- Home

- »

- Plastics, Polymers & Resins

- »

-

Tile Adhesive Market Size & Share, Industry Report, 2030GVR Report cover

![Tile Adhesive Market Size, Share & Trends Report]()

Tile Adhesive Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cementitious, Dispersion, Reaction Resin), By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-396-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tile Adhesive Market Summary

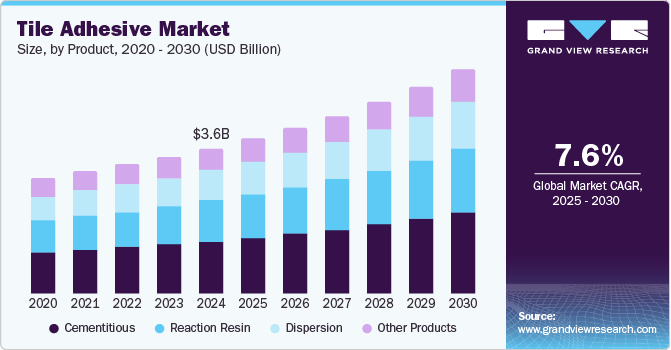

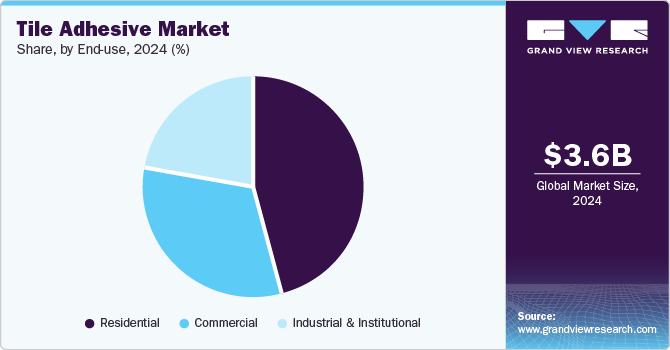

The global tile adhesive market size was estimated at USD 3.6 billion in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The increasing demand for marble and tiles in developing areas and rising reconstruction and renovation activities drive market growth.

Key Market Trends & Insights

- Asia Pacific dominated the global tile adhesive market with the largest revenue share of 38.6% in 2024.

- The tile adhesive market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By product, the cementitious segment led the market, holding the largest revenue share of 36.6% in 2024.

- By end use, the industrial and institutional segment is expected to grow at the fastest CAGR of 7.7% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3.6 Billion

- 2030 Projected Market Size: USD 5.60 Billion

- CAGR (2025-2030): 7.6%

- Asia Pacific: Largest market in 2024

Tiles are the most common flooring material due to its affordability and high durability. This trend is particularly noticeable in regions undergoing rapid development and modernization, where refurbishing existing structures and constructing new ones necessitate high-quality tile adhesives. Additionally, the desire for aesthetic improvements in residential and commercial properties drives the renovation market.

The increasing activities significantly influence the growth of the market in reconstruction and renovation. The demand for durable and reliable adhesives for tile installations has surged as urban and rural landscapes evolve. This trend is particularly noticeable in regions undergoing rapid development and modernization, where refurbishing existing structures and constructing new ones necessitate high-quality tile adhesives. Additionally, the desire for aesthetic improvements in residential and commercial properties drives the renovation market, further fueling the demand for specialized tile adhesives that cater to various design and functional requirements.

Innovations in tile design have expanded the tile adhesives market. Ceramic, vitrified, and porcelain tiles offer diverse styles and colors, ideal for spaces such as restaurants and cafes. Their aesthetic appeal, durability, and germ-resistant properties make them a popular choice for such environments. As new restaurant concepts and brands continue to emerge regularly, industry experts forecast a consistent opening of 1,000 to 2,000 restaurants in India each month in 2025.

Civic infrastructure is improving rapidly in numerous countries, with governments in developing nations like India making concerted efforts to enhance their construction sectors. This focus on construction is significantly impacting the tile adhesives market, driving demand as the need for durable and reliable bonding solutions grows. Such developments are essential for supporting the expanding infrastructure projects, indicating a positive trend in the market that aligns with the broader growth in construction activities.

Product Insights

The cementitious segment dominated the tile adhesive market and accounted for the largest revenue share, 36.6%, in 2024. This segment is highly prominent primarily because it consists of materials based on cement. These adhesives are known for their robustness and superior bonding capabilities, making them a preferred choice for various tiling applications. The appeal of cementitious tile adhesives lies in their ability to effectively bond tiles to multiple substrates, ensuring durability and longevity in residential and commercial settings. Their ease of use, cost-effectiveness, and compatibility with different types of tiles further contribute to their widespread adoption. This segment's significance is underscored by the continuous development in construction activities, where the demand for reliable and robust adhesive solutions constantly rises.

