- Home

- »

- Clinical Diagnostics

- »

-

Thyroid Cancer Diagnostics Market, Industry Report, 2033GVR Report cover

![Thyroid Cancer Diagnostics Market Size, Share & Trends Report]()

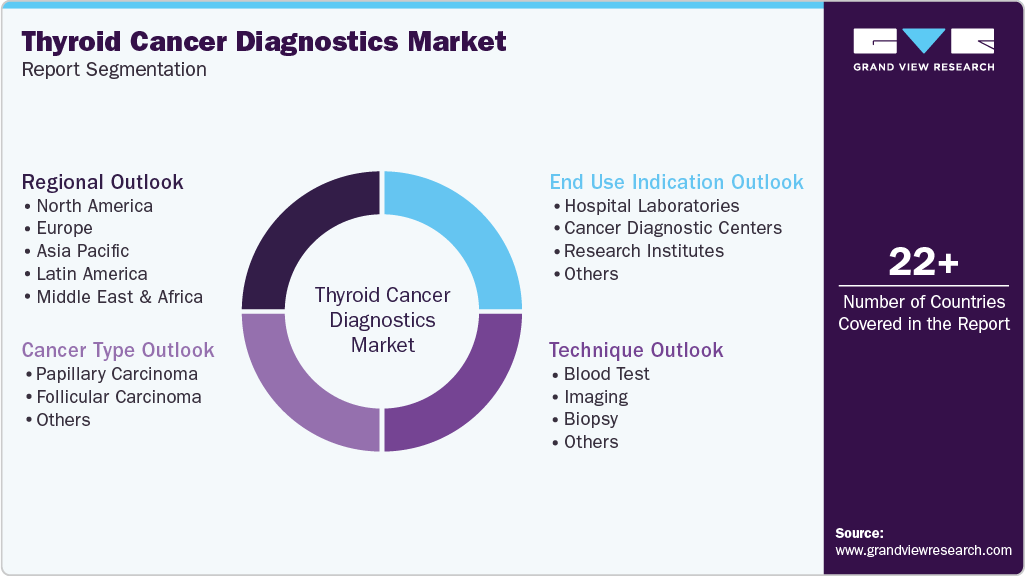

Thyroid Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Cancer Type (Papillary Carcinoma, Follicular Carcinoma), By Technique (Imaging, Biopsy), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-615-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thyroid Cancer Diagnostics Market Summary

