- Home

- »

- Medical Devices

- »

-

Thoracic Aortic Aneurysm Market Size, Industry Report, 2033GVR Report cover

![Thoracic Aortic Aneurysm Market Size, Share & Trends Report]()

Thoracic Aortic Aneurysm Market (2025 - 2033) Size, Share & Trends Analysis Report By Treatment (Open Surgical Repair (OSR), Thoracic Endovascular Aneurysm Repair (TEVAR)), By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-704-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thoracic Aortic Aneurysm Market Summary

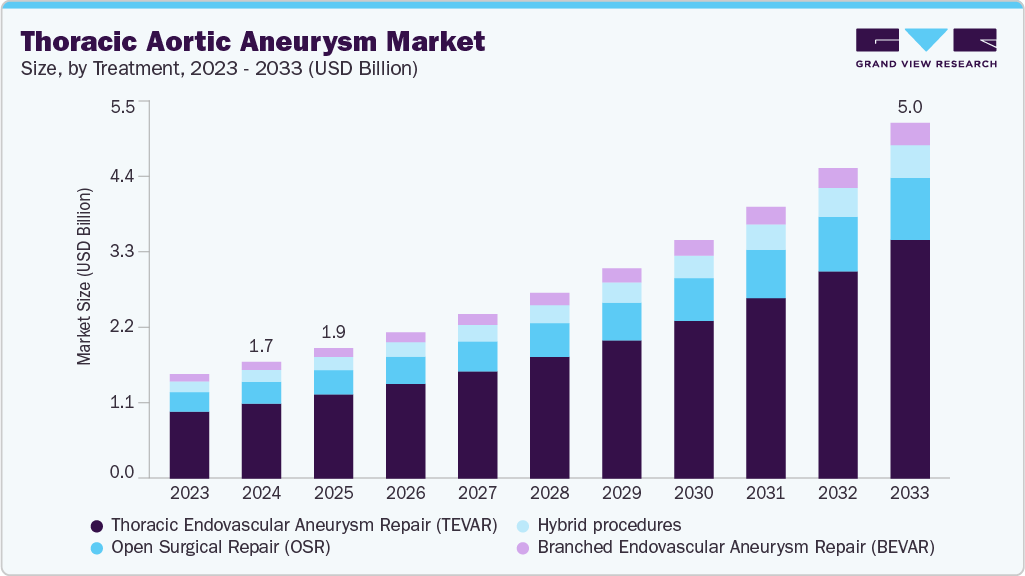

The global thoracic aortic aneurysm market size was estimated at USD 1.65 billion in 2024 and is projected to reach USD 5.04 billion by 2033, growing at a CAGR of 13.36% from 2025 to 2033. This growth is driven by the rising prevalence of hypertension and connective tissue disorders, an increasing aging population, and growing adoption of minimally invasive endovascular procedures.

