- Home

- »

- Healthcare IT

- »

-

Treatment Planning Systems And Advanced Image Processing Market Report 2030GVR Report cover

![Treatment Planning Systems And Advanced Image Processing Market Size, Share & Trends Report]()

Treatment Planning Systems And Advanced Image Processing Market Size, Share & Trends Analysis Report By Component, By Technique, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-363-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

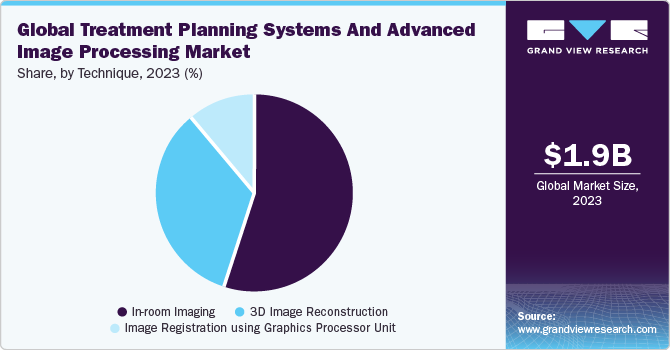

The global treatment planning systems and advanced image processing market size was estimated at USD 1.95 billion in 2023 and is expected to grow at a CAGR of 8.76% from 2024 to 2030. The rising incidence of cancer and the increasing number of medical imaging procedures are fueling the need for treatment planning systems, which is expected to boost market growth over the forecast period. Furthermore, the demand for precise and innovative cancer treatments through the use of advanced image processing technology is enhancing the market's expansion worldwide. The development of healthcare IT infrastructure and the increased implementation of Machine Learning (ML) and Artificial Intelligence (AI) in oncology treatment are also contributing to the growth of the market.

The rapidly increasing mortalities due to cancer at both regional and global levels is boosting the demand for advanced and innovative treatment practices. For instance, as per 2022 GLOBOCAN estimates, about 9,743,832 cancer-related mortalities, and approximate 19,976,499 new cancer cases were diagnosed globally. Lung cancer is the most common type of cancer, contributing about 12.4% of all cancer types followed by breast. In addition, the growing prevalence of cancer coupled with the demand for adequate treatment plans for better clinical outcomes is also anticipated to accelerate the growth of the market for treatment planning systems and advanced image processing. For instance, as per the GLOBOCAN 2022 statistics, it is estimated that the global burden will be over 53,504,187 new cancer cases by 2027.

GLOBAL CANCER STATISTICS 2022

Cancer

Incidence

Mortality

Lung

2,480,675

1,817,469

Breast

2,296,840

666,103

Colorectum

1,926,425

904,019

Prostate

1,467,854

397,430

Stomach

968,784

660,175

Liver

866,136

758,725

Thyroid

821,214

47,507

Cervix uteri

662,301

348,874

Bladder

614,298

220,596

NHL

553,389

250,679

Oesophagus

511,054

445,391

Pancreas

510,992

467,409

Leukaemia

487,294

305,405

Kidney

434,840

155,953

Corpus uteri

420,368

97,723

Furthermore, the increasing use of radiotherapy in diagnosing and treating cancer significantly contributes to the expansion of the market for treatment planning systems and advanced image processing. For instance, the WHO stated that over 50% of individuals with cancer need radiotherapy during their treatment. This method is commonly applied in managing prevalent cancers, including those of the breast, cervix, colorectal area, and lungs.

The increasing adoption of artificial intelligence and machine learning by the market players to develop oncology software solutions to enhance treatment plans, diagnosis, and management of cancer is further supporting to the growth of the market for treatment planning systems and advanced image processing. In addition, increasing initiatives and projects were undertaken to develop health information learning platforms to support improved quality of care for oncology which is also anticipated to boost market growth. For instance, ASCO, through its fully owned subsidiary, CancerLinQ LLC, created CancerLinQ, an oncology learning health system. Such a system is crucial for patients with cancer because fewer than 5% of these patients participate in clinical trials. This results in a lack of evidence for patient groups that are not included in trials.

