- Home

- »

- Medical Devices

- »

-

Transcranial Magnetic Stimulation System Market Report, 2033GVR Report cover

![Transcranial Magnetic Stimulation System Market Size, Share & Trends Report]()

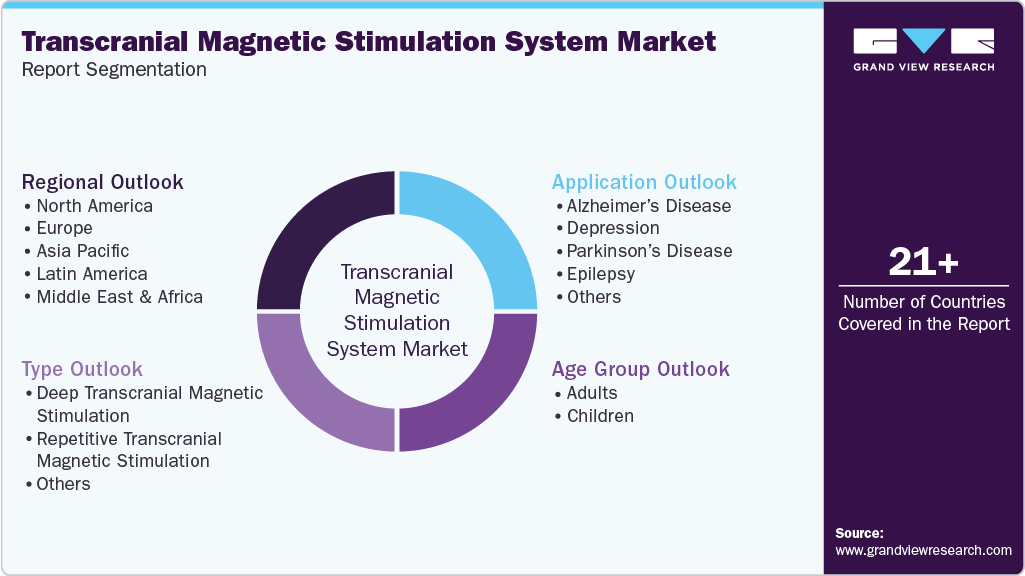

Transcranial Magnetic Stimulation System Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Deep Transcranial Magnetic Stimulation, Repetitive Transcranial Magnetic Stimulation, Others), By Application, By Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-914-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Transcranial Magnetic Stimulation System Market Summary

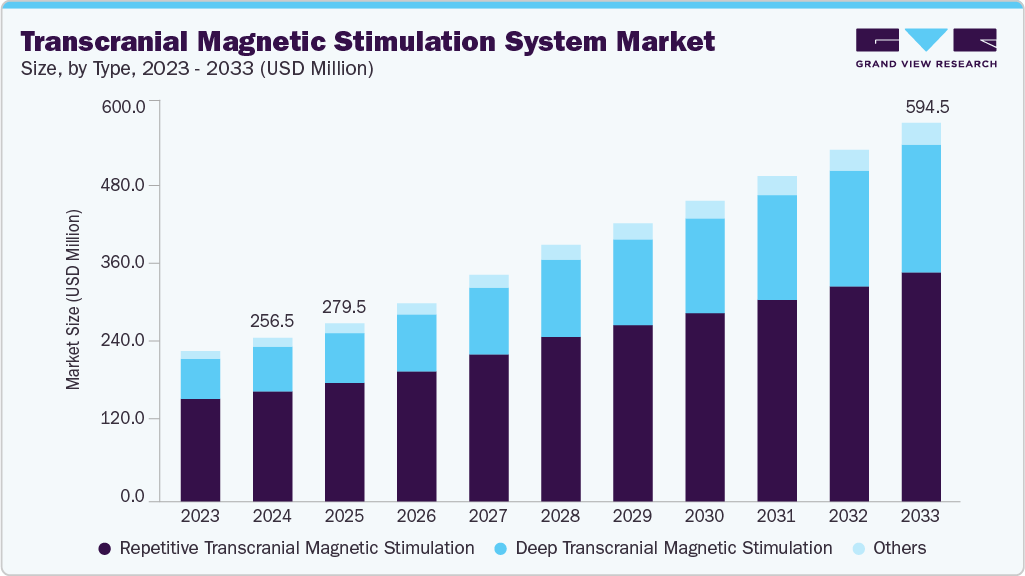

The global transcranial magnetic stimulation system market size was estimated at USD 256.53 million in 2024 and is projected to reach USD 594.49 million by 2033, growing at a CAGR of 9.89% from 2025 to 2033. The global market for transcranial magnetic stimulation system is experiencing significant growth, driven by increasing awareness of neurological disorders, the rising prevalence of neurological and mental health conditions, and a growing number of clinical trials focused on developing innovative TMS systems.