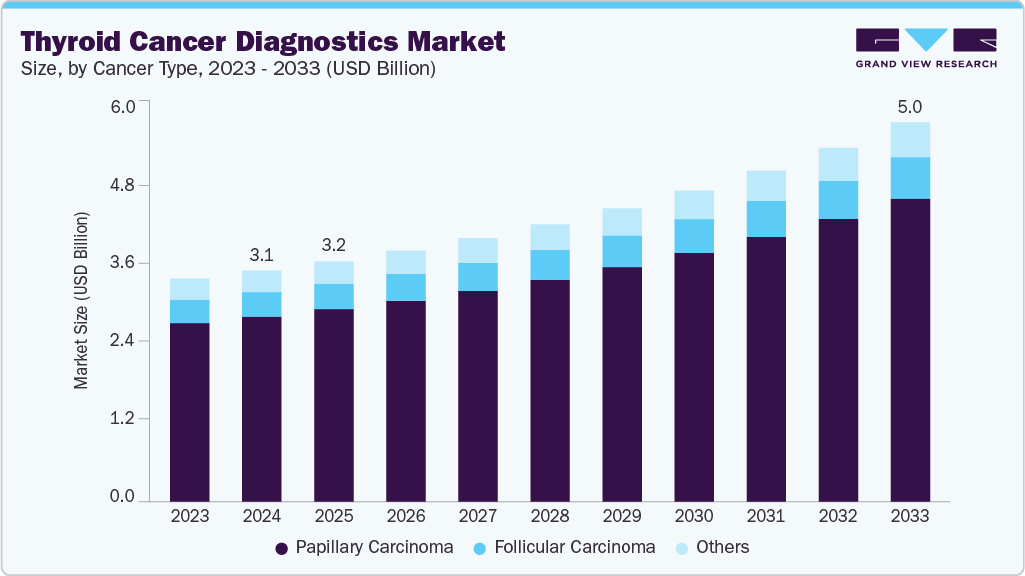

The global thyroid cancer diagnostics market size was estimated at USD 3.07 billion in 2024 and is projected to reach USD 5.03 billion by 2033, growing at a CAGR of 5.86% from 2025 to 2033. This growth is attributed to the growing incidence of thyroid cancer, growing awareness of early screening programs, and significant technological advancements in diagnostic tools such as imaging modalities and molecular testing.

Key Market Trends & Insights

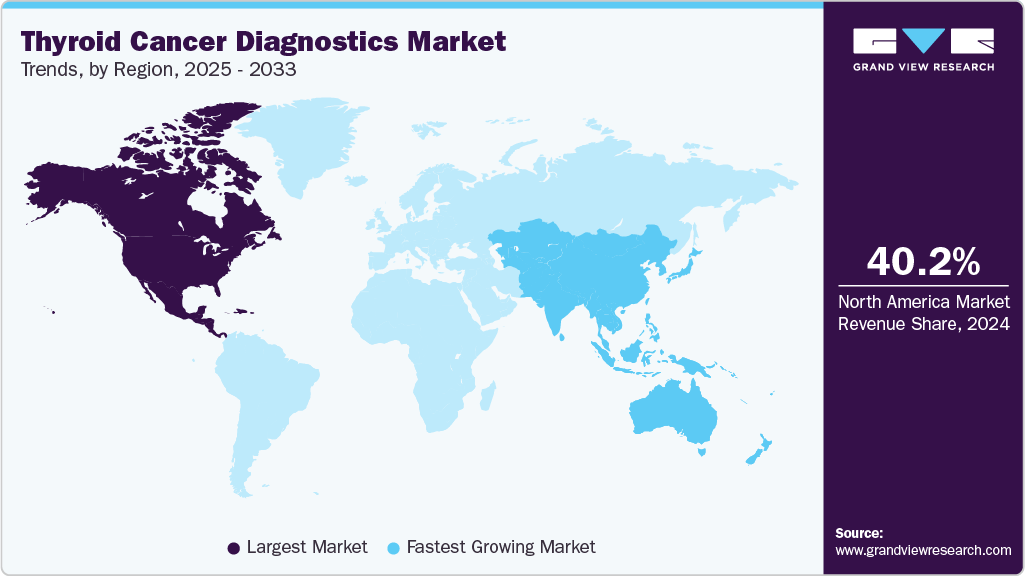

- North America dominated the thyroid cancer diagnostics market with the largest revenue share of 40.17% in 2024.

- The thyroid cancer diagnostics market in the Asia Pacific is expected to grow at the fastest CAGR of 8.9% over the forecast period.

- Based on cancer type, the papillary carcinoma segment led the market with the largest revenue share of 80.03% in 2024.

- In terms of technique, the imaging technique segment led the market with the largest revenue share of 36.92% in 2024.