Strategic initiatives adopted by market players to stay competitive in industry is also a factor contributing to market growth. These initiatives can encompass a wide range of actions, including but not limited to, the adoption of advanced technologies, entering into partnerships or mergers to leverage collective strengths, diversifying product portfolios to meet a broader range of consumer needs, and investing in research and development to innovate and improve product offerings. For instance, in March 2024, RefleXion Medical, Inc ., a company focused on cancer therapy, and Limbus AI, Inc., known for its cancer radiation therapy software, entered into a licensing agreement to integrate Limbus AI's Limbus Contour, an automated contouring software, into the RefleXion X1 system for radiotherapy treatment planning. This integration is expected to address and alleviate the primary challenge in planning patient treatment, which is accurately distinguishing the tumor from nearby vital organs and other healthy tissues.

Market Concentration & Characteristics

The industry growth stage is high, and the pace of the industry growth is accelerating. The industry for treatment planning systems and advanced image processing has seen significant innovation, owing to handling complex imaging data with remarkable speed, enabling the innovation of treatment plans that are both more precise and customized to individual patient needs. Furthermore, the growing demand for personalized medicine has driven innovation in this field. Medical professionals and patients are increasingly looking for treatments that are specifically designed to suit individual needs, prompting the industry to come up with advanced imaging techniques.

In order to expand their customer base and gain a larger industry share, major players in the industry are continuously working to improve their product offerings. This involves upgrading their products, exploring acquisitions, obtaining government clearances, and engaging in important cooperation activities. For instance, in February 2023, Varian, a Siemens Healthineers company, entered into an agreement with Nova Scotia Health to head the digital transformation of its extensive oncology services. This five-year project, named the Oncology Transformation Project (OTP), aims to build upon and merge Nova Scotia Health's current Varian software systems. The goal is to create an interconnected, comprehensive suite of oncology software and services, enhancing patient care across disciplines.

Treatment planning systems and advanced image processing has experienced considerable innovation due to the rapid innovation in these fields. For instance, in May 2023,DOSIsoft introduced a new solution, ThinkQA Secondary Dose Check, specifically designed to cater to Adaptive Radiotherapy Workflows.

Companies that develop treatment planning systems and advanced image processing are engaging in merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in September 2023, Varian Medical Systems, Inc. acquired Aspekt Solutions, a provider of medical physics, strategic consultation services and dosimetry. This acquisition will expand Varian's portfolio of Advanced Oncology Solutions (AOS) and enhance its capability to meet the increasing demand for tailored services and standardized care delivery.

Regulations play a crucial role in shaping the development, deployment, and use of treatment planning systems and advanced image processing within the healthcare sector. Key regulatory authorities, including the Food and Drug Administration (FDA) in the U.S., Europe's Medical Device Regulation (MDR) framework, Health Canada, and China's National Medical Products Administration (NMPA), are instrumental in overseeing these technologies. These bodies ensure that medical devices and software meet strict standards for safety, effectiveness, and data protection before they receive approval for use in clinical settings.

Seeking government approvals for products to stay competitive in the industry and the growing demand and adoption of advanced software and systems are important factor driving industry growth. For instance, in December 2023, MIM Software Inc., a medical imaging software provider, received clearance from the FDA for its latest AI auto-contouring product, Contour ProtégéAI+. This innovative Zero-Click AI Auto-Contouring Solution offers cancer treatment planners additional time for plan assessment.

The treatment planning systems and advanced image processing industry’s geographical reach has been expanding at a moderate to high level owing to population growth, growing healthcare expenditure, and regulatory environments. For instance, in February 2021, Elekta announced the establishment of an office in Egypt. This initiative is aimed at meeting the growing need for precision radiation medicine in North African region. This is expected to help the company to establish a strong foothold in the industry.