Key Market Trends & Insights

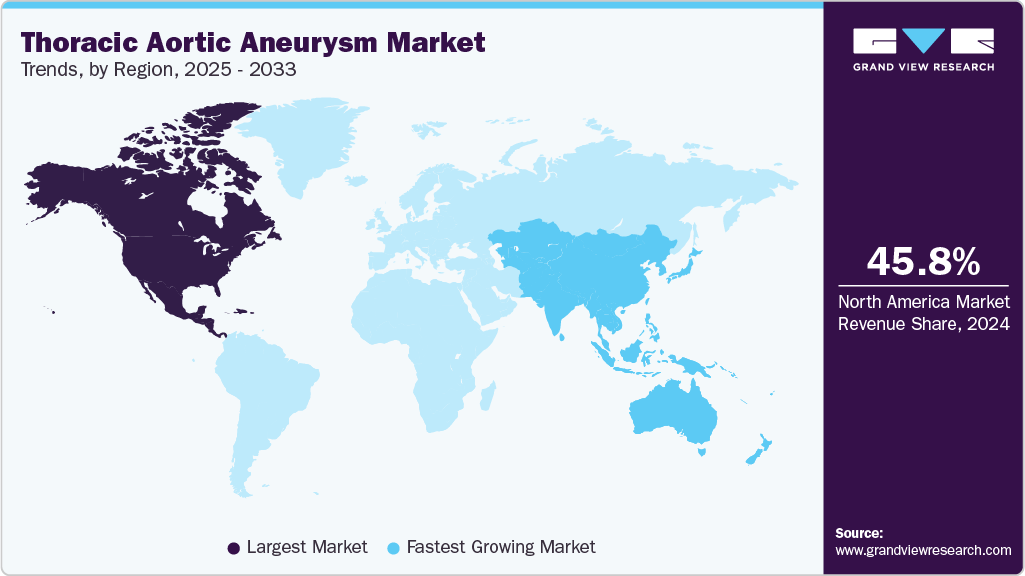

- North America thoracic aortic aneurysm market dominated the global market and accounted for the largest revenue share of 45.84% in 2024.

- The U.S. thoracic aortic aneurysm market is anticipated to register a significant growth rate during the forecast period.

- By treatment segment, the thoracic endovascular aneurysm repair (TEVAR) segment held the largest revenue share of 64.18% in 2024.

- By product segment, the aortic stent grafts segment held the largest revenue share of 78.97% in 2024.

- By end use segment, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.65 Billion

- 2033 Projected Market Size: USD 5.04 Billion

- CAGR (2025-2033): 13.36%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological advancements in stent graft design, improved diagnostic imaging, and early disease detection contribute to market expansion. Supportive reimbursement policies and expanding awareness of thoracic aortic aneurysms among both physicians and patients are further accelerating treatment uptake globally.The increasing prevalence of hypertension, smoking, and atherosclerosis, which are key risk factors for thoracic aortic aneurysm, is a major driver of market growth. As aging populations grow globally, the incidence of degenerative vascular conditions continues to rise, directly increasing the demand for diagnostic and therapeutic solutions. In March 2025, an article published in Biomedicines analyzed the relationship between atherosclerosis (AS) and aortic aneurysm (AA), including thoracic AA (TAA). It reported comorbidity rates ranging from 18% to 90%, influenced by aneurysm location, age, genetic background, and bicuspid aortic valves.

Technological advancements in endovascular aneurysm repair (TEVAR) have significantly boosted the market by offering minimally invasive alternatives to open surgery. These innovations have led to reduced hospital stays, lower procedural risks, and expanded treatment eligibility for high-risk patients. Device manufacturers are continually developing next-generation stent grafts with enhanced precision, flexibility, and durability, further accelerating their adoption among vascular surgeons worldwide. In May 2025, SHIP International Hospital in Dhaka performed a Thoracic Endovascular Aortic Repair (TEVAR) on a 57-year-old patient with a thoracic aortic aneurysm (TAA), a bulge in the chest portion of the aorta. Referred by a NICVD professor after being denied treatment elsewhere, the patient underwent the minimally invasive procedure with support from an endovascular stent graft vendor.

The growing use of advanced imaging modalities such as CT angiography, MRI, and ultrasound for early and accurate detection of thoracic aortic aneurysms is fueling market growth. National screening programs and increased awareness among both clinicians and patients are contributing to earlier diagnosis and timely intervention. In parallel, artificial intelligence tools and digital health platforms are being integrated into diagnostic pathways, supporting better risk stratification and patient monitoring.

In June 2025, an article published in Nature Communications discussed an AI model that enables opportunistic screening for thoracic aortic aneurysms (TAA) using routine breast MRI scans. The model improved detection rates by 3.5× compared to standard clinical reads. It flagged high-risk patients based on both aortic size and body-size-adjusted indices like AHI and ASI.

In April 2023, a systematic review published in the Journal of Vascular Surgery evaluated comorbidities in patients undergoing TEVAR for thoracic aortic aneurysm. The analysis revealed that hypertension was present in approximately 70% of patients, followed by coronary artery disease (35%), chronic kidney disease (20%), COPD (15%), and diabetes mellitus (12%). These comorbidities significantly influence both procedural risk and patient outcomes. The review pooled data from multiple studies, highlighting the consistent prevalence of these chronic diseases across various populations. This underscores the importance of preoperative risk stratification and careful perioperative management.