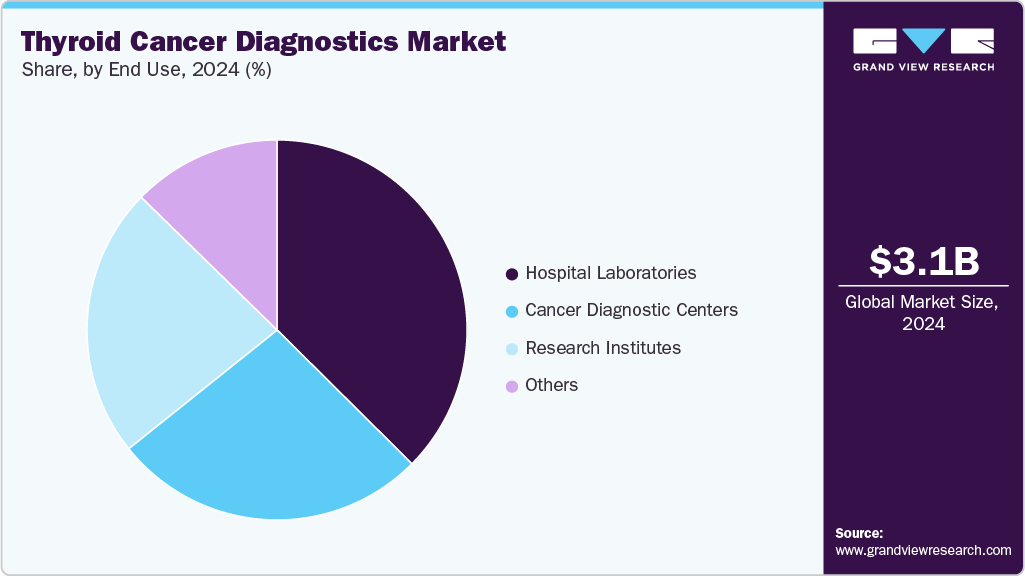

- Based on end use, the hospital laboratories segment led the market with the largest revenue share of 37.44% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.07 Billion

- 2030 Projected Market Size: USD 5.03 Billion

- CAGR (2025-2030): 5.86%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, increased healthcare spending, favorable reimbursement policies, and a shift toward personalized medicine. Furthermore, the growing aging population, improved healthcare infrastructure, and ongoing research and development efforts further support market expansion, enabling earlier and more accurate detection and management of thyroid cancer.

Thyroid cancer diagnostics encompass a broad range of tests and procedures, including imaging, biopsies, blood tests, and molecular profiling used to detect and characterize thyroid cancer, guiding clinical decisions and personalized treatment. The global market for these diagnostics is expanding rapidly, largely due to the increasing number of thyroid cancer patients. This rise in cases has heightened the demand for early detection and effective screening tools, as healthcare providers prioritize proactive identification to improve outcomes. According to the American Cancer Society, about 44,020 new cases of thyroid cancer are expected to be diagnosed in the U.S. in 2025. Approximately 31,350 cases occur in women and 12,670 in men. Thyroid cancer is notably more common in women and is often diagnosed at a younger age compared to many other cancers.

A significant driver of this market is technological advancement. For instance, in May 2024, GE Healthcare introduced Revolution RT, an advanced radiation therapy computed tomography (CT) solution. This innovative system is designed to enhance imaging accuracy and streamline simulation workflows, supporting a more personalized and seamless oncology care experience. Revolution RT incorporates AI-driven technologies and updated software platforms, enabling clinicians to achieve precise tumor targeting and more efficient care pathways.

In addition, the adoption of telemedicine and digital health platforms has further expanded access to thyroid cancer diagnostics, especially for individuals in remote or underserved areas. Through virtual consultations, patients can receive early screening recommendations and follow-up care, ensuring timely intervention regardless of geographic barriers.

Moreover, the growing prevalence of genetic testing for hereditary risk factors is creating new opportunities in the market. Advanced genomic panels can identify mutations linked to thyroid tumors, aiding in more accurate diagnosis and personalized treatment strategies. Collectively, these factors, including the rising incidence of thyroid cancer, cutting-edge technology like Revolution RT, the shift toward personalized medicine, digital health accessibility, and expanded genetic testing, are driving robust growth in the thyroid cancer diagnostics industry, leading to earlier detection and improved patient care.

Market Concentration & Characteristics

The degree of innovation in thyroid cancer diagnostics industry is advancing rapidly, driven by the need for earlier detection, precise tumor characterization, and improved patient management. Traditional diagnostic pathways relied heavily on ultrasound, fine-needle aspiration (FNA), and histopathology, but these often faced limitations such as indeterminate results and invasive procedures. Recent innovations have introduced molecular and genomic testing (e.g., BRAF, RAS, RET, and NTRK mutation panels) that improve diagnostic accuracy, guide targeted therapies, and reduce unnecessary surgeries. Furthermore, next-generation sequencing (NGS) and liquid biopsy assays are gaining momentum for non-invasive detection of circulating tumor DNA, enabling dynamic monitoring of disease progression. Artificial intelligence (AI) and machine learning algorithms are also being integrated into thyroid ultrasound imaging to enhance diagnostic accuracy and minimize inter-observer variability. Collectively, these advances represent a high degree of innovation, shifting thyroid cancer diagnostics toward more personalized, minimally invasive, and cost-effective approaches.