Component Insights

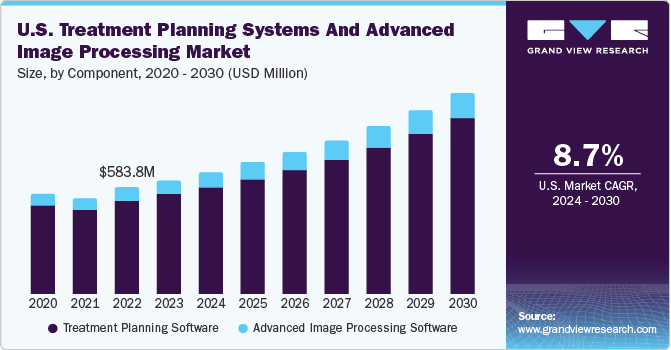

The treatment planning software segment dominated the market by capturing a share of in 2023. This high segment share is attributable to the growing prevalence of cancer and increasing demand for accurate and advanced oncology therapy solutions. The increasing awareness regarding the adoption of treatment planning software solutions due to its efficiency in cancer treatment using radiotherapy is further propelling the growth of the segment. In addition, advancements in healthcare infrastructure, increasing public-private partnerships, and preference to use software solutions over conventional practice are some of the major factors attributable to the high revenue share of the segment. For instance, Fujitsu in February 2021 collaborated with the researchers of the University of Toronto to develop technology to streamline radiation treatment plans for brain tumors and arteriovenous malformations procedures.

Advanced image processing software is anticipated to register the fastest growth rate of 10.3% during the forecast period. The increasing demand for radiology procedures for the diagnosis and treatment of cancer and the growing adoption of advanced medical imaging solutions are anticipated to boost the segment growth over the years. The increasing number of imaging modalities and growing modern radiology facilities all over the globe with AI-incorporated advanced image processing software are further anticipated to accelerate the growth of the segment. In addition, the shortage of trained radiology professionals is further boosting the demand for advanced image processing solutions.

Technique Insights

The in-room imaging segment accounted for the largest revenue share of 55.1% in 2023. The growing technological advancement in radiology procedures to treat cancer and provide real-time image data is one of the major factors responsible for the high share of the segment. To provide accurate and precise treatment solutions, there is an increasing demand for in-room imaging processes. This process includes capturing pictures during the time of therapy and sharing them across to radiologists to overcome challenges such as tissue radiotherapy toxicity, and dosage volume standardization. The benefits and growing adoption of in-room imaging processes to reduce dosage toxicity, improve target localization, improved tumor control, and shorter treatment course is further supporting the growth of the segment.

3D image reconstruction is anticipated to register the fastest growth rate over the forecast years. The increase in adoption of 3D image reconstruction due to its benefits in the treatment planning processes for dosage distribution planning, optimization of therapy process realization, applicator selection, and minimizing collateral tissue damage is anticipated to drive the growth rate of the segment over the years. The medical imaging oncology treatment process involves 3D image projections using reconstruction techniques from multiple images to create three-dimensional models to help doctors in faster and more accurate clinical diagnoses. The growing demand for fast and accurate cancer treatment practices to tackle the global cancer prevalence is one of the major factors anticipated to drive the growth of the 3D image reconstruction segment.

Application Insights

The validation of the image registration segment accounted for the highest revenue share of 27.3% in 2023. This share of the segment is attributable to the importance of image datasets creation and its registration for a treatment planning process. The medical image registration constructs real-time image datasets from anatomical atlases and multiple image modalities to help in efficient and accurate dose planning. These solutions conduct validations on dosage accumulation, dose distribution, and contours through the developed imaged datasets during cancer therapy. Varian Medical Systems and RaySearch Laboratories are the two key players developing platforms for image registration validation.

However, Adaptive radiotherapy is anticipated to register the fastest growth rate during the forecast years. Adaptive radiotherapy is widely used for treating neck, head, and stomach cancers. The increasing adoption of treatment planning systems and image processing solutions in adaptive radiotherapy to correct morphological variations is expected to accelerate the segment growth over the forecast period. In addition, the growing number of oncology radiotherapy facilities positively impacts the segment growth. Moreover, the increasing development of advanced treatment plan solutions by the manufacturers further supports the segment growth.

Regional Insights

North America treatment planning systems and advanced image processing market held the largest share of 38.9% in 2023 owing to the well-established healthcare infrastructure, which is crucial for the adoption and integration of advanced technologies, including treatment planning systems and image processing tools.

U.S. Treatment Planning Systems And Advanced Image Processing Market Trends

The treatment planning systems and advanced image processing market in U.S. held the largest market share in 2023 in the North America region. The increasing number of cancer cases across different age groups and the growing need for advanced treatment planning tools and imaging technologies are key factors propelling the U.S. market. Data from the National Cancer Institute, as of January 2022, indicates that the U.S. had an estimated 18.1 million individuals who had survived cancer. This underscores the critical demand for innovative healthcare solutions to manage and treat cancer effectively.

