- Home

- »

- Electronic Devices

- »

-

Thermal Printing Market Size & Share, Industry Report, 2030GVR Report cover

![Thermal Printing Market Size, Share & Trends Report]()

Thermal Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By Product Type (Desktop Printers, Mobile Printers), By Application, By End Use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-584-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Printing Market Summary

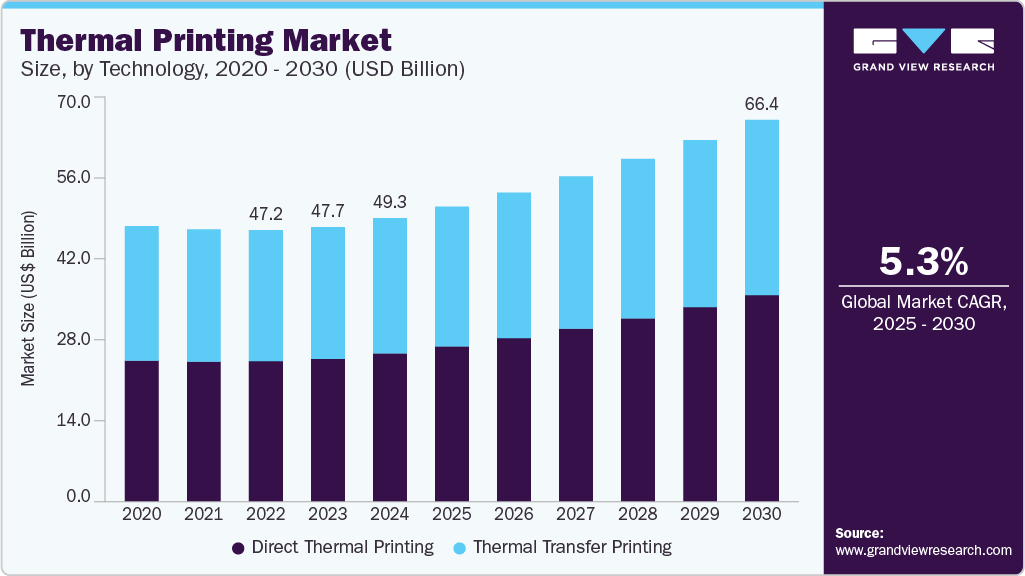

The global thermal printing market size was estimated at USD 49.3 billion in 2024 and is projected to reach USD 66.4 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The thermal printing industry is gaining momentum, driven by the rapid growth of e-commerce and retail industries andincreased use of thermal printers in healthcare and logistics.

Key Market Trends & Insights

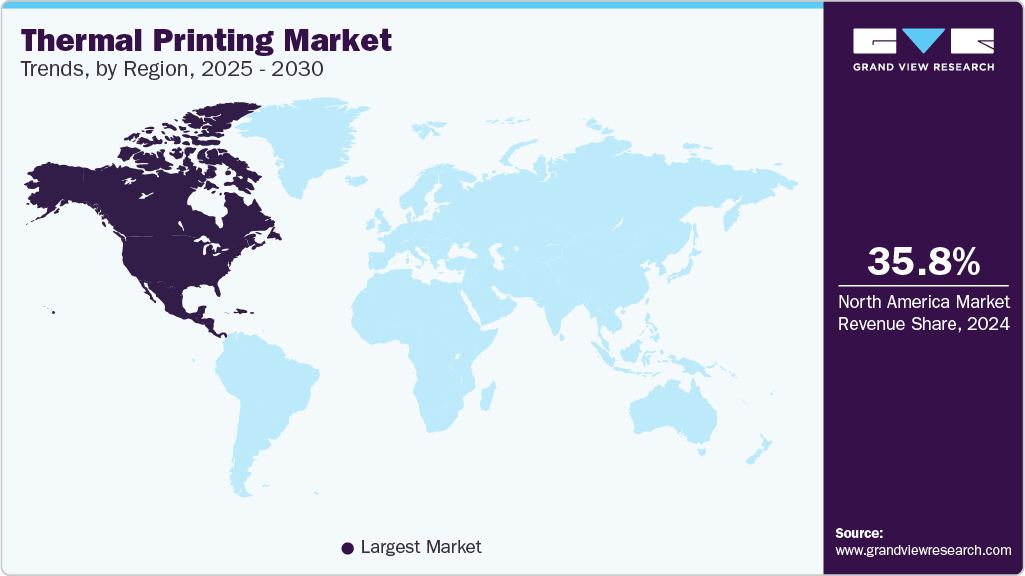

- North America dominated the thermal printing market with the largest revenue share of 35.8% in 2024.