M&A activities in thyroid cancer diagnostics industry focus on expanding molecular, genomic, and non-invasive testing capabilities. Large diagnostic firms acquire niche players specializing in NGS panels, mutation analysis (BRAF, RAS, RET, NTRK), and liquid biopsy to enhance precision oncology portfolios. AI-driven imaging startups are also attractive targets, improving ultrasound-based risk stratification. Beyond acquisitions, strategic collaborations are common, enabling global companies to access innovative assays, strengthen companion diagnostic offerings, and accelerate market penetration, ultimately driving consolidation and personalized patient care advancements.

Regulatory frameworks significantly influence the development, approval, and adoption of thyroid cancer diagnostics. Agencies such as the U.S. FDA and the European Medicines Agency (EMA) enforce stringent validation requirements to ensure clinical accuracy, analytical sensitivity, and reproducibility of molecular and imaging-based tests. Approval pathways for companion diagnostics have accelerated precision medicine approaches, particularly for therapies targeting RET and NTRK alterations. However, evolving regulations on laboratory-developed tests (LDTs) and reimbursement guidelines can delay market entry and increase compliance costs. Clearer regulatory pathways, harmonized standards, and expanded reimbursement coverage are expected to foster innovation and broader adoption of advanced thyroid cancer diagnostic solutions.

Product expansion in thyroid cancer diagnostics industry is driven by the integration of advanced molecular assays, next-generation sequencing (NGS) panels, and liquid biopsy solutions. Companies are broadening portfolios beyond traditional fine-needle aspiration (FNA) to include mutation analysis for BRAF, RAS, RET, and NTRK, as well as companion diagnostics for targeted therapies. AI-enabled imaging tools and digital pathology are also being introduced to improve diagnostic accuracy. These expansions enable more comprehensive, less invasive, and personalized diagnostic pathways, ultimately strengthening competitive positioning in precision oncology.

Regional expansion strategies in thyroid cancer diagnostics emphasize penetrating high-growth markets across Asia-Pacific, Latin America, and the Middle East, where cancer incidence and diagnostic infrastructure are rapidly evolving. Global leaders partner with local laboratories, hospitals, and distributors to accelerate market entry and regulatory approvals. Collaborations with regional health authorities help align diagnostic offerings with local clinical guidelines and reimbursement frameworks. This approach enhances accessibility, addresses unmet needs in early detection, and supports the global shift toward precision oncology and standardized thyroid cancer care.

Cancer Type Insights

The papillary carcinoma segment led the market with the largest revenue share of 80.03% in 2024, primarily driven by its high prevalence, accounting for the majority of thyroid cancer cases globally. In addition, increased awareness, improved screening programs, and advancements in imaging and molecular diagnostic techniques have enabled earlier and more accurate detection. Furthermore, environmental factors, lifestyle changes, and a younger average age at diagnosis also contribute to rising case numbers, driving demand for effective diagnostic solutions and supporting market expansion for this cancer type.

The follicular carcinoma diagnostics segment is expected to grow at the fastest CAGR of 5.6% over the forecast period, owing to its status as the second most common thyroid cancer, with a higher malignancy potential compared to papillary carcinoma. Furthermore, rapid invasion into surrounding tissues and a lower cure rate with increasing age highlight the need for precise and early detection. Moreover, increased susceptibility among females, greater focus on early diagnosis, and advancements in diagnostic technologies further fuel market growth for follicular carcinoma in the global thyroid cancer diagnostics segment.

