- Home

- »

- Medical Devices

- »

-

Topical Cyanoacrylates Market Size, Industry Report, 2033GVR Report cover

![Topical Cyanoacrylates Market Size, Share & Trends Report]()

Topical Cyanoacrylates Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (2-Octyl Cyanoacrylate, n-Butyl-Cyanoacrylate), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-645-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Topical Cyanoacrylates Market Summary

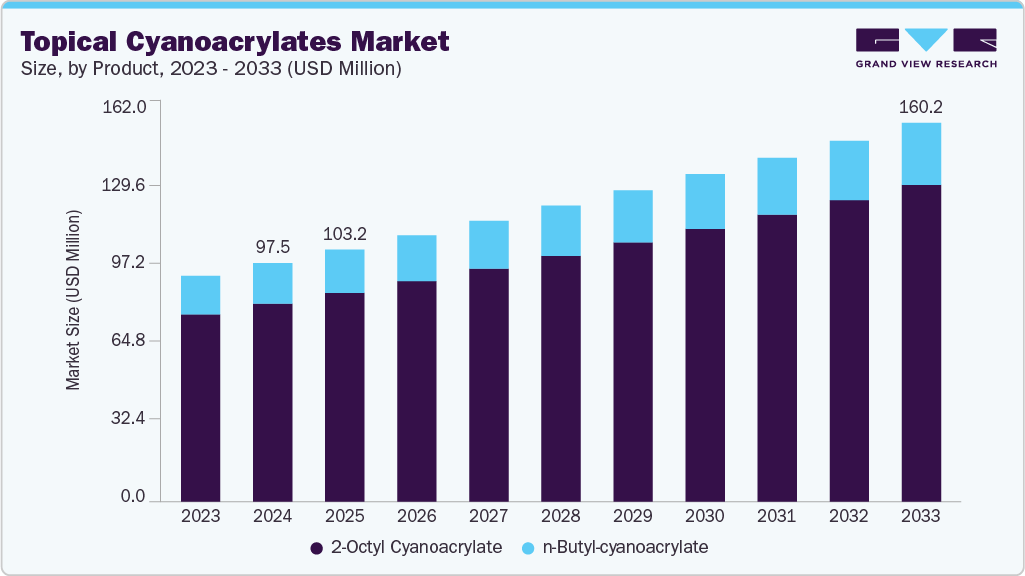

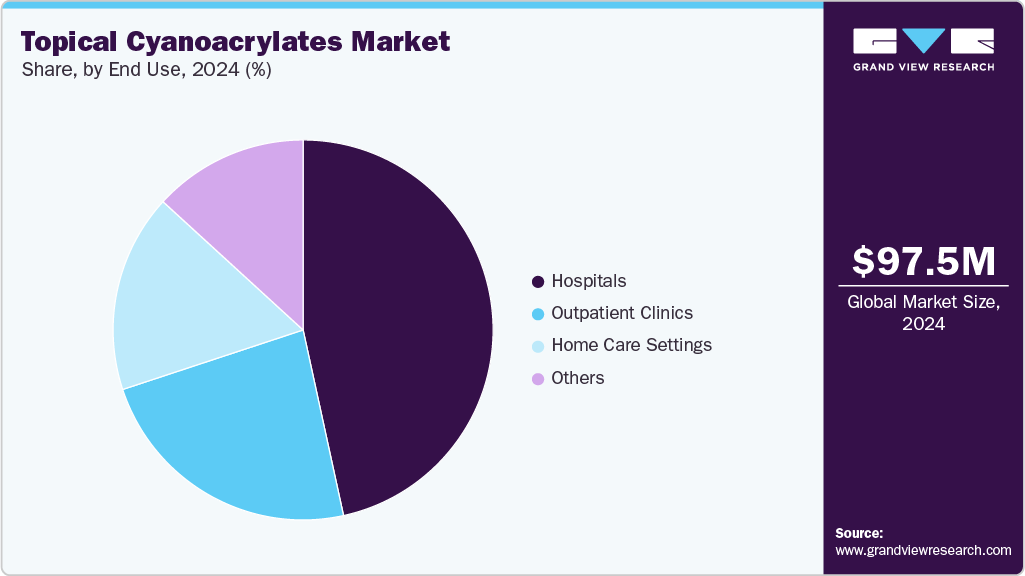

The global topical cyanoacrylates market size was estimated at USD 97.5 million in 2024, and is projected to reach USD 160.2 million by 2033, growing at a CAGR of 5.65% from 2025 to 2033. The market growth is primarily driven by increasing demand for advanced wound closure and tissue adhesion solutions across healthcare settings.