Key Market Trends & Insights

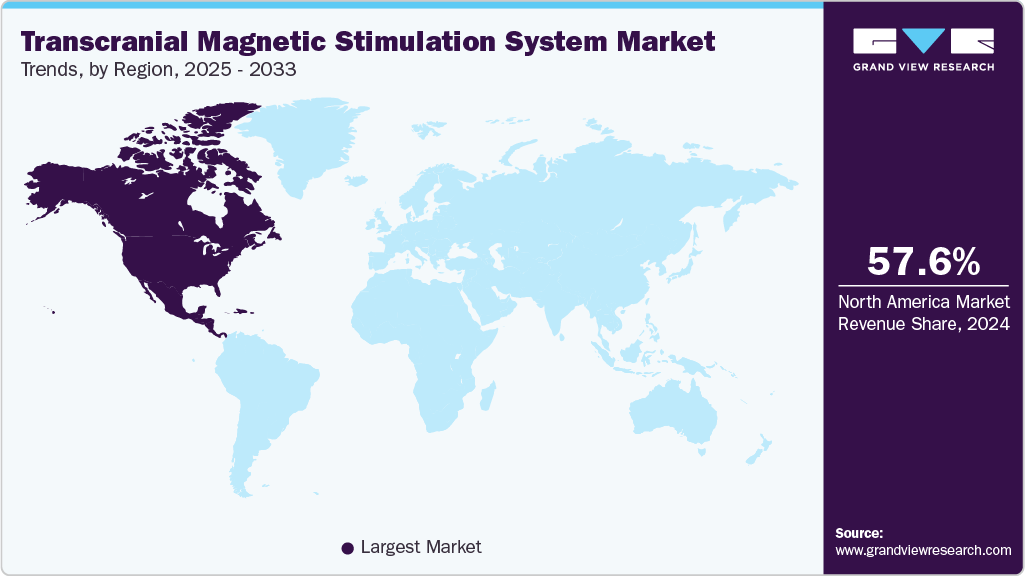

- North America dominated the transcranial magnetic stimulation system industry with the largest revenue share of 57.59% in 2024.

- The transcranial magnetic stimulation system industry in the U.S. accounted for the largest market revenue share of 85.34% in North America in 2024.

- Based on type, the Repetitive Transcranial Magnetic Stimulation (rTMS) segment led the market with the largest revenue share of 67.34% in 2024.

- Based on application, the Alzheimer’s disease segment is expected to grow at the fastest CAGR of 16.13% over the forecast period.

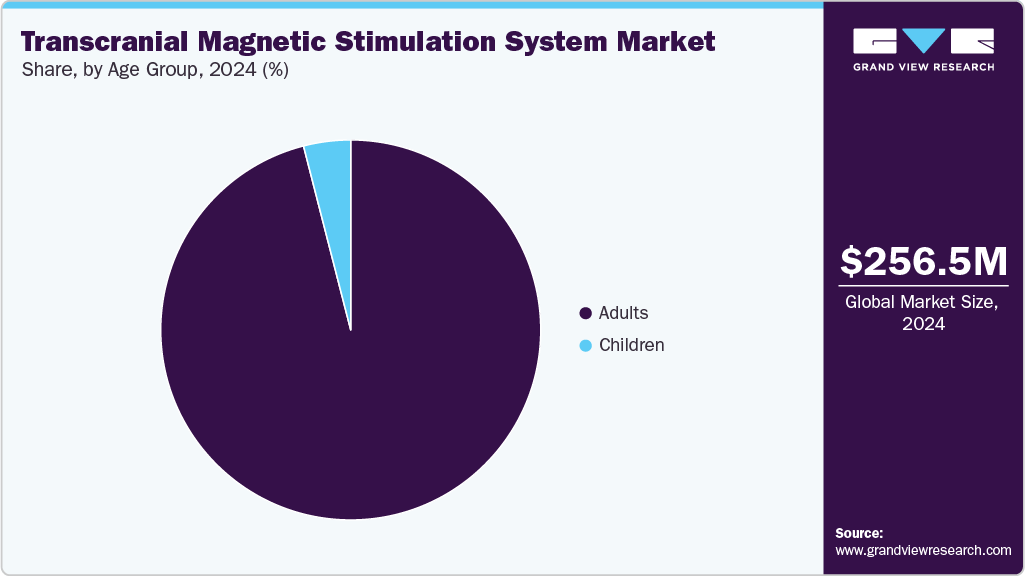

- By age group, the adults segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 256.53 Million

