- Home

- »

- Automotive & Transportation

- »

-

Truck Rental Market Size, Share And Trends Report, 2030GVR Report cover

![Truck Rental Market Size, Share & Trends Report]()

Truck Rental Market Size, Share & Trends Analysis Report By Truck, By Duration (Short Term, Long Term), By Propulsion (ICE, Electric), By Service Provider, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-422-5

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Truck Rental Market Size & Trends

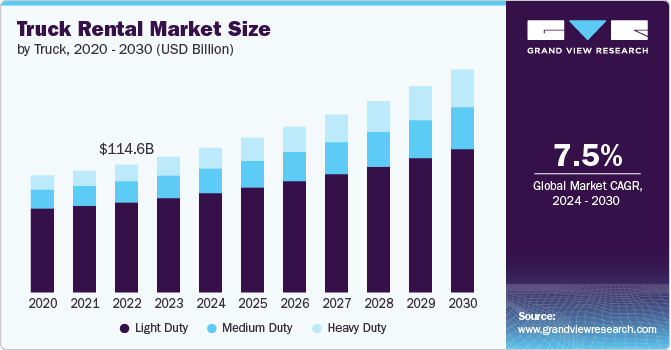

The global truck rental market was estimated at USD 121.38 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. The booming e-commerce industry significantly contributes to the growth of the truck rental market. With the surge in online shopping, there is an increasing need for efficient last-mile delivery solutions. Businesses, especially small and medium enterprises (SMEs), prefer renting trucks rather than investing in their fleet, as it offers flexibility and cost-effectiveness. This trend has led to a steady rise in demand for short-term and long-term truck rentals, particularly in urban areas with high delivery density.

Ongoing infrastructure projects and rapid urbanization also drive the growth of the truck rental market. Governments invest heavily in road networks, industrial parks, and urban development in many developing regions. These projects require significant logistics and transportation support, often provided by rented trucks. The need to transport construction materials, machinery, and other goods across various sites boosts the demand for truck rentals. Moreover, urbanization increases goods movement within cities, further fueling the market's growth.

Moreover, truck rental services offer businesses the flexibility to scale their operations without the long-term commitment of purchasing and maintaining a fleet. Renting allows companies to manage fluctuating demand more efficiently, reducing the financial burden of vehicle ownership, such as maintenance, insurance, and depreciation. This cost efficiency is particularly attractive to businesses operating on tight margins or those with seasonal demand patterns, driving the adoption of truck rental services across various industries.

Advancements in technology, particularly in fleet management systems, are enhancing the appeal of truck rental services. Modern truck rental companies offer vehicles with GPS tracking, telematics, and other advanced features that provide real-time vehicle performance data and route optimization. These technologies improve operational efficiency, reduce fuel consumption, and enhance overall safety, making truck rentals an attractive option for businesses looking to leverage the latest innovations in logistics and transportation.

Despite truck rental services' advantages, high operational costs can be a significant barrier. Rental companies often face substantial vehicle maintenance, insurance, fuel, and labor expenses. These costs can be passed on to customers through higher rental rates, making the service less attractive, particularly for price-sensitive businesses. Additionally, fluctuations in fuel prices and rising maintenance costs due to aging fleets can further strain the profitability of truck rental companies, potentially leading to reduced market growth.

Truck Insights

The light duty segment dominated the market in 2023 and accounted for a 69.6% share of global revenue. The demand for efficient transportation solutions among small-scale and local businesses drives the segment's growth. Light-duty trucks are particularly advantageous for companies such as local delivery services, food vendors, and tradespeople. These businesses often require a reliable vehicle, easy to drive and suitable for transporting goods or equipment within a local area. The affordability and availability of light-duty trucks through rental services enable these businesses to operate more effectively without the financial burden of purchasing a vehicle.

The heavy duty segment is projected to grow significantly from 2024 to 2030. The expansion of the logistics and supply chain sector drives the demand for heavy-duty trucks in the rental market. As global trade increases and supply chains become more complex, there is a growing need for reliable transportation of goods over long distances. Heavy-duty trucks are crucial for hauling large volumes of cargo across various regions. Companies in the logistics sector often opt to rent heavy-duty trucks to manage peak periods, seasonal demand, or specific contracts, which contributes to the growth of this segment in the truck rental market.