Key Market Trends & Insights

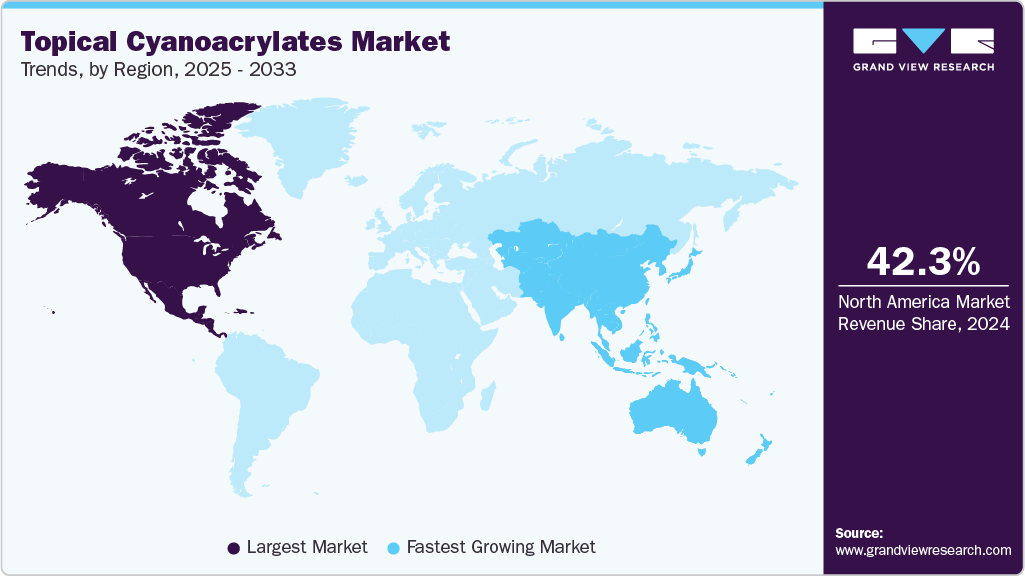

- North America dominated the topical cyanoacrylates market with the largest revenue share of 42.35% in 2024.

- The topical cyanoacrylates market in the U.S. accounted for the largest revenue share of 76.64% in North America in 2024.

- Based on product, the 2-Octyl Cyanoacrylate segment led the market with the largest revenue share in 2024.

- Based on application, the plastic surgery and aesthetic procedures segment is expected to grow at the fastest rate over the forecast period.

- By end use, the hospitals segment led the market with the largest revenue share of 46.58% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 97.5 Million

- 2033 Projected Market Size: USD 160.2 Million

- CAGR (2025-2033): 5.65%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising prevalence of chronic wounds, surgical procedures, and accident-related injuries has significantly boosted the need for effective, fast-acting adhesives that offer secure wound closure with minimal trauma. The topical cyanoacrylates market is driven by several key factors, including the increasing demand for efficient wound closure solutions, the rising prevalence of acute wounds, and the growing adoption of minimally invasive surgical procedures. The increasing burden of wounds, including minor cuts, lacerations, abrasions, and superficial burns, is expected to drive growth in the market. According to The Korean Society of Emergency Medicine, Lacerations continue to be a frequent reason for visits to emergency departments (EDs) in the U.S. They represent about 8.2% of all ED visits, leading to an estimated 7 to 9 million lacerations treated annually across U.S. emergency facilities. Many countries have a substantial population affected by such injuries, creating a strong demand for accessible treatment options. For instance, the National Safety Council, in 2022, around 52,600,000 people suffered nonfatal medically consulted injuries.