- The thermal printing market in U.S. held a dominant position in 2024.

- By technology, the direct thermal printing segment led the market with the largest revenue share of 52.3% in 2024.

- By product type, the desktop printers segment accounted for the largest market revenue share in 2024.

- By application, the barcode and label printing segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 49.3 Billion

- 2030 Projected Market Size: USD 66.4 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

The increasing adoption of RFID technology is further fueling the market, as it enhances tracking and inventory management capabilities across various sectors. However, high initial investment costs associated with industrial-grade printers remain a key challenge. The increasing demand for mobile printers presents a major growth opportunity for the market. These compact and portable devices are gaining traction among businesses for on-the-go printing needs, further expanding the market.

The rapid growth of e-commerce and retail industries is significantly driving demand for printing and labeling solutions. According to the Census Bureau of the Department of Commerce, in 2024, U.S. e-commerce sales reached USD 1.19 trillion, up 8.1% year-over-year, comprising 16.1% of total retail sales, according to the U.S. Census Bureau. Similarly, India’s e-commerce sector is projected to grow from USD 123 billion in 2024 to USD 292.3 billion by 2028 at a CAGR of 18.7%, as per the India Brand Equity Foundation. This surge increases the need for efficient shipping, inventory, and packaging labels, boosting adoption of thermal and mobile printers.

The rising adoption of RFID technology is significantly boosting demand for RFID-compatible label printers. RFID enables real-time tracking and inventory visibility, reducing human error and improving operational efficiency across retail, logistics, and healthcare sectors. For instance, Walmart has expanded its RFID mandate beyond apparel to include home goods, electronics, and toys, requiring suppliers to tag these products. This push for standardized RFID implementation is prompting businesses to invest in printers capable of encoding RFID labels, driving sustained growth in the RFID printer segment.

The increasing use of thermal printers in healthcare and logistics is driven by their critical role in enhancing efficiency, safety, and traceability. According to the U.S. Centers for Medicare & Medicaid Services (CMS), in healthcare, where U.S. national health expenditures reached USD 4.9 trillion in 2023, thermal printers are essential for printing patient wristbands, prescription labels, and lab specimen tags, supporting growing hospital and clinical service demands. For example, hospitals use thermal printers to ensure accurate patient identification, reducing medical errors. In logistics, thermal printers are used by carriers such as FedEx to generate durable, smudge-proof shipping labels that withstand rough handling. Their cost-efficiency and reliability make them indispensable in these expanding sectors.

Industrial-grade printers, designed for high-volume and advanced functionalities, typically cost between USD 5,000 to USD 20,000, depending on the printer type and specifications. Additionally, ongoing maintenance and operational costs can add to the financial burden. For small and medium-sized enterprises (SMEs), the high upfront cost can be a significant barrier, preventing them from adopting or upgrading to industrial-grade solutions, even though these investments offer long-term operational efficiency and cost savings.

Technology Insights

The direct thermal printing segment led the market with the largest revenue share of 52.3% in 2024. Factors such as the increasing demand for barcode and label printing in retail, logistics, and healthcare, as well as the technology's cost efficiency and low maintenance, are driving this growth. In addition, the rise in mobile and on-demand printing applications across industries such as retail and hospitality further boosts adoption. Advances in direct thermal paper technology, improving durability and legibility, also expand the use of these printers in more demanding environments, contributing to the segment's continued dominance.

