- Home

- »

- Next Generation Technologies

- »

-

Trade Credit Insurance Market Size And Share Report, 2030GVR Report cover

![Trade Credit Insurance Market Size, Share & Trends Report]()

Trade Credit Insurance Market Size, Share & Trends Analysis Report By Enterprise Size, By Coverage, By Application (Domestic, International), By End-use (Energy, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-009-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Trade Credit Insurance Market Size & Trends

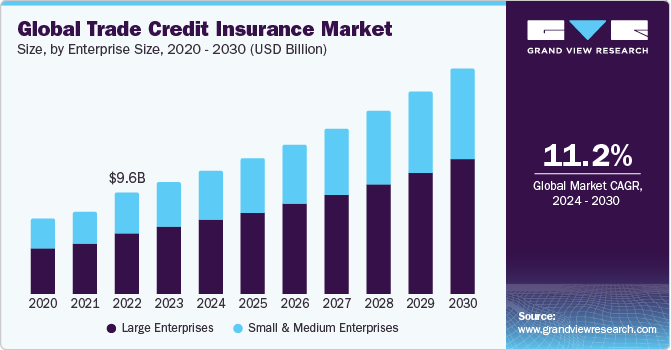

The global trade credit insurance market size was estimated at USD 10.58 billion in 2023 and is expected to grow at a CAGR of 11.2% from 2024 to 2030. The growth of the market can be attributed to the growing expansion of trade across several locations, leading to the demand for trade credit insurance to reduce the risk of non-payment from foreign buyers. Furthermore, increased uncertainty and protectionism in global trade are expected to drive the demand for trade credit insurance (TCI).

The business data provided by the insurers to companies can help them identify the difficulty in payments, and hence, insured companies can run their business with greater confidence. The introduction of digital software to streamline banking and insurance services and the use of data analytics and blockchain in trade finance is expected to drive market growth. Moreover, the market players are expanding trade credit solutions for digital platforms to gain a competitive advantage over their rivals.

For instance, in September 2023, Coface announced the launch of its new Application Programming Interfaces (API) portal, which is designed for financial directors and credit managers. Coface’s API Portal presently offers 26 API products in trade credit insurance of Business Information and provides access to Coface’s services and data on more than 188 million companies. Such innovative solutions are harnessing the market’s growth.

Artificial intelligence, machine learning, and the Internet of Things have significantly shaped the trade credit insurance sector. According to Gallagher Re, a global reinsurance broking and advisory firm, 1,528 international investors participated in 521 Insurtech deals, raising a total of USD 7.9 billion in 2022. The U.S. topped the list with 238 deals, followed by the U.K. with 35 deals, France with 27, and India with 26 deals. Investments in trade credit technology have been increasing in recent years as businesses and insurers seek to leverage technology to streamline processes and reduce risk, which bodes well for the market’s growth.

Trade credit insurance is insurance intended to protect businesses from economic and political risks that could affect their financial situation. Furthermore, the benefits of trade credit insurance policy, including protection of accounts receivable from loss caused by bankruptcy, insolvency, or credit risks, such as extended default, are driving the adoption of trade credit insurance worldwide. In addition, the rising strategic initiatives, such as partnerships, collaborations, and acquisitions, among market players are also expected to fuel the market’s growth. Moreover, the rise of digital technology enables insurers to offer more efficient and cost-effective services, making trade credit insurance more accessible and affordable to businesses.

Trade credit insurance can be costly and complex to manage, which might hinder the growth of the market. Furthermore, a lack of awareness among businesses about trade credit insurance policies also might hinder market growth. In addition, the conflict and differences in the trade regulations across different jurisdictions can be considered as one of the major factors restraining the market’s growth. However, the uncertainty in the market and increasing non-payment frauds worldwide are anticipated to propel the market’s growth over the forecast period.