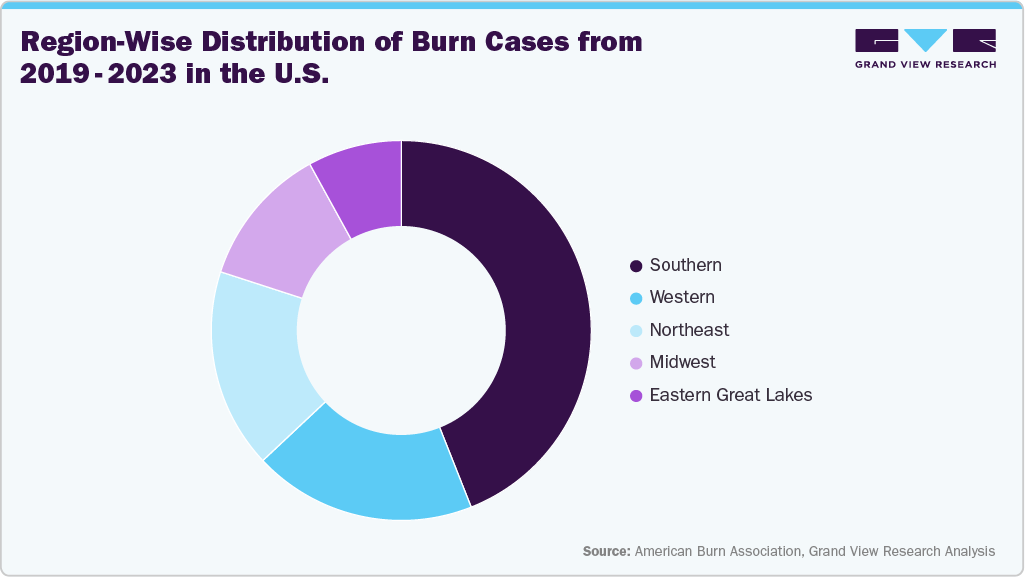

The rising incidence of minor burns, often caused by everyday household accidents, occupational hazards, and increased outdoor activities, significantly drives the demand for topical cyanoacrylate products. For instance, the World Health Organization (WHO) estimates that each year, 11 million people sustain burn injuries, with approximately 92% of these being minor burns that are managed in outpatient settings . Similarly, according to a Medscape report from May 2024, around 1.25 million individuals with burn injuries visit emergency departments in the U.S. annually, with approximately 63,000 of these cases involving minor burns. About one-third of these visits for burn injuries occur in emergency departments .

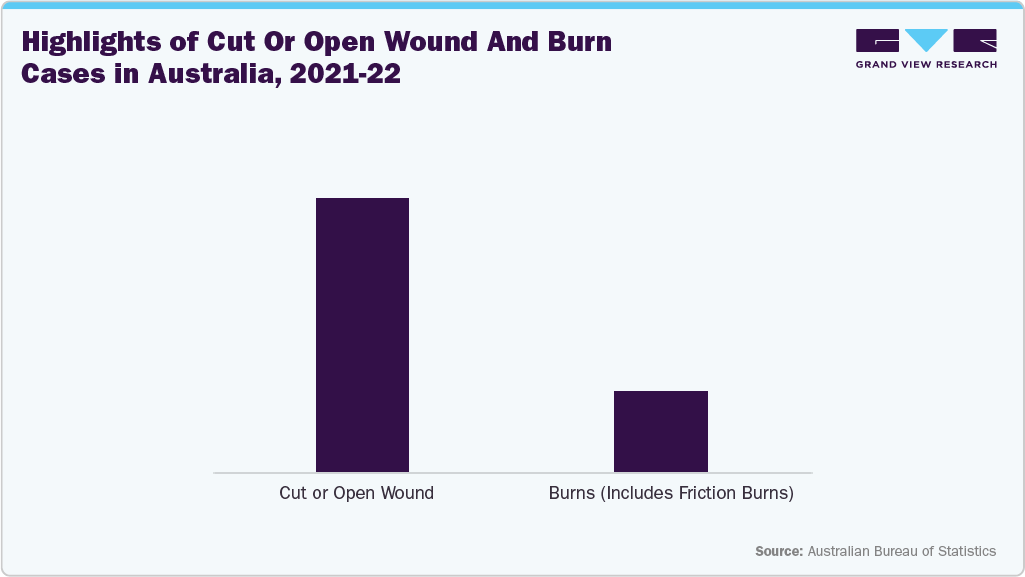

Workplace environments contribute significantly to the burden of acute wounds, which is driving the demand for topical cyanoacrylate products. According to data published by CCD Law in December 2023, approximately 30% of all workplace injuries involve cuts or lacerations, ranging from minor scratches and abrasions to more severe puncture wounds and amputations . In addition, similar trends have been observed in other countries. The Australian Bureau of Statistics reported in February 2023 that nearly 497,300 people had work-related injuries or illnesses in the 2021–2022 fiscal year, with cuts or open wounds. These numbers demonstrate the worldwide impact of acute wounds in workplaces and highlight the strong potential for growth in the topical cyanoacrylates market.

