- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Traffic Road Marking Coatings Market Size Report, 2030GVR Report cover

![Traffic Road Marking Coatings Market Size, Share & Trends Report]()

Traffic Road Marking Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Paint, Thermoplastic, Epoxy), By Type (Permanent, Removable), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-808-4

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Traffic Road Marking Coatings Market Summary

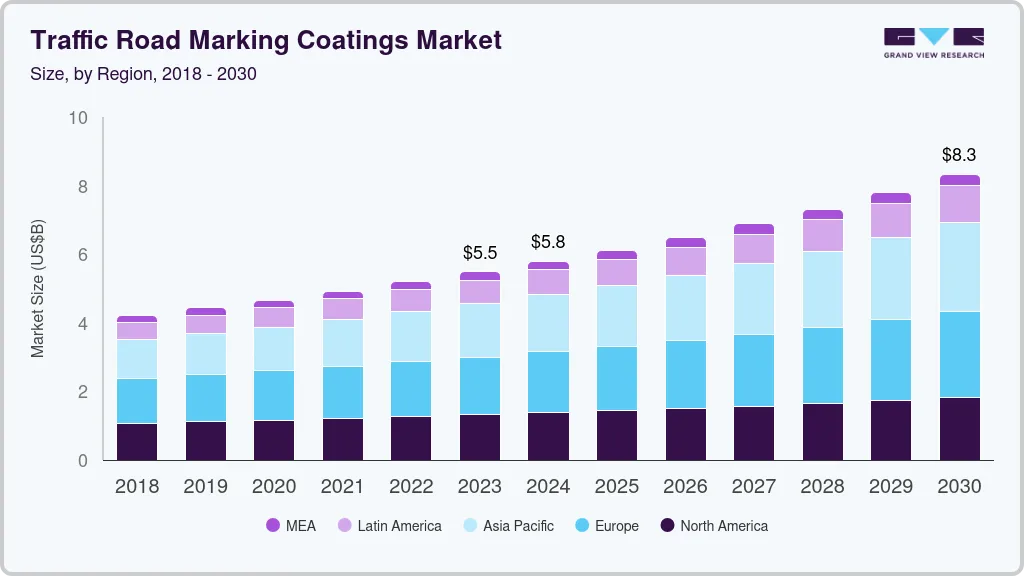

The global traffic road marking coatings market size was estimated at USD 5,485.2 million in 2023 and is projected to reach USD 8,332.6 million by 2030, growing at a CAGR of 6.2% from 2024 to 2030. Increasing spending on infrastructure development for constructing new highways and focusing on repair & maintenance operations are expected to be the key driving factors for the global market.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, Mexico is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, paint accounted for a revenue of USD 2,464.9 million in 2023.

- Thermoplastic is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 5,485.2 Million

- 2030 Projected Market Size: USD 8,332.6 Million

- CAGR (2024-2030): 6.2%

- Europe: Largest market in 2023

The industry is not only associated with new road construction activities but also with existing maintenance businesses, which drives the demand for repainting.

The market has witnessed increasing investments in intelligent street marking systems and machines that help in recording the driver speed, driving conditions, and temperature while communicating it to the vehicle’s sensor system. Paint is widely used for travel lanes, loading zone, and parking space markings. Thermoplastic coat, which is also known as hot melt marking, is gaining advantage owing to its properties, such as longevity and retro-reflectivity.

Preformed polymer tape is a plastic sheet applied to mark traffic lanes, stop bars, and crosswalks. Epoxy is another option that is both reliable and economical, consisting of a pigmented resin base and a catalyst. This type of coating is preferred over plastic due to its low cost and high reliability. Manufacturers are developing temperature-sensitive paints in response to adverse weather conditions like snowfall and heavy rain.

Rising demand in the markings for public and private parking spaces is expected to boost the market growth. Regulatory bodies across the globe are continuously formulating guidelines to improve road safety. While a well-established regulatory structure is already present in developed regions, such as North America and Europe, emerging economies are still working toward enhancing the framework to ensure road safety and maintenance.

Despite considerable supply chain instability during the initial months of the COVID-19 pandemic, several road maintenances and building projects increased due to reduced traffic. Aside from road building, the crisis and flight reductions provided a chance to evaluate runway construction windows. For example, in May 2020, Auckland Airport declared intentions to capitalize on the opportunity created by traffic restrictions during the pandemic to forward its runway pavement replacement project.