The findings reinforce TEVAR’s role as the preferred intervention for high-risk TAA patients, especially those with multiple chronic conditions. Compared to open surgical repair, TEVAR is associated with lower perioperative complication rates and reduced physiological burden. Its minimally invasive nature has made it the standard of care in patients with limited surgical tolerance. As clinical evidence continues to build, TEVAR has become firmly established in treatment algorithms and is increasingly supported in updated clinical guidelines.

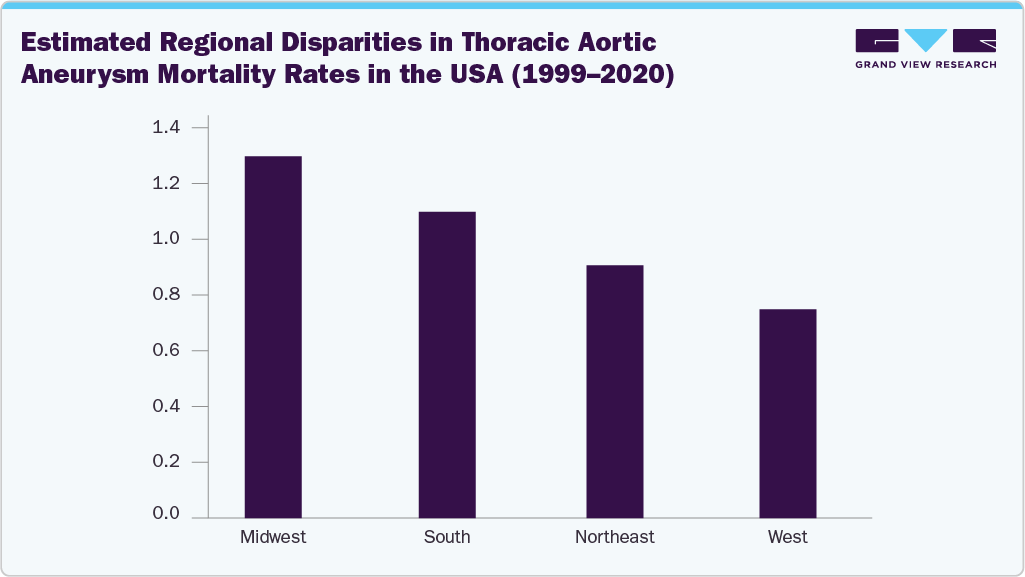

In March 2025, a study published in Archives of Cardiovascular Diseases analyzed thoracic aortic aneurysm (TAA)-related deaths in the U.S. using CDC WONDER data spanning 1999 to 2020. The chart illustrates estimated regional differences in age-adjusted mortality rates, showing the Midwest with the highest burden, followed by the South, while the West and Northeast had comparatively lower rates. These values visually represent regional mortality disparities, based on reported trends in the study.

The March 2025 analysis emphasized that despite a nationwide decline in TAA mortality, substantial demographic and geographic inequities persist. Contributing factors may include differences in healthcare infrastructure, comorbidity management, and access to timely endovascular repair. This illustrative chart underscores the study’s call for targeted public health efforts to address high-burden areas and improve outcomes across all U.S. populations.

Market Concentration & Characteristics

The thoracic aortic aneurysm market has witnessed high innovation, driven by advancements in endovascular repair techniques, AI-assisted imaging, and precision stent graft technologies. Developments such as branched and fenestrated grafts, low-profile delivery systems, and image-guided navigation have enhanced procedural safety and broadened the patient pool eligible for minimally invasive repair. In July 2025, MicroPort Endovastec completed initial commercial use of its next-generation Cratos stent graft system in China. Designed for thoracic endovascular aortic repair (TEVAR), Cratos features an adjustable proximal stent, refined delivery system, and improved deployment accuracy, enabling enhanced precision and reduced access requirements.

The market is seeing steady merger and acquisition activity as major medtech firms seek to expand their vascular intervention portfolios and access enabling technologies in imaging, navigation, and graft design. Consolidation efforts are aimed at accelerating R&D pipelines, strengthening geographic presence, and improving operational efficiencies across the aortic care continuum.