Furthermore, the growing incidence of sports-related injuries is one of the primary driving factors fueling market growth. For instance, according to the National Safety Council (NSC), exercise equipment was associated with approximately 482,886 injuries in 2023, marking it as the leading cause of injuries among all sports and recreation categories .

Sports Injuries by Number of Injuries, 2023

Sport, activity, or equipment

Injuries, 2023

Exercise, exercise equipment

482,886

Bicycles and accessories

405,688

ATVs, mopeds, minibikes, etc.

269,657

Basketball

332,391

Skateboards, scooters, hoverboards

221,313

Playground equipment

190,942

Baseball, softball

139,940

Soccer

212,423

Swimming, pools, equipment

166,011

Trampolines

111,212

Lacrosse, rugby, misc. ball games

72,096

Skating (excl. In-line)

69,833

Source: National Safety Council

Innovations and technological advancements have played a crucial role in expanding the applications of topical cyanoacrylates, with the development of formulations that offer improved biocompatibility, enhanced flexibility, and reduced risk of infection. These innovations have also led to the creation of faster-setting, more durable adhesives suitable for a wide range of medical applications. Regulatory developments are equally influential, as stringent approval processes and safety standards ensure the use of high-quality, medical-grade cyanoacrylates, thus fostering market confidence and adoption.

Governments and health authorities are increasingly emphasizing the importance of safe and effective wound management products, which has led to rigorous testing, certification, and compliance protocols. Overall, a combination of technological progress, evolving clinical needs, and regulatory support continues to propel the growth of the topical cyanoacrylates market, encouraging ongoing research and the development of next-generation adhesive solutions.

