- Home

- »

- Automotive & Transportation

- »

-

Tractor Implements Market Size & Share Report, 2022-2030GVR Report cover

![Tractor Implements Market Size, Share & Trends Report]()

Tractor Implements Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Cultivator & Tiller, Harrows, Planters, Spreaders, Plough, Baler), By Region (North America, APAC, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-979-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tractor Implements Market Summary

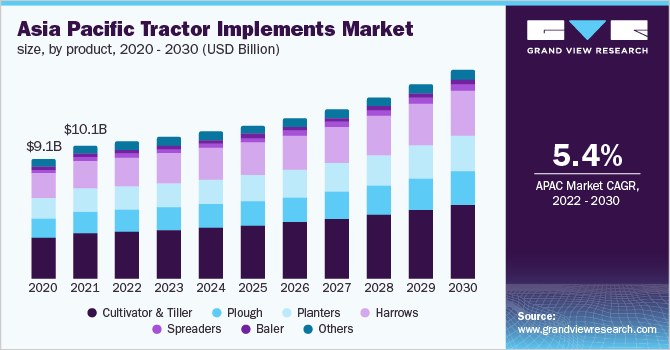

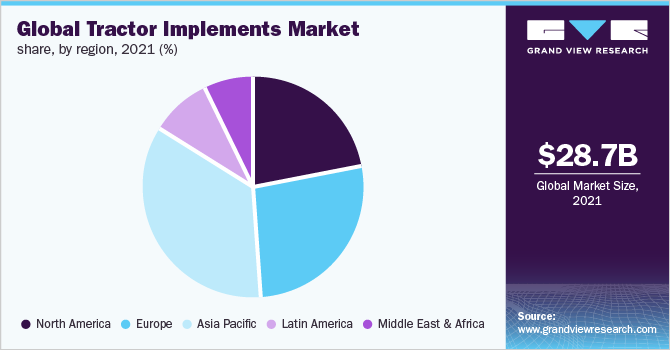

The global tractor implements market size was valued at USD 28.69 billion in 2021 and is projected to reach USD 43.50 billion by 2030, growing at a CAGR of 5.0% from 2022 to 2030. Rapid industrialization in the agriculture sector has resulted in increased expenditures on labor-intensive products, such as cultivators, harrows, and tillers, boosting industrygrowth.

Key Market Trends & Insights

- North America emerged as the second-largest regional market in 2021.

- Asia Pacific region dominated the global industry in 2021 and accounted for the maximum share of more than 35.25% of the overall revenue.

- Based on product, the The cultivator & tiller machinery segment dominated the industry and accounted for more than 33.3% of the overall revenue share in 2021.

Market Size & Forecast

- 2021 Market Size: USD 28.69 Billion

- 2030 Projected Market Size: USD 43.50 Billion

- CAGR (2022-2030): 5.0%

- North America: Largest market in 2021

Furthermore, the increasing scarcity of skilled labor leads to the adoption of new equipment and tools, supportingindustry growth. For instance, according to the data published by the International Labor Organization (ILO), headquartered in Geneva, Switzerland, the percentage of people working in the agriculture sector globally decreased from 44% in 1991 to 26% in 2020.It is expected that by 2025, China will have mechanized 75% of its crop plowing, planting, and harvesting processes. The rising adoption of modernized farm equipment is expected to fuel industry growth, which involves improving crop production and quality. Furthermore, the world’s rising population and increasing disposable income in various developing countries are increasing the global food demand. For instance, in July 2021, according to study findings by Wageningen University & Research, based out inthe Netherlands, food demand is expected to increase by between 35% to 56 % from 2010-2050.

This is shaping the market and boosting the adoption of various tractor implements to increase crop production. Several tractors implement manufacturers struggled to remain operational during the COVID-19 lockdowns, resulting in a sharp decline in business. The industry was negatively impacted in the first half of 2020. However, it bounced back and witnessed growth due to various significant global economies opening. In addition, manufacturers started adopting innovative strategies to recover from the pandemic.

For instance, in August 2021, Farmkart, an agricultural technology startup based out in India, launched rent4farm, a technology-enabled platform that provides unstructured agriculture equipment rental services. It offers competitive prices for renting advanced agriculture equipment and machinery.Although the prospects look promising, the industry is still faced with several challenges regarding the high capital costs of tractor implements, which is one of the bottlenecks for their adoption, especially for small farmers. Furthermore, farmers with small land holdings do not find it cost-effective to invest in tractor implements, which has resulted in one of the challenges hampering the industry growth.