- 2033 Projected Market Size: USD 594.49 Million

- CAGR (2025-2033): 9.89%

- North America: Largest market in 2024

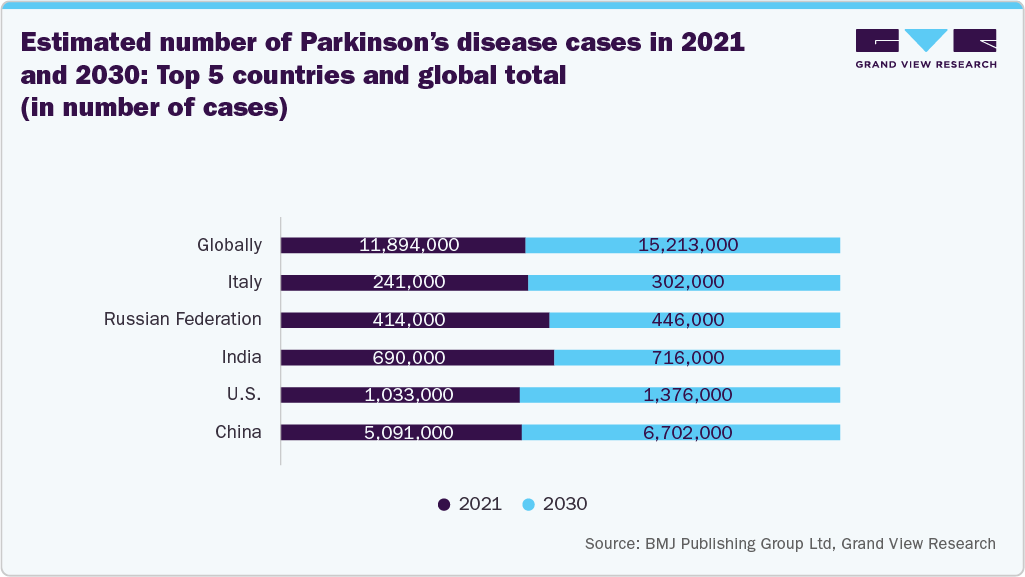

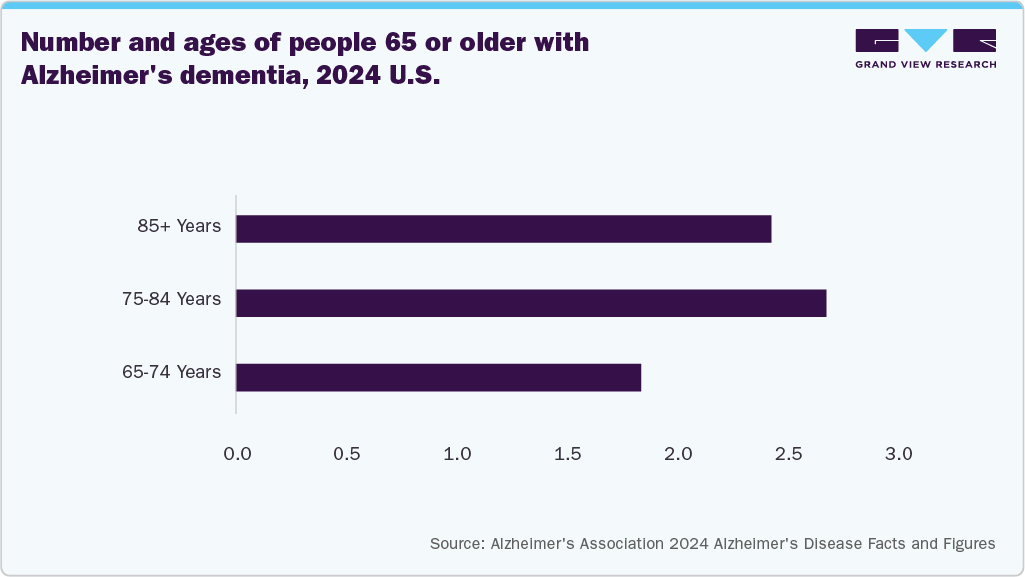

Moreover, the expanding adoption of TMS systems in hospitals and healthcare facilities and a heightened focus on market penetration in both emerging and developed regions are further propelling market expansion. The rising prevalence of neurological disorders, including epilepsy, Parkinson’s disease, Alzheimer’s disease, obsessive-compulsive disorder (OCD), and depression, is a significant driver for the TMS system industry. According to the WHO data published in February 2024, around 50 million people globally are living with epilepsy. In addition, data from the Alzheimer’s Association report published in April 2024 estimates that 6.90 million Americans aged 65 and older are affected by Alzheimer’s dementia.

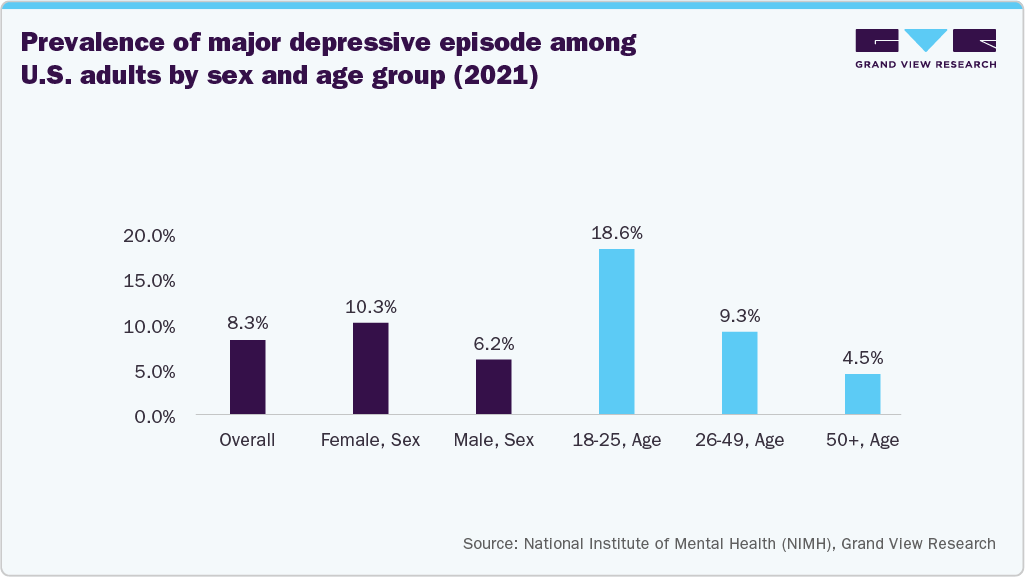

In addition, the WHO reported in August 2025 that approximately 5.7% of the global adult population suffers from depressive disorders. In addition, the study published by the National Library of Medicine in February 2024 reports that OCD is a prevalent disorder that affects around 1% to 3% of the global population. This considerable burden of neurological conditions is expected to fuel the demand for TMS systems, which use magnetic fields to modulate brain activity non-invasively. TMS has proven effective in treating depression and shows promise in managing other neurological disorders.

