- Home

- »

- Medical Devices

- »

-

Transdermal Skin Patches Market Size & Share Report, 2030GVR Report cover

![Transdermal Skin Patches Market Size, Share & Trends Report]()

Transdermal Skin Patches Market Size, Share & Trends Analysis Report By Type (Multi-layer Drug-in-Adhesive), By Application (Pain Relief), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-361-1

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Transdermal Skin Patches Market Trends

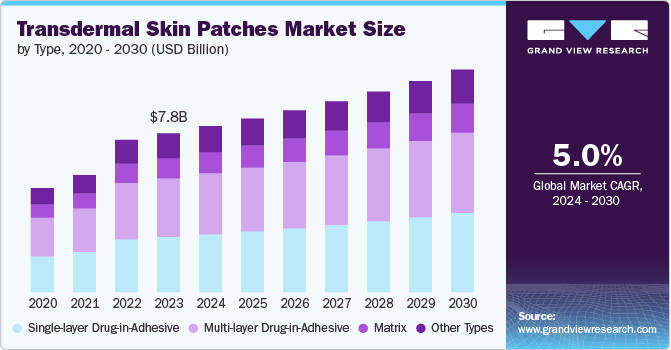

The global transdermal skin patches market was estimated at USD 7.82 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, chronic pain, etc., increased consumer preference for minimally invasive treatment, the aging global population, and technological advancements in transdermal drug delivery systems have significantly boosted the market.

Transdermal patches provide a noninvasive, convenient alternative to traditional oral and injectable medications. They enhance patient compliance and minimize the gastrointestinal side effects that often accompany oral drugs. This ease of use and consistent drug release over extended periods make transdermal patches particularly attractive for managing chronic conditions.

The market is experiencing significant growth, primarily driven by the increasing prevalence of chronic diseases worldwide. According to the CDC report published in February 2024, an estimated 129 million people in the U.S. have at least 1 major chronic disease, such as cancer, heart disease, obesity, diabetes, and hypertension. Managing chronic pain typically involves regular administration of pain relief medication, which can be cumbersome with oral or injectable forms due to their side effects and the need for frequent dosing.

Transdermal patches offer a solution by providing a controlled release of medication over extended periods, which enhances patient compliance and improves therapeutic outcomes. For instance, the fentanyl transdermal patch, used for managing severe chronic pain, delivers the drug continuously for 72 hours, reducing the need for frequent dosing and maintaining steady pain relief.

Innovations in drug delivery systems, including microneedles, iontophoresis, and permeation enhancers, have significantly broadened the scope of transdermal medication delivery, accommodating large molecules and biologics. Microneedle patches create microscopic channels in the skin, enabling the administration of large molecule drugs that are otherwise difficult to deliver transdermal. A notable example is the microneedle patch for insulin delivery in diabetic patients, which offers a painless alternative to daily injections, potentially improving glycemic control. Iontophoresis, another breakthrough technology, employs a small electric charge to enhance drug penetration through the skin. For instance, IontoPatch delivers anti-inflammatory drugs to treat conditions like tendinitis and bursitis, increasing the drug's absorption and effectiveness. These advancements boost the efficiency and reliability of transdermal delivery systems and introduce new therapeutic possibilities, driving market growth and expanding the range of treatable conditions through non-invasive means.

The rising consumer preference for minimally invasive treatments significantly drives the market. Patients and healthcare providers favor these patches for reduced pain, lower infection risk, and fewer side effects than oral medications or injections. For instance, hormone replacement therapy patches Estraderm Mx Patch by Biochemie Novartis offer a steady hormone release, minimizing side effects linked to fluctuating levels seen with oral HRT. In addition, patches for smoking cessation, pain management, and neurological disorders provide a discreet and convenient drug delivery method. This non-invasive approach enhances patient comfort and compliance, boosting the market growth as awareness of these benefits spreads.

Type Insights

Based on the type, multi-layer drug-in-adhesive transdermal patches held the largest market share of 36.95% in 2023, driven by their superior drug delivery efficiency and versatility across various applications. These innovative patches incorporate multiple adhesive layers, each infused with the active pharmaceutical ingredient (API), allowing controlled and sustained drug release over an extended period. This advanced design minimizes the risk of dose dumping and ensures a consistent therapeutic effect. For instance, the Fentanyl transdermal patch, commonly used for chronic pain management, employs a multi-layer structure to deliver continuous pain relief over 72 hours. This significantly enhances patient comfort and adherence to the treatment regimen compared to oral painkillers that require frequent dosing. These patches' extended-release and reduced dosing frequency make them more convenient for patients, particularly those managing chronic conditions. Similarly, the Clonidine transdermal patch, used for hypertension, offers a weekly dosing schedule, enhancing patient adherence and ensuring better blood pressure control compared to daily oral tablets.