The reaction resin segment of the tile adhesive market is expected to grow at the fastest CAGR of 8.2% over the forecast period. Reaction resin adhesives are designed for demanding environments, offering high performance and durability. This makes them ideal for areas exposed to harsh conditions, such as bathrooms, kitchens, and industrial spaces. While often more expensive and requiring more careful application than cementitious adhesives, their superior bonding strength and longevity justify the investment for projects demanding the highest adhesive performance standards. Their versatility and efficacy in securing tiles firmly to various substrates also contribute to their growing popularity in the commercial and high-end residential sectors.

During the COVID-19 pandemic, people sought ways to enhance their homes due to increased time spent there. Bathroom renovations, along with updates to kitchens and living areas, gained significant attention, leading to a substantial surge in demand for home improvement projects.

End Use Insights

The residential sector led the tile adhesive market and accounted for the largest revenue share of 46.1% in 2024. The market for residential applications is experiencing significant growth due to the increasing demand for durable and high-quality adhesives in home construction and renovation projects. Homeowners and contractors alike seek adhesives that provide robust and long-lasting bonds and adapt to various substrates and conditions found within household environments, such as moisture in bathrooms and heat in kitchens. Moreover, the market prefers products that offer ease of application and minimal maintenance, with a growing interest in eco-friendly options. This trend pushes manufacturers to innovate and develop adhesives that meet residential needs without compromising performance or aesthetics.

With upcoming projects like Godrej Group-owned Anamudi Real Estates LLP's Plutonium Business Park in Navi Mumbai and Shriram Properties' premium residential complex, the demand for tile adhesives is expected to increase. India's residential real estate market is on the brink of a transformative shift, driven by the nation's ambitious goal to reach a USD 40 trillion GDP by 2047, positioning the sector as a major engine of economic growth. Furthermore, with plans to build 100 million homes by the end of this decade, 2025 is anticipated to be a critical year for housing development.

The market is significantly driven by home renovations, with reconstruction billings surpassing new construction for the first time in 2022. Economic factors such as the housing shortage, which created a 2.3 million-home gap from 2012 to 2022, push homeowners to renovate instead of building new homes. Additionally, inflation makes renovation more affordable, with an average cost of USD 100 per square foot compared to USD 150 for new construction. These factors are leading more people to renovate, driving demand for tile adhesives in residential projects.

The industrial and institutional sectors in the tile adhesive market are expected to grow significantly at a CAGR of 7.7% over the forecast period. The growth is driven by the construction of new facilities and the renovation of existing ones. In these sectors, the demand leans towards adhesives that are durable and strong and capable of withstanding heavy foot traffic, equipment use, and environmental stressors such as chemicals and extreme temperatures. Furthermore, compliance with safety and health regulations becomes paramount, necessitating products that contribute to safe indoor air quality and are resistant to fire and slippage. In 2022, around 1.66 million international students were enrolled in European institutions, a number expected to grow as more students are drawn to Europe’s diverse academic and cultural offerings. This influx of students has spurred the need for new construction and infrastructure, driving the demand for materials such as adhesive tiles.

Regional Insights

Asia Pacific tile adhesive market dominated the global market, with the largest revenue share of 38.6% in 2024. The construction industry in the Asia Pacific region is set for substantial growth, fueled by government investments, technological progress, and a strong emphasis on sustainability. India's National Investment Pipeline assigns USD 1.4 trillion for infrastructure, focusing on urban development and renewable energy. The rise in affordable housing projects in countries such as Vietnam and India, along with Indonesia’s USD 32 billion capital relocation plan, is driving demand in the construction market, thereby significantly boosting the tile adhesive market.

China Tile Adhesive Market Trends

China tile adhesive market dominated the Asia Pacific market and accounted for the largest revenue share in 2024. China's 14th Five-Year Plan includes a USD 4.2 trillion investment in transportation and urbanization, fueling the construction industry's growth. In 2023, the world’s 100 largest construction companies generated over USD 1.91 trillion in revenue, a 3.4% increase from the previous year, with more than half of those revenues coming from China. Chinese-based companies accounted for 53.5% of the total, with 8 of the top 10 construction firms based there. This surge in construction activity in the country is driving significant growth in the tile adhesive market.