The thermal transfer printing segment is expected to grow at the fastest CAGR from 2025 to 2030. This growth is driven by the increasing need for high-quality, durable labels and barcodes that can withstand harsh environmental conditions, particularly in industries such as manufacturing, automotive, and logistics. Also, the rise in demand for specialized labels, including RFID and tamper-proof labels, further fuels the segment's growth. Technological advancements in printhead design and the growing adoption of advanced labeling solutions in logistics and healthcare sectors are further supporting the segment growth.

Product Type Insights

The desktop printers segment accounted for the largest market revenue share in 2024. This growth is driven by the growing trend for on-demand printing and customization, increasing demand for compact, cost-effective, and versatile printing solutions, particularly in small to medium-sized businesses. Desktop printers are widely used in industries such as retail, healthcare, and logistics for tasks including printing labels, barcodes, and invoices. Their ability to deliver high-quality prints at lower operational costs, along with user-friendly features, makes them an appealing choice for businesses with moderate printing needs.

The industrial printers segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing demand for high-volume, high-quality printing solutions across industries such as manufacturing, logistics, and packaging. Industrial printers, which offer durability, speed, and precision, are crucial for tasks such as barcoding, labeling, and marking products and packaging. For instance, global logistics companies, including FedEx and DHL, use industrial printers to generate robust, scannable labels for shipping. In addition, the rise of automation in factories and the need for compliance with traceability regulations are further accelerating the adoption of industrial printers.

Application Insights

The barcode and label printing segment accounted for the largest market revenue share in 2024. As supply chains become more complex and globalized, businesses are relying heavily on barcodes and labels for tracking products, reducing human errors, and ensuring regulatory compliance. For instance, the retail and logistics sectors use barcode and label printing to streamline operations and track inventory in real time. The increasing demand for efficient inventory management, traceability, and compliance across various industries, and the rapid growth of e-commerce, has further boosted the need for robust labeling solutions to meet the demands of fast shipping and accurate order fulfillment.

The RFID tag printing & encoding segment is expected to register at the fastest CAGR from 2025 to 2030. Major retailers, including Walmart and Target, have adopted RFID to optimize stock management and prevent theft. In addition, the healthcare sector is increasingly using RFID tags for tracking medical devices, improving patient safety, and ensuring compliance with regulatory standards. As the demand for contactless solutions increases, RFID tag printing and encoding technologies are expected to see substantial growthacross industries such as retail, healthcare, and logistics.