Regulatory bodies such as the FDA and EMA play a central role in the development and deployment of thoracic aortic aneurysm devices, particularly due to their classification as high-risk implants. Companies must comply with extensive clinical evaluation, safety data, and post-market surveillance requirements. Shifts toward real-world evidence, digital documentation, and harmonized international standards are influencing both time-to-market and long-term market sustainability.

Manufacturers are continuously advancing their thoracic aortic repair offerings with improved stent graft materials, modular delivery systems, and adjunctive tools for intraoperative imaging and navigation. These developments aim to improve procedural precision, reduce complications, and extend device applicability to challenging anatomies. Iterative product updates are focused on enhancing ease of use for clinicians and minimizing recovery times for patients.

Global players are increasingly targeting emerging markets across Asia-Pacific, Latin America, and the Middle East, where improving healthcare infrastructure, increasing procedural awareness, and evolving reimbursement systems are creating new growth opportunities. Companies are strengthening local distribution networks, investing in clinician training, and adapting product lines to meet regional regulatory and clinical needs.

Treatment Insights

The thoracic endovascular aneurysm repair (TEVAR) segment dominated the market with the largest revenue share of 64.18% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. TEVAR's rapid adoption is attributed to its minimally invasive nature, which offers reduced operative time, lower complication rates, shorter hospital stays, and quicker recovery compared to open surgery. In February 2025, an article published by the Spencer Fox Eccles School of Medicine highlighted advancements in thoracic aortic aneurysm treatment. University of Utah Health is participating in a long-term outcome trial for the Thoraflex Hybrid, a device that combines open and endovascular approaches for thoracic aneurysms. It remains the only center in the Mountain West offering physician-modified endovascular grafts (PMEG) as part of its comprehensive thoracic repair program.

The open surgical repair (OSR) segment is anticipated to grow at the significant CAGR over the forecast period, despite being less frequently used compared to TEVAR. OSR remains the standard of care in anatomically complex cases or when endovascular access is not feasible. Its continued relevance is supported by improvements in surgical techniques, perioperative care, and patient outcomes in high-volume centers. In June 2025, the Journal of Vascular Surgery Cases, Innovations and Techniques detailed a complex open three-stage surgical repair of multifocal thoracic aortic aneurysms in a 34-year-old patient with a rare MYH11 mutation. The procedure involved total arch replacement followed by descending thoracoabdominal repair, emphasizing meticulous neuroprotection to reduce spinal cord ischemia.

Product Insights

The aortic stent grafts segment dominated the market with a revenue share of 78.97% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the rising preference for minimally invasive procedures, continuous advancements in graft materials and designs, and increasing adoption of endovascular repair techniques such as TEVAR. In February 2025, Stanford Medicine reported in-house participation in the ARISE II national clinical trial, becoming the first site in the Western U.S. to implant an investigational ascending aortic stent graft. Published by Stanford’s Department of Cardiothoracic Surgery, the update detailed a minimally invasive alternative to open-heart surgery, using a catheter-delivered GORE stent graft for ascending aorta disease.

The aortic repair accessory devices segment is anticipated to grow at a significant CAGR over the forecast period, driven by the growing volume of endovascular procedures and the need for adjunctive tools that enhance procedural precision and safety. These devices, which include guidewires, sheaths, catheters, and embolic protection systems, play a critical role in improving deployment accuracy and minimizing intraoperative complications. In June 2024, Medtronic introduced the Steerant aortic guidewire in the U.S. and Canada for use in EVAR and TEVAR procedures. Designed with a soft 15 cm tip and a progressively stiff body, it enhances control and safeguards delicate thoracic vessels. Initial TEVAR cases demonstrated smoother device navigation and greater accuracy during thoracic aneurysm treatment.

End Use Insights

The hospitals segment dominated the market with a revenue share of 77.01% in 2024, reflecting their central role in managing complex thoracic aortic aneurysm cases. Hospitals are equipped with advanced imaging systems, hybrid operating rooms, and multidisciplinary teams necessary for performing high-risk procedures like TEVAR and open surgical repair. In June 2025, an article published in The Hindu reported that Meenakshi Super Speciality Hospital in Madurai successfully treated a 70-year-old man with a ruptured thoracic aortic aneurysm using the TEVAR (Thoracic Endovascular Aortic Repair) procedure. The patient, initially in cardiogenic shock with an aortic rupture into the oesophagus, showed marked recovery after the minimally invasive stent graft placement.