Europe Treatment Planning Systems And Advanced Image Processing Market Trends

The treatment planning systems and advanced image processing market in Europe held a significant market share in 2023, owing to the presence of key players in region such as RaySearch Laboratories; MIM Software, Inc.; Accuray, Inc.; and Elekta. In addition,the rise in cancer prevalence in several European countries is also a major factor contributing to the regional market growth.

The treatment planning systems and advanced image processing market in the UK is anticipated to expand due to the rising number of cancer cases, improvements in healthcare infrastructure, higher healthcare expenditure, and the growing need for precise radiotherapy treatment options.

The treatment planning systems and advanced image processing market in France is expected to grow over the forecast period due to theincreasing prevalence of chronic diseases, such as cancer, which necessitates the use of advanced diagnostic and treatment planning technologies to ensure effective patient care. Moreover, the French healthcare system is undergoing significant advancements, with a strong emphasis on integrating advanced technology to enhance treatment accuracy and outcomes.

The treatment planning systems and advanced image processing market in Germany is expected to grow over the forecast period this can be attributed to a rapid aging of the population. With age, the prevalence of various diseases, particularly cancer and cardiovascular issues, tends to increase. Such conditions often necessitate thorough diagnosis and treatment plan.

Asia Pacific Treatment Planning Systems And Advanced Image Processing Market Trends

Asia Pacific treatment planning systems and advanced image processing market is estimated to witness the fastest CAGR during the forecast period. This region is undergoing rapid economic development, leading to increased healthcare expenditure both by governments and private entities. This financial investment is facilitating the adoption of advanced healthcare technologies, including treatment planning systems and advanced imaging solutions.

Treatment planning systems and advanced image processing market in China is expected to grow, over the forecast period. The increasing cases of cancer has become a public health concern in the country. This surge in cancer cases, is associated with high morbidity & mortality and created a need for innovative radiotherapy technologies in China, which is further expected to drive the market.

Treatment planning systems and advanced image processing market in Japan is expected to grow, over the forecast period. The rising adoption of advanced medical technology in Japan is a significant growth driver. The Japanese healthcare system is known for its willingness to invest in and embrace new technologies, supported by government policies and healthcare spending. This proactive approach towards healthcare innovation ensures that both healthcare providers and patients benefit from the latest developments in medical technology, further stimulating market growth.

Treatment planning systems and advanced image processing market in India is expected to grow, primarily due to the increasing prevalence of chronic disorders such as cancer, cardiovascular diseases, diabetes, and respiratory conditions. For instance, according to the data published by International Agency for Research on Cancer in 2022, there were about 1,413,316 cases of new cancer in India.

Latin America Treatment Planning Systems And Advanced Image Processing Market Trends

The treatment planning systems and advanced image processing in the Latin America market is anticipated to undergo moderate growth throughout the forecast period. This growth is mainly fueled by the rapid development of economies in the region, particularly in countries such as Brazil and Mexico, which are major contributors to the expansion of the overall market.

The treatment planning systems and advanced image processing market in MEA is anticipated to witness growth owing to several key factors. The growing number of chronic diseases, including cancer, along with an aging population, are key drivers for the market in the MEA. Moreover, the expensive nature of these technologies, alongside the slow uptake of treatment planning solutions due to a shortage of skilled professionals, may hinder market expansion.

Key Treatment Planning Systems And Advanced Image Processing Company Insights

The leading companies in the treatment planning systems and advanced image processing market are actively engaging in strategic initiatives to maintain and enhance their competitive position within the industry. These initiatives include broadening their product offerings and securing necessary approvals, which ensures their solutions meet regulatory standards and cater to the evolving needs of healthcare providers. Furthermore, they are entering into partnerships and acquisitions, which not only expand their operational capabilities and market reach but also enable them to integrate complementary technologies and expertise into their portfolio. In addition, mergers and acquisitions are being pursued as a strategy to consolidate market presence. These efforts are aimed at driving growth, and enhancing market share, of treatment planning and image processing solutions in the healthcare sector.