Market Characteristics

Manufacturers within the traffic road marking coatings market prioritize the development of innovative products, such as temperature-sensitive, durable, and reflective paints. These manufacturers anticipate a significant level of forward integration within the market to enhance their global market positioning.

Major companies operating in the market include Dow Inc., 3M Company, and Asian Paints PPG Pvt. Ltd. The products manufactured by these companies are used in applications such as metropolitan road markings, highway markings, and airfield markings. They are also used in footpath markings and indoor & parking spaces markings. Sporting surfaces markings and kern markings are also among a few other road safety applications for the company’s products. Companies are majorly using strategies such as joint ventures, mergers & acquisitions, production capacity expansions, and new product developments to drive their revenues and increase their market shares.

For instance, Ingevity Corporation has announced its deal to purchase the privately held entities Ozark Materials, LLC and Ozark Logistics, LLC in a cash transaction valued at $325 million. The completion of the acquisition is contingent upon regulatory endorsement and standard closing prerequisites, with Ingevity anticipating the transaction to conclude in the early stages of the fourth quarter of 2022.

The emerging & key companies estimate a huge potential demand from developed markets in the countries of North America and Europe. Traffic road marking coatings manufacturers also collaborate with other players in the market to sustain and grow in the marketplace. For instance, in January 2022, Geveko Markings was acquired and commenced operations under the ownership of Oré Peinture, a French manufacturer of road marking paint and safety materials. This acquisition resulted in the expansion of Geveko Markings' presence in France, as well as an increase in its overall assets and production capacity.

Product Insights

Thermoplastic coating is projected to emerge as the fastest-growing product segment and accounted for a revenue share of over 23.0% in 2023. Conventional paint is ideal for markings on private spaces and public streets. These paints are available in different colors, each symbolizing a different function, viz. best reflectors, areas frequented by a heavy fork-lift truck, essential for temporary marks. In December 2020, SWARCO Road Marking Systems collaborated with students to research the practicality of integrating natural polymers in thermoplastic street markings, and their efforts earned them the Borealis Student Innovation Prize.

Thermoplastic markings are applied in a thick/built-up layer to create rumble strips. This coating sets quickly and adheres firmly to the surface. Extra additives can be added to retain its color over time, thus improving its reflective capabilities. High strength and resistance make them wear resistance.

Preformed polymer tapes, also referred to as tape or cold plastic, are placed either over the surface of the pavement or the asphalt concrete during the hardening process. Along with its use for crosswalks and stop bars, it is also supplied in sheets from which unique shapes, forms, or letters can be designed. In February 2021, Dow released its DURATRACKTM 2K Technology for big area markings like green cycling lanes. Dow's green bicycle lane coatings combine the simplicity and sprayability of waterborne solutions with the reliability and performance of a two-component solution. The solution was designed to provide residents of the economy with safer multi-modal traveling alternatives.

Type Insights

Based on the type, the market is segmented into permanent and removable traffic road marking coatings. Permanent traffic road marking includes pavement tapes and paints. Aerosol permanent paints are widely used for traffic line marking. They exhibit an extremely high percentage of solid and resin content, contributing to exterior durability and water, weather, and abrasion resistance. Aerosol paints are available in a variety of colors but white and yellow are mostly preferred in several applications including crosswalks, streets, highways, airport runways, and parking lots. These paints have a longer life compared to conventional paints. In January 2019, Ennis-Flint, Inc., a manufacturer, and supplier of pavement marking materials, made progress toward a new production facility in the Triad. The new facility focused on increasing the processing capacity of premade thermoplastic pavement markings for the company's specialty market goods.

Removable traffic road markings are primarily used for painting signs, identification numbers, and direction arrows on warehouse floors, road construction zones, synthetic turf fields, and others. These paints are tough and durable, however, can be easily removed or can wear off when exposed to the environment in a year.