The ambulatory surgery centers (ASC) segment is expected to grow at the fastest rate during the forecast period. The major driver for market growth is the increasing shift toward outpatient endovascular procedures due to their lower cost, shorter recovery times, and improved procedural efficiency. As minimally invasive techniques like TEVAR become more refined and device delivery systems more compact, ASCs are increasingly positioned to handle select thoracic aneurysm cases in appropriately screened patients, enhancing accessibility while easing the burden on hospital infrastructure. In August 2024, according to Surgical Information Systems, there are over 6,300 Medicare-certified ambulatory surgery centers (ASCs) in the U.S., with cardiology and pain management emerging as the fastest-growing specialties.

Regional Insights

The North America thoracic aortic aneurysm market dominated the global market with a revenue share of 45.84% in 2024. This dominance is attributed to advanced healthcare infrastructure, higher diagnosis rates, and increasing awareness about aneurysm-related risks. The presence of major market players and strong reimbursement frameworks also contributes significantly. In May 2024, an article published in Science Translational Medicine detailed how Michigan Medicine researchers developed the first efficient 3D human cell-based model of thoracic aortic aneurysm using bioengineered vascular grafts implanted in rats. The model successfully replicated aneurysm formation and enables better drug testing.

U.S. Thoracic Aortic Aneurysm Market Trends

The U.S. thoracic aortic aneurysm market dominated the North American market in 2024, due to high disease prevalence and early adoption of advanced treatment technologies. Growth is further driven by the availability of minimally invasive procedures and the increasing geriatric population. In January 2025, the Journal of Vascular Surgery published a U.S.-based analysis of 141,651 thoracic aortic aneurysm (TAA) cases from 2004 to 2019, showing a sharp decline in open surgical repair for ruptured TAA (from 100% to 29%) as thoracic endovascular aortic repair (TEVAR) use rose.

Europe Thoracic Aortic Aneurysm Market Trends

The thoracic aortic aneurysm market in Europe is expected to grow significantly over the forecast period. This growth is driven by rising awareness, increasing healthcare spending, and improved diagnostic imaging technologies. Countries like Germany and France are leading contributors, owing to well-established cardiovascular care systems. In July 2025, the European Heart Journal reported that excessive glycosylation via the hexosamine biosynthetic pathway contributes to thoracic aortic aneurysm by weakening the aortic wall. Inhibiting this pathway reversed aortic damage, highlighting a potential non-surgical therapeutic target for TAA.

The thoracic aortic aneurysm industry in the UK is expected to grow significantly during the forecast period. Favorable healthcare policies, an aging population, and increased adoption of endovascular aneurysm repair (EVAR) techniques are key drivers. The National Health Service’s (NHS) initiatives to enhance early detection and treatment accessibility also boost growth. In June 2025, Aortic Dissection Awareness UK & Ireland launched a patient information leaflet titled Understanding Thoracic Aortic Aneurysm, endorsed by the British Cardiovascular Society. Targeted at the UK and Europe, the leaflet provides plain-language guidance on symptoms, treatment, and genetic risks, aiming to empower patients and reduce the risk of life-threatening aortic dissections.

Asia Pacific Thoracic Aortic Aneurysm Market Trends

The Asia Pacific thoracic aortic aneurysm market is expected to register the fastest growth rate over the forecast period. The surge is fueled by rapid urbanization, increasing lifestyle diseases, and improving access to healthcare services. Rising investments in healthcare infrastructure, especially in India and Southeast Asia, are fostering early diagnosis and treatment uptake. In May 2025, MicroPort Endovastec's Castor Branched Aortic Stent Graft System achieved first clinical use in Malaysia, Kazakhstan, and South Korea, with Singapore debuting its fenestrated variant. Designed for complex thoracic aortic pathologies, the Castor Fenestration offers a less invasive alternative to open-chest surgery and strengthens MicroPort’s global footprint in customized endovascular care.

