- Home

- »

- Advanced Interior Materials

- »

-

Timber Construction Market Size, Industry Report, 2033GVR Report cover

![Timber Construction Market Size, Share & Trends Report]()

Timber Construction Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Residential, Non-residential), By Timber Type (Softwood, Commercial, Engineered Wood), And By Segment Forecasts

- Report ID: GVR-4-68040-699-1

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Timber Construction Market Summary

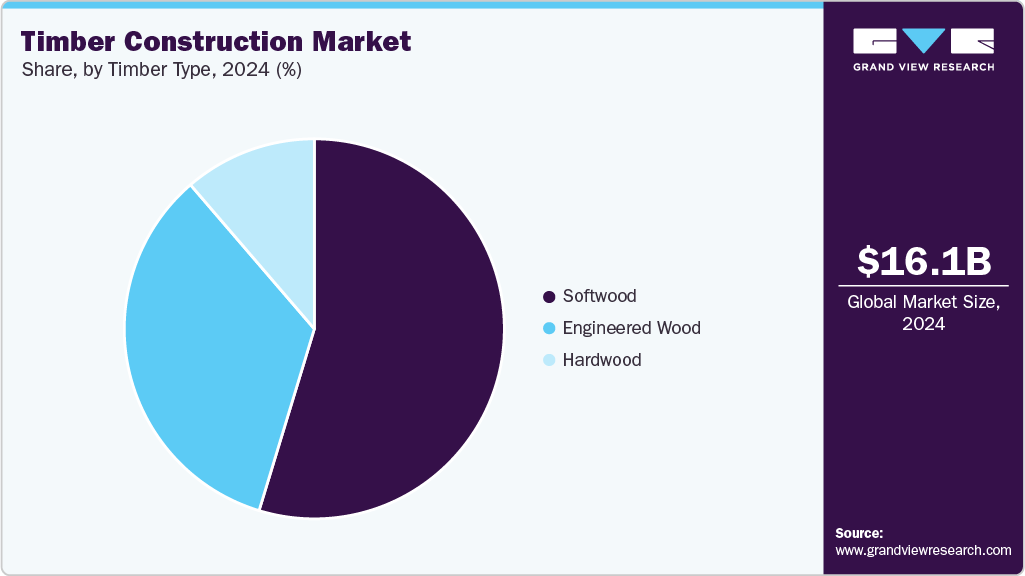

The global timber construction market size was estimated at USD 16.13 billion in 2024 and is projected to reach USD 36.49 billion by 2033, growing at a CAGR of 9.6% from 2025 to 2033, driven by increasing global focus on sustainable building practices. As a renewable and carbon-sequestering material, timber is gaining prominence over concrete and steel, which are associated with higher carbon emissions.