Technique Insights

The imaging technique segment led the market with the largest revenue share of 36.92% in 2024. This growth is attributed to its critical role in the early detection and evaluation of thyroid nodules and tumors. Furthermore, advanced imaging modalities such as ultrasound, CT, MRI, and PET scans provide non-invasive, highly accurate, and rapid results, improving diagnostic confidence. Moreover, the integration of artificial intelligence and enhanced imaging resolution further supports precise tumor localization and monitoring, making imaging an indispensable tool in thyroid cancer diagnosis and management.

The biopsy technique segment is expected to grow at the fastest CAGR of 5.99% over the forecast period, owing to its essential function in confirming thyroid cancer diagnosis at the cellular level. In addition, the increasing adoption of molecular and genetic analysis through biopsy samples enables more personalized and targeted treatment strategies. Furthermore, advances in next-generation sequencing and biomarker analysis have improved diagnostic accuracy, supporting individualized care. The demand for minimally invasive, reliable, and definitive diagnostic techniques continues to drive the expansion of biopsy in the market.

End Use Insights

The hospital laboratories segment led the market with the largest revenue share of 37.44% in 2024, driven by increasing patient inflow for cancer diagnosis, rising awareness of thyroid disorders, and expanding healthcare infrastructure, especially in developing regions. In addition, hospitals are often the primary point of care, providing comprehensive diagnostic services, advanced technologies, and specialized personnel. Furthermore, investments in modern equipment and integration of molecular and genetic testing capabilities further enhance the accuracy and efficiency of thyroid cancer diagnostics in hospital settings, supporting continued market expansion.

The research institutes segment is expected to grow at the fastest CAGR of 6.92% from 2025 to 2033, due to increased global funding for cancer research and a strong focus on innovation. These institutes play a pivotal role in developing and validating new diagnostic technologies, such as advanced molecular assays and genetic profiling. Furthermore, collaborative efforts with academic and industry partners, access to grant funding, and participation in clinical trials drive breakthroughs in early detection and personalized medicine, positioning research institutes as key contributors to market advancement.

Regional Insights

North America dominated the thyroid cancer diagnostics market with the largest revenue share of 40.17% in 2024. This growth is attributed to a high prevalence of thyroid cancer, robust healthcare infrastructure, and widespread adoption of advanced molecular diagnostic technologies. In addition, the region benefits from significant investments in research, favorable reimbursement policies, and active government initiatives promoting early detection. Furthermore, the presence of leading manufacturers and strong commercial performance also accelerates market growth, while ongoing awareness campaigns and access to innovative diagnostic solutions ensure continued expansion across the region.

U.S. Thyroid Cancer Diagnostics Market Trends

The thyroid cancer diagnostics market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by a large patient pool, high healthcare spending, and rapid integration of genetic testing, AI-driven imaging, and biomarker research. The country’s focus on early detection is supported by public health campaigns and regulatory support for advanced diagnostic products. Furthermore, favorable insurance coverage, active research and development, and the presence of top-tier medical institutions contribute to the adoption of cutting-edge diagnostic technologies, making the U.S. a leader in thyroid cancer diagnostics.

Asia Pacific Thyroid Cancer Diagnostics Market Trends

The thyroid cancer diagnostics market in the Asia Pacific is expected to grow at the fastest CAGR of 8.9% over the forecast period, owing to a rising incidence of thyroid cancer, increasing healthcare expenditure, and expanding diagnostic infrastructure. In addition, government initiatives to enhance cancer screening, growing consumer awareness, and the entry of major market players are key contributors. Furthermore, rapid urbanization, improved access to healthcare services, and advancements in imaging and molecular diagnostics are also driving demand, particularly in emerging economies within the region.

The Japan thyroid cancer diagnostics market is anticipated to grow at the fastest CAGR during the forecast period. This is attributed to an aging population, high health consciousness, and strong governmental focus on cancer screening programs. Furthermore, the country’s advanced healthcare system supports the adoption of innovative diagnostic technologies. Moreover, increased investment in research, collaboration with global industry leaders, and public awareness campaigns have led to early detection and improved patient outcomes, making Japan a significant contributor to regional market expansion.