Matrix is expected to grow at the fastest CAGR of 5.5% during the forecast period. This growth is attributed to their enhanced formulation flexibility and cost-effective manufacturing. In matrix patches, the active pharmaceutical ingredient (API) is dispersed within a polymer matrix, allowing for a uniform distribution and consistent drug release. This design offers significant flexibility in formulating various APIs, making developing patches for different therapeutic applications easier. For instance, the Nicotine transdermal patch, widely used for smoking cessation, employs a matrix design that provides a steady release of nicotine throughout the day. This steady release helps to reduce withdrawal symptoms and cravings, significantly improving the success rates of smoking cessation programs.

Application Insights

The pain relief segment held the largest market share of 23.18% in 2023 due to the increasing prevalence of chronic pain conditions. Chronic pain stemming from conditions like arthritis, fibromyalgia, and lower back pain affects millions globally, driving demand for effective and manageable pain relief solutions. The Institute for Health Metrics and Evaluation report published in August 2023 predicts that by 2050, 1 billion people will be affected by osteoarthritis, with 15% of individuals aged 30 and older currently experiencing it. Transdermal patches provide a continuous and controlled release of analgesics, ensuring sustained pain relief without the peaks and troughs associated with oral medications. They eliminate the need for multiple daily doses, injections, or complex medication regimens, making them particularly suitable for patients with chronic pain who require long-term treatment. For instance, the buprenorphine transdermal patch, used for managing moderate to severe chronic pain, provides a week-long release of medication. This convenience is especially beneficial for elderly patients or those with mobility issues, who may find it challenging to adhere to frequent dosing schedules. These patches' discreet nature and ease of application further contribute to their popularity among patients and healthcare providers.

The smoking reduction segment is anticipated to grow at the fastest CAGR in the market, driven by the increasing awareness of the health risks associated with smoking. According to the estimations published by WHO in July 2023, smoking tobacco kills more than 8 million people each year. Public health campaigns and stringent regulations on tobacco use have heightened awareness about the dangers of smoking, including lung cancer, cardiovascular diseases, and respiratory conditions. Nicotine transdermal patches offer a proven, non-invasive solution for smoking cessation by delivering a controlled dose of nicotine to alleviate withdrawal symptoms and reduce cravings. For instance, in April 2023, Rusan Pharma initiated a campaign to promote tobacco cessation, featuring their brand '2baconil', a 24-hour nicotine transdermal patch.

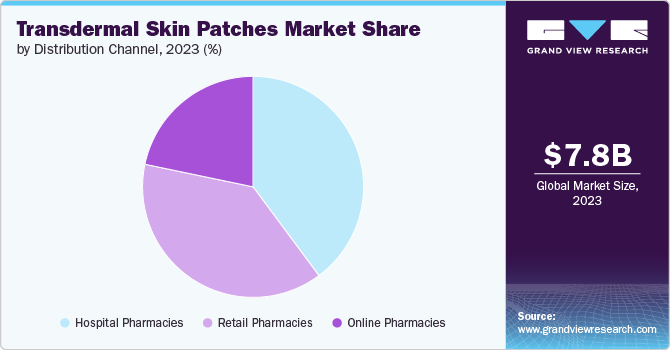

Distribution Channel Insights

The hospital pharmacies segment held the largest market share of 39.83% in 2023, driven by the high patient traffic and trust associated with hospitals. Hospitals cater to a large number of patients daily, providing a steady demand for various medications, including transdermal patches. Patients often rely on hospital pharmacies for their prescriptions following hospital visits or stays, ensuring a consistent and reliable distribution channel for these products. Moreover, hospital pharmacists' professional guidance and support are crucial in educating patients about the correct use of transdermal patches, their benefits, and potential side effects. This expert advice is particularly important for first-time users or those using patches for complex treatments, such as hormone replacement therapy or pain management.

Online pharmacies is expected to grow at the fastest CAGR of 5.4% during the forecast period. The increasing adoption of e-commerce and online shopping has significantly broadened the availability of healthcare products, including transdermal patches. Platforms like Amazon and Walgreens offer a diverse range of transdermal patches, catering to patients managing chronic conditions with enhanced convenience and accessibility. Moreover, the COVID-19 pandemic accelerated the shift towards online shopping across all sectors, including healthcare. This shift was driven by the preference for contactless transactions and the convenience of shopping from home. As habits formed during the pandemic persist, the online pharmacies segment is expected to grow robustly.

Regional Insights

North America dominated the market with a revenue share of 35.90% in 2023 due to the advanced healthcare infrastructure and regulatory frameworks that facilitate developing and approving innovative transdermal patch technologies. Moreover, the high prevalence of chronic diseases such as diabetes, cardiovascular disorders, and chronic pain conditions in North America fuels the demand for effective and convenient treatment options like transdermal patches. The CDC reports that cigarette smoking is the leading cause of preventable disease, disability, and death in the U.S., with over 480,000 deaths annually. In 2021, 11.5% of U.S. adults aged 18 or older smoked cigarettes, resulting in 28.3 million adults and over 16 million Americans living with smoking-related diseases.

