Total Ankle Replacement Market Trends

The global total ankle replacement market size was estimated at USD 709.67 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.62% from 2024- 2030. Increasing prevalence of weakened bones & reduced bone density coupled with growing incidence of musculoskeletal disorders is driving the demand for total ankle replacement therapies. In addition, the growing availability of advanced ankle replacement options and rapidly developing healthcare infrastructure are anticipated to impact market growth positively. Increasing availability of minimally invasive surgeries and growing awareness drive market growth. Furthermore, growing participation in sporting events & physical activities causing injuries, is driving the market demand.

The COVID-19 pandemic resulted in a significant decline in the demand for total ankle replacement. Various government bodies-imposed travel restrictions & lockdowns, resulting in the postponement/ cancellation of elective surgical procedures, thereby negatively impacting the market growth. The cancellation of surgical procedures had a direct influence on the global demand for ankle replacement. A study published in January 2021 in the National Joint Registry 18th Annual Report stated a 53% decline in ankle replacement surgeries in England, Northern Ireland, and Wales. Therefore, the prominent decline in ankle replacement procedures significantly impacted the quality of patients’ lives.

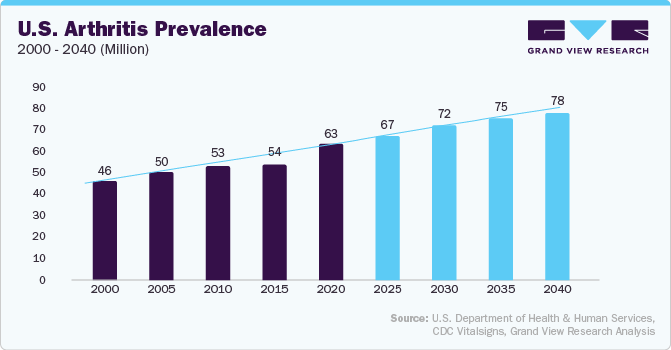

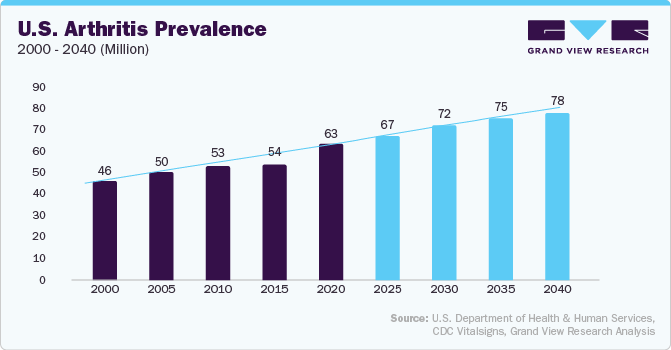

Growing prevalence of arthritis, osteoarthritis, and rheumatoid arthritis is driving the market demand. As per an article published in Sage Journal of Cartilage in December 2021, the prevalence of ankle osteoarthritis in rugby players was 4.6% and in football players was estimated between 9%-19%. Ankle replacements are used to reduce ankle pain, increase joint stability, and enhance overall mobility.

