- Home

- »

- Medical Devices

- »

-

Thoracic Surgery Devices Market Size & Share Report, 2030GVR Report cover

![Thoracic Surgery Devices Market Size, Share & Trends Report]()

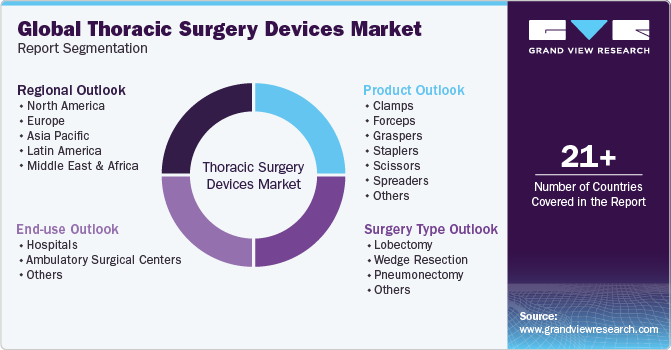

Thoracic Surgery Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Surgery Type (Lobectomy, Wedge Resection), By Product (Forceps, Staplers), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-135-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thoracic Surgery Devices Market Summary

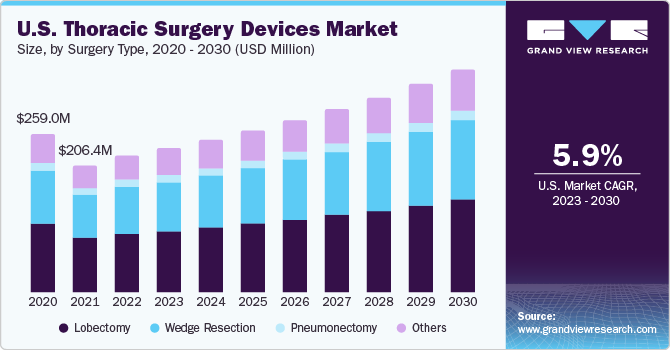

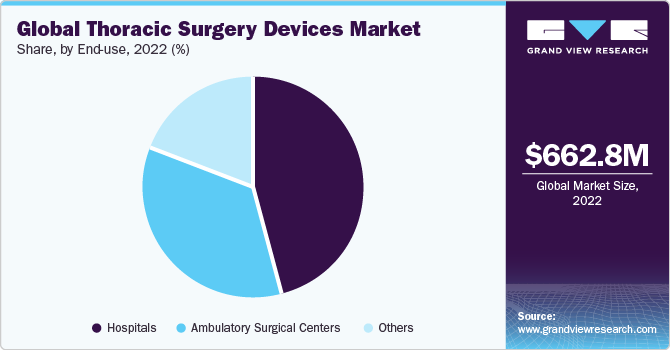

The global thoracic surgery devices market size was estimated at USD 662.77 million in 2022 and is projected to reach USD 1.08 billion by 2030, growing at a CAGR of 6.42% from 2023 to 2030. The market growth is driven by factors, such as the increasing prevalence of conditions like lung cancer, COPD, and heart diseases, continuous innovations in surgical techniques and tools, including minimally invasive options, and the growing aging population.

Key Market Trends & Insights

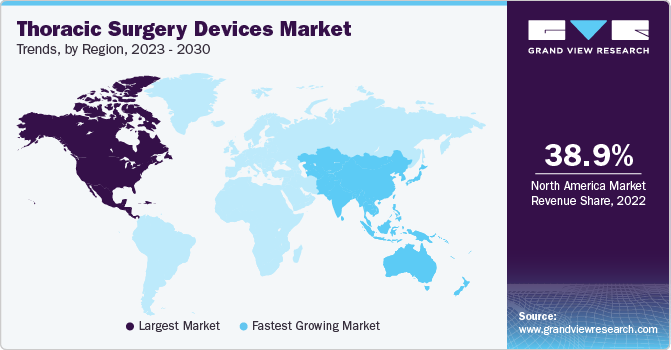

- North America held the largest share of about 38.87% in 2022.

- The Asia Pacific region is estimated to grow at the highest CAGR of more than 8.01% from 2023 to 2030.

- By product, the forceps segment dominated the market with a share of over 26.12% in 2022.

- By surgery type, the lobectomy segment dominated the market in 2022 with a share of 43.2%.

- By end-use, the hospital segment dominated the market with a share of 45.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 662.77 Million

- 2030 Projected Market Size: USD 1.08 Billion

- CAGR (2023-2030): 6.42%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The growing aging population is a significant growth driver of the market. Elderly people are more susceptible to thoracic conditions, such as lung cancer, esophageal disorders, and heart diseases. The elderly population's higher incidence of these diseases is leading to a growing demand for thoracic surgeries and the devices required to perform them effectively. The aging population underscores the importance of patient-centered care and minimally invasive approaches. Elderly patients often prefer procedures that minimize postoperative pain, complications, and lengthy hospital stays. These factors are contributing to the market growth. Advances in surgical technologies have greatly influenced the growth of the market. Minimally invasive surgical techniques, including video-assisted thoracoscopic surgery (VATS) and robotic-assisted surgery, have gained popularity due to their reduced invasiveness and faster patient recovery times.

These techniques require specialized devices and instruments designed for precision and efficiency, thereby spurring innovation, and driving the market's expansion. The expansion of healthcare infrastructure, particularly in emerging markets, is contributing to the growth of the market. Improved access to healthcare services, including thoracic surgeries, is increasing the demand for thoracic surgery devices globally. As more healthcare facilities offer thoracic surgical procedures, there is a corresponding increase in the need for devices that aid in diagnosis, treatment, and postoperative care, further propelling market growth.