Furthermore, the growing burden of neurological disorders remains considerable across both developing and developed nations, driving the demand for advanced treatment technologies. For instance, according to the National Institute of Mental Health, an estimated 21.0 million adults in the U.S. experienced at least one major depressive episode in 2021, accounting for 8.3% of the adults. This prevalence highlights the growing need for effective, non-invasive treatment options such as transcranial magnetic stimulation systems.

Companies are endlessly upgrading their existing products by incorporating advanced features and improving user experience to meet the growing needs of researchers and medical professionals. For instance, in July 2025, the updated Magstim Rapid Transcranial Magnetic Stimulation Research System received FDA approval. This enhanced system offers a sleek 15” touchscreen and user-friendly software, thus providing an intuitive interface. Its Windows-based platform allows greater compatibility and all-in-one integration with external devices.

Key features of the new Rapid System include:

-

Enhanced motor-evoked potential (MEP) functionality for excellent signal quality

-

Multiple configurations, including Super Rapid (100Hz), Standard Rapid (50Hz), and Super Rapid Plus1 (100Hz)

-

Streamlined patient data management tools

-

Optional accessories such as TMS carts, treatment chairs, and a variety of standard and sham coils

-

Diverse stimulator pulse configurations, including repetitive, biphasic, standard, and burst stimulation

“The New Magstim Rapid is grounded in research and driven by quality. The Magstim Rapid is one of the most requested and used systems in the world of TMS. Walk into almost any neuroscience research institution or hospital or clinic using neuromodulation and you will likely see a Magstim Rapid. The team worked with users worldwide to build enhancements that will carry the Rapid into the next generation. said Ronnie Stolec-Campo, CEO, Welcony.”

These product upgrades are developed with a focus on clinicians and researchers, and clinicians are expected to fuel market growth by enhancing treatment precision, operational efficiency, and overall user satisfaction.

Furthermore, the rising adoption of advanced technologies such as cloud computing and machine learning to enhance patient outcomes is expected to drive market growth significantly. Market players influence these innovations to develop more precise and effective treatment solutions. For instance, in May 2023, Soterix Medical companny announced patient recruitment for a parcel-guided repetitive transcranial magnetic stimulation (pg-rTMS) depression trial. The company is developing a cloud-based targeting software for pg-rTMS using technology that is licensed from Columbia University. This approach combines machine learning, anatomical magnetic resonance imaging (MRI), and data from the Human Connectome Project (HCP) atlas to develop optimized, personalized rTMS therapy tailored to individual patients.

"Parcel-guided rTMS represents a major technical advance in rTMS therapy by combining three unique SMI technologies. One, Soterix Medical provides the unique FDA-cleared navigation system, not interrupted by line-of-sight issues. Two, Soterix Medical has developed seamless cloud-based systems for neuromodulation optimization. And three, the TMS targeting approach developed by Columbia University provides the key to delivering rTMS therapy optimized to each patient's brain-circuit." Said Dr. Abhishek Datta, CEO and CTO of Soterix Medical.”

Market Concentration & Characteristics

The transcranial magnetic stimulation (TMS) system industry exhibits a high degree of innovation, driven by advancements in coil design, targeting precision, and integration with neuroimaging techniques, enhancing treatment efficacy and expanding applications for neurological and psychiatric disorders. For instance, in September 2025, neurocare group AG, a pioneer in personalized mental health and performance solutions, announced it had obtained FDA clearance to treat Major Depressive Disorder (MDD) in adolescents with its advanced Apollo TMS Therapy devices, a cutting-edge Transcranial Magnetic Stimulation (TMS) system.

Regulations significantly influence the transcranial magnetic stimulation (TMS) system industry by ensuring safety and efficacy, fostering innovation through standardized guidelines, and impacting market entry, pricing, and reimbursement policies, ultimately shaping the industry's growth, adoption rates, and technological advancements. For instance, in the U.S., TMS systems are regulated by the FDA as medical devices under the Federal Food, Drug, and Cosmetic Act. Most TMS systems are classified as Class II devices, considered moderate risk and subject to special controls to ensure safety and effectiveness.

Repetitive Transcranial Magnetic Stimulation Devices Cleared by the U.S. FDA for Major Depression, Migraine, or Obsessive-Compulsive Disorder

Device

Manufacturer

Indication

FDA Clearance No.