Varian Medical Systems, Accuray Incorporated, Elekta are are among the major market players driving innovation and growth in the treatment planning systems and advanced image processing sector. These companies are committed to developing advanced solutions that cater to the evolving needs of healthcare providers and patients.

Key Treatment Planning Systems And Advanced Image Processing Companies:

The following are the leading companies in the treatment planning systems and advanced image processing market. These companies collectively hold the largest market share and dictate industry trends.

- Accuray Incorporated

- Elekta

- Philips Healthcare

- RaySearch Laboratories

- Varian Medical Systems

- Brainlab

- Prowess Inc.

- DOSIsoft SA

- ViewRay Inc.

- MIM Software Inc.

Recent Developments

-

In May 2024, Elekta announced the acquisition of Philips Healthcare’s Pinnacle Treatment Planning System (TPS) patent portfolio. This strategic move bolsters Elekta’s position in treatment planning and underscores its commitment to being the innovation leader in radiation therapy.

-

In September 2023, Accuray Incorporated announced the establishment of a new Global Training Center at its headquarters in Madison, Wisconsin. This initiative is aimed at advancing radiotherapy treatment techniques, responding to the increasing demand for precision cancer care.

-

In January 2023, ViewRay, Inc. disclosed that Chindex Medical acquired 10 ViewRay MRIdian Systems for advanced cancer treatment.

Treatment Planning Systems And Advanced Image Processing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.10 billion

Revenue forecast in 2030

USD 3.47 billion

Growth rate

CAGR of 8.76% from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technique, application

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Accuray Incorporatd; Elekta; Koninklijke Philips NV; RaySearch Laboratories; Varian Medical Systems; Brainlab; Prowess, Inc.; DOSIsoft SA; Viewray, Inc.; MIM Software, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Treatment Planning Systems And Advanced Image Processing Market Report Segmentation

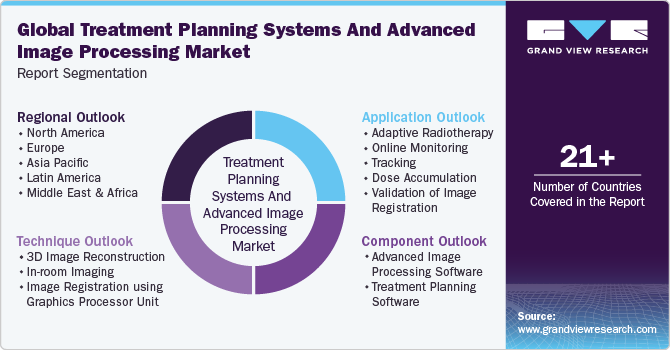

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global treatment planning systems and advanced image processing market report on the basis of component, technique, application and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Image Processing Software

-

Treatment Planning Software

-

Auto-Contouring Software

-

Multi-Modality Software

-

PET/CT Deformable Software

-

DICOM-RT Software

-

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

3D Image Reconstruction

-

In-room Imaging

-

Image Registration using Graphics Processor Unit

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Adaptive Radiotherapy

-

Online Monitoring

-

Tracking

-

Dose Accumulation

-

Validation of Image Registration

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global treatment planning systems and advanced image processing market size was estimated at USD 1.95 billion in 2023 and is expected to reach USD 2.10 billion in 2024.

b. The global treatment planning systems and advanced image processing market is expected to grow at a compound annual growth rate of 8.76% from 2024 to 2030 to reach USD 3.47 billion by 2030.

b. North America dominated the treatment planning systems & advanced image processing market with a share of 38.9% in 2023. This is attributable to rapid technological advancements in oncology coupled with a favorable regulatory environment and increasing government and private initiatives.

b. Some key players operating in the treatment planning systems & advanced image processing market include RaySearch Laboratories, Varian Medical Systems, Accuray Inc., Elekta, Brainlab, Prowess, Inc, DOSIsoft SA, MIM Software, Inc., and Philips Healthcare.

b. Key factors driving the treatment planning systems and advanced image processing market growth include a rapid increase in global cancer prevalence, developing healthcare IT sector, rising adoption of AI/ML into oncology processes, rising investments in the oncology treatment and care segments, and increasing demand for innovative treatment solutions.

b. The treatment planning software segment dominated the market for treatment planning systems & advanced image processing and held the largest revenue share of 87.8% in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."