Key Market Trends & Insights

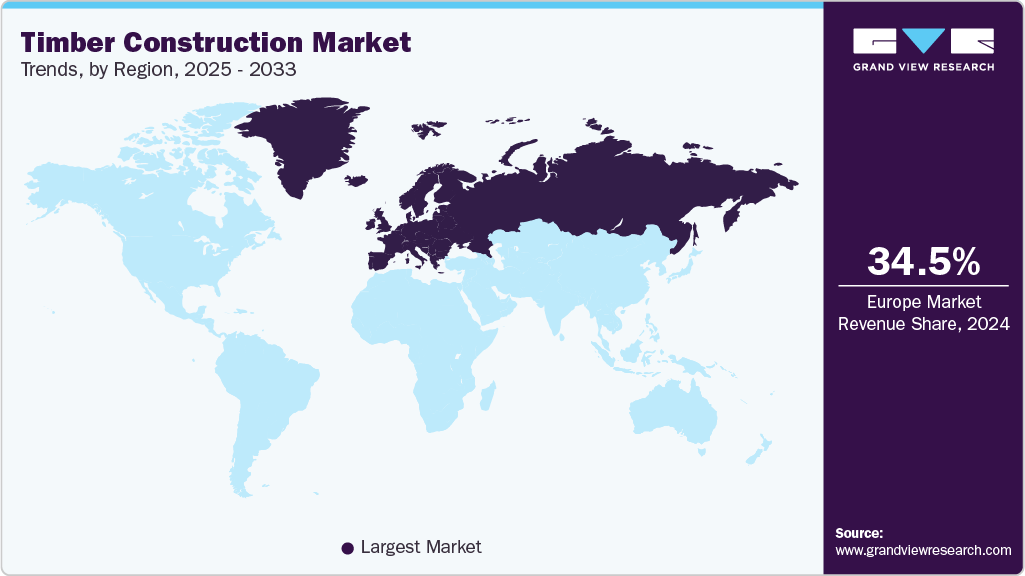

- Europe dominated the timber construction market with the largest revenue share of 34.35% in 2024.

- By timber type, engineered wood segment is expected to grow at the fastest CAGR of 10.1% over the forecast period.

- By end use, non-residential segment is expected to grow at the fastest CAGR of 10.1% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 16.13 Billion

- 2033 Projected Market Size: USD 36.49 Billion

- CAGR (2025-2033): 9.6%

- Europe: Largest market in 2024

Growing awareness of environmental concerns and government regulations to reduce the construction industry's carbon footprint has fueled demand for timber-based building solutions. In addition, timber construction supports green certifications such as LEED and BREEAM, further driving adoption across residential, commercial, and institutional sectors.Urbanization and the need for affordable housing propel demand for faster, more efficient building methods, where timber offers notable advantages. Prefabricated timber structures reduce construction timelines significantly and require less labor, making them attractive in cost-sensitive and labor-constrained environments. This is particularly evident in developed economies with aging construction workforces and rising labor costs. Furthermore, timber buildings offer excellent thermal insulation properties, reducing energy consumption and operational costs over time.

Technological advancements in engineered wood products such as cross-laminated timber (CLT) and glulam are also key growth drivers. These innovations allow timber to be used in multi-story and large-scale commercial buildings, expanding its application range. Modern timber products improved fire resistance, strength, and durability, alleviating earlier safety concerns and earning greater acceptance among architects and structural engineers. This has enabled timber construction to move beyond small-scale residential use to mid- and high-rise urban projects.