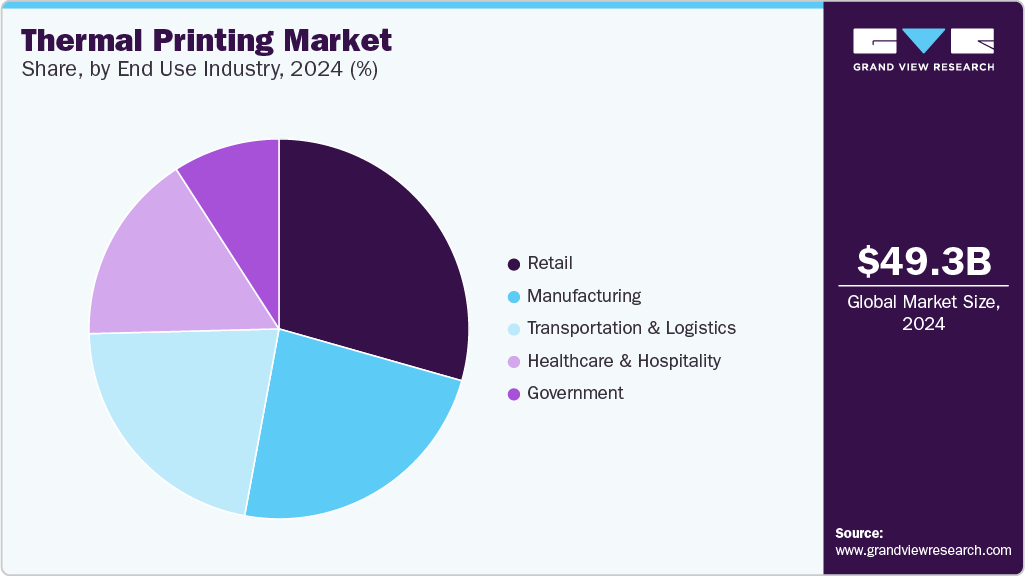

End Use Industry Insights

The retail segment accounted for the largest market revenue share in 2024. Factors such as the increasing demand for efficient inventory management, the growing trend of omnichannel retailing, the rise of e-commerce, and the need for real-time stock tracking are driving this growth. Retailers are increasingly adopting thermal printing solutions for barcode and label printing, enhancing customer experiences and improving operational efficiency. For instance, in March 2024, Tactile Technologies announced a strategic partnership with Seiko Instruments to enhance thermal printing solutions across South Africa. This collaboration focuses on delivering high-performance mobile and label printers for retail, logistics, and hospitality sectors, further showcasing the increasing reliance on advanced printing solutions in the retail industry.

The transportation & logistics segment is expected to register at the fastest CAGR from 2025 to 2030, owing to the growing need for streamlined supply chain operations, enhanced tracking, and accurate shipping documentation. Companies operating in the industry rely heavily on thermal printers to produce resilient shipping labels that endure the rigors of transit and handling, ensuring accurate parcel tracking. Also, the integration of RFID technology and automation within warehouses is creating a higher demand for thermal printers, offering opportunities for growth and innovation in this segment.

Regional Insights

North America dominated the thermal printing market with the largest revenue share of 35.8% in 2024. The North American market is being driven the increasing demand for efficient and reliable printing solutions in industries such as retail, logistics, healthcare, and manufacturing. As businesses increasingly rely on automated systems, the need for fast, cost-effective, and durable thermal printing solutions has grown. In Canada, the market is benefiting from advancements in retail technologies and the integration of thermal printing in supply chain management. The rise in e-commerce and omnichannel retailing in Canada further fuels the need for high-performance barcode and label printing.

Companies in North America are focusing on enhancing operational efficiency, improving user experience, and supporting the growing demand for mobile and wireless printing solutions. These efforts are driven by the region’s emphasis on small businesses and entrepreneurs who seek cost-effective, compact, and high-performance devices for their operations. In November 2025, Jadens (HK) Company Limited is set to launch its new wireless Bluetooth thermal printer in North America, targeting small business owners and entrepreneurs. Designed to address time-consuming label and document printing tasks, the printer offers ink-free operation and comes with versatile label options. The product aims to enhance work efficiency through compact, mobile printing solutions, aligning with the growing demand for user-friendly, high-speed thermal printing technologies in personal and professional applications.

U.S. Thermal Printing Market Trends

The thermal printing market in U.S. held a dominant position in 2024. The market in the U.S. is witnessing significant transformation, driven by the growing emphasis on operational efficiency and cost reduction across industries. As businesses increasingly seek ways to streamline their processes, the adoption of advanced thermal printing technologies, such as mobile and on-demand printing solutions, has surged. This trend is particularly evident in logistics and retail, where rapid labeling and barcode printing capabilities are essential for fast-moving goods and inventory tracking. For instance, in May 2023, Toshiba America Business Solutions launched its Duplex Linerless Thermal Printer (DL1024), which prints simultaneously on both sides of a label without requiring a liner or backing material. This innovation reduces labeling costs by up to 40%, eliminates label liner waste, and supports more sustainable practices.

In Mexico, the market is benefiting from the growth of the logistics and retail sectors mainly. The country’s increasing role as a manufacturing and distribution hub for North America has driven demand for thermal printing solutions, especially for barcode and shipping label applications in warehouses and distribution centers.

Asia Pacific Thermal Printing Market Trends

The thermal printing market in Asia Pacific was identified as a lucrative market in 2024, driven by rapid e-commerce growth, increasing industrial automation, and the need for faster, more efficient labeling solutions. As digital commerce scales rapidly, particularly in economies including China, Japan, India, and South Korea, businesses are increasingly investing in thermal printing solutions to support high-volume retail, warehousing, and shipment labeling needs.In India, thermal printing demand is rising due to the packaging industry’s rapid 22-25% annual growth. According to India Brand Equity Foundation (IBEF), this sector ranks fifth in the economy, supported by 900+ paper units and 526 operational mills. Thermal printers are essential for high-speed, ink-free barcode and label printing on packaging materials, meeting the needs of India’s growing e-commerce, FMCG, and logistics sectors focused on automation and traceability. In South Korea, robust investments in smart logistics and the electronics supply chain are contributing to adoption of thermal printers, particularly in high-precision labeling applications needed in export-oriented sectors.