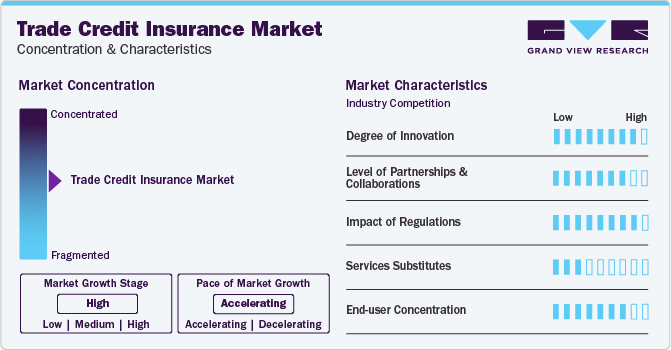

Market Characteristics & Concentration

The industry growth stage is high, and the pace of the industry growth is accelerating. Emerging trends such as tailored credit insurance solutions, streamlined underwriting processes, and the increasing prevalence of digital platforms are reshaping the landscape of trade credit insurance. These innovations are not only enhancing the overall convenience and accessibility for policyholders but are also revolutionizing traditional practices within the trade credit insurance industry.

High levels of partnerships play a crucial role in shaping the trade credit insurance industry. Leading players are forming collaborations to diversify their product offerings, leverage technological advancements, and strengthen their positions in the trade credit insurance landscape. This strategic approach is essential for achieving a balance between sustained growth and effective integration within the trade credit insurance industry.

The regulatory environment has a significant influence on the trade credit insurance industry, impacting risk assessment standards, underwriting practices, and operational protocols. Stringent regulations play a pivotal role in defining policy features, establishing premium structures, and ensuring fair practices within the trade credit insurance sector.

Trade credit insurance does not have any direct substitutes. While letters of credit and factoring invoices can be considered indirect substitutes in the industry, they may not offer the same level of superior protection and risk mitigation. These alternatives often lack the coverage and financial security provided by trade credit insurance. Hence, the service substitutes are considered as low in the industry.

The trade credit insurance industry exhibits high-End-user concentration among businesses. Businesses across various sectors are increasingly recognizing the importance of trade credit insurance to mitigate the risks associated with buyer default and ensure financial stability. This trend highlights the industry’s adaptability to diverse user needs, shaping a dynamic and responsive industry landscape within the trade credit insurance sector.

Enterprise Size Insights

Large enterprises led the market and accounted for 60.3% of the global revenue in 2023 and is expected to retain its dominance over the forecast period. The growth can be attributed to the increasing demand for trade credit insurance policies by large enterprises to reduce the risks of non-payments. Furthermore, market players such as Allianz Trade are involved in offering trade credit insurance specifically designed for large enterprises to protect their cash flow and receivables. Additionally, large enterprises trade in large sales volumes over long payment terms, where the risk of non-payment can be significant. Hence, large enterprises are adopting trade credit insurance policies worldwide.

The small & medium enterprises segment is expected to grow at the fastest CAGR over the forecast period. This can be attributed to Small & Medium Enterprises (SMEs) in the trade credit sector experiencing cash-flow difficulties as many of their sales are tied up in credit to buyers. Therefore, small & medium enterprises receive support from TCI as trade finance concentrates more on the trade itself than the underlying borrower.

Moreover, governments worldwide are trying to support SMEs by introducing different schemes. For instance, in July 2022, the Export Credit Guarantee Corporation of India (ECGC), an export credit provider, unveiled a new scheme to insure up to 90% of the credit risk in export finance, assisting small- & medium-sized exporters by empowering banks & financial institutions to provide more credit for export in the face of global economic volatility.

Coverage Insights

The whole turnover coverage segment accounted for the largest market revenue share in 2023. The whole turnover policy coverage provides cover against the risk of non-payment. Usually, businesses purchase the whole turnover policy to support their credit control management and get coverage against their total debtor book. Furthermore, the high share of this segment can be credited to the whole turnover coverage being less expensive and safeguarding insurers from the initial high-probability credit losses. Moreover, the insured can significantly reduce coverage costs by raising the deductible, depending on its risk retention capabilities.

