- Home

- »

- Clothing, Footwear & Accessories

- »

-

Trail Running Shoes Market Size, Industry Report, 2030GVR Report cover

![Trail Running Shoes Market Size, Share & Trends Report]()

Trail Running Shoes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Light Trail, Rugged Trail, Off Trail), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-251-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trail Running Shoes Market Summary

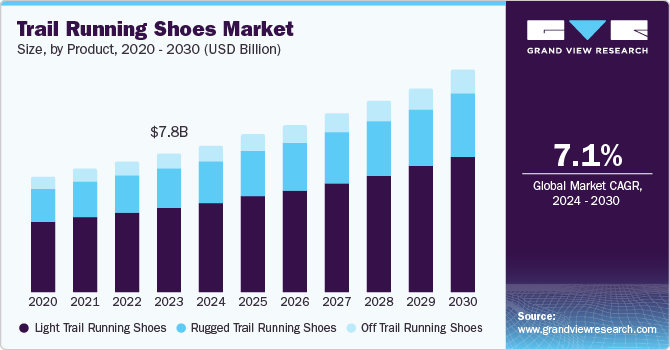

The global trail running shoes market size was estimated at USD 7.82 billion in 2023 and is projected to reach USD 12.54 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The growth is attributed to the increase in demand for trail running, which is expected to grow the product’s demand. In addition, social trends about inclination toward outdoor sports and recreational activities play a vital role in shaping the market.

Key Market Trends & Insights

- The Asia Pacific trail running shoes market held the highest market revenue share of 35.7% in 2023.

- The U.S. trail running shoes market held a significant market share in North America in 2023.

- By product, the light trail running shoes segment dominated the market and accounted for a revenue share of 59.8% in 2023.

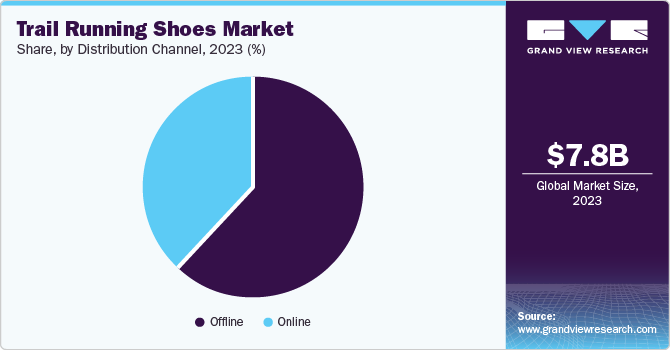

- By distribution channel, the light trail running shoes segment dominated the market and accounted for a revenue share of 59.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.82 Billion

- 2030 Projected Market Size: USD 12.54 Billion

- CAGR (2024-2030): 7.1%

- Asia Pacific: Largest market in 2023

Threats in off-road running have led to more people seeking shoes specifically created for trail running.

Trail running shoes come with durable outsoles with patterned treads that provide maximum traction on rocks, mud, and gravel-the rising popularity of outdoor fitness activities, including trail running. As more individuals seek to engage with nature and maintain an active lifestyle, the demand for specialized footwear that can handle rugged terrains has surged. Moreover, the growing emphasis on health and wellness among consumers has led to an increased focus on physical fitness. Trail running effectively combines cardiovascular exercise with outdoor enjoyment, prompting more people to invest in appropriate footwear.

The availability of e-commerce sites and specialty outdoor retail stores has provided consumers various trail running shoes. This accessibility is helpful for both the experienced runner and the newcomer, which propels the market. For instance, in the Asia-Pacific region, higher levels of urbanization alongside growing disposable income drive people to engage in outdoor activities, thus driving the trail running shoe market. Also, improvements in design, materials, and biomechanics have boosted the efficiency of trail running shoes. Aspects like enhanced grip, gear’s reduced weight, and enhanced shock absorption are valuable for consumers who wish to get the best equipment to facilitate their outdoor activities.

Product Insights

The light trail running shoes segment dominated the market and accounted for a revenue share of 59.8% in 2023. Lightweight shoes are favored by many runners because they reduce fatigue during long-distance runs. The trend towards minimalism in running footwear has led manufacturers to innovate with materials and designs that prioritize weight reduction without sacrificing support or protection. This shift aligns with consumer preferences for agility and speed on trails. In addition, advancements in materials technology have enabled brands to develop lighter yet durable shoes that provide excellent grip, cushioning, and breathability. Innovations such as advanced foam technologies, breathable mesh uppers, and lightweight rubber outsoles contribute to the appeal of light trail running shoes.

