- Home

- »

- Next Generation Technologies

- »

-

Third-party Banking Software Market Size, Share Report, 2030GVR Report cover

![Third-party Banking Software Market Size, Share & Trends Report]()

Third-party Banking Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type, By Deployment (On-premise, Cloud), By Application, By End-use (Retail Banks, Commercial Banks), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-963-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

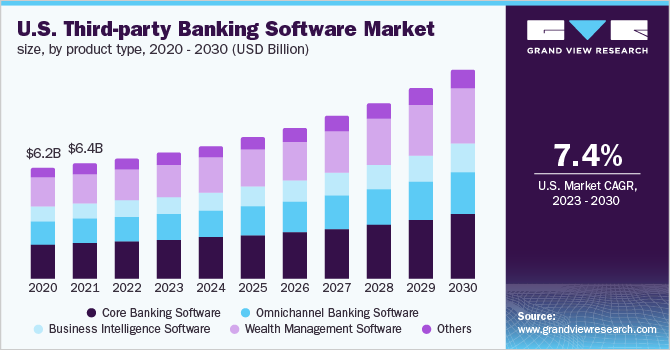

The global third-party banking software market size was valued at USD 26.09 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. The significant expansion of the banking, financial services, and insurance (BFSI) industry as a result of economic growth is a major growth driver. In addition, the integration of several cloud-computing services, including databases, networking, and analytics in banking software, is also contributing to the industry’s growth. Customers prefer using smartphones and computers to conduct transactions and access their accounts, which is anticipated to raise demand for the adoption of third-party banking software.

The growing adoption of technologically advanced analytical tools such as big data analytics is impacting the growth positively. The analytical tools help to process big chunks of data efficiently for making business decisions, identifying trends in the market, and increasing profitability. As the banking sector is a data-driven industry, the deployment of third-party software integrated with various analytical tools helps in managing the data efficiently.

Moreover, a shift has been observed from conventional methods to computerized methods for tracking & recording monetary transactions and bookkeeping, which, in turn, supports the growth of the third-party banking software market. In line with this, the rising demand for process standardization and core banking systems in the BFSI sector is fueling market growth.

The growing need to improve the operational efficiency and productivity of the banking sector is driving the global market for third-party banking software. The banking sector has undergone a significant transformation, which has caused its operational procedures to be customized.

Due to altered client needs, diminishing revenues, and the need for operational flexibility, the banking industry has gradually shifted its focus toward third-party software over the past few years. In addition, the software helps banks gain a competitive edge over rival financial institutions by lowering operational expenses and minimizing human errors that can result in losses.

Banking companies across the world are continuously encouraging the utilization of end-to-end technology to enhance their offerings. For instance, In June 2022, Temenos AG announced that TS Banking Group, a U.S.-based banking organization, had chosen its banking services running on the Temenos Banking Cloud for a complete digital revolution. The group will move all of its banking operations to Temenos' top open platform, which is designed explicitly for composable banking. The TS Banking Group will be able to scale more effectively and with greater agility with the help of Temenos Banking Cloud.

The expansion of the third-party banking software market is, however, constrained by concerns about information security. Moreover, the significant costs associated with switching from conventional to new automated systems act as one of the major obstacles to the growth of the industry. In addition, the lack of qualified professionals to utilize third-party banking software properly and safely as the software holds extremely sensitive information is another factor hampering the growth.

Moreover, the institutions are not hesitant and looking forward to investing in technologies such as cloud computing and encryption to enhance their third-party software offerings. The growing emphasis on training professionals owing to the rising significance of the application of third-party banking software is expected to support the growth.

COVID-19 Impact Analysis

Throughout the projection period, the COVID-19 pandemic outbreak is anticipated to have a significant impact on the market's growth. People all around the world are becoming more and more reliant on digital payment methods as a result of their desire to prevent any possible coronavirus exposure from contaminated surfaces. The growing preference for online banking solutions in the wake of the outbreak of the pandemic is particularly opening opportunities for the integration of third-party banking software. Also, the growth of digital payment platforms is complementing the growth of the industry.