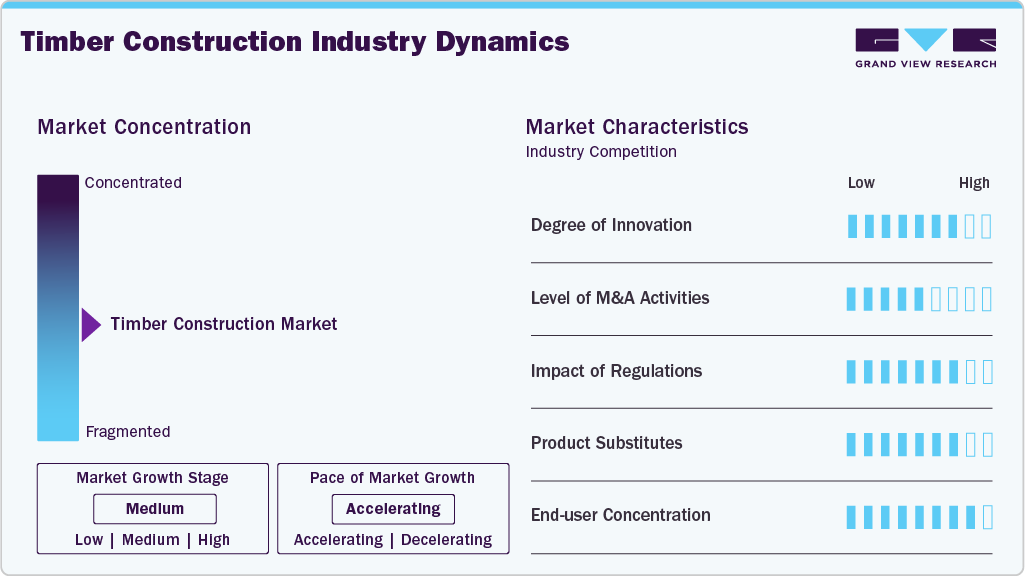

Market Concentration & Characteristics

The timber construction industry exhibits a moderately concentrated structure, with a mix of established players and emerging innovators driving competitive dynamics. The degree of innovation is high, particularly in developing engineered wood products like cross-laminated timber (CLT) and laminated veneer lumber (LVL), which are revolutionizing the application of wood in mid- and high-rise construction. Mergers and acquisitions are becoming more frequent, as larger firms seek to expand their technological capabilities, regional presence, and product portfolios through strategic consolidation. These activities are helping firms achieve economies of scale and streamline production to meet rising global demand.

Regulatory frameworks play a pivotal role in shaping the market, especially those related to building codes, fire safety, and sustainability standards. Regulation acts as a growth catalyst in regions where green construction incentives are prevalent, such as Europe and North America. Conversely, market penetration remains slower in areas with stringent structural or fire safety codes that have not yet adapted to modern timber technologies. While timber faces substitution threats from concrete and steel, its sustainable and aesthetic appeal and increasing end-user preference for eco-friendly structures strengthen its position. The end-user base is broadening, with notable adoption across residential, commercial, and institutional sectors, though large real estate developers and public infrastructure projects account for a significant share, contributing to moderate end-user concentration.

End Use Insights

The residential segment held the highest revenue share of 61.9% in 2024, driven by rising demand for sustainable and energy-efficient housing solutions. Increasing awareness of environmental concerns and the need to reduce carbon footprints has encouraged builders and homeowners to adopt timber as a preferred construction material. Timber offers advantages such as faster construction timelines, cost-effectiveness, and excellent thermal insulation properties, making it an attractive choice for residential buildings. Furthermore, government incentives and green building certifications further support the adoption of timber in residential construction, reinforcing its role as a key contributor to sustainable urban development.

Non-residential is expected to grow at the fastest CAGR of 9.9% over the forecast period, driven by increasing demand for eco-friendly and architecturally flexible building solutions in commercial, educational, and public infrastructure projects. Timber's ability to offer aesthetic appeal, reduced construction time, and improved environmental performance prompts its adoption in offices, schools, hotels, and community centers. Many developers also leverage timber for its carbon-sequestration benefits, aligning with global sustainability targets. Moreover, advancements in engineered wood products like cross-laminated timber (CLT) enhance structural integrity, making timber suitable even for mid-rise commercial buildings. These factors collectively support the growing footprint of timber in the non-residential construction segment.

Timber Type Insights

Softwood segment held the highest revenue share of 54.7% in 2024, driven by its abundant availability, cost-effectiveness, and favorable structural properties. Softwoods such as spruce, pine, and fir are widely used in residential and non-residential construction due to their lightweight nature and ease of processing. These species are particularly suited for framing, paneling, and other structural applications, making them a preferred choice among builders. Softwood timber is typically sourced from sustainably managed forests, aligning with growing environmental and regulatory demands. Its compatibility with modern construction technologies and engineered wood products further enhances its demand, especially in prefabricated and modular building systems.

Engineered wood is expected to grow at the fastest CAGR of 10.1% over the forecast period, driven by its structural efficiency, sustainability, and versatility. Products such as cross-laminated timber (CLT), glued laminated timber (glulam), laminated veneer lumber (LVL), and oriented strand board (OSB) offer high strength-to-weight ratios and dimensional stability, making them ideal for a wide range of construction applications. Engineered wood is particularly favored in mid-rise and high-rise buildings due to its ability to support significant loads while enabling faster, cleaner construction. In addition, the segment benefits from advancements in prefabrication technologies, reducing on-site labor and construction waste. With increasing emphasis on carbon footprint reduction and renewable building materials, engineered wood is expected to witness sustained global demand across residential, commercial, and infrastructure projects.