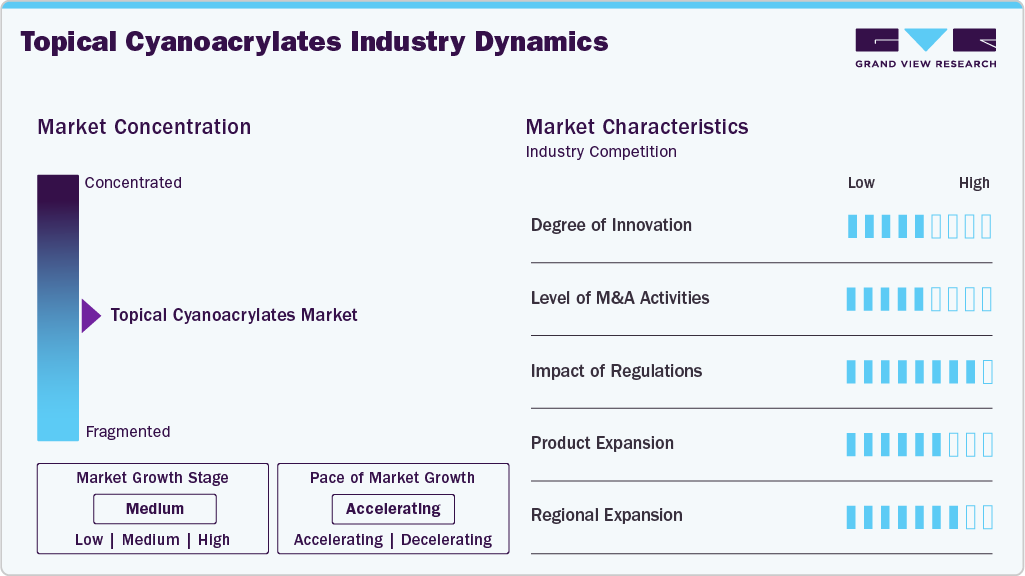

Market Concentration & Characteristics

The global topical cyanoacrylates industry demonstrates a moderate degree of innovation, primarily driven by advances in adhesive formulations that enhance adhesion strength, biocompatibility, and ease of application for medical wound closure and dermatological procedures. For instance, Meril Life’s MeriGlu Topical Skin Adhesive, consisting of monomeric N-Butyl Cyanoacrylate, has a superior strength and flexibility, a faster set time <50 seconds, and is also easy to apply . Recent innovations focus on developing faster-setting, less toxic, and more flexible cyanoacrylate formulations to improve patient outcomes and expand clinical applications. Additionally, ongoing research aims to incorporate antimicrobial properties and biodegradable components, reflecting a continuous push toward more advanced, safer, and versatile products.

Stringent regulatory frameworks established by agencies such as the FDA, EMA, and other regional authorities ensure that products meet specific safety and efficacy criteria, which can impact market entry and approval timelines. These regulations also drive innovation by encouraging the development of safer, more effective formulations while potentially increasing compliance costs for manufacturers. For instance, in June 2023, LiquiBandFix8/LIQUIFIX received Pre-Market Approval (PMA) from the U.S. Food and Drug Administration (FDA) for use in hernia repair procedures. The device employs drops of cyanoacrylate adhesive rather than traditional metal tacks to secure mesh to tissue during both open and laparoscopic hernia surgeries. As the first product of its kind approved in the United States, it is expected to benefit patients by offering a less invasive application that may help decrease pain and reduce post-operative complications.

The market has experienced a moderate but strategic level of mergers and acquisitions (M&A), reflecting the industry's drive for innovation, expanded capabilities, and market consolidation. For instance, in May 2023, H.B. Fuller Company, the world's largest pureplay adhesives manufacturer, announced its acquisition of Adhezion Biomedical, a privately owned U.S.-based medical adhesives company. Adhezion Biomedical serves clients in over 40 countries and holds more than 35 international certifications, including 105 patents.The acquisition of Adhezion, which develops and distributes specialized, proprietary cyanoacrylate technologies for surgical procedures, wound care, and infection prevention in healthcare environments, strengthens H.B. Fuller’s position in the topical skin bonding market by establishing a larger, more scalable platform. This move complements the capabilities gained through the company's 2021 purchase of Tissue Seal. It enhances its vertically integrated adhesive manufacturing and packaging capabilities, further expanding its footprint in the medical adhesives sector.

In the global topical cyanoacrylates market, product substitutes such as traditional sutures, staples, and other tissue adhesives like fibrin glues or polyurethane-based adhesives are commonly considered alternatives. While cyanoacrylates are favored for their rapid bonding, ease of application, and reduced procedure time, these substitutes offer different advantages depending on the clinical scenario. For instance, sutures provide longer-lasting wound closure and are preferred for deep or tension-bearing wounds. In contrast, fibrin glues are utilized in cases requiring more flexible or biologically compatible options. The global topical cyanoacrylates industry is characterized by a moderate level of market concentration, with a few key players dominating a significant share of the industry.

Product Insights

The 2-Octyl Cyanoacrylate segment held the largest share in 2024, attributed to its superior properties that meet the demanding needs of wound closure and tissue adhesion applications. One of the primary driving factors is its excellent flexibility and durability, which allow it to adapt to body movements without cracking or peeling, making it ideal for skin closures. Additionally, 2-Octyl Cyanoacrylate offers rapid bonding and minimal tissue reaction, reducing healing time and enhancing patient comfort. Innovations in formulation have also contributed to its dominance, such as the development of advanced, skin-friendly variants that improve biocompatibility and reduce the risk of infection. Growing awareness of minimally invasive procedures and the increasing preference for non-invasive wound closure methods further propel its adoption. These factors collectively make 2-Octyl Cyanoacrylate a preferred choice in medical settings, reinforcing its leading market position.

