- Home

- »

- Electronic Security

- »

-

Thermal Scanners Market Size, Share, Industry Report, 2030GVR Report cover

![Thermal Scanners Market Size, Share & Trends Report]()

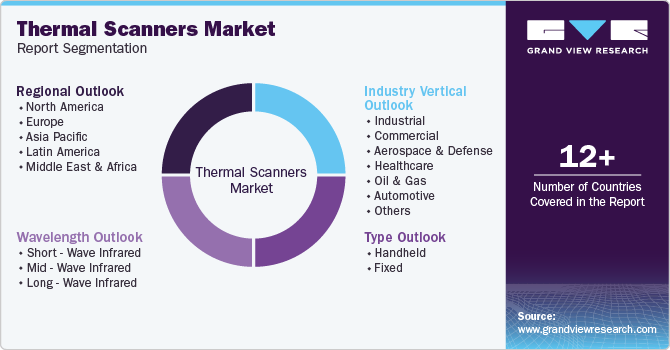

Thermal Scanners Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Handheld, Fixed), By Wavelength (Short-Wave, Mid-Wave, Long-Wave), By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-231-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Scanners Market Summary

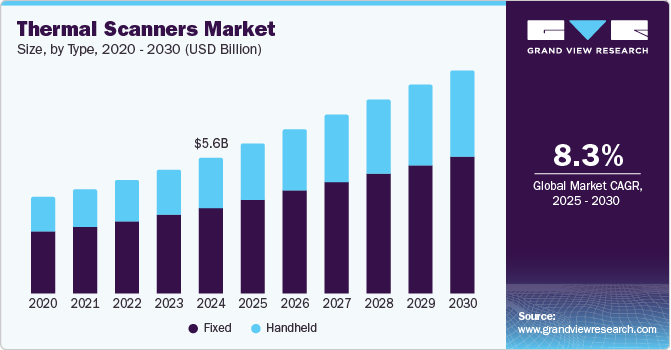

The global thermal scanners market was valued at USD 5.61 billion in 2024 and is projected to reach USD 9.23 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2030. Several key factors are driving the expansion of this market.

Key Market Trends & Insights

- The North America thermal scanners market dominated the global revenue with a revenue share of 41.0% in 2024.

- In Europe, the thermal scanners market is witnessing significant growth.

- The Asia Pacific region is witnessing rapid growth in the thermal scanners market.

- Based on type, the fixed segment dominated the market with a revenue share of 63.2% in 2024.

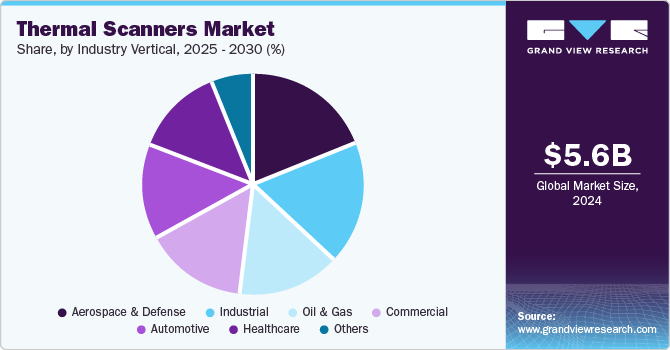

- In terms of industry vertical, the aerospace & defense segment dominated the market with the highest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.61 Billion

- 2030 Projected Market Size: USD 9.23 Billion

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These include the rising demand for thermal scanners at airports for mass screening, increasing government expenditures globally in the aerospace and defense sectors, and heightened R&D investments by companies, governments, and capital firms to create advanced thermal scanning solutions.The need for effective fever detection and infection control has led to the widespread adoption of thermal scanners in various settings, including airports, healthcare facilities, and workplaces. This trend is further amplified by government mandates and increased investments in healthcare infrastructure across regions, particularly in Asia-Pacific, where rapid urbanization and industrialization are driving demand for these devices.

Moreover, the increasing integration of thermal scanning technology with advanced systems such as IoT and AI leads to market expansion. This integration heightens the capabilities of thermal scanners, enabling real-time data analytics and remote monitoring, which are essential for effective industrial automation and surveillance applications. For instance, Arrow Electronics introduced an AI thermal sensing solution designed to accelerate the development of health monitoring devices. This integrates AI capabilities with thermal imaging to enable accurate temperature screening in various environments, such as healthcare settings.