FDA Clearance Date

Savi Dual Migraine Therapy

ENeura

Migraine (acute and prophylactic treatment in individuals ≥12 years)

K230358

5/16/2023

NeuroStar Advanced Therapy System

Neuronetics

Major Depressive Disorder

K231926

3/22/2024

Horizon 3.0 TMS Therapy System

Magstim

Major Depressive Disorder, Obsessive-Compulsive Disorder

K222171

1/13/2023

ALTMS Magnetic Stimulation Therapy System

REMED Co., Ltd

Major Depressive Disorder

K220625

4/6/2022

NeuroStar

Neuronetics

Major Depressive Disorder

K083538

12/16/2008

Brainsway Deep TMS System

Brainsway

Major Depressive Disorder

K122288

1/7/2013

Obsessive-Compulsive Disorder

K183303

3/8/2019

SpringTMS Total Migraine System

Eneura

Migraine headache with aura

K140094

5/21/2014

Rapid Therapy System

Magstim

Major Depressive Disorder

K143531

5/8/2015

Magvita

Tonica Elektronik

Major Depressive Disorder

K150641

7/31/2015

Mag Vita TMS Therapy System w/Theta Burst Stimulation

Tonica Elektronik

Major Depressive Disorder

K173620

8/14/2018

Neurosoft

TeleEMG

Major Depressive Disorder

K160309

12/22/2016

Horizon

Magstim

Major Depressive Disorder

K171051

9/13/2017

Horizon TMS Therapy System (Theta Burst Protocol)

Magstim

Major Depressive Disorder

K182853

3/15/2019

Nexstim

Nexstim

Major Depressive Disorder

K171902

11/10/2017

Apollo

Mag & More

Major Depressive Disorder

K180313

5/4/2018

Source: BLUE CARE NETWORK BENEFIT COVERAGE

The transcranial magnetic stimulation system industry has experienced a low but strategic level of mergers and acquisitions (M&A), reflecting the industry's drive for innovation, expanded capabilities, and market consolidation. For instance, in August 2025, BrainsWay announced that it has entered into a strategic equity financing agreement with Axis Management Company, Inc. (“Axis Integrated Mental Health” or “Axis”), a management services organization supporting multiple mental health clinics in Colorado. Under the terms of the agreement, BrainsWay will initially invest USD 2.3 million, with the possibility of an additional USD 1 million milestone-based investment. This will secure a minority stake in Axis through a preferred security with annual compounding. The agreement also includes a redemption mechanism related to the shares.

In the transcranial magnetic stimulation system industry, there are several product substitutes, as a result threat of substitutes is high. Several alternative treatments are available for managing depression and other neurological disorders, including vagus nerve stimulation (VNS), Electroconvulsive Therapy (ECT), and Deep Brain Stimulation (DBS).

Market concentration remains significant, with key players dominating the industry. Major companies such as NeuroStar (Neuronetics), BrainsWay, neuorcare group (AG), and MagVenture, IncNexstim, among others hold substantial market shares due to their extensive product portfolios, brand image, technological advancements, and strong distribution networks. This high level of concentration indicates limited competition and potential barriers for new entrants.

Type Insights

The repetitive transcranial magnetic stimulation segment held the largest revenue share of 67.34% in 2024 as repetitive transcranial magnetic stimulation (rTMS) is the most widely adopted form of TMS therapy, in which repeated magnetic pulses are applied to specific regions of the brain across multiple treatment sessions. rTMS is primarily used to manage major depressive disorder (MDD) and has demonstrated strong effectiveness in alleviating symptoms among patients who have not responded adequately to conventional therapies.

The growing launches of advanced rTMS systems, such as the new Magstim Rapid rTMS System, drives growth in the transcranial magnetic stimulation industry by expanding clinical applications, improving usability, and enhancing research capabilities. With FDA clearance for peripheral nerve stimulation in pain relief, along with advanced features like a 15” touchscreen, Windows-based integration, and improved MEP functionality, the device supports both therapeutic and research needs. These innovations contributes to increasing adoption among healthcare providers and attract broader use in academic and clinical research settings, fueling overall segment growth.

The deep transcranial magnetic stimulation segment is expected to grow at the fastest rate over the forecast period owing to its expanding therapeutic applications, rising prevalence of mental health disorders, and growing regulatory approvals and reimbursements. For instance, in June 2024, BrainsWay announced that the U.S. Food and Drug Administration (FDA) has approved an expanded indication for its Deep Transcranial Magnetic Stimulation system (dTMS). This approval now permits the treatment of patients with MDD aged 22 to 86, extending the previous upper age limit of 68. This expanded FDA approval significantly broadens the potential patient population for Deep TMS therapy, opening opportunities to treat a wider age range of individuals with major depressive disorder.

Application Insights

The depression segment held the largest revenue share in 2024 owing to rising global prevalence of depression, the increasing burden of TRD, and the growing preference for non-pharmacological, non-invasive therapies with fewer side effects compared to antidepressants. For instance, a multicenter study involving over 307 patients showed sustained improvements in depression severity scores after TMS treatment, highlighting its long-term therapeutic potential. In addition, real-world evidence has validated its effectiveness across diverse patient groups, improving adoption in clinical practice.

According to a WHO report published in August 2025, an estimated 4% of the global population is affected by depression. The prevalence is higher among adults, impacting 5.7% overall, 4.6% in men and 6.9% in women, and 5.9% of individuals aged 70 years and older. Globally, approximately 332 million people live with depression, with women being 1.5 times more likely to experience the condition compared to men. In addition, more than 10% of pregnant women and new mothers are affected, highlighting the widespread and diverse impact of this disorder.