Regional Insights

Europe dominated the timber construction market in 2024 with a revenue share of 34.53% and is further expected to grow significantly over the forecast period. Europe represents one of the most mature markets, underpinned by strong environmental regulations, circular economy initiatives, and a long-standing tradition of wood architecture. The European Union’s climate goals and subsidies for sustainable construction practices accelerate the shift toward timber. Countries such as Sweden, Austria, and Finland are pioneers in mass timber development, leveraging their advanced forestry sectors and R&D investments. Public and private sector collaborations further advance innovation and cross-border timber project execution. High consumer awareness about ecological building materials and the growing trend of urban wooden high-rises support consistent regional market expansion.

Germany Timber Construction Market Trends

The timber construction market in Germany is a key driver within the European landscape, and it is known for its precision engineering and sustainable design practices. The market is supported by robust government incentives promoting eco-friendly building methods and stringent energy efficiency standards. Increasing acceptance of modular and prefabricated wooden homes, driven by rising housing demands and urban densification, creates new opportunities. Germany's strong research base in construction technology is leading to continued advancements in fire safety, acoustic insulation, and structural integrity of timber buildings. Moreover, cultural appreciation for wood architecture, especially in residential and educational facilities, sustains long-term growth momentum.

Asia Pacific Timber Construction Market Trends

The timber construction market in APAC is driven by increasing urbanization, expanding residential infrastructure, and a growing emphasis on sustainable building practices. Countries like Japan and Australia are promoting timber use through regulatory support and innovation in prefabricated timber housing. Rising environmental concerns and the push for low-carbon construction alternatives are prompting builders to adopt engineered wood products. Moreover, cost-effective labor and rapid infrastructure development in Southeast Asian countries are boosting timber demand. Integrating digital construction technologies such as BIM enhances timber design and project execution across the region.

China timber construction market is propelled by the government’s focus on green building policies and carbon neutrality targets. While historically reliant on concrete and steel, China gradually incorporating timber into public buildings and housing projects, especially in environmentally sensitive regions. The expansion of sustainable forestry practices and rising domestic production of engineered wood are supporting supply-side dynamics. Moreover, efforts to diversify building materials and reduce dependence on carbon-intensive inputs align with the country’s decarburization strategy. Growth in the tourism and hospitality sector, particularly in eco-resorts and wooden homestays, also encourages the adoption of timber-based structures.

North America Timber Construction Market Trends

The timber construction market in North America is driven by technological innovation in engineered wood products and a strong regulatory push for green building certifications like LEED and WELL. The U.S. and Canada are witnessing increased acceptance of mass timber in commercial and institutional buildings, spurred by updated building codes and rising environmental awareness. The availability of vast forest resources and advances in fire-resistant wood treatment enhance the region's capability to meet growing demand. Rising costs of traditional materials like concrete and steel encourage builders to explore cost-effective and renewable timber solutions, particularly in mid-rise and modular construction.

The U.S. timber construction market is benefiting from progressive changes in national and state-level building codes that now permit the use of mass timber in taller structures. Developers' and architects' heightened focus on sustainability fuels the preference for low-carbon materials like CLT and glulam. The growing popularity of green real estate investments and ESG-focused construction projects further accelerates timber adoption. Technological advancements in fire safety, seismic performance, and moisture control make timber viable for diverse building applications. Moreover, timber’s aesthetic appeal and reduced construction time through prefabrication appeal to developers and end-users.

Latin America Timber Construction Market Trends

The timber construction market in Latin America is gaining ground due to abundant forest resources and rising awareness about climate change mitigation. Countries like Brazil and Chile are exploring the potential of timber to address housing shortages cost-effectively and sustainably. Government support for social housing projects and disaster-resilient structures encourages using prefabricated timber systems. In addition, timber offers a faster construction timeline, which is crucial for post-disaster reconstruction and rural infrastructure development. International investments in sustainable forestry and knowledge-sharing partnerships contribute to the region’s evolving timber construction landscape.