Europe Transdermal Skin Patches Market Trends

The transdermal skin patches market in Europe is characterized by stringent regulations, high disease prevalence driving demand, a focus on innovation, and increasing acceptance of non-invasive treatment options. Regulatory bodies such as the European Medicines Agency (EMA) play a crucial role in overseeing the approval and monitoring of these products, fostering consumer trust and market growth. Pharmaceutical companies and research institutions in countries like Germany, UK, and France are at the forefront of innovation in transdermal drug delivery systems, exploring new formulations and delivery mechanisms to enhance therapeutic outcomes and patient convenience.

Asia Pacific Transdermal Skin Patches Market Trends

The transdermal skin patches market in Asia Pacific is anticipated to witness significant growth over the forecast period owing to the region's large and rapidly growing population, rising disposable incomes and urbanization, and increasing healthcare spending and demand for advanced medical treatments. As awareness of chronic diseases such as diabetes, cardiovascular disorders, and pain management grows, there is a corresponding rise in demand for effective and convenient drug delivery systems like transdermal patches. According to the report published by the Shanghai Municipal People's Government in July 2023, China's elderly population, comprising 190 million, faces a significant public health issue due to chronic diseases. The National Health Commission reports that 75% of those over 60 have one chronic disease, and 43% have at least two. Chronic diseases are the leading cause of death for Chinese people, accounting for 86.6% of all deaths.

Key Transdermal Skin Patches Company Insights

This market is highly competitive, with several major players competing for market share. These companies are investing heavily in R&D, forming strategic partnerships, and launching new products to differentiate themselves. Their focus on technological advancements to improve patient care is driving significant revenue growth in the market.

Key Transdermal Skin Patches Companies:

The following are the leading companies in the transdermal skin patches market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd

- Novartis AG

- Teikoku Pharma USA Inc.

- Viatris Inc.

- Johnson & Johnson

- Luye Pharma Group

- Purdue Pharma Manufacturing LP

- Henan Lingrui Pharmaceutical Ltd

- Samyang Biopharmaceuticals Corp.

- Hisamitsu Pharmaceutical Co, Inc.

Recent Developments

-

In September 2023, Corium, LLC, a biopharmaceutical company, published data confirming the success of its donepezil transdermal system, ADLARITY, in a placebo-controlled trial with healthy volunteers. It is the first U.S. FDA-approved donepezil transdermal system for patients with mild, moderate, and severe Alzheimer's dementia.

-

In September 2023, Zydus Lifesciences Ltd announced the final approval from the U.S. Food and Drug Administration (USFDA) for its Norelgestromin and Ethinyl Estradiol Transdermal System. This skin patch delivers a combination hormone medication designed to prevent pregnancy effectively.

-

In August 2023, Yaral Pharma, the U.S. generics subsidiary of IBSA, introduced the Lidocaine Patch 5%, positioned as an AB-rated equivalent to Lidoderm. This prescription-strength lidocaine patch is a significant addition to Yaral Pharma's lineup of non-opioid prescription products designed to alleviate pain and inflammation effectively.

Transdermal Skin Patches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.17 billion

Revenue forecast in 2030

USD 10.95 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors and trends, clinical trials outlook, volume analysis

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd; Novartis AG; Teikoku Pharma USA Inc.; Viatris Inc.; Johnson & Johnson; Luye Pharma Group; Purdue Pharma Manufacturing LP; Henan Lingrui Pharmaceutical Ltd; Samyang Biopharmaceuticals Corp.; Hisamitsu Pharmaceutical Co, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transdermal Skin Patches Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global transdermal skin patches market based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single-layer Drug-in-Adhesive

-

Multi-layer Drug-in-Adhesive

-

Matrix

-

Other Types

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pain Relief

-

Smoking Reduction and Cessation Aid

-

Cardiovascular Disorders

-

Neurological Disorders

-

Hormonal Therapy

-

Other Applications

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transdermal skin patches market size was estimated at USD 7.82 billion in 2023 and is expected to reach USD 8.17 billion in 2024.

b. The global transdermal skin patches market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 10.95 billion by 2030.

b. North America dominated the transdermal skin patches market with a share of 35.90% in 2023. This is attributable to huge investments undertaken by prominent as well as new market entrants.

b. Some key players operating in the transdermal skin patches market include Teva Pharmaceutical Industries Ltd; Novartis AG; Teikoku Pharma USA Inc.; Viatris Inc.; Johnson & Johnson; Luye Pharma Group; Purdue Pharma Manufacturing LP; Henan Lingrui Pharmaceutical Ltd; Samyang Biopharmaceuticals Corp.; Hisamitsu Pharmaceutical Co, Inc.

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases, where conventional drug delivery systems, such as oral drugs have lower potency due to the hepatic first-pass metabolism.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."