The Alzheimer's disease segment is anticipated to witness the fastest growth in 2024 due to ongoing advancements in neurostimulation technology and a growing recognition of TMS as a potential noninvasive therapeutic option for cognitive decline. With the rising prevalence of Alzheimer's disease and other neurodegenerative disorders globally, there is an increasing demand for innovative treatments that can improve patient outcomes. In addition, extensive research and clinical trials are exploring the efficacy of TMS in enhancing neural connectivity and cognitive function in Alzheimer's patients.

Regulatory approvals, expanding clinical evidence supporting TMS as a viable intervention, and growing collaborations in the area of Alzheimer's disease are further fueling market growth over the forecast period. For instance, in June 2025, Nexstim announced that it has entered into an agreement with Sinaptica Therapeutics, Inc. to collaborate on projects related to Alzheimer’s disease. This agreement covers activities planned for 2025, prior to the completion of a definitive agreement anticipated before year-end. In addition, in June 2024, Nexstim disclosed that it had signed a non-binding Letter of Intent with Sinaptica concerning the development, manufacturing, and supply of Sinaptica’s proprietary precision neuromodulation system. This system is based on Nexstim’s NBS 6 platform and features advanced TMS-EEG and neuronavigation capabilities, aimed at treating Alzheimer’s disease and mild cognitive impairment (MCI). As a result, the Alzheimer's disease segment is poised for rapid expansion, driven by unmet medical needs and technological innovation.

Age Group Insights

The adults segment held the largest share in 2024 as adults are more likely to be diagnosed with major depressive disorder and other mental health conditions that are effectively treated with TMS, leading to higher demand within this demographic. In addition, number of TMS systems approved for adults are higher with broader applications as compared to children, and therefore contribute the to highest revenue share of adults segment. Regulatory approvals and clinical guidelines also predominantly support TMS use in adults, further reinforcing its prevalence. As a result, the adults segment remains the primary driver of TMS market growth in 2024, with ongoing research and expanding indications gradually increasing its reach to younger patients in the future.

The children segment is anticipated to witness the fastest CAGR over the forecast period, due to rising awareness of non-invasive treatment options, increasing prevalence of neurodevelopmental disorders, technological advancements in TMS, and the expansion of pediatric neurology and rehabilitation centers.

In addition, expanding clinical trials and regulatory approvals, and expanding coverage are paving the way for broader adoption in pediatric care, while a rising focus on early intervention strategies is driving demand. For instance, in March 2025, Neuronetics announced that Evernorth Health Services, a wholly owned subsidiary of The Cigna Group, has expanded its coverage of NeuroStar Transcranial Magnetic Stimulation (TMS). This expansion now includes adolescents aged 15 and older with major depressive disorder (MDD). Covering approximately 15 million lives, this new policy significantly enhances access to non-drug treatment options for adolescent patients seeking alternatives to medication for depression. This combination of factors is anticipated to propel rapid market expansion within the pediatric segment, making it a key growth driver in the overall TMS market during this period. .

Regional Insights

North America transcranial magnetic stimulation system industry accounted for the largest revenue share of 57.59% in 2024, driven primarily by the rising prevalence of neurological and psychiatric disorders, including depression, anxiety, Parkinson’s disease, and Alzheimer’s disease. In the U.S. and Canada, increasing awareness of non-invasive treatment options and the limitations of conventional pharmacological therapies has accelerated the adoption of TMS, particularly for patients with treatment-resistant conditions.

Technological advancements, such as deep TMS devices capable of targeting deeper brain regions, have expanded the clinical applications of these systems and improved treatment outcomes, further encouraging adoption by hospitals, specialized clinics, and mental health centers. The region benefits from well-established healthcare infrastructure, favorable regulatory frameworks, and growing reimbursement coverage, collectively enhancing patient accessibility.

U.S. Transcranial Magnetic Stimulation System Market Trends

The U.S. transcranial magnetic stimulation system industry held the largest share of 85.34% in 2024 in the North America region owing to growing cases of major depressive disorder. Over the past decade, rates of depression among U.S. adolescents and adults have risen significantly, leading to a growing number of patients who do not respond adequately to pharmacological therapies. TMS offers a non-invasive alternative that has been shown to improve mood, cognitive function, and overall quality of life in individuals with treatment-resistant depression. The rising awareness among healthcare providers and patients about the efficacy of TMS, combined with its relatively low side-effect profile compared to long-term medication use, has fueled adoption in clinics, hospitals, and mental health centers. In addition, the large and diverse patient population, including higher-risk groups such as women, adolescents, and adults with disabilities, further contributes to the expanding demand for TMS therapies.

As per data published by the CDC, in April 2025, the National Center for Health Statistics highlighted a significant rise in depression among U.S. adolescents and adults over the past decade, with prevalence increasing by 60%, according to the National Health and Nutrition Examination Survey (NHANES). Nearly 40% of individuals aged 12 and older with depression received counseling or therapy from a health professional in the previous year. In 2023, more than one in ten U.S. adults took prescription medication for depression, with women (15.3%) more than twice as likely as men (7.4%) to use medication.

