- Home

- »

- Plastics, Polymers & Resins

- »

-

Transparent Barrier Packaging Films Market Report, 2030GVR Report cover

![Transparent Barrier Packaging Films Market Size, Share & Trends Report]()

Transparent Barrier Packaging Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PE, EVOH, PP, PET, PA, PVDC, BOPP), By Application (Food & Beverages, Pharmaceutical, Personal Care Product), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-9

- Number of Report Pages: 172

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

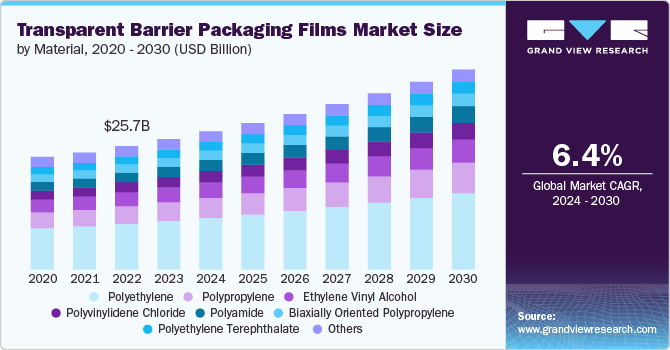

The global transparent barrier packaging films market size was estimated at USD 27.15 billion in 2023 and is expected to expand at a CAGR of 6.35% from 2024 to 2030. The rising preference for transparency that enables consumers to see the product before purchasing is driving the market. Additionally, the growing food and beverage industries is fueling the demand for transparent barrier packaging.

Another notable trend in the market is the increasing focus on sustainable and eco-friendly materials. More businesses are shifting towards using biodegradable and recyclable materials for transparent barrier packaging to reduce their environmental impact. This trend is driven by increasing consumer demand for eco-friendly products and stricter environmental regulations. By adopting sustainable packaging solutions, companies aim to enhance their brand image, meet regulatory requirements, and attract environmentally conscious consumers.

Drivers, Opportunities & Restraints

The rising preference for packaging that allows consumers to see the product before purchasing is a major driver for the Transparent Barrier Packaging Films Market. This type of packaging builds trust and confidence in the product's quality by providing visibility, which is particularly important for food items where freshness and appearance matter. Additionally, the expanding food and beverage industry is fueling the demand for transparent barrier packaging, as it helps keep products fresh and extends their shelf life by protecting against moisture, oxygen, and other gases. Companies are increasingly choosing this packaging to meet consumer expectations and stand out in the competitive market.

Expansion in emerging markets presents significant growth opportunities for the Transparent Barrier Packaging Films Market. As these regions undergo rapid urbanization and experience rising disposable incomes, the demand for packaged foods, beverages, and consumer goods is increasing. Consumers in these markets are looking for high-quality products with extended shelf life, which transparent barrier packaging can provide by protecting products from moisture, oxygen, and other gases. The visibility offered by transparent packaging builds trust and confidence in product quality. This growing need for advanced packaging solutions creates a promising opportunity for companies to expand their presence and tap into these developing markets.

Meeting stringent regulatory standards for packaging materials, especially in the food and pharmaceutical industries, poses a significant challenge for the Transparent Barrier Packaging Films Market. Companies must invest heavily in research, testing, and certification processes to ensure their packaging complies with these regulations. This involves extensive and costly efforts to meet safety, quality, and environmental standards, which can be a barrier for smaller companies or those with limited resources. Moreover, the constantly evolving nature of regulations requires ongoing investment to stay compliant, further increasing costs and complexity for manufacturers. This regulatory burden can slow down the introduction of new products and innovations in the market, impacting overall growth and competitiveness.

Material Insights

Based on material, Polyethylene (PE) held the market with the largest revenue share of 37.24% in 2023. PE is widely used in various packaging applications owing to its excellent moisture resistance, good clarity, and strong mechanical properties. These characteristics make PE an ideal choice for packaging perishable food products, pharmaceuticals, and consumer goods that require protection from moisture and contaminants while allowing visibility of the product.

Polyamide (PA) are another significant category within the Transparent Barrier Packaging Films Market, known for their exceptional barrier properties, strength, and versatility. Polyamide, commonly known as nylon, is valued for its high resistance to punctures, chemicals, and oxygen, making it an ideal material for preserving the freshness and integrity of packaged goods.

Polypropylene (PP) is increasingly being integrated with advanced technologies to create interactive and intelligent packaging solutions. These smart packages can feature QR codes, RFID tags, and even embedded sensors that provide real-time information about the product, such as freshness indicators for food items or authentication for pharmaceuticals.

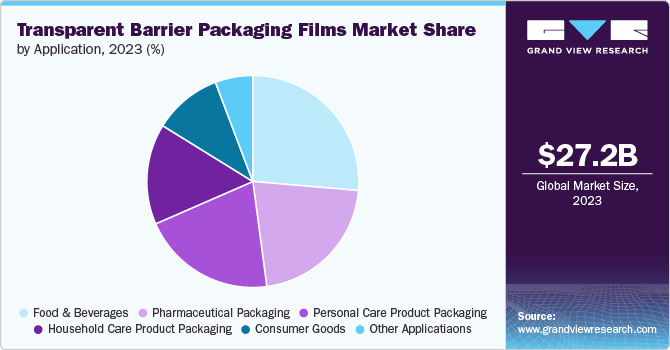

Application Insights

Based on application, food & beverages held the market with the largest revenue share of 41.18% in 2023, driven by the growing consumer preference for convenience foods. As busy lifestyles lead more people to seek ready-to-eat meals and packaged snacks, manufacturers are turning to transparent barrier packaging to ensure these products remain fresh and appealing. This packaging not only extends shelf life but also enhances the product’s visual appeal, allowing consumers to see the quality of the food inside.