Product Type Insights

The core banking software segment dominated the market in 2022 and accounted for a share of more than 31.0% of the global revenue. The rapid changes in the banking sector carry a risk that institutions may become incompetent if they do not implement and adapt to the changes. Therefore, the institutions realized that there is a significant impact of digital technology on consumers, and their expectations, some of which can be fulfilled by the adoption of core banking software.

As a result, the substantial efforts being made by numerous companies to improve their banking software products are also encouraging the growth of the segment. For instance, in June 2022, Regions Bank, the 25th largest bank in the U.S., invested in the execution of a technology-oriented transformation. They designed the platform's fundamental migration using a combination of the cloud and cutting-edge technologies.

The wealth management software segment is anticipated to witness the fastest growth over the forecast period. The demand for third-party wealth management software is expected to be driven by the retired population as more people are looking for wealth management services that help them create enough retirement income. People are seeking financial advisory and wealth management services to better manage their wealth as a result of longer life expectancies and growing medical costs. Thus, an increase in the adoption of wealth management software is anticipated to augment the growth.

Deployment Insights

The on-premise segment dominated the market in 2022 and accounted for a share of more than 60.0% of the global revenue. The dominance of this segment is attributed to the easy customization options, flexibility, and higher security levels as it runs on private servers. Moreover, the institutions looking for authority over their software and control over the data prefer on-premise platforms over the cloud.

The cloud segment is expected to register the fastest growth over the forecast period. The pandemic and the rapid influx of competitive & cloud-native fintech startups are the two fundamental causes of the current surge in interest in cloud migration. According to a survey conducted by The Economist Business Intelligence Unit in 2021, 72% of IT executives in the banking industry saw cloud adoption as an essential business strategy.

Application Insights

The risk management segment dominated the market in 2022 and accounted for a share of over 41.0% of the global revenue. Risk management application of third-party banking software enables banking institutions to improve the efficacy of risk assessment and aids in mitigating losses. The rising incidences of security breaches and strict regulatory compliances, also the advancements in the Internet of Things (IoT), are expected to further propel the growth of the segment.

The business intelligence segment is anticipated to grow at the fastest CAGR over the forecast period. The primary factor driving the growth is that the business intelligence application of third-party banking software supports the banks in making informed decisions based on facts related to trends and consumer behavior. In addition, the rising integration of data analytics by end-users to analyze the produced data is driving the market. Moreover, the integration of artificial intelligence (AI) into software is expected to create significant growth opportunities.

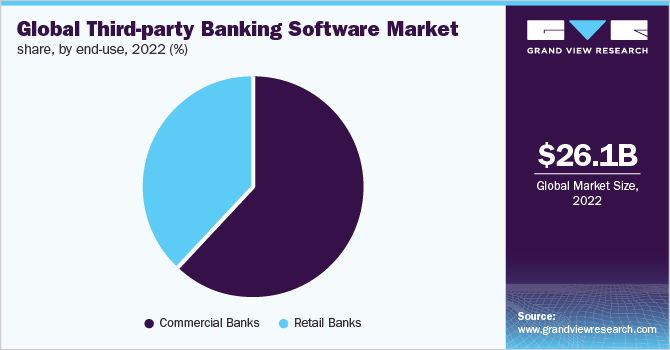

End-use Insights

The retail banks segment dominated the market in 2022 and accounted for a share of over 62.0% of the global revenue. Growing demand for third-party banking software in retail banks as it reduces operational costs is expected to fuel the growth. Moreover, the needs of the customers are better understood through the efficient and centralized system of retail banking software.

The commercial banks segment is anticipated to register the fastest CAGR over the forecast period. Commercial banks are turning towards the implementation of software as they face regulatory and competitive pressure. Commercial banks prefer third-party banking software as it can be configured to adapt to any business process. It can interact and integrate with any external system and can enhance compliance capabilities and data management. These are some of the factors responsible for the growth of the segment.