China thoracic aortic aneurysm market is anticipated to register considerable growth during the forecast period. The market growth is attributed to increased government focus on healthcare modernization and expanding health insurance coverage. The rising incidence of hypertension and smoking-related conditions has also heightened the demand for aneurysm screening and interventions. In April 2024, a systematic review in Frontiers in Public Health reported a 47% hypertension among older adults in China. As hypertension elevates perioperative risk in thoracic aneurysm cases, TEVAR remains a safer alternative to open repair. These findings emphasize the need for targeted interventions in aging populations with chronic disease.

Latin America Thoracic Aortic Aneurysm Market Trends

The Latin America thoracic aortic aneurysm market is anticipated to witness considerable growth over the forecast period. This is driven by improved diagnostic capabilities and increasing awareness of cardiovascular diseases. Brazil and Argentina are emerging as key markets due to the rising geriatric population and government-led health reforms. In May 2025, MicroPort Endovastec received marketing approval for the Talos stent graft system in Brazil and Argentina. Designed for thoracic aortic aneurysm treatment, Talos features a unique distal honeycomb design and extended stent length to enhance distal lumen expansion and improve long-term outcomes. The approval expands MicroPort’s footprint in Latin America.

Argentina thoracic aortic aneurysm market is anticipated to register considerable growth during the forecast period. The expansion is supported by rising public health campaigns and the strengthening of public-private hospital infrastructure. A growing aging population and increasing burden of chronic diseases are expected to boost demand for surgical and endovascular interventions. In October 2024, according to Health in the Americas, 68.4% of adults in Argentina were overweight or obese, and 22.6% had hypertension key risk factors for thoracic aortic aneurysms (TAA). The country also has a rapidly aging population, with 12.4% over 65. These chronic disease trends signal a growing demand for TEVAR solutions.

Middle East and Africa Thoracic Aortic Aneurysm Market Trends

The Middle East and Africa thoracic aortic aneurysm market is anticipated to witness considerable growth over the forecast period. This is largely due to improving healthcare access, particularly in urban centers, and rising investment in hospital infrastructure. The Gulf Cooperation Council (GCC) countries are focusing on adopting advanced cardiovascular treatment technologies. In December 2024, a case in the Journal of Surgical Case Reports described the use of thoracic endovascular aortic repair (TEVAR) for a patient with a penetrating thoracic aortic injury and spinal cord trauma. The patient was stable and presented late, allowing TEVAR to be used instead of open surgery.

UAE thoracic aortic aneurysm market is anticipated to register considerable growth during the forecast period. Factors such as rising healthcare expenditure, adoption of cutting-edge vascular surgical technologies, and expansion of private healthcare facilities are driving the market. Government-led initiatives to promote early screening and medical innovation also contribute. In May 2025, according to the UAE government portal, chronic diseases such as cancer and diabetes remain leading health concerns, prompting national screening and prevention initiatives. The UAE aims to cut cancer fatalities by 18% and diabetes prevalence through targeted programs.

Key Thoracic Aortic Aneurysm Company Insights

Key participants in the thoracic aortic aneurysm industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Thoracic Aortic Aneurysm Companies:

The following are the leading companies in the thoracic aortic aneurysm market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- W.L. Gore & Associates, Inc.

- Cook Medical Inc.

- Terumo Corporation

- MicroPort Scientific Corporation

- Boston Scientific Corporation

- Artivion Inc.

- Cardiatis S.A.

- Endologix Inc.

- Braile Biomédica

- Lombard Medical

- CryoLife, Inc.

Recent Developments

-

In April 2025, In April 2025, Gore & Associates gained FDA approval for four new large-diameter tapered configurations of its Gore TAG Conformable Thoracic Stent Graft with Active Control system. The expanded sizing options are intended to better accommodate diverse aortic anatomies, especially in patients with restricted true lumen dimensions.

-

In March 2025, Cook Medical announced the U.S. commercial launch of its Zenith Alpha 2 (ZTA2) thoracic endovascular graft after receiving FDA approval. The device introduces the option for carbon dioxide flushing, aimed at reducing air embolism risk, and is based on the company’s established Zenith platform.

-

In May 2023, Terumo Aortic received FDA approval to expand the use of its RELAY Pro Thoracic Stent-Graft System in the U.S. to treat aortic dissections and transections. The approval is supported by positive outcomes from pivotal clinical trials, reinforcing the device’s precision and suitability for minimally invasive procedures.