Product Insights

By product, the forceps segment dominated the market with a share of over 26.12% in 2022. Forceps are versatile surgical instruments used in a wide range of medical procedures, including thoracic surgery. They are essential for grasping, holding, manipulating, and dissecting tissues, making them indispensable tools for thoracic surgeons. Moreover, thoracic surgeries often require precise and delicate tissue handling. Forceps provide surgeons with the fine control needed to perform intricate procedures, minimizing the risk of damage to surrounding structures.

The stapler segment is projected to witness a considerable growth rate in the coming years. The adoption of minimally invasive surgical techniques, such as video-assisted thoracoscopic surgery (VATS) and robotic-assisted surgery, has been on the rise. Staplers are essential tools for creating secure and precise anastomoses or connections within the thoracic cavity during these minimally invasive procedures. Their use reduces the need for hand suturing, leading to quicker, more efficient surgeries and shorter patient recovery times. Such advantages associated with staplers are anticipated to foster segment growth.

Surgery Type Insights

The lobectomy segment dominated the market in 2022 with a share of 43.2%. The segment growth is attributed to the growing prevalence of lung cancer globally, and lobectomy is a primary treatment option for early-stage lung cancer. Given the high incidence of lung cancer, the demand for lobectomy procedures and associated devices is substantial. Moreover, lobectomy is considered the gold standard treatment for localized lung cancer. It offers the best chance of curing the disease while preserving adequate lung function.

As a result, lobectomy is frequently chosen by healthcare providers and surgeons, ensuring a consistent demand for devices tailored to this procedure. The wedge resection segment is projected to witness considerable growth during the forecasted period. The adoption of minimally invasive surgical techniques, including video-assisted thoracoscopic surgery (VATS), has expanded the use of wedge resection. These techniques reduce patient trauma, result in shorter hospital stays, and offer faster recovery times, making them attractive options for both patients and surgeons.

End-use Insights

The hospital's end-use segment dominated the market with a share of 45.9% in 2022. Hospitals are the preferred choice for treating severe thoracic conditions, such as advanced-stage lung cancer, complicated cardiovascular diseases, and trauma cases. These conditions often require extensive resources, advanced technologies, and a multidisciplinary approach, which hospitals can offer.

The ambulatory surgical centers (ASCs) segment is projected to witness the fastest growth rate over the forecast years. ASCs are designed for outpatient surgical procedures, and there is a growing trend toward performing thoracic surgeries in these facilities. Patients prefer ASCs for same-day surgeries, convenience, and shorter wait times.

Regional Insights

North America held the largest share of about 38.87% in 2022. The growth can be attributed to its advanced healthcare infrastructure, technological leadership, rising disease incidence, aging population, robust healthcare spending, commitment to R&D, skilled healthcare workforce, rigorous regulatory standards, and patient awareness and access. These factors collectively establish North America as a prominent and thriving hub for thoracic surgical care and associated devices.

The Asia Pacific region, on the other hand, is estimated to grow at the highest CAGR of more than 8.01% from 2023 to 2030. Rising disposable incomes and expanding healthcare coverage in some Asia Pacific countries have led to increased healthcare spending. Patients have greater access to advanced diagnostic and treatment options, including thoracic surgeries, contributing to market growth.

Key Companies & Market Share Insights

The market has various players, including public and private market players. Companies in the market are constantly investing in R&D activities to introduce innovative designs and technologies. In March 2023, Prana Thoracic, Inc. announced the closing of USD 3 million founding Series A. These factors have further contributed to the market growth. Some of the prominent players in the global thoracic surgery devices market include:

-

Medtronic plc

-

Cardio medical GmbH

-

Intuitive Surgical

-

Richard Wolf GmbH

-

Grena Ltd.

-

Dextera Surgical Inc.

-

Teleflex Inc.

-

Medela Healthcare

-

LivaNovaplc

-

Sklar Surgical Instruments

Thoracic Surgery Devices Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 697.64 million

The revenue forecast in 2030

USD 1.08 billion

Growth rate

CAGR of 6.42% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgery type, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Denmark, Sweden, Norway, Japan; China; India; South Korea; Australia; Thailand, Brazil; Mexico; Argentina, South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Medtronic plc; Cardio Medical GmbH; Intuitive Surgical; Richard Wolf GmbH; Grena Ltd.; Dextera Surgical Inc.; Teleflex Inc.; Medela Healthcare; LivaNovaplc; Sklar Surgical Instruments

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thoracic Surgery Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thoracic surgery devices market report on the basis of product, surgery type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Clamps

-

Forceps

-

Graspers

-

Staplers

-

Scissors

-

Spreaders

-

Needle Holders

-

Others

-

-

Surgery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lobectomy

-

Wedge Resection

-

Pneumonectomy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global thoracic surgery devices market size was estimated at USD 662.77 million in 2022 and is expected to reach USD 697.64 million in 2023.

b. The global thoracic surgery devices market is expected to grow at a compound annual growth rate of 6.42% from 2023 to 2030 to reach USD 1.08 billion by 2030.

b. North America dominated the thoracic surgery devices market with a share of 38.9% in 2022. This is attributable to the presence of major players in the region.

b. Some key players operating in the thoracic surgery devices market include Medtronic plc, Cardio medical GmbH, Intuitive Surgical, Richard Wolf GmbH, Grena Ltd., Dextera Surgical Inc.,Teleflex Incorporated, Medela Healthcare, LivaNovaplc, and Sklar Surgical Instruments.

b. Key factors that are driving the thoracic surgery devices market growth include the rising incidence of thoracic disease and technological advancements related to surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.