for thermal insulation coatings.

The automotive & transportation segment is projected to grow at the fastest CAGR of 5.6% over the forecast period. The transition to electric vehicles (EVs) demands effective thermal management systems to optimize battery performance and ensure passenger comfort. Thermal insulation coatings reduce heat transfer in critical areas, enhancing vehicle efficiency. Furthermore, stringent emissions and fuel efficiency regulations compel manufacturers to adopt these coatings to improve performance and minimize energy consumption.

Regional Insights

Asia Pacific thermal insulation coating market dominated the global market with a revenue share of 33.7% in 2024. Robust investments in construction and infrastructure projects are propelling the demand for energy-efficient solutions. Furthermore, a heightened awareness of energy conservation and sustainability encourages industries to adopt advanced thermal insulation coatings. The region’s advantageous access to raw materials and the presence of key manufacturers further bolster market growth opportunities.

China Thermal Insulation Coating Market Trends

The thermal insulation coating market in China dominated Asia Pacific with a significant revenue share in 2024. Significant infrastructure and construction investments drive the demand for energy-efficient solutions such as thermal insulation coatings. Moreover, the implementation of stringent Minimum Energy Performance Standards (MEPS) in China for buildings is mandating high-efficiency standards for heating solutions and insulation, enhancing energy efficiency and reducing carbon emissions across various sectors.

North America Thermal Insulation Coating Market Trends

North America thermal insulation coating market is expected to grow at a CAGR of 5.3% over the forecast period, owing to is stringent energy efficiency regulations and a commitment to reducing carbon emissions. Established infrastructure and continued investments in industrial applications, particularly within the oil and gas sector, significantly enhance its market share.

The thermal insulation coating market in U.S. dominated North America with the largest revenue share in 2024. The U.S. government has implemented incentives to enhance energy-efficient technologies, notably through the Inflation Reduction Act (IRA), which allocates substantial funding for initiatives such as the High-Efficiency Electric Home Rebate program, offering up to USD 14,000 per household for insulation upgrades, driving market growth and environmental awareness.

Europe Thermal Insulation Coating Market Trends

Europe thermal insulation coating market held a substantial market share in 2024 due to rising consumer purchasing power and a strong emphasis on sustainable building practices. Countries in the region are making substantial investments in energy-efficient technologies, including thermal insulation coatings, while stricter regulations further drive demand for innovation and efficiency.

The thermal insulation coating market in Germany is expected to grow significantly in the forecast period. Germany’s commitment to reducing greenhouse gas emissions has spurred significant investments in energy-efficient technologies, particularly thermal insulation coatings. The construction sector increasingly adopts these solutions to meet the Energy Saving Ordinance (EnEV) mandates.

Key Thermal Insulation Coating Company Insights

Some key companies operating in the market include Evonik Industries AG, Mascoat, Carboline, and Nippon Paint Holdings Co., Ltd. Strategic initiatives encompass technological innovations, product enhancements, and collaborative partnerships aimed at broadening market reach and enhancing overall competitiveness.

-

Mascoat specializes in thermal insulation coatings that deliver energy efficiency, condensation protection, and sound control. Their eco-friendly solutions cater to diverse industries, including commercial, industrial, marine, and automotive, while ensuring corrosion prevention and minimal maintenance.

-

Sherwin-Williams provides a comprehensive selection of thermal insulation coatings designed to enhance energy efficiency and protect surfaces across multiple applications, effectively reducing heat transfer, improving safety, and ensuring durability in demanding environments.

Key Thermal Insulation Coating Companies:

The following are the leading companies in the thermal insulation coating market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Mascoat

- Carboline

- Nippon Paint Holdings Co., Ltd.

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Kansai Paint Co., Ltd.

- Grand Polycoats Company Pvt. Ltd.

- Sika AG

Recent Developments

-

In August 2024, PPG launched PPG PITT-THERM 909 spray-on insulation coating, enhancing operational efficiency & safety in high-heat environments of gas, oil, chemical, and petrochemical industries.

-

In October 2023, Sherwin-Williams introduced the Heat-Flex 7000 thermal insulative coating system, providing personnel protection and energy efficiency in industrial applications with a single spray application, enhancing insulation against corrosion & heat.

Thermal Insulation Coating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.75 billion

Revenue forecast in 2030

USD 15.10 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa.

Country scope

U.S.; Germany; France; UK; China; Japan; India;

Key companies profiled

Evonik Industries AG; Mascoat; Carboline; Nippon Paint Holdings Co., Ltd.; Akzo Nobel N.V.; PPG Industries, Inc.; The Sherwin-Williams Company; Kansai Paint Co., Ltd.; Grand Polycoats Company Pvt. Ltd.; Sika AG

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Insulation Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global thermal insulation coating market report based on, product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Epoxy

-

Polyurethane

-

YSZ

-

Mullite

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Aerospace & Defense

-

Manufacturing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.