Thoracic Aortic Aneurysm Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.85 billion

Revenue forecast in 2033

USD 5.04 billion

Growth rate

CAGR of 13.36% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; W.L. Gore & Associates, Inc.; Cook Medical Inc.; Terumo Corporation; MicroPort Scientific Corporation; Boston Scientific Corporation; Artivion Inc.; Cardiatis S.A.; Endologix Inc.; Braile Biomédica; Lombard Medical; CryoLife, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thoracic Aortic Aneurysm Market Segmentation

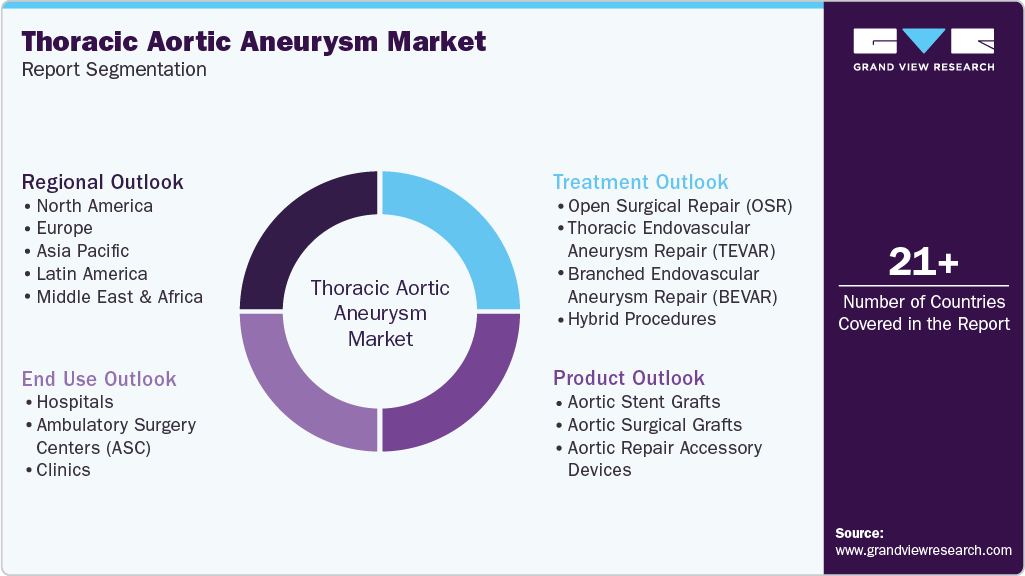

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global thoracic aortic aneurysm market report based on treatment, product, end use, and region:

-

Treatment Outlook (Revenue USD Million, 2021 - 2033)

-

Open Surgical Repair (OSR)

-

Thoracic Endovascular Aneurysm Repair (TEVAR)

-

Branched Endovascular Aneurysm Repair (BEVAR)

-

Hybrid Procedures

-

-

Product Outlook (Revenue USD Million, 2021 - 2033)

-

Aortic Stent Grafts

-

Aortic Surgical Grafts

-

Aortic Repair Accessory Devices

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgery Centers (ASC)

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global thoracic aortic aneurysm market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 1.85 billion in 2025

b. The global thoracic aortic aneurysm market is expected to grow at a compound annual growth rate of 13.36% from 2025 to 2030 to reach USD 5.04 billion by 2030.

b. North America dominated the thoracic aortic aneurysm market with a revenue share of 45.84% in 2024. This dominance is attributed to advanced healthcare infrastructure, higher diagnosis rates, and increasing awareness about aneurysm-related risks.

b. Some key players operating in the market include Medtronic plc; W.L. Gore & Associates, Inc.; Cook Medical Inc.; Terumo Corporation; MicroPort Scientific Corporation; Boston Scientific Corporation; Artivion Inc.; Cardiatis S.A.; Endologix Inc.; Braile Biomédica; Lombard Medical; CryoLife, Inc.

b. This growth of the thoracic aortic aneurysm market is driven by the rising prevalence of hypertension and connective tissue disorders, increasing aging population, and growing adoption of minimally invasive endovascular procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.