Middle East & Africa Timber Construction Market Trends

The timber construction market in the Middle East & Africa is emerging, fueled by growing interest in sustainable architecture and rising tourism-related infrastructure development. In the Gulf countries, where steel and concrete dominate, timber is being explored for its thermal insulation properties and design flexibility, especially in eco-resorts and leisure developments. South Africa and parts of East Africa are also witnessing increasing use of timber in affordable housing projects and educational facilities, supported by local forestry initiatives. However, limited domestic timber production and high import dependency pose challenges, although policy reforms and foreign investments in sustainable building are gradually addressing these barriers.

Key Timber Construction Company Insights

Some key players operating in the market are Stora Enso Oyj, Binderholz GmbH:

-

Stora Enso Oyj is a Finnish-Swedish multinational focused on renewable materials. It is one of the global leaders in wood products, including mass timber. The company offers cross-laminated timber (CLT), laminated veneer lumber (LVL), and other engineered wood products for commercial and residential construction. Stora Enso emphasizes sustainability, circular economy principles, and carbon-neutral solutions in its timber construction offerings.

-

Binderholz GmbH specializes in solid wood products and innovative building solutions. The company manufactures and supplies glulam, CLT, and single-layer solid wood panels for structural timber construction. Binderholz is known for its integrated production facilities and full utilization of raw materials, supporting ecological construction with a focus on energy efficiency and sustainability.

Metsä Group and B&K Structures are some of the emerging participants in the market.

-

Metsä Group, headquartered in Finland, is a key player in the bioeconomy and wood processing industries. Metsä Wood offers high-quality engineered wood products like Kerto® LVL and plywood, ideal for prefabricated buildings and modular construction. Metsä promotes low-carbon construction and digital design tools that enable efficient timber architecture.

-

B&K Structures is a UK-based company that provides hybrid structural systems using timber, steel, and concrete. It delivers sustainable construction solutions using glulam, CLT, and timber-steel combinations. The company serves sectors including commercial buildings, education, and public infrastructure, with a strong focus on design precision and environmental impact reduction.

Key Timber Construction Companies:

The following are the leading companies in the timber construction market. These companies collectively hold the largest market share and dictate industry trends.

- Stora Enso Oyj

- Binderholz GmbH

- Metsä Group

- B&K Structures

- Mayr-Melnhof Holz Holding AG

- Hasslacher Holding GmbH

- Weyerhaeuser Company

- Structurlam Mass Timber Corporation

- Sterling Structural

Recent Developments

-

In February 2025, ALLPLAN and Dietrich announced a strategic partnership to advance the digitalization and sustainability of timber construction. This collaboration focuses on integrating specialized software solutions to enhance the design-to-construction workflow, improve cost efficiency, and promote environmentally responsible building practices.

Timber Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.53 billion

Revenue forecast in 2033

USD 36.49 billion

Growth rate

CAGR of 9.6% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, timber type, region

Regional scope

North America; Europ; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Stora Enso Oyj; Binderholz GmbH; Metsä Group; B&K Structures; Mayr-Melnhof Holz Holding AG; Hasslacher Holding GmbH; Weyerhaeuser Company; Structurlam Mass Timber Corporation; Sterling Structural

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Timber Construction Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global timber construction market based on end use, timber type, and region:

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Timber Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Softwood

-

Hardwood

-

Engineered Wood

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global timber construction market size was estimated at USD 16.13 billion in 2024 and is expected to reach USD 17.53 billion in 2025

b. The global timber construction market is expected to grow at a compound annual growth rate (CAGR) of 9.6% from 2025 to 2033 to reach USD 36.49 billion by 2033.

b. Residential segment held the highest revenue share of 61.9% in 2024, driven by rising demand for sustainable and energy-efficient housing solutions.

b. Some key players operating in the timber construction market include Stora Enso Oyj, Binderholz GmbH, Metsä Group, B&K Structures, Mayr-Melnhof Holz Holding AG, Hasslacher Holding GmbH, Weyerhaeuser Company, Structurlam Mass Timber Corporation, Sterling Structural.

b. The key factors that are driving the timber construction market growth include rising demand for sustainable building materials, advancements in engineered wood technology, and supportive government regulations promoting low-carbon construction practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.