The China thermal printing market saw substantial growth, fueled by the country’s booming e-commerce sector. According to China's National Bureau of Statistics, online retail sales reached USD 2.15 trillion in 2024, with 974 million online shoppers and over 1 billion online payment users. This massive consumer base has led to an increased demand for thermal printing solutions, particularly for barcode labels, packaging, and shipping purposes in the logistics sector. Companies in China are focusing on providing high-speed and eco-friendly thermal printing solutions to meet the growing demand from industries such as retail, logistics, and manufacturing.

The thermal printing market in Japan held a significant share in 2024. The country’s stable and mature retail environment, combined with the steady growth in B2C e-commerce, is driving demand for efficient labeling solutions. According to Japan’s Ministry of Economy, Trade and Industry (METI), B2C e-commerce sales of goods reached approximately USD 162.4 billion in 2022, growing by 5.37% year-over-year. This steady growth in online retail, combined with the focus on automation and operational efficiency, is propelling demand for advanced thermal printing solutions across industries in Japan.

Europe Thermal Printing Market Trends

The thermal printing market in Europe was identified as a lucrative region in 2024. The European market is witnessing significant transformation, supported by rising adoption of sustainable packaging solutions, advancements in digitized retail operations, and growing investment in intelligent logistics infrastructure. Regulatory initiatives such as the EU’s Packaging and Packaging Waste Regulation (PPWR) are encouraging the use of recyclable and linerless thermal printing technologies. Also, sectors such as food processing, pharmaceuticals, and manufacturing are increasingly leveraging thermal printers to meet labeling compliance and traceability requirements.

The Germany thermal printing market is being shaped by a surge in demand for automated labeling across logistics, warehousing, and industrial operations. As Germany remains the logistics backbone of the EU, companies are integrating high-performance thermal printers into their supply chains to enable faster and more accurate product tracking. Industry participants such as Zebra Technologies Corporation and Bixolon Co., Ltd. are enhancing their offerings in the German market through rugged, industrial-grade printing solutions tailored to high-volume operations.

The thermal printing market in UK is anticipated to grow at the fastest CAGR during the forecast period. According to the International Trade Administration, U.S. Department of Commerce, UK e-commerce revenue is projected to reach USD 285.60 billion by 2025, with a compound annual growth rate of 12.6%. The expansion of last-mile delivery services and click-and-collect models is further supporting the need for real-time label and receipt printing across fulfillment points. In addition, compliance with GS1 labeling standards in healthcare and food retail is boosting demand for precision thermal printers in the country.

Key Thermal Printing Company Insights

Some of the key players operating in the market include Zebra Technologies Corporation, Honeywell International Inc., Seiko Epson Corporation, and TSC Auto ID Technology Co., Ltd.

-

Founded in 1969 and headquartered in Illinois, U.S., Zebra Technologies Corporation is a prominent player in thermal printing and automatic identification solutions. The company designs and manufactures thermal barcode and RFID printers, mobile computing devices, data capture scanners, and related software. Zebra serves a broad range of industries, including retail, healthcare, transportation & logistics, and manufacturing. The company is known for its high-performance direct thermal and thermal transfer printers and has expanded its footprint through innovations in IoT-enabled devices and cloud-based printer management platforms.

-

Founded in 1906 and headquartered in North Carolina, U.S., Honeywell International Inc. operates a broad portfolio across aerospace, building technologies, performance materials, and safety & productivity solutions. Within the thermal printing space, Honeywell provides industrial, desktop, and mobile thermal printers that support barcode labeling, RFID encoding, and receipt printing. The company caters to sectors such as logistics, retail, healthcare, and warehousing, offering integrated solutions that combine hardware with Honeywell’s software platforms for enterprise mobility and workflow automation.