Furthermore, the market is benefiting from substantial investments in research and development aimed at creating refined thermal scanning technologies. Despite their higher cost and maintenance requirements, cooled thermal scanners are gaining traction in specialized applications such as military defense and scientific research due to their superior sensitivity and image resolution. As manufacturers strive to enhance product affordability and performance, the competitive landscape is evolving, promising continued growth for the thermal scanners industry in the coming years.

Type Insights

The fixed segment dominated the market with a revenue share of 63.2% in 2024 due to its extensive application in industrial and commercial settings. These scanners are permanently installed, providing continuous monitoring and surveillance, which is crucial for environments that require constant temperature checks, such as manufacturing plants and healthcare facilities. The reliability and accuracy of fixed thermal scanners make them ideal for detecting variances in equipment and ensuring safety compliance. For instance, The Asian Development Bank (ADB), in collaboration with UNICEF, has assisted the Government of India in deploying thermal scanners to facilitate mass screening of passengers at key entry points.

The handheld segment is projected to grow at the highest CAGR during the forecast period, primarily due to its versatility and ease of use. Handheld thermal scanners are favored for their portability, allowing users to conduct temperature screenings in various locations, including public spaces, and during inspections. The demand surged during the COVID-19 pandemic as organizations sought efficient ways to screen individuals without physical contact. This adaptability makes handheld devices increasingly popular for temporary and immediate screening needs across multiple sectors.

Wavelength Insights

The Long-Wave Infrared (LWIR) segment dominated the thermal scanners industry with the highest revenue share in 2024 due to its extensive applications across various industries, particularly in defense and security. LWIR technology excels in detecting heat signatures, making it vital for surveillance, search and rescue operations, and industrial monitoring. The increasing focus on national security and public safety has led to a growing demand for LWIR technology, further solidifying its market leadership as organizations seek reliable solutions for effective monitoring and threat detection.

The Short-Wave Infrared (SWIR) segment is expected to grow at the highest CAGR over the forecast period due to its unique capabilities and versatility. SWIR technology is particularly effective in applications requiring high-resolution imaging under varying environmental conditions, such as fog or smoke. Companies such as BMW and Audi are integrating SWIR cameras into their advanced driver-assistance systems (ADAS) to improve night-time visibility and pedestrian detection. For instance, in 2023, Teledyne FLIR and Valeo, a division of Teledyne Technologies Incorporated, joined forces to integrate thermal imaging technology into the automotive sector with the goal of enhancing road safety for users. This partnership will produce the first Automotive Safety Integrity Level (ASIL) B thermal imaging technology tailored for night vision applications in advanced driver-assistance systems (ADAS).

Industry Vertical Insights

The aerospace & defense segment dominated the market with the highest share in 2024 due to the critical role these devices play in enhancing security and operational efficiency within the industry. Thermal scanners are extensively utilized for applications such as border surveillance, aircraft structural health monitoring, and law enforcement operations. Their ability to function effectively in all weather conditions and provide real-time thermal imaging makes them indispensable for military and civilian aerospace operations. The ongoing investments in defense technology and the need for advanced surveillance systems further contribute to the segment's dominance as organizations prioritize safety and threat detection in an increasingly complex global environment.

The healthcare segment is expected to grow at the fastest CAGR over the forecast period, owing to an increasing emphasis on public health safety and disease prevention. The COVID-19 pandemic has significantly accelerated the adoption of thermal scanners in healthcare settings for non-contact temperature screening, helping to quickly identify individuals with elevated body temperatures. As healthcare facilities strive to implement effective infection control measures, the demand for thermal scanning technology is expected to rise. In addition, advancements in thermal imaging technology that enhance accuracy and integration with other health monitoring systems are expected to lead to segment growth.

Regional Insights

The North America thermal scanners market dominated the global revenue with a revenue share of 41.0% in 2024, driven by a combination of advanced healthcare infrastructure and heightened public health awareness following the COVID-19 pandemic. The region's extensive adoption of thermal scanners for non-contact temperature screening in airports, hospitals, and public spaces has solidified its importance in safety protocols. In addition, North America is home to leading manufacturers that innovate and enhance thermal imaging technology, incorporating features such as AI and IoT for real-time monitoring.

U.S. Thermal Scanners Market Trends

In the U.S., the market is driven by increasing security concerns and the demand for health monitoring solutions. The COVID-19 pandemic has significantly accelerated the adoption of thermal scanners across various sectors, including healthcare, transportation, and public venues. As organizations prioritize safety protocols, there is a heightened focus on integrating advanced thermal imaging technologies for effective surveillance and operational efficiency. Moreover, ongoing investments in defense and security technologies further strengthen the market, reflecting a commitment to enhancing public safety and situational awareness.