The single buyer coverage segment, on the other hand, is anticipated to register a significant growth rate over the forecast period. The growth of this segment can be attributed to the credit limit offered that enables underwriters to cover all financial transactions with the customer. This policy provides highly tailored protection against a single buyer failing to pay for goods or services provided. The companies involved in dealing with new customers commonly opt for single-buyer insurance to avoid a customer’s payment issues.

Application Insights

The international application segment accounted for the largest market revenue share in 2023. This growth is attributed to the benefits of trade credit insurance, such as significantly lowering the payment risks associated with international business. By providing the exporter a conditional assurance of payment if the foreign purchaser defaults, trade credit insurance fosters confidence and facilitates smoother cross-border transactions. Furthermore, the growing launch of trade credit insurance policies tailored specifically for exporters is further anticipated to drive the segment's growth, making it an increasingly attractive risk mitigation strategy for businesses venturing into the global marketplace.

The domestic application segment is expected to grow at the fastest CAGR over the forecast period. The growth of this segment can be attributed to a rise in the adoption of trade credit insurance within domestic sales. The rise in the adoption of trade credit insurance in the domestic market can be attributed to businesses focusing on avoiding bad debts and improving their cash flow. Furthermore, trade credit insurance offers companies the protection they require as their customer base consolidates, creating a larger receivable from minimal customers and protecting them from great risk.

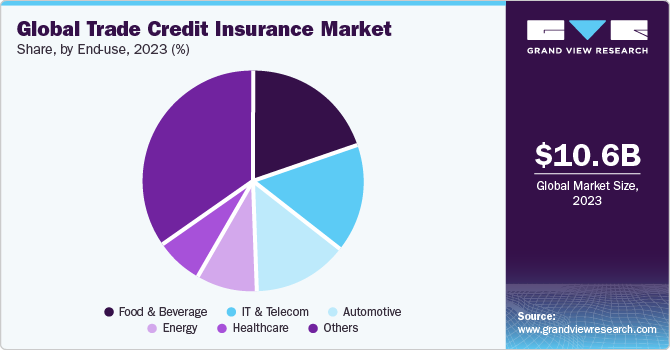

End-use Insights

Food & beverage accounted for the largest market revenue share in 2023. The segment growth can be attributed to the increasing demand for trade credit insurance across the food & beverage industry. The low margins, changing consumer expectations such as high-quality ingredients, and volatile agricultural commodity pricing have created a need for protection of cash flows driving trade credit insurances across the food & beverage industry. Furthermore, trade credit insurance allows food & beverage companies to mitigate credit risk and enhance competitiveness by offering extended payment terms, thereby driving the segment’s growth.

The automotive segment is anticipated to register the fastest CAGR over the forecast period. The growth of this segment can be attributed to the automotive sector being a major industry facing uncertainties due to rapid technological advancements, changing consumer tastes, government regulations, and relative pricing. Furthermore, trade credit insurance can be particularly important in the automotive industry, given the high value of transactions and the potential risks associated with supplying goods to a wide range of customers. The growing awareness regarding the benefits of trade credit insurance among businesses in the automotive industry is also driving the segment’s growth.

Regional Insights

The trade credit insurance market in North America is expected to grow at a significant CAGR from 2024 to 2030. There has been an increasing interest in trade credit insurance among North American businesses, as trade tensions, economic uncertainty, and supply chain disruptions have increased credit risk. As a result, many businesses have turned to trade credit insurance as a way to protect their cash flow, manage risk, and ensure that they are paid for their goods and services.

U.S. Trade Credit Insurance Market Trends

The U.S. trade credit insurance market is expected to grow at a significant CAGR from 2024 to 2030. Trade credit insurance is widely adopted in the U.S. to cover risks such as insolvency. Moreover, insurers in the U.S. are offering a variety of policies to meet the specific needs of businesses operating in different sectors and industries, thus contributing to the country’s growth.

The trade credit insurance market in Canada is expected to grow at a significant CAGR from 2024 to 2030. In Canada, trade credit insurance is widely available and is offered by both domestic and international insurers. Major insurers offer a range of policies to meet the needs of Canadian businesses operating domestically and internationally.