The rugged trail running shoes segment is expected to grow at a significant CAGR from 2024 to 2030. Players in the market offer a range of designs tailored for different types of terrain, allowing brands to meet specific needs within the market. The popularity of athleisure wear has expanded the market for versatile footwear, including rugged trail running shoes that can be worn both on and off the trail. In addition, developing advanced materials for outsoles, midsoles, and uppers enhances durability, grip, and comfort. Innovative tread patterns provide superior traction on various surfaces, improving safety and performance. Moreover, online platforms have made it easier for consumers to purchase trail running shoes, expanding the market reach.

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share in 2023 due to product experience, variety, and comparison. Consumers often prefer to try on products before purchasing to ensure proper fit and comfort. Also, these stores allow customers to compare different brands, models and features side-by-side. Understanding local running communities and their preferences helps tailor product offerings and marketing efforts through offline distribution channels. These stores have expanded its reach to the tier 2 tier 3 cities catering to the needs of underserved areas.

The online segment is expected to grow at the fastest CAGR during the forecast period. Online shopping allows consumers to browse a wide range of products from the comfort of their homes, compare prices, read reviews, and make informed decisions without the pressure of in-store sales tactics. E-commerce platforms often provide a broader selection of trail running shoes than physical stores. This variety includes different brands, styles, sizes, and price points that cater to diverse consumer preferences. In addition, social media platforms such as Instagram and Facebook have integrated shopping features that enable brands to showcase their products directly within their feeds. Influencer partnerships also drive traffic and sales through targeted advertising campaigns.

Regional Insights

North America trail running shoes market is expected to grow at significant CAGR during the forecast period due to the increasing participation of people in trail running, growing focus on health and wellness, technological advancement in material, design & manufacturing, and increasing social media influence. Continuous innovation in shoe design, including advanced cushioning technologies, lightweight materials, and superior traction systems, enhances performance on rugged terrains. Moreover, consumers' growing focus on health and wellness has increased interest in outdoor activities that combine physical exertion with mental rejuvenation. Trail running offers a unique blend of cardiovascular exercise and natural immersion, appealing to fitness enthusiasts seeking holistic well-being.

U.S. Trail Running Shoes Market Trends

The U.S. trail running shoes market held a significant market share in North America in 2023 owing to health and wellness trends, technological advancement, and community building through events. The organization of trail running events and races fosters community engagement and brand loyalty among participants, further driving demand for specialized footwear tailored for these activities. For instance, Adidas AG launched a Trail mentorship program to celebrate the commercial launch of its shoes, TERREX offers a mentorship program with Team TERREX, providing personalized coaching and support.

Europe Trail Running Shoes Market Trends

Europe trail running shoes market is expected to grow at a significant CAGR from 2024 to 2030 due to growing health and fitness awareness, technological advancement in footwear, increasing youth engagement in outdoor sports, growing publicity of trail running shoes marketed by key players with the help of online platforms to reach customers. Platforms like Instagram and TikTok have popularized outdoor activities among younger generations. Influencers showcasing their trail running experiences inspire their followers to engage with the sport, leading to increased sales of related gear, including shoes.

UK trail running shoes market held a substantial market share in 2023. The growing trend towards outdoor activities, particularly among health-conscious individuals, has significantly boosted the demand for trail running shoes. As more people seek to engage with nature and participate in outdoor sports, trail running has emerged as a favored choice due to its accessibility and health benefits. Moreover, social media plays a crucial role in promoting outdoor sports like trail running through influencer marketing and community engagement initiatives.

Asia Pacific Trail Running Shoes Market Trends

The Asia Pacific trail running shoes market held the highest market revenue share of 35.7% in 2023. This is mainly attributed to the presence of a large population base, increasing interest in outdoor activities, particularly among younger demographics, increasing focus on health and wellness, the influence of social media and fitness communities, the rise of e-commerce, Moreover increasing urbanization and accessibility of trail running shoes through Brand-owned Retail Stores and Multi-brand Retail Stores have propelled the demand for trail running shoes in the region.