Comparison of Octyl Cyanoacrylate And Butyl Cyanoacrylate Tissue Adhesives

Properties

Octyl Cyanoacrylate

Butyl Cyanoacrylate

Degradation

Slower

Slow

Firm flexibility

Higher

High

Bonding Strength

Stronger

Strong

Heat released

Less

More

Setting time

Short

Shorter

Source: Der Pharma Chemica

The n-butyl-cyanoacrylate segment is anticipated to experience significant growth at a CAGR of 5.09% over the forecast period, driven by several key factors. Its superior adhesive properties, flexibility, and biocompatibility make it highly suitable for medical and surgical applications, particularly in wound closure and tissue bonding. Advances in formulation technology have enhanced its curing time, durability, and safety profile, further boosting its adoption in minimally invasive procedures and wound management. Additionally, increasing demand for fast-healing and infection-resistant adhesives in healthcare settings, along with ongoing innovations such as combining n-butyl-cyanoacrylate with antimicrobial agents, are expected to expand its application scope.

Application Insights

The general surgery segment held the largest market share in 2024, attributed to increasing preference for tissue adhesives over traditional sutures and staples due to their ease of use, reduced procedure time, and minimal invasiveness, which are highly valued in general surgical procedures. Innovations such as the development of fast-acting, bio-compatible, and infection-resistant cyanoacrylate formulations have significantly improved their safety and effectiveness, further fueling their adoption in general surgery. Additionally, the rising prevalence of chronic wounds, surgical infections, and the need for efficient wound closure solutions have propelled the demand for topical adhesives.

The plastic surgery and aesthetic procedures segment is expected to grow at the fastest CAGR within the global topical cyanoacrylates market over the forecast period, due to several driving factors and ongoing innovations. Increasing societal acceptance and rising awareness about cosmetic enhancements are fueling demand for minimally invasive and non-surgical procedures, many of which utilize cyanoacrylate adhesives for wound closure and skin sealing.

End Use Insights

The hospital segment dominated the market in 2024. Hospitals require reliable, fast-acting adhesives for wound closure, surgical incisions, and tissue bonding, making cyanoacrylates an ideal choice because of their ease of use, strong adhesive properties, and ability to reduce procedure times. The increasing prevalence of surgical procedures worldwide, coupled with a rising focus on minimally invasive techniques, further propels demand in hospital environments. Innovations such as formulations with enhanced biocompatibility, reduced toxicity, and improved flexibility have expanded the scope of use in diverse medical applications, strengthening hospital adoption.

The home care settings segment is projected to experience significant growth over the forecast period, driven by several key factors. Increasing awareness among consumers regarding wound management and the desire for convenient, cost-effective treatment options are fueling demand for over-the-counter adhesive products suitable for home use. Advances in formulation technology have led to the development of safer, easy-to-apply cyanoacrylate adhesives that require minimal training, making them ideal for non-professional use. Additionally, the rising prevalence of minor cuts, abrasions, and skin injuries, coupled with an aging population seeking self-care solutions, further propels this segment's growth.

Regional Insights

North America dominated the topical cyanoacrylates market with the largest revenue share of 42.35% in 2024, driven by advancements in medical technology, increasing demand for minimally invasive procedures, and a rising emphasis on efficient wound management. Cyanoacrylate adhesives’ convenience, rapid application, and effectiveness have made them a preferred alternative to traditional sutures and staples in many healthcare settings across North America. One of the primary factors fueling market growth is the rising prevalence of accidental injuries and trauma-related wounds. According to data from the Centers for Disease Control and Prevention (CDC), millions of lacerations are treated annually in emergency departments across the U.S. and Canada. The need for quick, reliable wound closure solutions in emergency and outpatient care has propelled the adoption of topical cyanoacrylates. Additionally, the increasing popularity of outpatient surgeries and minimally invasive procedures further supports the demand for skin adhesives, as they offer benefits such as reduced procedural time, decreased discomfort, and minimal scarring.

U.S. Topical Cyanoacrylates Market Trends

The U.S. topical cyanoacrylates industry held the largest revenue share of 76.64% in 2024, driven by increasing demand for minimally invasive wound closure options and a shift towards faster, more efficient healthcare procedures. Their growing adoption in emergency, outpatient, and surgical settings underscores their importance in modern wound management. According to the U.S. Bureau of Labor Statistics, around 2,569,000 total cases of nonfatal injuries and illnesses were reported in 2023.

Europe Topical Cyanoacrylates Market Trends

The Europe topical cyanoacrylates industry is growing rapidly, mainly because the number of older adults is increasing. The aging European population, coupled with rising incidences of chronic wounds and surgical procedures (minimally invasive), has amplified demand for effective wound adhesives. Moreover, stringent regulatory approvals and advancements in medical-grade formulations have bolstered market growth by ensuring safety and efficacy.