Europe Thermal Scanners Market Trends

In Europe, the thermal scanners market is witnessing significant growth. The region has seen increased investments in advanced surveillance technologies as governments emphasize enhanced security measures. This trend is complemented by the automotive industry's growing adoption of thermal imaging technology for applications such as advanced driver-assistance systems (ADAS), which enhance vehicle safety and operational efficiency. The emphasis on public health and safety continues to influence the market, with thermal scanners being increasingly utilized in healthcare settings for effective monitoring and disease prevention.

Asia Pacific Thermal Scanners Market Trends

The Asia Pacific region is witnessing rapid growth in the thermal scanners market due to rising public health initiatives and increasing industrial applications. The region has implemented widespread thermal screening measures in response to health crises, particularly in transportation hubs and public spaces. Furthermore, the growing manufacturing sector is leveraging thermal imaging technology for equipment maintenance and monitoring of structural integrity.

In China, the thermal scanners industry is experiencing growth driven by substantial investments in both military and commercial sectors. The Chinese government has prioritized enhancing border security and surveillance capabilities, leading to increased procurement of advanced thermal imaging systems. In addition, the industrial and automotive sectors in China are increasingly embracing thermal imaging technology for quality control and preventive maintenance, reflecting the country's broader initiative toward high-tech manufacturing and infrastructure development.

Key Thermal Scanners Company Insights

The thermal scanners industry is characterized by the presence of several key players that significantly influence its dynamics. Notable players include FLIR Systems Inc., recognized for its advanced thermal imaging solutions, and Fluke Corporation, which offers a variety of thermal cameras for industrial applications. Other prominent companies include L3HARRIS Technologies Inc., specializing in defense and aerospace applications, and Axis Communications AB, known for innovative security solutions. Moreover, firms such as Leonardo S.p.A., HGH Infrared Systems, and Opgal contribute to the market with specialized thermal imaging products tailored to various industries.

-

3M offers a range of thermal imaging solutions designed for various applications, including industrial monitoring, healthcare, and safety compliance. 3M's thermal scanners are known for their accuracy and reliability, making them suitable for critical environments where temperature monitoring is essential.

-

AMETEK Land, a division of AMETEK, Inc., specializes in providing high-performance thermal imaging solutions tailored for industrial applications. The company focuses on delivering precise temperature measurement and monitoring systems that are essential for quality control and preventive maintenance in manufacturing processes. AMETEK Land's thermal scanners are widely used in industries such as metals, glass, and petrochemicals, where accurate temperature readings are critical for operational efficiency and safety.

Key Thermal Scanners Companies:

The following are the leading companies in the thermal scanners market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AMETEK Land (Land Instruments International Ltd)

- Fluke Corporation

- HGH

- L3Harris Technologies, Inc

- Leonardo S.p.A.

- Nippon Avionics Co. Ltd.

- OMEGA Engineering Inc.

- Opgal Optronic Industries Ltd.

- Optotherm, Inc.

- Teledyne FLIR LLC

- Tonbo Imaging

Recent Development

-

In May 2024, Obsidian Sensors, a San Diego-based company specializing in high-resolution thermal sensors, partnered with Taiwanese electronics firm Quanta Computer to target automotive applications. This collaboration follows a recent ruling by the U.S. National Highway Traffic Safety Administration (NHTSA) mandating that all new cars must include autonomous emergency braking (AEB) systems by 2029.

-

In February 2022, AMETEK Land launched the LWIR-640 long-wavelength thermal imager, designed to provide constant and reliable temperature measurements in tough industrial environments. This advanced thermal imaging solution offers a temperature measurement range of 0 to 1000 °C and features high pixel resolution, making it suitable for various applications, including predictive maintenance and process control.

Thermal Scanners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.19 billion

Revenue forecast in 2030

USD 9.23 billion

Growth Rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, wavelength, industry vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa.

Key companies profiled

3M; AMETEK Land (Land Instruments International Ltd); Fluke Corporation; HGH; L3Harris Technologies, Inc; Leonardo S.p.A.; Nippon Avionics Co. Ltd.; OMEGA Engineering Inc.; Opgal Optronic Industries Ltd.; Optotherm, Inc.; Teledyne FLIR LLC; Tonbo Imaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Scanners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermal scanners market report based on type, wavelength, industry vertical, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Fixed

-

-

Wavelength Outlook (Revenue, USD Million, 2018 - 2030)

-

Short - Wave Infrared

-

Mid - Wave Infrared

-

Long - Wave Infrared

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Aerospace & Defense

-

Healthcare

-

Oil & Gas

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.