Product Insights

The cultivator & tiller machinery segment dominated the industry and accounted for more than 33.3% of the overall revenue share in 2021. Farming activities are mechanized and automated with cultivators and tillers. In addition to increasing agricultural output, it also contributes to efficient utility usage. Modernization of agriculture, technological advancements, and the introduction of high-performance cultivators and tillers have increased the demand for cultivators and tillers. Companies develop and invest in new, advanced equipment that provides farmers with practical solutions for cultivating and plowing their fields. For instance, in June 2022, Vaderstad, based out in Sweden, launched a new disc cultivator, the carrier XT 425-625, which allows various machines to optimize their performance and provides better efficiency with low diesel consumption.

The harrow segment is expected to expand at the second-fastest CAGR from 2022 to 2030. The increasing focus on heavy residue management is a crucial factor driving the segment's growth. The agricultural industry relies heavily on harrowing for soil preparation, and several companies are launching harrows explicitly designed to handle heavy residues efficiently. For instance, in August 2021, Breviglieri launched Breviglieri Mekfarmer 80 Power Harrow with a packer roller for farmers to reduce the absorption of fuel and power consumption and provided better soil crumbling. Farmers can therefore maximize the use of fertilizers, seeds, and irrigation. The mechanization of farms contributes to the preservation of farm products and increases profitability and cost-effectiveness by reducing post-harvest losses.

Regional Insights

On the basis of geographies, the global industry has been further sub-divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The Asia Pacific region dominated the global industry in 2021 and accounted for the maximum share of more than 35.25% of the overall revenue. The region is projected to expand further at the fastest growth rate retaining its dominant position throughout the forecast period. This region has several primary drivers, including a growing population and the resultant need to increase yields. A growing number of farmers in developing countries are adopting automation and precision agriculture practices, which bodes well for cultivating and tilling machinery.

North America emerged as the second-largest regional market in 2021 and is projected to expand further at a steady growth rate during the forecast period. The countries in the North America region are increasingly adopting automation and smart farming solutions to meet the growing demand. These countries are experiencing labor shortages, which, in turn, is augmenting the adoption of mechanized farming products and solutions that perform a wide range of farm-related activities with maximum accuracy and productivity.

Key Companies & Market Share Insights

Companies are engaging in several growth strategies, such as partnerships, mergers & acquisitions, and product launches, to stay afloat in the competitive industry. For instance,in May 2021, CLAAS KGaA Mbh based out inHarsewinkel, Germany, acquired a minority stake in Dutch startup AgXeed B.V. The acquisition was intended to promote the commercialization of autonomous farming machines.Some of the prominent players in the global tractorimplements market include:

-

Claas KGaA Mbh

-

Deere & Company

-

Kubota Corp.

-

CNH Industrial N.V.

-

Agco Corporation

-

Tractors and Farm Equipment Limited (TAFE)

-

SDF Group

-

Mahindra & Mahindra

-

J C Bamford Excavators Ltd. (JCB)

-

Actuant

-

Kuhn Group

-

Alamo Group

Tractor Implements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 29.38 billion

Revenue forecast in 2030

USD 43.50 billion

Growth rate

CAGR of 5.0 % from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil; Mexico; Rest of Latin America

Key companies profiled

Claas KGaA Mbh; Deere & Company; Kubota Corp.; CNH Industrial N.V.; Agco Corp.; Tractors and Farm Equipment Ltd. (TAFE); SDF Group; Mahindra & Mahindra; J C Bamford Excavators Ltd. (JCB); Actuant; Kuhn Group; Alamo Group

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Tractor Implements Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global tractor implements market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cultivator &Tiller

-

Plough

-

Planters

-

Harrows

-

Spreaders

-

Baler

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global tractor implements market size was estimated at USD 28.69 billion in 2021 and is expected to reach USD 29.38 billion in 2022

b. The global tractor implements market is expected to grow at a compound annual growth rate of 5.0% from 2022 to 2030 to reach USD 43.50 billion by 2030.

b. The cultivator & tiller segment dominated the tractor implements market and accounted for 33% of the global revenue share in 2021.

b. Some key players operating in the tractor implements market include John Deere, CNH Industrial N.V., Mahindra & Mahindra Limited, and AGCO Corporation

b. Key factors that are increasing demand for tractor implements are increasing farmers' approach towards simplifying the post-harvesting operations, coupled with high demand for advanced implements during the land development phase.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.