The UK topical cyanoacrylates market is driven by escalating demand for minimally invasive procedures. As healthcare providers increasingly prefer less traumatic wound management options, topical cyanoacrylates have gained prominence due to their ease of application, rapid bonding, and reduced risk of infection. This trend is especially relevant in emergency medicine, outpatient clinics, and surgical procedures, where quick and efficient wound closure is essential. The convenience and efficiency offered by cyanoacrylate adhesives align with the broader shift towards outpatient and day-care procedures, thereby fueling market growth.

Asia Pacific Topical Cyanoacrylates Market Trends

The Asia Pacific topical cyanoacrylates industry is expected to grow at the fastest CAGR over the forecast period, attributed to the expanding healthcare sector across APAC countries such as China, India, Japan, and South Korea. Topical cyanoacrylates are extensively employed in medical applications, particularly in wound closure, dermatology, and surgical procedures. Their ability to provide a strong, quick, and minimally invasive seal makes them an attractive alternative to traditional sutures and staples. The rising prevalence of chronic wounds, burns, and surgical procedures in the region, coupled with increased healthcare expenditure, has amplified the demand for advanced wound management solutions, including topical adhesives. Moreover, the growing geriatric population in countries like Japan and China, which is more susceptible to skin-related ailments and requires effective wound management, further propels the market.

The China Topical Cyanoacrylates market is experiencing strong growth, driven by the increasing prevalence of chronic wounds, surgical procedures, and trauma cases has contributed to a higher adoption of topical cyanoacrylate adhesives. China's expanding healthcare infrastructure and government initiatives aimed at improving healthcare services further support this trend, making advanced wound management solutions more accessible and popular. Furthermore, there's a strong and rising preference for minimally invasive procedures among both patients and healthcare providers in China, as these procedures offer benefits like reduced trauma, shorter recovery times, less pain, and fewer complications.

Latin America Topical Cyanoacrylates Market Trends

The Latin America topical cyanoacrylates industry is influenced by a combination of economic, industrial, healthcare, and technological factors that drive its growth and development. Cyanoacrylates, commonly known as super glues, are fast-acting adhesives widely used in medical, industrial, and consumer applications. In Latin America, several driving forces contribute to the increasing demand and expanding market presence of topical cyanoacrylates.

One of the primary factors is the expanding healthcare sector across Latin American countries. The rising prevalence of chronic wounds, surgical procedures, and skin-related injuries has boosted the demand for advanced wound closure and adhesive solutions. Topical cyanoacrylates are preferred in many medical settings due to their rapid bonding, biocompatibility, and ability to minimize infection risk. Countries like Brazil, Mexico, and Argentina are investing heavily in healthcare infrastructure, which enhances access to innovative medical adhesives, further fueling market growth.

Middle East Africa Topical Cyanoacrylates Market Trends

The topical cyanoacrylates industry in the Middle East and Africa (MEA) is growing fast, mainly due to rising investments in healthcare. One of the primary growth drivers is the ongoing enhancement of healthcare infrastructure. Many countries within this region are investing heavily in improving medical facilities and expanding access to advanced medical procedures. Governments and private sectors are increasingly adopting modern wound closure techniques, favoring tissue adhesives like cyanoacrylates over traditional sutures and staples because they reduce procedure time, minimize infection risk, and improve patient comfort.

Key Topical Cyanoacrylates Company Insights

The topical cyanoacrylates market is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority market share, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the market is predicted to grow during the forecast period.

Key Topical Cyanoacrylates Companies:

The following are the leading companies in the topical cyanoacrylates market. These companies collectively hold the largest market share and dictate industry trends.

- Medline Industries, LP

- Advanced Medical Solutions Group plc

- H.B. Fuller Medical Adhesive Technologies, LLC

- Meril Life

- Ethicon (Johnson & Johnson MedTech)

- Medtronic

- Alfa Pharma GmbH

- Epiglue Pharma Pvt. Ltd.

- B.Braun SE

- Resivant Medical LLC.