Duration Insights

The short term segment dominated the market in 2023. The rise of the gig economy and the increasing number of independent contractors in the logistics and transportation sectors fuel short-term truck rentals' growth. Freelance drivers, moving services, and on-demand delivery providers often prefer short-term rentals to meet specific job requirements. The gig economy's emphasis on flexibility and on-demand services aligns perfectly with the short-term rental model, driving its growth in the truck rental market.

The long term segment is projected to grow significantly from 2024 to 2030. The mitigation of depreciation risk drives the growth of the segment. Vehicle depreciation is a major concern for companies that own their fleet. Trucks and other commercial vehicles lose value over time, significantly impacting on a company's balance sheet. Long-term rentals mitigate this risk by transferring the burden of depreciation to the rental company. Businesses can use the vehicles for their intended period without worrying about resale value, allowing them to focus on their core operations while maintaining a fleet that meets their needs.

Propulsion Insights

The internal combustion engine (ICE) segment dominated the market in 2023. The presence of established infrastructure and support systems drives the market's growth. The infrastructure supporting ICE trucks, including refueling stations and maintenance facilities, is well-established and widely available. This extensive network provides convenience and reliability for businesses that rely on ICE trucks. As a result, companies often prefer ICE trucks due to the ease of access to support services and the familiarity of the existing infrastructure.

The electric segment is projected to grow significantly from 2024 to 2030. The rise of urbanization and the implementation of low-emission zones in many cities drive the segment's growth. Low-emission zones restrict access to areas with high pollution levels, making electric trucks ideal for operations within these zones. Rental companies can cater to businesses operating in urban areas by providing electric trucks that comply with local regulations. This alignment with urban environmental policies boosts the demand for electric truck rentals.

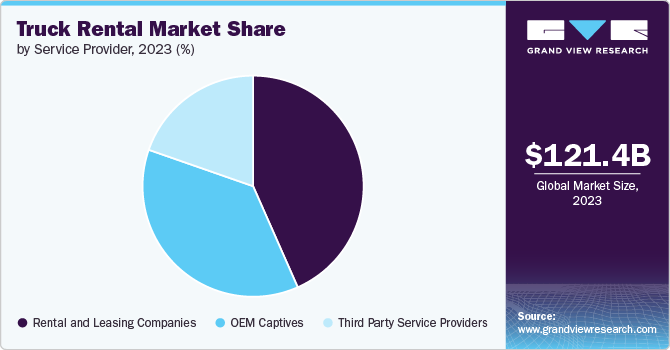

Service Provider Insights

The rental and leasing companies segment dominated the market in 2023. The improved services and customer support offered by these companies drive the market growth. Many companies offer value-added services such as 24/7 roadside assistance, comprehensive maintenance packages, and customized leasing solutions tailored to specific business needs. These improvements in service quality and customer support make rental and leasing options more attractive to businesses looking for reliable and hassle-free transportation solutions.

The OEM captives segment is projected to grow significantly from 2024 to 2030. The customized financing option offered by the OEM captives can be more appealing to businesses than traditional lenders. These financing options often include favorable terms such as lower interest rates, flexible payment schedules, and tailored lease agreements that match the specific needs of different industries. This flexibility helps businesses manage their cash flow more effectively and reduces the financial burden of acquiring new trucks. OEM captives' attractive financing solutions drive their adoption in the truck rental market as businesses seek to optimize their fleet management.

Regional Insights

The North America truck rental market held a significant share of the global market in 2023. The rise of urban delivery needs, driven by the growth of online shopping and on-demand services, contributes to the growth of truck rentals. Cities in the region face increasing challenges related to congestion and regulatory restrictions on commercial vehicles. Truck rentals allow businesses to use specialized vehicles for urban deliveries, such as smaller trucks or electric vehicles, which are well-suited for navigating city environments and meeting regulatory requirements.

U.S. Truck Rental Market Trends

Truck rental market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The expansion of rental networks and the diversification of services offered by rental companies contribute to this growth. Rental companies are increasingly providing a wider range of vehicles, including specialized trucks for various industries, and offering additional services such as maintenance and support.