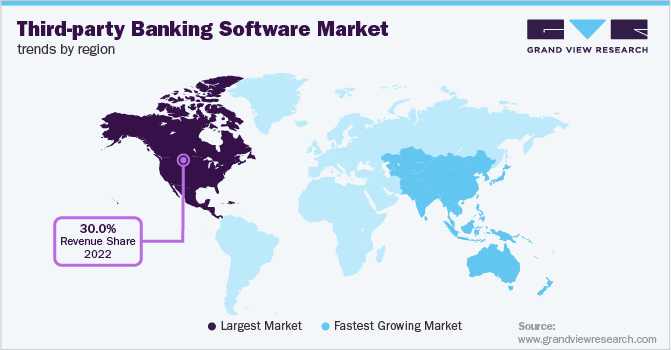

Regional Insights

North America dominated the third-party banking software market in 2022 and accounted for a share of over 30.0% of the global revenue. The growth in the banking industry in North America and the growing acceptance of third-party software to increase operational efficiency are expected to accentuate the growth of the regional market.

In addition, the presence of several key players such as Microsoft, and IBM is expected to create a positive outlook for the growth of the industry. Moreover, another significant factor that is propelling the growth is that the North America region stands at the forefront of the digitalization of the BFSI sector which is expected to increase the demand for third-party software.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth can be attributed owing to the notable regulatory compliances, and the developing IT infrastructure in countries like such as China, India, and Japan. The aggressive efforts being pursued by various organizations across the region to promote the utilization of third-party banking software are also expected to contribute to the growth of the segment.

Key Companies & Market Share Insights

The market is fragmented and can be characterized by the presence of many prominent players. Industry incumbents are pursuing various strategies, such as strategic partnerships, new product launches, geographic expansion, and others, as part of the efforts to enhance their offerings.

For instance, in December 2021, Pershing, the Bank of New York Mellon Corporation’s fintech vertical, acquired Optimal Asset Management, a customized direct indexing provider. FutureSafe, an investing automation service operated by Optimal Asset Management, also became part of Pershing X. Moreover, the players are investing aggressively in R&D activities to enhance their product offerings. Some prominent players in the global third-party banking software market include:

-

Microsoft Corporation

-

International Business Machines (IBM) Corporation

-

Oracle Corporation

-

SAP SE

-

Tata Consultancy Services (TCS)

-

Infosys Ltd.

-

Capgemini SE

-

Accenture plc

-

FIS, Inc.

-

Fiserv, Inc.

Third-party Banking Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.53 billion

Revenue forecast in 2030

USD 47.90 billion

Growth rate

CAGR of 8.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product type, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Microsoft Corporation; International Business Machines (IBM) Corporation; Oracle Corporation; SAP SE; Tata Consultancy Services (TCS); Infosys Ltd.; Capgemini SE; Accenture plc; FIS. Inc.; Fiserv, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

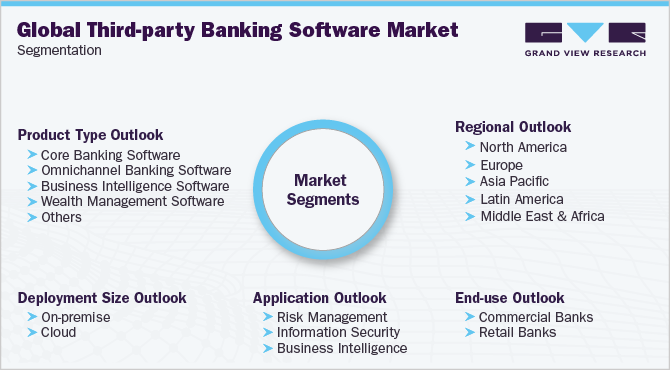

Global Third-party Banking Software Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global third-party banking software market report based on product, deployment, application, end-user, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Core Banking Software

-

Omnichannel Banking Software

-

Business Intelligence Software

-

Wealth Management Software

-

Others

-

-

Deployment Size Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Risk Management

-

Information Security

-

Business Intelligence

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Banks

-

Retail Banks

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global third-party banking software market size was estimated at USD 26.09 billion in 2022 and is expected to reach USD 27.53 billion in 2023.

b. The global third-party banking software market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 47.90 billion by 2030.

b. North America dominated the third-party banking software market with a share of 30.07% in 2022. This is attributable to the rising adoption of third-party banking software to increase operational efficiency.

b. Some key players operating in the third-party banking software market include Microsoft Corporation, International Business Machines (IBM) Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services (TCS), Infosys Ltd., Capgemini, Accenture, FIS. Inc., Fiserv, Inc.

b. The key factor driving the third-party banking software market growth is the growing adoption of analytical tools such as big data to improve the operational efficiency and productivity of the banking sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.