Key Thermal Printing Companies:

The following are the leading companies in the thermal printing market. These companies collectively hold the largest market share and dictate industry trends.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Seiko Epson Corporation

- TSC Auto ID Technology Co., Ltd.

- Bixolon Co., Ltd.

- Sato Holdings Corporation

- Brother Industries, Ltd.

- GoDEX International Co., Ltd.

- Citizen Systems Japan Co., Ltd.

- Toshiba TEC Corporation

Recent Developments

-

In April 2025, Source Technologies announced the acquisition of AMT Datasouth's printer assets, enhancing its portfolio in the thermal printing industry. The acquisition expands Source Technologies' offerings, including thermal printing solutions for label, barcode, and receipt printing.

-

In March 2025, Distribution Management (DM) announced the expansion of its product portfolio with the addition of Brother’s thermal desktop and industrial printers. This partnership enhances DM’s offerings in thermal printing, mobile, and labeling solutions, aligning with Brother’s vision for growth. By leveraging DM’s extensive reseller network, Brother aims to expand its reach across various sectors, including state and local government.

-

In October 2024, Munbyn announced the launch of two new label printers aimed at small and medium-sized businesses. The Realwriter RW402 addresses common challenges including paper waste and downtime with advanced technology that reduces paper jams to under 0.01%. The Munbyn FM226, designed for entrepreneurs, offers portability and long-lasting battery life, making it ideal for creating custom branding labels on the go.

-

In April 2024, Kite Packaging launched a new range of thermal labels and printers, featuring both direct thermal and thermal transfer options. The range includes desktop and mobile printers from various brands, as well as Kite's own entry-level models.

-

In January 2024, Munbyn launched the RW401AP wireless label printer, targeting small and medium-sized businesses. The printer’s 300dpi high-resolution capabilities enhance print quality, producing clearer images and logistics labels.

Thermal Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.3 billion

Revenue forecast in 2030

USD 66.4 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Technology, product type, application, end use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Zebra Technologies Corporation; Honeywell International Inc.; Seiko Epson Corporation; TSC Auto ID Technology Co., Ltd.; Bixolon Co., Ltd.; Sato Holdings Corporation; Brother Industries, Ltd.; GoDEX International Co., Ltd.; Citizen Systems Japan Co., Ltd.; Toshiba TEC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Printing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermal printing market report based on technology, product type, application, end use industry, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Thermal Printing

-

Thermal Transfer Printing

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop Printers

-

Mobile Printers

-

Industrial Printers

-

POS Printers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Barcode and Label Printing

-

Receipt Printing

-

RFID Tag Printing & Encoding

-

Wristband Printing

-

Ticket Printing

-

Asset & Inventory Tagging

-

Shipping Label Printing

-

-

End Use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Healthcare & Hospitality

-

Transportation & Logistics

-

Manufacturing

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermal printing market size was estimated at USD 49.3 billion in 2024 and is expected to reach USD 66.4 billion in 2030.

b. The global thermal printing market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 66.4 billion by 2030.

b. North America thermal printing market accounted for 35.8% of the global share in 2024. The thermal printing market in North America is being driven the increasing demand for efficient and reliable printing solutions in industries such as retail, logistics, healthcare, and manufacturing. As businesses increasingly rely on automated systems, the need for fast, cost-effective, and durable thermal printing solutions has grown in the region.

b. Some key players operating in the thermal printing market include Zebra Technologies Corporation, Honeywell International Inc., Seiko Epson Corporation, TSC Auto ID Technology Co., Ltd., Bixolon Co., Ltd., Sato Holdings Corporation, Brother Industries, Ltd., GoDEX International Co., Ltd., Citizen Systems Japan Co., Ltd., Toshiba TEC Corporation.

b. Key factors that are driving the market growth include rapid growth of e-commerce and retail industries and increased use of thermal printers in healthcare and logistics. The increasing adoption of RFID technology is further fueling the market, as it enhances tracking and inventory management capabilities across various sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.