Europe Truck Rental Market Trends

Truck rental market in Europe is expected to witness notable growth from 2024 to 2030. Stricter environmental regulations and policies in Europe are influencing the truck rental market. European countries are implementing stringent emission standards to combat air pollution and promote sustainability. Truck rental companies are adapting to these regulations by offering newer, cleaner vehicles that comply with environmental standards.

Asia Pacific Truck Rental Market Trends

Truck rental market in Aisa Pacific held the largest share of 39.84% of the global market in 2023. The booming e-commerce sector in APAC is significantly driving growth of truck rental market. As online shopping expands, there is an increasing need for efficient and reliable last-mile delivery solutions. Truck rentals allow e-commerce businesses to scale their delivery operations based on demand, especially during peak periods such as holidays and promotional events.

Key Truck Rental Company Insights

Key players operating in the truck rental market include Enterprise Holdings, Inc.; The Hertz Corporation.; Penske; Ryder System, Inc.; Avis Rent A Car System, LLC; NationaLease; Daimler Truck AG; United Rentals, Inc.; Bush Truck Leasing; and Kenworth Sales Company. The companies are focusing on various strategic initiatives, including partnerships & collaborations, new product development, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2024, Flexter, an online platform for finding and comparing real-time availability and prices of moving trucks, announced a strategic partnership with Green Motion, a rental software solutions provider. The collaboration aims to streamline the short-term truck rental reservation process worldwide, making it simpler for suppliers to showcase their fleets and for renters to find the perfect truck for their needs.

-

In July 2023, NHR Group entered a strategic partnership with Hertz to enhance its truck and van rental offerings. The collaboration aims to leverage Hertz's extensive fleet and logistical expertise alongside NHR Group's established presence in New Zealand's commercial vehicle rental sector. The partnership is expected to provide a wider range of vehicles, including cargo vans and trucks, to meet diverse customer needs, thereby improving accessibility and convenience for businesses and individuals requiring transportation solutions.

Key Truck Rental Companies:

The following are the leading companies in the truck rental market. These companies collectively hold the largest market share and dictate industry trends.

- Enterprise Holdings, Inc.;

- The Hertz Corporation.;

- Penske; Ryder System, Inc.;

- Avis Rent A Car System, LLC;

- NationaLease;

- Daimler Truck AG;

- United Rentals, Inc.;

- Bush Truck Leasing;

- Kenworth Sales Company

Truck Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 129.39 billion

Revenue forecast in 2030

USD 199.58 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Truck, duration, propulsion, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Enterprise Holdings, Inc.; The Hertz Corporation.; Penske; Ryder System, Inc.; Avis Rent A Car System, LLC; NationaLease; Daimler Truck AG; United Rentals, Inc.; Bush Truck Leasing; and Kenworth Sales Company

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Truck Rental Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the truck rental market based on truck, duration, propulsion, service provider, and region.

-

Truck Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Duty

-

Medium Duty

-

Heavy Duty

-

-

Duration Outlook (Revenue, USD Million, 2018 - 2030)

-

Short Term

-

Long Term

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Rental and Leasing Companies

-

OEM Captives

-

Third Party Service Providers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global truck rental market size was estimated at USD 121.38 billion in 2023 and is expected to reach USD 129.39 billion in 2024.

b. The global truck rental market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 199.58 billion by 2030.

b. Asia Pacific dominated the truck rental market with a share of 39.84% in 2023. The booming e-commerce sector in APAC is significantly driving the growth of the truck rental market. As online shopping expands, there is an increasing need for efficient and reliable last-mile delivery solutions.

b. Some key players operating in the truck rental market include Enterprise Holdings, Inc.; The Hertz Corporation.; Penske; Ryder System, Inc.; Avis Rent A Car System, LLC; NationaLease; Daimler Truck AG; United Rentals, Inc.; Bush Truck Leasing; and Kenworth Sales Company.

b. Key factors that are driving the market growth include the growing popularity of autonomous truck rental services and increased demand for efficient transportation and delivery services in the e-commerce sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."