Depression was found to be more common in females (16%) than males (10.1%), and its prevalence decreased with age, ranging from 19.2% among adolescents aged 12-19 to 8.7% among adults aged 60 and older. Most individuals with depression (87.9%) reported difficulty performing work, home, or social activities, and 31.2% reported extreme difficulty. Women with depression were also more likely than men to seek therapy or counseling in the past year (43% vs. 33.2%).

Europe Transcranial Magnetic Stimulation System Market Trends

The Europe transcranial magnetic stimulation system industry is witnessing steady growth, driven by the rising prevalence of depression and other neurological and psychiatric conditions, along with increasing demand for non-invasive treatment alternatives. Broader clinical acceptance of repetitive and deep TMS therapies and supportive regulatory frameworks, such as CE marking under the EU Medical Device Regulation, accelerates regional adoption. Favorable reimbursement policies in several countries, including Germany and France, are further encouraging the use of TMS, particularly for treatment-resistant depression. Growing awareness among healthcare providers and patients, along with advancements in device technology, is also contributing to wider accessibility.

The UK transcranial magnetic stimulation system industry is driven by depression and epilepsy as the two major clinical areas driving the demand for TMS systems. Depression, particularly treatment-resistant depression, affects a large segment of the population and continues to strain the NHS, with rising prevalence among both adults and young people. Traditional therapies such as antidepressants and psychotherapy often fail to achieve adequate outcomes in severe cases, creating a strong need for advanced, non-invasive options like TMS. At the same time, epilepsy represents another important driver, as patients who do not respond well to anti-epileptic drugs are increasingly being considered for neuromodulation-based approaches. TMS offers potential benefits in reducing seizure frequency and improving cognitive function without the systemic side effects of long-term drug therapy. Growing clinical validation, NHS pilot programs, and increasing awareness among neurologists and psychiatrists are further accelerating the adoption of TMS for these indications. As per data published by the Epilepsy Society, in August 2025, in the UK, epilepsy affects over 100,000 children and young people, with 23 new cases diagnosed every day. Epilepsy can start at any age, including in childhood.

Asia Pacific Transcranial Magnetic Stimulation System Market Trends

The Asia Pacific transcranial magnetic stimulation system industry is witnessing significant growth, fueled by rising awareness and demand for non-invasive treatments for neurological and psychiatric disorders. The increasing prevalence of conditions such as depression, anxiety, Parkinson’s disease, and Alzheimer’s disease is driving both patient and healthcare provider interest in TMS as an effective alternative to conventional therapies. Technological advancements, including deep TMS devices capable of targeting deeper brain regions, are expanding the clinical applications of TMS and improving treatment outcomes. Growth is further supported by expanding healthcare infrastructure, establishing specialized clinics, and government initiatives in several APAC countries promoting advanced medical treatments. The market is highly competitive, with both local and global players focusing on innovation, enhanced treatment protocols, and broader accessibility.

The China transcranial magnetic stimulation system industry is experiencing growth due to a convergence of demographic, clinical, technological, and policy-driven factors. The rising prevalence of mental health disorders, particularly depression and anxiety, has significantly increased the demand for innovative, non-invasive therapies such as TMS. Urbanization, lifestyle changes, and heightened social pressures have contributed to higher rates of psychiatric conditions, making advanced treatment modalities increasingly necessary. At the same time, China’s rapidly aging population is driving a surge in neurodegenerative disorders, including Alzheimer’s disease, which expands the potential patient base for TMS therapies targeting cognitive decline and associated psychiatric symptoms. Technological advancements in TMS devices, including improved precision, safety, and efficacy, facilitate wider clinical adoption across hospitals, psychiatric clinics, and specialized neurology centers.

Latin America Transcranial Magnetic Stimulation System Market Trends

The Latin America transcranial magnetic stimulation system industry is experiencing growth, driven by the rising prevalence of depression, anxiety disorders, and other neurological conditions across the region. Countries such as Brazil and Argentina are witnessing increasing adoption of TMS therapy due to its non-invasive nature and strong clinical outcomes in treatment-resistant depression. Growing mental health awareness, combined with a shift in healthcare priorities toward neurological and psychiatric care, is supporting therapy’s acceptance among both healthcare providers and patients.

Middle East & Africa Transcranial Magnetic Stimulation System Market Trends

The Middle East & Africa transcranial magnetic stimulation system industry is expanding, supported by the rising burden of depression, anxiety, and other neurological disorders in the region. Countries in the Gulf Cooperation Council (GCC), such as Saudi Arabia, the UAE, and Kuwait, are leading adoption due to substantial healthcare investments, modernization of mental health infrastructure, and government initiatives to reduce the stigma around psychiatric care.

Key Transcranial Magnetic Stimulation System Company Insights

The transcranial magnetic stimulation system industry is moderately fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in transcranial magnetic stimulation system market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the transcranial magnetic stimulation system industry is predicted to grow during the forecast period.

Key Transcranial Magnetic Stimulation System Companies:

The following are the leading companies in the transcranial magnetic stimulation system market. These companies collectively hold the largest market share and dictate industry trends.

- Nexstim

- BrainsWay

- Magstim (Welcony)

- MagVenture A/S

- eNeura, Inc.