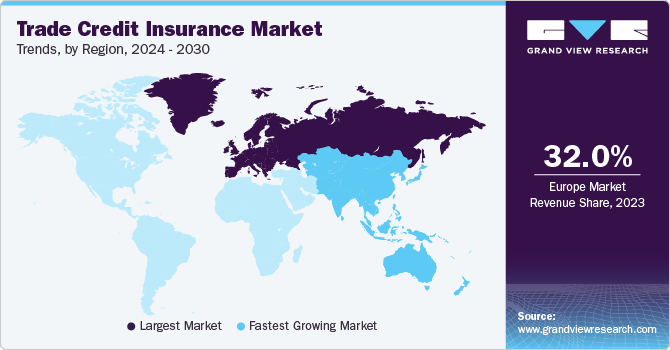

Europe Trade Credit Insurance Market Trends

Europe trade credit insurance market dominated and accounted for 32.0% in 2023 and is anticipated to retain its position over the forecast period. The presence of major market vendors and the high adoption of advanced technologies in the region are the key factors driving the region’s growth. Moreover, favorable government initiatives to support companies are driving the European market’s growth.

The trade credit insurance market in the U.K. is expected to grow at a significant CAGR of 11.3% from 2024 to 2030. According to Allianz Trade’s economic research department, the government’s fiscal support in the U.K. supported about 4,300 businesses on average between 2022 and 2023. Trade credit insurance can be further used to protect pending receivables and support these businesses.

Germany trade credit insurance market is expected to grow at a significant CAGR from 2024 to 2030. Trade credit insurance can offer significant benefits to businesses, such as access to credit information and risk management tools. These benefits are driving the adoption of trade credit insurance in Germany.

Asia Pacific Trade Credit Insurance Market Trends

The trade credit insurance market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. Asia Pacific is characterized by growing economies that are leveraging debt and financing instruments to support the growth of the market. In August 2022, the Asian Development Bank (ADB) signed an agreement with five global insurance companies to organize up to USD 1 billion of co-financing capacity to help financial institutions present in Asia Pacific. Such initiatives bode well for the growth of the market in Asia Pacific.

China trade credit insurance market is expected to grow at a significant CAGR from 2024 to 2030. The growing demand for the market in China can be attributed to an increased appetite for trading on credit with B2B customers and an increasing preference for enhanced credit management practices that seek to minimize credit risk.

The trade credit insurance market in Japan is expected to grow at a significant CAGR from 2024 to 2030. The adoption of trade credit insurance is helping Japanese businesses expand sales, geographically expanding into new international markets, reducing bad debt reserves, and protecting against non-payment. These benefits are driving the adoption of trade credit insurance in Japan.

India trade credit insurance market is expected to grow at a significant CAGR from 2024 to 2030. In March 2020, the Insurance Regulatory & Development Authority of India (IRDA) authorized trade credit insurance for the Ministry of Micro, Small & Medium Enterprises (MSME) sector and credit insurance for the Trade Receivables Discounting System (TReDS) platform and under a regulatory sandbox approach, which contributed to the Indian market’s growth.

MEA Trade Credit Insurance Market Trends

The trade credit insurance market in MEA is expected to grow at a significant CAGR from 2024 to 2030. The Middle East is expected to witness robust growth in the credit insurance market, owing rapid adoption of digital solutions and a prominent Export Credit Agency present in the region.

UAE trade credit insurance market is expected to grow at a significant CAGR from 2024 to 2030. The Atradius Payment Practices Barometer UAE 2022 revealed a year-on-year growth in the number of businesses adopting trade credit insurance. Several businesses are expressing a rising preference for TCI due to the need to minimize Days Sales Outstanding (DSO) and protect cash flow.

Key Trade Credit Insurance Company Insights

Some of the key players operating in the market include Allianz Trade, Coface, Atradius N.V., Zurich, and American International Group, Inc.

-

Allianz Trade is a global trade insurance firm that specializes in areas such as debt collection, surety, structured trade credit & political risk, and fraud insurance. It leverages market knowledge, economic intelligence, and industry risk analysis to assist customers in better anticipating, analyzing, and responding to changes in market conditions.