India trail running shoes market is expected to grow significantly due to the increasing popularity of outdoor activities and adventure sports among urban as well as rural youth has led to a surge in demand for specialized footwear. Moreover, the growing awareness of health and fitness, coupled with a rise in lifestyle-related diseases, has motivated individuals to adopt running as a form of exercise. In addition, advancements in shoe technology, including improved cushioning and durability, cater to the needs of serious runners and casual enthusiasts. In addition, the expansion of e-commerce platforms facilitates easy access to a variety of brands and models, enhancing consumer choice.

Key Trail Running Shoes Company Insights

Some of the key companies in the trail running shoes market include VF Corporation, New Balance, Wolverine World Wide, Inc., Brooks Sports, Inc, Adidas AG, Nike, Inc., and others. Organizations are focusing on innovative and efficient trail running shoe offerings to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Adidas AG focuses on performance-driven products that cater to athletes and sports enthusiasts alike. Among its extensive offerings, Adidas AG specializes in trail running shoes designed for rugged terrains. Their trail running shoes feature advanced technologies such as Boost cushioning for energy return, Continental rubber outsoles for superior grip, and lightweight mesh uppers for breathability. Models like the Terrex series exemplify durability and traction, making them ideal for off-road adventures.

-

Nike, Inc. provides a specialized range of trail running shoes designed for outdoor enthusiasts. Its trail running shoes include models like the Nike Wildhorse and Nike Terra Kiger, featuring durable outsoles for enhanced traction, breathable mesh uppers for comfort, and responsive cushioning systems that provide stability on rugged terrain. These shoes are engineered to support runners in various conditions while ensuring optimal performance.

Key Trail Running Shoes Companies:

The following are the leading companies in the trail running shoes market. These companies collectively hold the largest market share and dictate industry trends.

- VF Corporation

- New Balance

- Wolverine World Wide, Inc.

- Brooks Sports, Inc

- Adidas AG

- Nike, Inc.

- SKECHERS USA, Inc.

- ASICS America Corporation

- Deckers Brands

- Amer Sports

Recent Developments

-

In July 2024, Nike AG introduced the Nike Ultrafly, its first trail shoe featuring a carbon Flyplate in the sole. Developed over two years with elite athletes, the Ultrafly is designed for speed and grip on tough terrains. It includes Vibram’s Litebase technology and MegaGrip compound for optimal traction.

-

In August 2023, Adidas AG TERREX introduced the Agravic Speed Ultra, a trail running shoe developed with top athletes over two years. Featuring a LIGHTSTRIKE PRO midsole for cushioning and energy return, integrated Energy Rods for a dynamic stride, and a Continental Rubber outsole for traction, this shoe is designed for ultra-distance races.

Trail Running Shoes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.31 billion

Revenue forecast in 2030

USD 12.54 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

VF Corporation; New Balance; Wolverine World Wide, Inc.; Brooks Sports, Inc; Adidas AG; Nike, Inc.; SKECHERS USA, Inc.; ASICS America Corporation; Deckers Brands and Amer Sports

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trail Running Shoes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global trail running shoes report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Trail Running Shoes

-

Rugged Trail Running Shoes

-

Off Trail Running Shoes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global trail running shoes market size was estimated at USD 6.38 billion in 2019 and is expected to reach USD 6.80 billion in 2020.

b. The global trail running shoes market is expected to grow at a compound annual growth rate of 5.9% from 2019 to 2025 to reach USD 8.92 billion by 2025.

b. North America dominated the trail running shoes market with a share of 32.8% in 2019. This is attributable to the ongoing trend of ultra-trail running in the region, most notably in the U.S. and Canada.

b. Some key players operating in the trail running shoes market include VF Corporation; New Balance Athletics, Inc.; Wolverine World Wide Inc.; Brooks Sports, Inc.; Adidas AG; Nike Inc.; Skechers U.S.A, Inc.; Asics Group; Deckers Outdoor Corporation; and Amer Sports.

b. Key factors that are driving the trail running shoes market growth include the increasing global participation in outdoor sports and the growing popularity of trail running events, including Ultra-Trail du Mont-Blanc (UTMB).

b. Trail running shoes are preferred by consumers over conventional running shoes as they are made specifically for handling rough and rugged terrains, and offer better traction on challenging surfaces.

b. The offline distribution channel led the trail running shoes market in 2018 and is expected to maintain its dominance through 2025, while the online segment is poised to show the fastest growth over the forecast period.

b. The trail running shoes are broadly classified into 3 types that are - light, rugged, and off-trail running shoes, with the light trail and rugged trail segments expected to show the fastest growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.