The personal care product packaging segment of the market is rapidly expanding, driven by the growing demand for high-quality and visually appealing packaging solutions. This segment includes a wide range of products, such as cosmetics, skincare items, shampoos, and other toiletries, where packaging plays a critical role in brand image and consumer trust.

Regional Insights

North America transparent barrier packaging films market is driven by stringent regulatory standards. Regulatory bodies such as the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) enforce strict food safety and packaging standards, encouraging the adoption of high-quality transparent barrier solutions. This compliance not only ensures product safety but also helps brands differentiate themselves in a competitive market by showcasing their products clearly.

U.S. Transparent Barrier Packaging Films Market Trends

The transparent barrier packaging films market of the U.S. is characterized by high level of disposable income and the emergence of e-commerce industry.With e-commerce continuing to expand, businesses are increasingly investing in high-quality packaging solutions that can withstand the rigors of delivery while still showcasing their products effectively.

Asia Pacific Transparent Barrier Packaging Films Market Trends

Asia Pacific transparent barrier packaging films market dominated the global market and accounted for largest revenue share of 37.66% in 2023. The Asia-Pacific (APAC) region, characterized by rapid urbanization coupled with the increasing population in the region is driving the demand for food & beverages, pharmaceutical packaging, personal care product packaging and other industry-based products.

The Asia-Pacific region an expansion of the middle-class population. The burgeoning middle class in countries like China, India, and Indonesia is driving demand for premium and branded products. This demographic shift is leading to higher consumption of packaged foods, beverages, and personal care items, all of which benefit from transparent barrier packaging. The middle-class consumers’ preference for transparency and quality assurance makes transparent packaging a preferred choice.

Europe Transparent Barrier Packaging Films Market Trends

The transparent barrier packaging films market of Europe is projected to witness significant growth. Consumers are increasingly prioritizing health and sustainability, leading to a high demand for organic and natural products. This trend is driven by a growing awareness of the benefits of organic foods and natural personal care products, which are perceived to be healthier, safer, and more environmentally friendly. As a result, transparent barrier packaging has become essential in this market.

KeyTransparent Barrier Packaging Films Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Amcor Plc, Bemis Company, Inc., Berry Global, Inc., Mondi Group, Toray Industries, Inc., Uflex Ltd., Toppan Printing Co., Ltd., and Wipak Group. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Transparent Barrier Packaging Films Companies:

The following are the leading companies in the transparent barrier packaging films market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Bemis Manufacturing Company

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- DS Smith

- 3M

- Mitsubishi Chemical Advanced Materials

- Innovia Films

- TOPPAN INC.

- Daibochi Berhad

- Klöckner Pentaplast

- OIKE & Co., Ltd.

- Mondi

- DuPont

- Celplast Metallized Products

- Cosmo Films Ltd.

- UFlex Limited

- WINPAK LTD

Recent Developments

-

In March 2024, TOPPAN, a leading global provider of packaging solutions, developed a new sustainable barrier film called GL-SP that uses biaxially oriented polypropylene (BOPP) as the substrate. This film offers high oxygen and water vapor barrier performance, transparency, and a thin form factor, making it suitable for packaging dry contents.

-

In March 2024, Jindal Poly Films, a prominent manufacturer of flexible packaging materials, introduced a new PP mono-material barrier solution. This innovative product is designed to provide enhanced barrier properties and recyclability compared to traditional multi-layer flexible packaging.

Transparent Barrier Packaging Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.76 billion

Revenue forecast in 2030

USD 41.60 billion

Growth rate

CAGR of 6.35% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK, Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Amcor plc; Bemis Manufacturing Company; Berry Global Inc.; Sealed Air; Sonoco Products Company; DS Smith; 3M; Mitsubishi Chemical Advanced Materials; Innovia Films; TOPPAN INC.; Daibochi Berhad; Klöckner Pentaplast; OIKE & Co., Ltd.; Mondi; DuPont; Celplast Metallized Products; Cosmo Films Ltd.; UFlex Limited; WINPAK LTD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transparent Barrier Packaging Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented transparent barrier packaging films market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Ethylene Vinyl Alcohol (EVOH)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polyamide (PA)

-

Polyvinylidene Chloride (PVDC)

-

Biaxially Oriented Polypropylene (BOPP)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceutical Packaging

-

Personal Care Product Packaging

-

Household Care Product Packaging

-

Consumer Goods

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global transparent barrier packaging films market size was estimated at USD 27.15 billion in 2023 and is expected to reach USD 28.76 billion in 2024.

b. The global transparent barrier packaging films market is expected to grow at a compound annual rate of 6.35% from 2024 to 2030, reaching USD 41.60 billion by 2030.

b. The polyethylene segment led the global transparent barrier packaging films market, accounting for more than 37.24% of the global revenue in 2023.

b. Some of the major companies in the global transparent barrier packaging films market include Amcor plc, Bemis Manufacturing Company, Berry Global Inc., Sealed Air, Sonoco Products Company, DS Smith, 3M, Mitsubishi Chemical Advanced Materials, Innovia Films, TOPPAN INC., Daibochi Berhad, Klöckner Pentaplast, OIKE & Co., Ltd., Mondi, DuPont, Celplast Metallized Products, Cosmo Films Ltd., UFlex Limited, WINPAK LTD

b. The rising preference for transparency that enables consumers to see the product before purchasing is driving the market. Additionally, the growing food and beverage industries is fueling the demand for transparent barrier packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.