Europe Tile Adhesive Market Trends

Europe tile adhesive market is expected to grow significantly at a CAGR of 7.7% over the forecast period. In 2023, Europe, led by France and Spain, had 40 companies in the Top 100, contributing around 21% of global revenue, with a notable 11.3% increase in sales and a 25.2% rise in construction market capitalization. The share of the R&M (Renovation and Maintenance) market has grown from 48% in 2008 to over 54% in 2022. Renovation, especially in the residential sector, is expected to grow further due to rising energy prices and sustainability regulations, such as the Energy Performance of Buildings Directive, further boosting the demand for tile adhesive in the region.

The tile adhesive market in Germany led the Europe market with the largest revenue share in 2024. In Germany, the growing demand for multi-tasking sanitary, heating, and air conditioning installers who can handle both traditional installations and sustainable upgrades such as heat pumps is driving the need for tile adhesives. Homeowners prefer these versatile professionals for efficient home improvements, including sustainable renovations and boosting tile adhesive demand. The country's strong construction sector, which has seen substantial investments in infrastructure and residential projects, and the increasing demand for energy-efficient and sustainable building solutions, has further bolstered the need for high-quality tile adhesives.

North America Tile Adhesive Market Trends

The North American tile adhesive market accounted for a substantial market share in 2024. The growing renovation of buildings in the region is a major driver of the tile adhesive market. Many renovations are driven by necessity rather than choice, such as after natural disasters such as Hurricane Ian, which destroyed over 5,000 homes and damaged 30,000 more in 2022, the insurance didn’t cover full rebuilds. Additionally, aging buildings, especially in cities such as New York, require renovations to meet modern standards and green initiatives. Americans’ growing passion for home renovations is evident, with Home and Garden Television ranking as the 11th most popular TV channel in 2023 and Zillow becoming a popular platform for design inspiration. A striking 93% of older people in North America prefer to age in their own homes rather than move in with relatives or into assisted living.

The tile adhesive market in the U.S. accounted for the largest revenue share in 2024. The growing trend of remodeling is boosting the tile adhesive market, as homeowners seek to replace outdated floors with modern, aesthetically pleasing tiles. Factors such as urbanization, increased construction activity, and a shift towards contemporary interior designs are driving the market in the U.S. High-performance adhesives are in demand forboth new builds and renovations. Additionally, government initiatives promoting energy efficiency and indoor environmental quality are encouraging the use of eco-friendly adhesives.

Key Tile Adhesive Company Insights

Major tile adhesive market companies include Taylor Adhesives, Dow, HENRY, and Arkema, among others. These companies invest in product innovation, focusing on eco-friendly solutions and improving adhesive performance.

-

Taylor Adhesives is a manufacturer of tile adhesives, and flooring solutions and offers products for the construction industry. It offers a wide range of adhesives, grouts, and sealants designed for both residential and commercial applications. The company focuses on meeting the evolving needs of contractors and builders by providing reliable, durable, and eco-friendly products in order to enhance the performance and longevity of tile installations.

-

Dow is a material science company that offers innovative tile adhesive solutions for residential and commercial applications. Its products support energy efficiency and eco-friendly building practices. Dow serves the construction, automotive, consumer goods, electronics, energy, agriculture, and water treatment industries.

Key Tile Adhesive Companies:

The following are the leading companies in the tile adhesive market. These companies collectively hold the largest market share and dictate industry trends.

- Taylor Adhesives

- Dow

- HENRY

- Arkema

- Schomburg

- ISOLERA GMBH

- AZO GmbH & Co. KG

- Cemi-Cola Port, SL.

- Indarex Commerce S.L.

- BUTECH BUILDING TECHNOLOGY SAU

Recent Developments

-

In July 2024, Magicrete launched a new ad campaign featuring actor Sumeet Vyas, promoting its tile adhesive over traditional cement-based methods. The campaign highlights the superior strength, durability, and ease of use of Magicrete's adhesive, addressing common issues with sand and cement, such as cracking and debonding.

-

In January 2024, Omnicol launched a range of powdered tile adhesives, including the PL200 Omnicem, a highly flexible S2 adhesive suitable for various applications. Ideal for both walls and floors, indoors and outdoors, it supports recent cement screeds and reduces curing time from 90 to 28 days.

Tile Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.88 billion

Revenue forecast in 2030

USD 5.60 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Taylor Adhesives; Dow; HENRY; Arkema; Schomburg; ISOLERA GMBH; AZO GmbH & Co. KG; Cemi-Cola Port, SL.; Indarex Commerce S.L.; BUTECH BUILDING TECHNOLOGY SAU

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tile Adhesive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tile adhesive market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cementitious

-

Dispersion

-

Reaction Resin

-

Other Products

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial & Institutional

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.