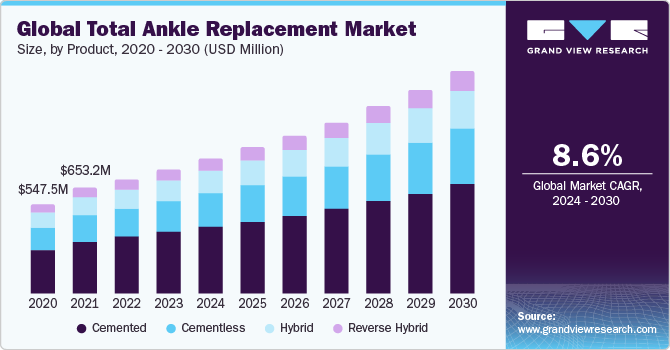

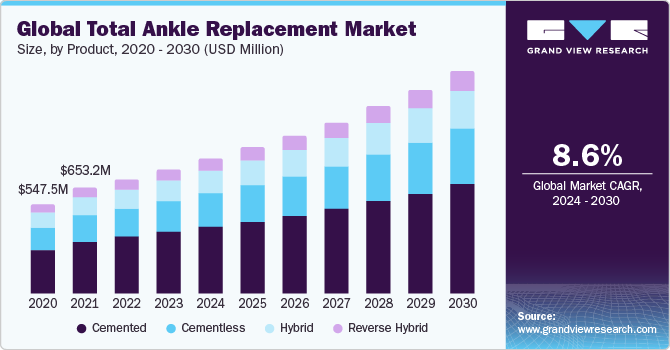

Fixation Type Insights

Based on the product, the total ankle replacement market is segmented into cemented, cement-less, hybrid, and reverse hybrid. The cemented segment held the largest market share in 2023. This is attributable to the growing incidence of sporting injuries owing to the significant rise in participation in sporting and fitness activities, along with unhealthy lifestyles, and insufficient rest & recovery.

As per estimates published by The Johns Hopkins University 2023, in the U.S., approximately 30 million children & adolescents participate in sports, and the country records about 3.5 million injuries annually. Furthermore, growing awareness and adoption of minimally invasive surgeries is another driving force.

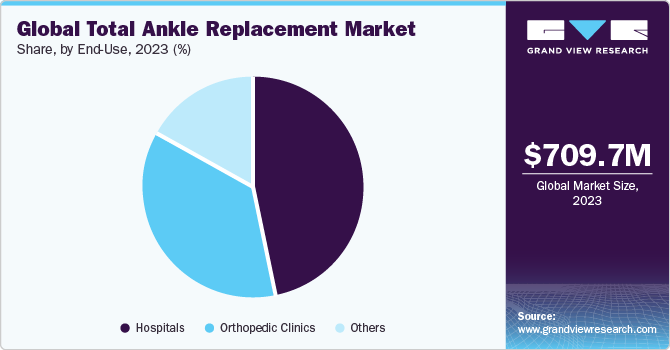

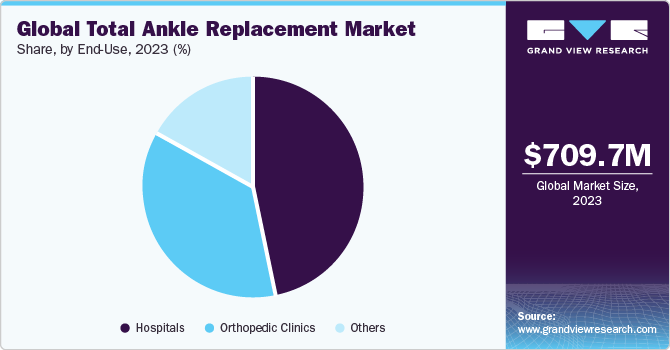

End Use Insights

On the basis of end-use, the market is segmented into hospitals, orthopedic clinics, and others. Hospitals held the largest market share in 2023. The availability of a comprehensive suite of treatment solutions in hospitals, such as advanced surgical equipment and highly skilled practitioners, is driving the segment's growth.

In addition, patients' perception of considering hospitals as a more secure environment for surgical interventions impacts the demand for hospitals. Lastly, hospitals have tie-ups with renowned insurance providers and offer seamless reimbursement processes for patients.

Regional Insights

North America dominated the market in 2023. This is attributed to the growing prevalence of arthritis in the U.S., growing awareness towards ankle replacement therapies, availability of a well-established healthcare infrastructure, high healthcare spending, and favorable reimbursement policies.

As per Statistics Canada 2021, approximately 5.9 million Canadians suffer from arthritis. Similarly, as per the Centers for Disease Control and Prevention (CDC), in October 2021, 58.5 million Americans were diagnosed with arthritis.

Key Total Ankle Replacement Company Insights

Key players operating in the market are DePuy Synthes, Stryker Corporation, MatOrtho, Zimmer Biomet, Smith+Nephew, Corin Group, In2Bones, Allegra Orthopedics Limited, Restor3D Inc. Market players are focusing on devising innovative product pipelines and other strategic initiatives to expand their business footprint.

-

In November 2021, Stryker launched Prophecy Infinity Resect-Through Guides which are used in total ankle replacement surgeries.

-

In January 2021, Trilliant Surgical, a manufacturer of foot & ankle orthopedic implants was acquired by DJO, LLC. Through this acquisition, the company expanded their product portfolio.