- NeuroStar (Neuronetics)

- Neurosoft

- CloudNeuro

- Soterix Medical Inc.

- Brain Ultimate Inc.

- DEYMED Diagnostic s.r.o.

- Salience TMS (Salience Health)

- NeuroQore (Ontario Brain Institute)

- SEBERS Medical

- neurocare group AG (MAG & More)

- Shenzhen Yingchi Technology Co., Ltd.

- Shanghai Goodmed Medical Device Co., Limited

- Guangzhou MeCan Medical Limited

- Others

Recent Developments

-

In September 2025, neurocare group AG, a pioneer in personalized mental health and performance solutions, announced it had obtained FDA clearance to treat Major Depressive Disorder (MDD) in adolescents with its advanced Apollo TMS Therapy devices, a cutting-edge Transcranial Magnetic Stimulation (TMS) system.

-

In August 2025, neurocare group AG announced that it had received FDA clearance to treat Obsessive-Compulsive Disorder (OCD) using its advanced Apollo TMS Therapy devices, a cutting-edge system in Transcranial Magnetic Stimulation.

-

In August 2025, BrainsWay announced that it has entered into a strategic equity financing agreement with Axis Management Company, Inc. (“Axis Integrated Mental Health” or “Axis”), a management services organization supporting multiple mental health clinics in Colorado. Under the terms of the agreement, BrainsWay will initially invest USD 2.3 million, with the possibility of an additional USD 1 million milestone-based investment. This will secure a minority stake in Axis through a preferred security with annual compounding. The agreement also includes a redemption mechanism related to the shares.

-

In July 2025, neurocare group AG announced the acquisition of MeJa Psychologie, a reputable psychological care provider based in the Netherlands with a focus on perinatal mental health. This strategic acquisition increases neurocare’s clinic network to 11 locations across the Netherlands and represents an important move into specialized care for pregnancy, early parenthood, and family wellbeing.

-

In July 2025, Magstim announced the release of the New Magstim Rapid TMS System, a powerful update to one of the most trusted TMS devices in neuroscience.

-

In June 2025, Magstim announced a significant milestone: the Magstim Horizon 3.0 system with StimGuide Pro neuro-navigation has officially received MDR (Medical Device Regulation) approval and is now in use by customers across the EU for Transcranial Magnetic Stimulation (TMS).

-

In June 2025, BrainsWay announced that it has entered into a strategic equity financing agreement with Stella MSO, LLC (“Stella Mental Health” or “Stella”). Stella is a management services organization supporting over 20 mental health clinics across the U.S. and Israel, which have collectively treated more than 30,000 patients to date.

-

In June 2025, Nexstim announced that it has entered into an exclusivity agreement (“Exclusivity Agreement”) with Sinaptica Therapeutics, Inc. (“Sinaptica”) as part of their planned collaboration in the field of Alzheimer’s disease. This agreement pertains to activities in 2025 and precedes the anticipated finalization of a definitive agreement (“Definitive Agreement”) expected before the end of the year.

Transcranial Magnetic Stimulation System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 279.46 million

Revenue forecast in 2033

USD 594.49 million

Growth Rate

CAGR of 9.89% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, age group, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA)

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, Kuwait and UAE.

Key companies profiled

Nexstim; BrainsWay; Magstim (Welcony); MagVenture A/S; eNeura, Inc.; NeuroStar (Neuronetics); Neurosoft; CloudNeuro; Soterix Medical Inc.; Brain Ultimate Inc.; DEYMED Diagnostic s.r.o.; Salience TMS (Salience Health); NeuroQore (Ontario Brain Institute); SEBERS Medical; neurocare group AG (MAG & More); Shenzhen Yingchi Technology Co., Ltd.; Shanghai Goodmed Medical Device Co., Limited; Guangzhou MeCan Medical Limited; Others.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transcranial Magnetic Stimulation System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global transcranial magnetic stimulation system market report based on type, application, age group, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Deep Transcranial Magnetic Stimulation

-

Repetitive Transcranial Magnetic Stimulation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Alzheimer’s Disease

-

Depression

-

Parkinson’s Disease

-

Epilepsy

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Adults

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global transcranial magnetic stimulation system market size was estimated at USD 256.53 million in 2024 and is expected to reach USD 279.46 million in 2025.

b. The global transcranial magnetic stimulation system market is expected to grow at a compound annual growth rate of 9.89% from 2025 to 2033 to reach USD 594.49 million by 2033.

b. Repetitive Transcranial Magnetic Stimulation (rTMS) dominated the transcranial magnetic stimulator market with a share of 67.34% in 2024. This is attributable to increasing preference by the surgeons and increased application of rTMS.

b. Some of the key players operating in the transcranial magnetic stimulation system market include NeuroStar (Neuronetics), BrainsWay, neurocare group AG, Magstim (Welcony), eNeura Inc. (Aruene Corp.), MagVenture, Inc., Nexstim, SEBERS Medical, DEYMED Diagnostic s.r.o., and Soterix Medical Inc.

b. Key factors that are driving the transcranial magnetic stimulation system market growth include Increasing prevalence of neurological disorders, technological advancements, increasing awareness towards products, and increasing incidence of psychological disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.