-

Atradius N.V. is a global insurance company operating in areas such as trade insurance, debt collection, and surety. It also provides tailor-made solutions through its special products unit division. The company has a dedicated team called Atradius Global that is committed to the individual trade credit insurance needs of multinational businesses.

Chubb, Great American Insurance Company, QBE Insurance Group Limited, Credendo, and Aon plc are some of the emerging market participants in the market.

-

Chubb is a multinational insurance company. It offers various types of insurance to a diverse group of clients, including personal accident insurance, casualty insurance, trade credit insurance, commercial & personal property insurance, supplemental health insurance, life insurance, and reinsurance. The company is a component of the S&P 500 index and is listed on the New York Stock Exchange under the symbol CB.

-

QBE Insurance Group Limited is an Australia-based multinational company. It provides trade credit insurance, reinsurance, specialty, commercial, and personal insurance products, and risk management solutions with operations in all major insurance markets. It has operations in 27 countries, including Australia, and serves various regions such as Europe, North America, and Asia Pacific. The company is listed on the Australian Securities Exchange under the ticker symbol QBE.

Key Trade Credit Insurance Companies:

The following are the leading companies in the trade credit insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Allianz Trade

- Atradius N.V.

- Coface

- American International Group, Inc. (AIG)

- Zurich

- Chubb

- QBE Insurance Group Limited

- Great American Insurance Company

- Aon plc

- Credendo

Recent Developments

-

In May 2023, TradeCreditTech (TCT) announced its partnership with TreasurUp. Through this collaboration, the companies aim to digitize trade credit insurance and credit risk management for small and medium-sized businesses through banks. Through the partnership, certain banks will get access to TreasurUp’s trade credit platform and integrate it into their online Commercial Banking portal.

-

In March 2023, Origin India, a trade credit insurance provider based in India, partnered with AU Group, a Paris-based broker specializing in trade receivables. This partnership enabled Origin India to offer a broad range of insurance products and services to its Indian customers. As a result of this partnership, AU Group expanded its geographical scope, enhancing its service capabilities.

-

In January 2023, Coface, a term credit insurance provider, acquired Rel8ed, a North American data analytics boutique. With this acquisition, Rel8ed’s analytics capabilities and wealthy data sets will benefit Coface trade credit insurance.

Trade Credit Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.71 billion

Revenue forecast in 2030

USD 22.13 billion

Growth rate

CAGR of 11.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Enterprise size, coverage, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Allianz Trade; Atradius N.V; Coface; American International Group Inc, (AIG); Zurich; Chubb; QBE Insurance Group Limited; Great American Insurance Company; AON PLC; Credendo

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trade Credit Insurance Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global trade credit insurance market report based on enterprise size, coverage, application, end-use, and region.

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Coverage Outlook (Revenue, USD Billion, 2017 - 2030)

-

Whole Turnover Coverage

-

Single Buyer Coverage

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Food & Beverage

-

IT & Telecom

-

Healthcare

-

Energy

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global trade credit insurance market size was estimated at USD 10.58 billion in 2023 and is expected to reach USD 11.71 billion in 2024.

b. The global trade credit insurance market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 22.13 billion by 2030.

b. Europe dominated the trade credit insurance market with a revenue share of 32.0% in 2023 on account of several factors, such as the presence of major market vendors like Chubb, Zurich, Allianz Trade, Coface, Atradius N.V., and more and the high adoption of advanced technologies and government schemes in the region to support companies by promoting trade credit insurance are the key factors driving the market growth in the region.

b. Some of the key players operating in the trade credit insurance market include Allianz Trade, Atradius N.V., Coface, American International Group, Inc., Zurich, Chubb, QBE Insurance Group Limited, Great American Insurance Company (FCIA), AON plc, and Credendo.

b. The demand for trade credit insurance has been gaining momentum as the pandemic has increased uncertainties in global businesses. In addition, the temporary shutdown of production units has led to increased business losses, due to which defaults in payment have risen tremendously, which is expected to drive market growth in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."