Recent Developments

-

In August 2024, Resivant Medical announced that it had obtained U.S. Food and Drug Administration (FDA) 510(k) clearance for its initial two products: the Cutiva Topical Skin Adhesive and the Cutiva PLUS Skin Closure System, which features an innovative combination of an adhesive mesh patch and high-viscosity Cutiva liquid adhesive.

-

In September 2023, Advanced Medical Solutions Group plc announced that it has entered into an agreement with TELA Bio, Inc., a specialist in designing and developing innovative soft-tissue reconstruction solutions aimed at optimizing clinical outcomes, to commercialize LiquiBandFix8 in the U.S.

-

In June 2023, LiquiBandFix8/LIQUIFIX received Pre-Market Approval (PMA) from the U.S. Food and Drug Administration (FDA) for use in hernia repair procedures. The device employs drops of cyanoacrylate adhesive rather than traditional metal tacks to secure mesh to tissue during both open and laparoscopic hernia surgeries. As the first product of its kind approved in the U.S., it is expected to benefit patients by offering a less invasive application that may help decrease pain and reduce post-operative complications.

-

In May 2023, H.B. Fuller Company, the world's largest pureplay adhesives manufacturer, announced its acquisition of Adhezion Biomedical, a privately owned U.S.-based medical adhesives company. Adhezion Biomedical serves clients in over 40 countries and holds more than 35 international certifications, including 105 patents. The acquisition of Adhezion, which develops and distributes specialized, proprietary cyanoacrylate technologies for surgical procedures, wound care, and infection prevention in healthcare environments, strengthens H.B. Fuller’s position in the topical skin bonding market by establishing a larger, more scalable platform. This move complements the capabilities gained through the company's 2021 purchase of Tissue Seal. It enhances its vertically integrated adhesive manufacturing and packaging capabilities, further expanding its footprint in the medical adhesives sector.

-

In February 2023, Advanced Medical Solutions Group plc, a global leader in tissue-healing technologies, announced the acquisition of Connexicon Medical Limited (“Connexicon”), a specialist in tissue adhesive technologies. The deal includes an initial upfront payment of USD 8.07 million, with additional deferred payments linked to the achievement of specific research & development, regulatory, and commercial milestones between 2023 and 2027. This acquisition reinforces AMS’s position in the USD 300 million global tissue adhesive market, broadens its product portfolio, and markedly enhances its technical and R&D capabilities in cyanoacrylate technology .

Topical Cyanoacrylates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 103.2 million

Revenue forecast in 2033

USD 160.2 million

Growth rate

CAGR of 5.65% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Medline Industries, LP; Advanced Medical Solutions Group plc; H.B. Fuller Medical Adhesive Technologies, LLC; Meril Life; Ethicon (Johnson & Johnson MedTech); Medtronic; Alfa Pharma GmbH; Epiglue Pharma Pvt. Ltd.; B.Braun SE; Resivant Medical LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Topical Cyanoacrylates Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global topical cyanoacrylates market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

2-Octyl Cyanoacrylate

-

n-Butyl-Cyanoacrylate

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Plastic Surgery and Aesthetic Procedures

-

Orthopedic

-

Pediatric

-

Gynecology

-

Dental Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Clinics

-

Home Care Setting

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global topical cyanoacrylates market size was estimated at USD 97.51 million in 2024 and is expected to reach USD 103.2 million in 2025.

b. The global topical cyanoacrylates market is expected to grow at a CAGR of 5.65% from 2025 to 2033 and is projected to reach USD 160.16 million by 2033.

b. On the basis of product, 2-octyl cyanoacrylate segment held the largest share of 73.23% in 2024.This growth can be attributed due to its superior properties that meet the demanding needs of wound closure and tissue adhesion applications

b. Some of the key players include Medline Industries, LP, Advanced Medical Solutions Group plc, H.B. Fuller Medical Adhesive Technologies, LLC, Meril Life, Ethicon (Johnson & Johnson MedTech), Medtronic, Alfa Pharma GmbH, Epiglue Pharma Pvt. Ltd., B.Braun SE, and Resivant Medical LLC, among others.

b. The topical cyanoacrylates market is primarily driven by increasing demand for advanced wound closure and tissue adhesion solutions across healthcare settings. The rising prevalence of chronic wounds, surgical procedures, and accident-related injuries has significantly boosted the need for effective, fast-acting adhesives that offer secure wound closure with minimal trauma.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.