Europe Thyroid Cancer Diagnostics Market Trends

The thyroid cancer diagnostics market in Europe is expected to witness at a significant CAGR over the forecast period, fueled by rising thyroid cancer incidence, supportive healthcare policies, and the integration of advanced diagnostic techniques. In addition, the region benefits from substantial funding for research, cross-border collaborations, and harmonized regulatory standards that streamline the introduction of new diagnostic products. Furthermore, public health initiatives, widespread access to healthcare, and the adoption of digital and molecular diagnostics contribute to improved detection rates and sustained market growth across European countries.

Key Thyroid Cancer Diagnostics Company Insights

Key players in the global thyroid cancer diagnostics industry include F.Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Siemens Healthcare GmbH, and others. These companies implement strategies such as investing in research and development, introducing advanced diagnostic technologies, expanding product portfolios, forming collaborations and partnerships, and focusing on regulatory approvals. These approaches help enhance diagnostic accuracy, broaden market reach, and address evolving patient and healthcare provider needs.

-

Siemens Healthcare GmbH offers a comprehensive portfolio of laboratory assays and automated immunoassay systems designed to detect, diagnose, and monitor thyroid disorders, including thyroid cancer. The company manufactures and supplies advanced diagnostic solutions that are used to assess thyroid function, monitor differentiated thyroid cancer, and support clinical decision-making. Siemens operates primarily in the laboratory diagnostics and medical imaging segments.

-

Bio-Rad Laboratories, Inc. develops and markets a wide range of molecular testing kits, reagents, and automated systems that enable the detection and analysis of thyroid cancer biomarkers. Bio-Rad operates in the clinical diagnostics segment, providing tools for genetic, protein, and cellular analysis. It supports both routine diagnostic testing and advanced research in thyroid cancer and related endocrine disorders.

Key Thyroid Cancer Diagnostics Companies:

The following are the leading companies in the thyroid cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- F.Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Bio-Rad Laboratories, Inc

- GE HealthCare

- Hologic, Inc.

- Koninklijke Philips N.V.

- Toshiba Corporation

- Agilent Technologies, Inc.

- Illumina, Inc.

Recent Developments

-

In October 2024, GE HealthCare took a leading role in Thera4Care, an initiative to revolutionize cancer care through theranostics. This personalized approach integrates imaging diagnostics and targeted therapeutics, using molecular imaging to visualize tumors and deliver radioactive drugs.

-

In August 2024, Illumina's TruSight Oncology (TSO) Comprehensive test secured FDA approval, marking a milestone as the pan-cancer companion diagnostic claims and the first distributable comprehensive genomic profiling IVD kit.

Thyroid Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.19 billion

Revenue forecast in 2033

USD 5.03 billion

Growth rate

CAGR of 5.86% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Cancer type, technique, end use, region.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Abbott; F.Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc; GE HealthCare; Hologic, Inc.; Koninklijke Philips N.V.; Toshiba Corporation; Agilent Technologies, Inc.; Illumina, Inc

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thyroid Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global thyroid cancer diagnostics market report based on cancer type, technique, end use, and region.

-

Cancer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Papillary carcinoma

-

Follicular carcinoma

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood Test

-

Imaging

-

Biopsy

-

Others

-

-

End Use Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Laboratories

-

Cancer Diagnostic Centers

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Papillary carcinoma dominated the thyroid cancer diagnostics market with a share of 80.3% in 2024. This is attributable due to this condition recording one of the highest cure rates among all cancer types, with a five-year survival rate of nearly 98%.

b. Some key players operating in the thyroid cancer diagnostics market include Abbott; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc; General Electric; Koninklijke Philips N.V.; Toshiba Corporation; Agilent Technologies, Inc.; and Illumina, Inc.

b. The global thyroid cancer diagnostics market size was estimated at USD 3.07 billion in 2024 and is expected to reach USD 3.19 billion in 2025.

b. The global thyroid cancer diagnostics market is expected to grow at a compound annual growth rate of 5.86% from 2025 to 2033 to reach USD 5.03 billion by 2033.

b. Key factors that are driving the market growth include rising prevalence of thyroid cancer and increasing emphasis on early diagnosis & treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.