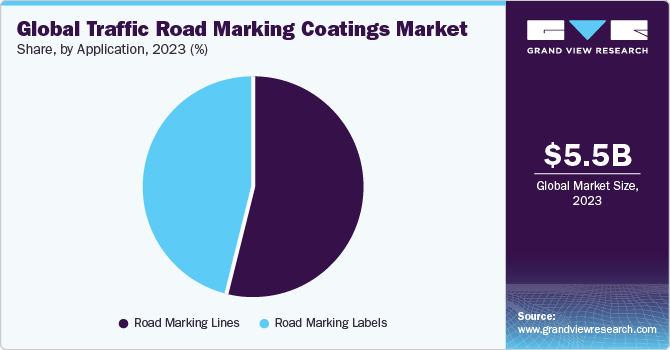

Application Insights

Road marking lines emerged as the largest application segment with a market share of 55.1% in terms of revenue in 2023. The rising usage of road marking lines to guide the vehicles on the road is expected to propel the demand for road marking lines in the coming years. The marking indicates the delineation of traffic path and lateral clearance from traffic hazards for safe and smooth movement on the road. It also serves as a tool for providing information, controlling traffic, and warning road users.

Road marking labels is projected to emerge as the fastest-growing application segment owing to their high suitability for roads, public highways, and on-site applications. Traffic road marking labels promote traffic safety, notify drivers of the speed limit, and provide directions and other useful information to all road users including pedestrians and cyclists. Basic road labeling includes regulatory warnings, roadwork signs, and informational signs. All road marking labels must comply with the road traffic regulations.

Regional Insights

Europe has emerged as the largest market while the Asia Pacific is projected to witness the highest growth during the forecast period. The European Union Road Federation, as a part of its ongoing efforts, is actively researching to develop standard recommendations to reach its goal of reducing highway fatalities. Usage of high-quality building materials, safety measures, training, and better surveillance of contractors are expected to augment the demand in the coming years.

The U.S. government has rolled out initiatives to enhance road infrastructure and encourage the development of durable, high-performance coating products with enhanced visibility and skid resistance. Facilitating vertical market integration by launching manufacturing units for motorway marking and traffic paints will give contractors and applicators a chance to acquire better control over the cost and quality of products. This is expected to support the regional market growth during the forecast period.

Key Traffic Road Marking Coatings Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

Sherwin-Williams Company is engaged in increasing its product offering for traffic road marking coatings market. The company has a wide product portfolio of about nine coating materials catering to road marking coating applications.

- Automark Technologies (India) Pvt. Ltd. was established in 2002 and is headquartered in Nagpur, India. It is involved in manufacturing pavement marking and road striping & marking products. The company started manufacturing thermoplastic materials in 2004 with a production capacity of 5 metric kilotons per day and as of 2021.

Key traffic road marking coatings Companies:

The following are the leading companies in the traffic road marking coatings market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these traffic road marking coatings companies are analyzed to map the supply network.

- AutoMark Technologies (India) Pvt. Ltd.

- The Sherwin-Williams Company

- Geveko Markings

- Ennis Flint, Inc.

- Crown Techno

- Dow Inc.

- The 3M Company

- Swarco

Traffic Road Marking Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.80 billion

Revenue forecast in 2030

USD 8.33 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; Italy; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia, South Africa

Key companies profiled

AutoMark Technologies (India) Pvt. Ltd.; The Sherwin-Williams Company; Geveko Markings; Ennis Flint, Inc.; Crown Techno; Dow Inc; The 3M Company; Swarco

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Traffic Road Marking Coatings Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global traffic road marking coatings market report based on product, type, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paint

-

Thermoplastic

-

Performed Polymer Tape

-

Epoxy

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Permanent

-

Removable

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Road Marking Lines

-

Road Marking Labels

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global traffic road marking market size was estimated at USD 4.92 billion in 2021 and is expected to reach USD 5.21 billion in 2022.

b. The global traffic road marking market is expected to grow at a compound annual growth rate of 6.0% from 2022 to 2030 to reach USD 8.27 billion by 2030.

b. Europe dominated the traffic road marking market with a share over of 31% in 2021. This is attributable to the rising usage of high-quality building materials, safety measures, training, and better surveillance on contractors to reduce highway fatalities and increase road safety.

b. Some key players operating in the traffic road marking market include AutoMark Technologies (India) Pvt. Ltd.; Sherwin-Williams Company; Geveko Markings; Ennis Flint, Inc.; Crown Techno; Dow Inc.; 3M Company; and Swarco.

b. Key factors that are driving the traffic road marking market growth include traffic road marking application for signals, signs, and traffic road markings, and an increase in highway and street construction initiatives by the various government across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.